- Home

- »

- Advanced Interior Materials

- »

-

Petroleum Sorbent Pads Market Size, Industry Report, 2033GVR Report cover

![Petroleum Sorbent Pads Market Size, Share & Trends Report]()

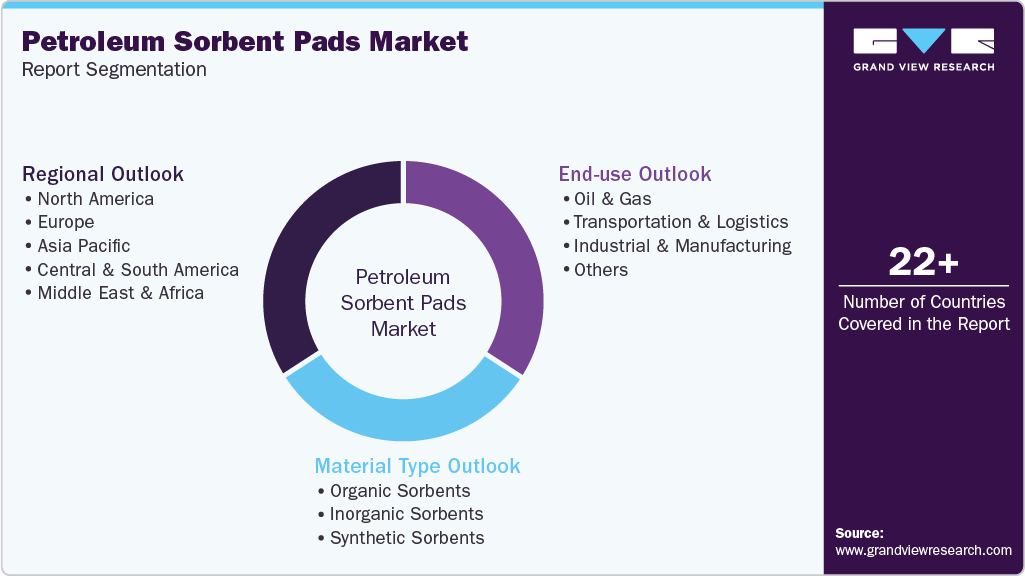

Petroleum Sorbent Pads Market (2025 - 2033) Size, Share & Trends Analysis Report By Material Type (Organic Sorbents, Inorganic Sorbents, Synthetic Sorbents), By End-use (Oil & Gas, Transportation & Logistics, Industrial & Manufacturing), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-654-3

- Number of Report Pages: 107

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Petroleum Sorbent Pads Market Summary

The global petroleum sorbent pads market size was estimated at USD 27.86 billion in 2024 and is projected to reach USD 47.88 billion by 2033, growing at a CAGR of 6.2% from 2025 to 2033. Demand for petroleum sorbent pads is rising due to the expansion of oil & gas, marine, and industrial sectors.

Key Market Trends & Insights

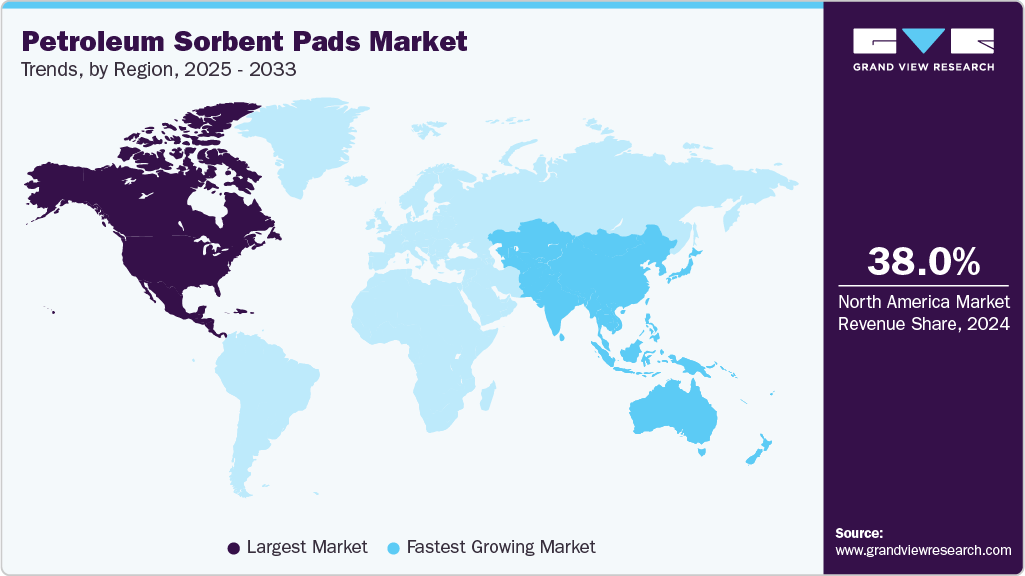

- North America dominated the petroleum sorbent pads market with the largest revenue share of 38.0% in 2024.

- The petroleum sorbent pads market in the U.S. is expected to grow significantly.

- By material type, the organic sorbents segment is expected to grow at fastest CAGR of 6.4% over the forecast period.

- By end use, the transportation & logistics segment is expected to grow at fastest CAGR of 6.6% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 27.86 Billion

- 2033 Projected Market Size: USD 47.88 Billion

- CAGR (2025-2033): 6.2%

- North America: Largest market in 2024

- Asia Pacific: Fastest market in 2024

Frequent leaks, spills, and maintenance activities in these industries require reliable absorbent solutions. These pads offer a quick, efficient, and cost-effective way to control oil-based fluids. Rising global awareness of environmental risks from oil pollution is also a contributing factor. Industries are increasingly investing in spill response kits to comply with safety norms. Regular operational use, not just emergency scenarios, is also boosting adoption. The emphasis on workplace safety and pollution prevention is further fueling market growth.

Stricter environmental regulations across the U.S., Europe, and Asia are a key driver. Authorities now mandate that oil-handling sites maintain sorbent materials for spill control. Offshore drilling, industrial growth, and old infrastructure increase the risk of leaks, boosting product usage. The need to avoid heavy fines and reputational damage makes companies invest in preventive measures. Innovations in materials such as polypropylene and biodegradable options are making pads more efficient. Rising awareness of sustainability and spill preparedness also plays a role. Combined, these factors create a strong foundation for long-term demand.

The market is seeing a shift toward sustainable petroleum sorbent pads made from natural materials. Manufacturers are introducing biodegradable products made from cotton, corn cob, and coconut husk. Advanced synthetic materials with improved oil retention are also gaining popularity. Lightweight, multilayered pads that offer higher absorption rates are in demand. Smart pads with embedded sensors are emerging for automated spill monitoring. Reusable and washable sorbents are being tested for cost-efficiency. Innovation is focused on improving performance while aligning with environmental standards.

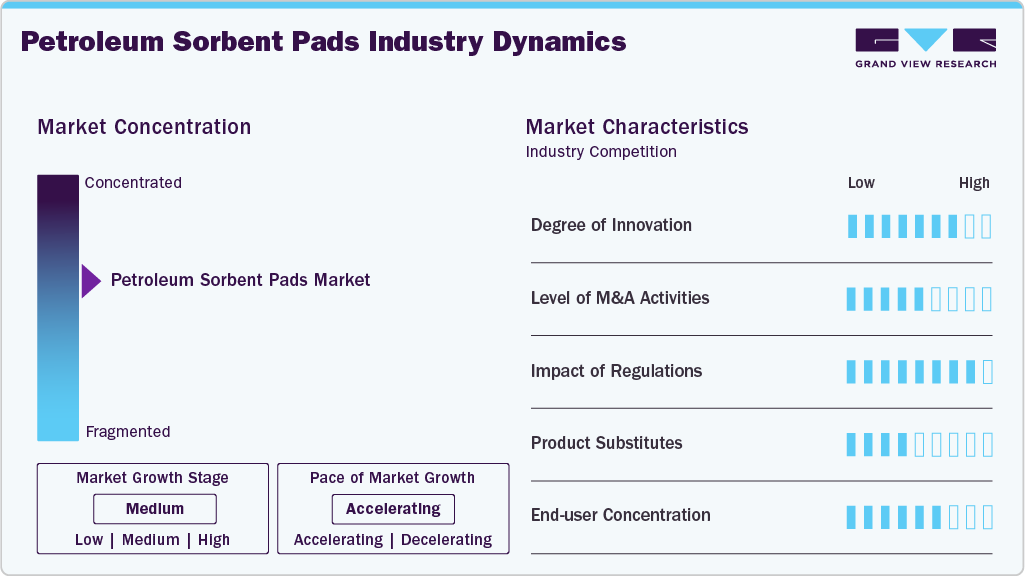

Market Concentration & Characteristics

The petroleum sorbent pads market is moderately fragmented with both global and regional players. Large companies such as 3M and New Pig have strong distribution networks and extensive product lines. At the same time, niche players offer customized solutions for specific industries. Competitive pricing, eco-friendly designs, and absorbency efficiency are key differentiators. While global brands dominate large contracts, local firms cater to compliance in smaller geographies. Market entry barriers are low due to simple product design but require regulatory alignment. This keeps the competitive landscape dynamic and moderately consolidated.

Petroleum sorbent pads face substitution threats from absorbent booms, chemical dispersants, and loose absorbents. However, pads are preferred for precision use, portability, and ease of disposal. Booms are more suitable for large water-based spills, not localized leaks. Dispersants often have environmental drawbacks and complex usage protocols. Pads remain dominant for quick-response and maintenance-based applications. Their low cost and user-friendliness make them the go-to solution across industries. Overall, the threat of substitution is present but relatively moderate in impact.

Material Type Insights

The Synthetic Sorbents segment held highest revenue market share of 61.4% in 2024, because of their superior oil absorption capacity, hydrophobic nature, and consistent performance across diverse environments. Unlike organic or inorganic alternatives, synthetic pads, especially those made from meltblown polypropylene offer fast wicking, lightweight handling, and high efficiency, even in marine settings where water repellency is crucial. Their durability and resistance to tearing or chemical breakdown make them reliable for both emergency and routine industrial use. These pads are also widely customizable in terms of size, thickness, and layering, suiting different operational needs. Their widespread availability and affordability further support large-scale deployment across oil & gas, transport, and manufacturing industries.

Organic sorbents segment is expected to grow at the fastest CAGR of 6.4% over the forecast period, due to their natural composition, high absorbency, and environmental friendliness. Materials such as cotton, peat moss, sawdust, and plant fibers are commonly used to create biodegradable and low-impact pads. These are preferred in industries and regions with strict sustainability mandates, especially in Europe and parts of Asia. Organic sorbents are also easier to dispose of and often meet government waste management standards. Their cost-effectiveness and availability from renewable sources make them popular among small to mid-scale industries. As circular economy practices rise, organic sorbents continue to hold a strong market presence. Their appeal is rooted in both environmental and regulatory compliance factors.

End-use Insights

Oil & Gas segment held the highest revenue market share of 55.3% in 2024, due to the inherently high risk of leaks and spills during extraction, refining, and transportation. This industry faces stringent environmental compliance requirements that mandate having sorbent pads as part of spill prevention and response plans. Offshore platforms, refineries, and pipeline operators maintain extensive inventories of pads for both routine and emergency scenarios. The pads are used for maintenance, cleanup, and safety assurance at every stage of the value chain. Their quick deployment and efficiency in absorbing hydrocarbons make them indispensable. Given the scale of operations and regulatory scrutiny, this sector represents the largest share of the market. Demand from oil & gas is expected to remain stable and dominant in the long term.

The transportation and logistics segment is expected to grow at the fastest CAGR of 6.6% over the forecast period, due to the increase in global freight movement and fuel usage. Rail yards, airports, trucking depots, and shipping ports are incorporating these pads into maintenance routines and spill kits. As fuel storage, vehicle servicing, and cargo handling generate risks of leaks, the need for quick spill containment tools is rising. Regulatory bodies are also enforcing spill control standards in transport hubs and intermodal facilities. Sorbent pads are easy to store, lightweight, and highly portable, making them ideal for mobile operations. Companies are increasingly investing in them to minimize downtime and environmental liabilities. This segment is expected to see sustained growth as infrastructure and transport networks expand globally.

Regional Insights

North America dominated the petroleum sorbent pads market and accounted for the largest revenue share of about 38.0% in 2024, supported by a well-established oil & gas industry and strict regulatory compliance requirements. The U.S. and Canada mandate that petroleum-handling facilities maintain sorbent materials under environmental and safety laws. Spill response is an integral part of industrial operations, with pads used extensively across drilling, refining, and transportation sectors. Government agencies frequently procure large volumes of petroleum sorbent pads for emergency preparedness. Innovations in sorbent materials and deployment methods are also driving growth. Companies in this region prioritize quality certifications and durable product performance. North America will continue to remain a mature and influential market.

U.S. Petroleum Sorbent Pads Market Trends

The U.S. represents the largest national market for petroleum sorbent pads, thanks to its strong oil, gas, marine, and industrial base. The EPA’s SPCC rule requires all oil-handling facilities to stockpile sorbent pads and related equipment. Public and private sectors alike invest in maintaining compliance through routine purchases and stockpiling. The military, coast guard, and environmental agencies frequently procure sorbents for disaster readiness. Domestic manufacturers are at the forefront of product development, offering high-performance and eco-friendly variants. Private industries are adopting smart sorbent solutions for automated monitoring and usage tracking. The U.S. will likely continue to set global benchmarks for spill management.

Asia Pacific Petroleum Sorbent Pads Market Trends

Asia Pacific is expected to grow at the fastest CAGR of 6.5% in the forecast period, due to rapid industrialization and expanding oil refining capacity. Countries like China, India, and Indonesia are witnessing a surge in manufacturing and petrochemical activities. Increased transportation of crude oil and stringent regional spill prevention policies are fueling product demand. Governments are also investing in port safety infrastructure and emergency response systems. The rising presence of local manufacturers offering cost-effective pads supports broader market penetration. Many regional companies are also exploring bio-based sorbents to align with sustainability goals. Overall, the region is expected to dominate future growth in both volume and innovation.

China’s petroleum sorbent pads market is being driven by strict government enforcement of industrial pollution control norms. Rapid urban development and industrial activity have raised environmental risks, making spill prevention a top priority. Ports, refineries, and chemical hubs are key end users, particularly in coastal regions. Domestic producers are expanding capacity and introducing low-cost and biodegradable options to meet rising demand. Sustainability-focused government directives are pushing manufacturers to develop innovative materials. There is also growing collaboration between public agencies and private firms for emergency oil spill management. China is expected to emerge as both a major consumer and exporter in the coming years.

Europe Petroleum Sorbent Pads Market Trends

Europe’s petroleum sorbent pads market is shaped by its strong environmental policies and industrial hygiene regulations. The REACH framework and ISO safety standards require facilities to control and prevent hazardous liquid spills. Demand is growing in sectors such as manufacturing, automotive, railways, and maritime logistics. Several European companies are leading innovation in biodegradable and reusable sorbent technologies. Facilities across the region increasingly prefer EU-certified, eco-safe pads that meet disposal and recyclability requirements. Countries such as France, the Netherlands, and Sweden are also enhancing public sector procurement of spill control tools. Europe remains a stable, regulation-driven market with steady technological advancement.

Germany plays a central role in the European petroleum sorbent pads market due to its large industrial base and emphasis on sustainable practices. The country’s strict environmental norms and industrial safety codes make sorbent pad usage mandatory in many sectors. Automotive, chemical, and mechanical industries use these pads for daily maintenance and emergency preparedness. Public transport systems and freight depots also require absorbent pads for accident management. There is growing adoption of reusable and eco-labeled sorbents as firms strive for circular economy goals. Domestic manufacturers focus on R&D and product certifications to maintain quality. Germany is a regional leader in both usage and innovation.

Central & South America Petroleum Sorbent Pads Market Trends

Central & South America’s market for petroleum sorbent pads is gradually expanding, driven by oil exploration and industrial activities in Brazil, Mexico, and Argentina. While regulatory enforcement varies by country, there is a rising focus on environmental preparedness. Oil refineries, offshore rigs, and transport companies are early adopters of sorbent technology. International organizations are collaborating with local governments on training and spill response infrastructure. Cost sensitivity remains a key factor, encouraging the use of affordable, single-use pads. Import dependence for premium products is gradually reducing with regional manufacturing initiatives. Latin America holds long-term growth potential, particularly with improved regulation and education.

Middle East & Africa Petroleum Sorbent Pads Market Trends

The Middle East & Africa region is witnessing slow but steady growth in petroleum sorbent pad adoption. Oil-rich countries such as Saudi Arabia, UAE, and Nigeria are focusing on improving spill response capabilities. The region’s heavy dependence on petroleum exports increases the risk of spills, particularly in offshore activities. Government and private initiatives are encouraging use of sorbent pads at oil terminals, ports, and petrochemical plants. However, limited awareness and regulatory enforcement restrict broader usage in less developed regions. Imports dominate the market, although some local production is emerging. With increasing emphasis on industrial safety, this market is expected to expand gradually.

Key Petroleum Sorbent Pads Company Insights

Some of the key players operating in the market include 3M, Darcy Spillcare Manufacture Ltd.

-

3M is a global leader in industrial safety and environmental protection products, offering high-performance petroleum sorbent pads made primarily from polypropylene. Their solutions are widely used in oil & gas, marine, and manufacturing sectors for regulatory compliance and rapid spill response.

-

Darcy specializes in environmental protection products, including oil-only sorbent pads designed for land and marine applications. The company focuses on spill prevention and response, particularly in the UK and European markets, aligning with strict regulatory standards.

Brady Corporation. and Oil-Dri Corporation are some of the emerging market participants in the petroleum sorbent pads market.

-

Brady, through its SPC (Spill Control Products) line, provides a comprehensive range of oil-only absorbents and spill kits. Known for quality and reliability, Brady serves various industries including logistics, utilities, and industrial maintenance with regulatory-compliant solutions.

-

Oil-Dri manufactures both granular and pad-based absorbents tailored for petroleum spill control. Their sorbents are used in industrial facilities, transportation hubs, and environmental services, with a focus on efficient oil retention and workplace safety.

Key Petroleum Sorbent Pads Companies:

The following are the leading companies in the petroleum sorbent pads market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- New Pig Corporation

- Brady Corporation.

- Oil-Dri Corporation

- Sorbent Products Company (SPC)

- Chemtex

- Darcy Spillcare Manufacture Ltd.

- Fentex Ltd.

- ENPAC LLC

- Meltblown Technologies Inc.

Recent Developments

- In July 2024, 3M introduced their “HP” series of petroleum sorbent pads (HP‑156, HP‑157), designed with hydrophobic meltblown polypropylene and engineered for compact storage while maintaining high absorbency. These lightweight pads are tailored for tight spaces and routine maintenance, offering quick oil spill response capability.

Petroleum Sorbent Pads Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 29.59 billion

Revenue forecast in 2033

USD 47.88 billion

Growth rate

CAGR of 6.2% from 2025 to 2033

Base year for estimation

2024

Actual estimates/Historical data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2021 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material type, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea

Key companies profiled

3M; New Pig Corporation; Brady Corporation.; Oil-Dri Corporation; Sorbent Products Company (SPC); Chemtex; Darcy Spillcare Manufacture Ltd.; Fentex Ltd.; ENPAC LLC; Meltblown Technologies Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Petroleum Sorbent Pads Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global petroleum sorbent pads market report on the basis of material type, end-use, and region:

-

Material Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Organic Sorbents

-

Inorganic Sorbents

-

Synthetic Sorbents

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil & Gas

-

Transportation & Logistics

-

Industrial & Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global petroleum sorbent pads market size was estimated at USD 27.86 billion in 2024 and is expected to reach USD 29.59 billion in 2025.

b. The global petroleum sorbent pads market is expected to grow at a compound annual growth rate of 6.2% from 2025 to 2033 to reach USD 47.88 billion by 2033.

b. The synthetic sorbents segment of the market accounted for the largest revenue share of 61.4% in 2024, driven by their superior oil absorption capacity, hydrophobic nature, and consistent performance across diverse environments.

b. Some of the key players operating in the petroleum sorbent pads market include 3M, New Pig Corporation, Brady Corporation., Oil-Dri Corporation, Sorbent Products Company (SPC), Chemtex, Darcy Spillcare Manufacture Ltd., Fentex Ltd., ENPAC LLC, and Meltblown Technologies Inc.

b. Key factors driving the petroleum sorbent pads market include rising environmental regulations, increased oil spill incidents, industrial expansion, and the demand for efficient, eco-friendly spill containment solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.