- Home

- »

- Pharmaceuticals

- »

-

Pharmaceutical Analytical Testing Outsourcing Market 2030GVR Report cover

![Pharmaceutical Analytical Testing Outsourcing Market Size, Share & Trends Report]()

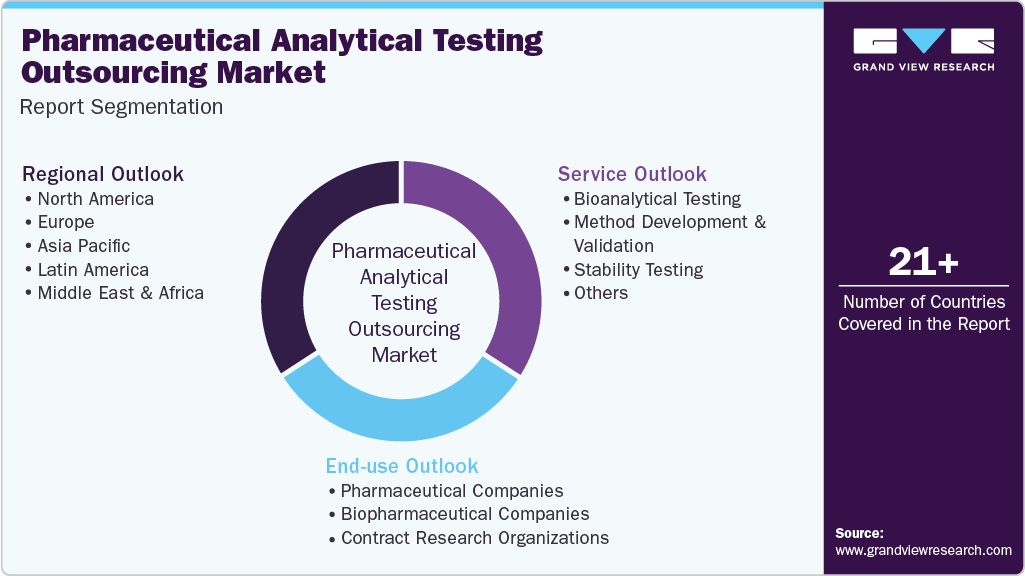

Pharmaceutical Analytical Testing Outsourcing Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Bioanalytical Testing, Stability Testing), By End-use (Pharmaceutical Companies, Biopharmaceutical Companies), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-365-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Analytical Testing Outsourcing Market Summary

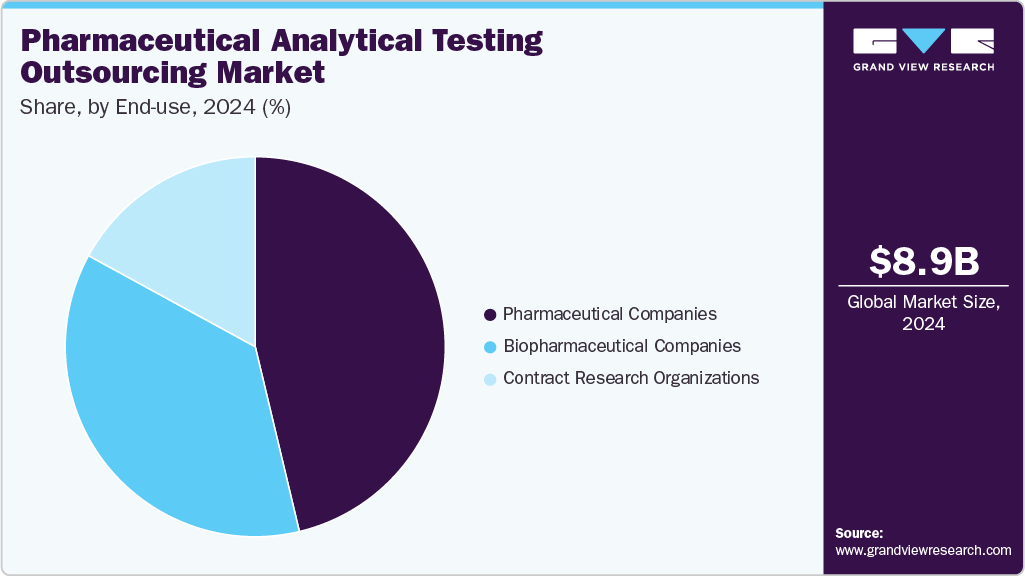

The global pharmaceutical analytical testing outsourcing market size was estimated at USD 8.96 billion in 2024 and is projected to reach USD 14.56 billion by 2030, growing at a CAGR of 8.5% from 2025 to 2030. The market growth is driven by the increasing emphasis on product safety and quality, growing regulatory scrutiny, and the cost advantages associated with outsourcing.

Key Market Trends & Insights

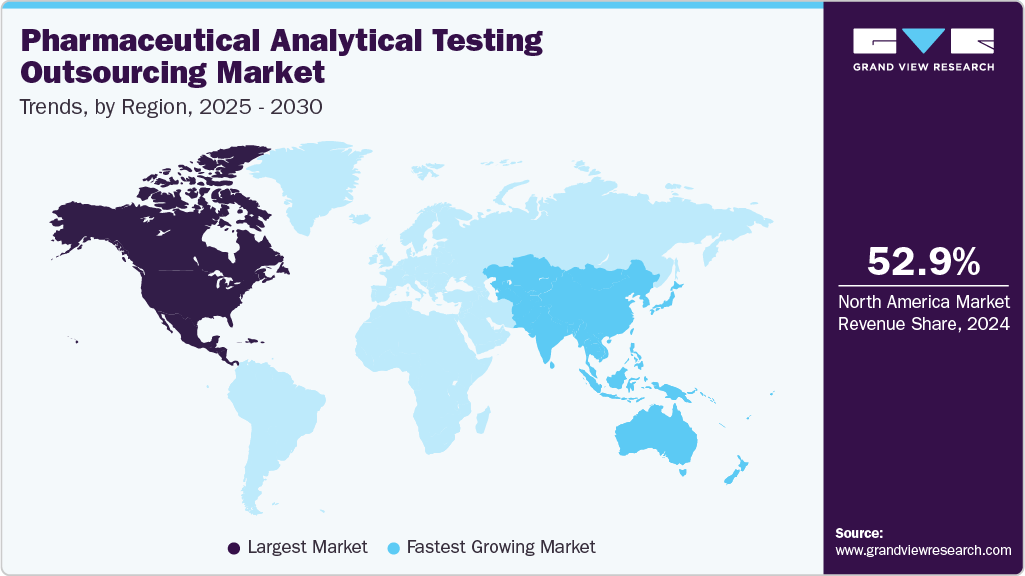

- North America dominated the global market in 2024, holding a revenue share of 52.91%.

- The U.S. pharmaceutical analytical testing outsourcing market is experiencing significant growth.

- In terms of service, the bioanalytical testing segment dominated the market, accounting for a revenue share of 38.44% in 2024.

- In terms of end use, the pharmaceutical companies segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.96 Billion

- 2030 Projected Market Size: USD 14.56 Billion

- CAGR (2025-2030): 8.5%

- North America: Largest market in 2024

Pharmaceutical and biotechnology companies are increasingly turning to outsourcing for analytical testing to optimize resources, adhere to compliance standards, and enhance operational efficiency.Moreover, growing investments in R&D have accelerated the demand for these testing services as many organizations lack the necessary infrastructure for extensive analytical testing making, outsourcing as a strategic approach to save both time and costs. The growing complexity of regulatory requirements across various regions has further led rising shift towards outsourcing analytical testing. As pharmaceutical companies expand their product pipelines and seek to enter new markets, the demand for specialized testing services to meet stringent regulatory standards increases. Analytical testing outsourcing allows companies to access advanced technologies and expertise without the substantial upfront investments required for in-house capabilities. In addition, this trend is supported by the increasing number of CDMOs, CMOs, CROs, and independent testing labs offering tailored solutions that cater to a wide array of pharmaceutical products, from drug formulations to biologics and medical devices. Other factors, such as the changing regulations for in vivo and in vitro tests, are expected to propel the growth of the pharmaceutical analytical testing outsourcing market. Moreover, the high demand for quality generic drugs, the need for improved analytical testing methods, and enhanced review and approval process transparency are anticipated to further fuel market expansion. This growth is also expected to encourage new drug R&D that aligns with global development.

Moreover, growing stringent regulatory requirements are benefiting the expansion of pharmaceutical analytical testing demand in emerging economies, where outsourcing partners offer competitive pricing for a range of services. Besides, countries across Asia Pacific and Latin America are becoming key hubs for outsourced analytical testing due to supportive regulatory environments, skilled labor availability, and rising pharmaceutical production. Furthermore, the increasing adoption of biosimilars and personalized medicine adds complexity to drug development, necessitating robust analytical testing protocols. This is encouraging pharmaceutical companies to collaborate with outsourcing partners who offer specialized capabilities in areas such as stability testing, bioanalytical services, method validation, and microbiological analysis, reinforcing the market's long-term growth prospects.

In addition, changing pharmaceutical industry scenarios, cost advantages, innovation, and new product development directly influence the demand for testing services. Driven by pricing concerns, competitive pressures, and the need to reduce lead time to market, companies are increasingly opting to outsource testing operations. The rising focus on customized care and ongoing technological progress has accelerated new product development. Similarly, introducing biosimilars, combination products, and other innovative medicines has significantly fueled the demand for pharmaceutical analytical testing services.

Opportunity Analysis

The pharmaceutical analytical testing outsourcing market is witnessing significant growth as drug development becomes increasingly complex, particularly with the rise of biologics, biosimilars, and gene therapies. As pharmaceutical and biotechnology companies face the challenge of navigating more stringent regulatory environments, outsourcing testing services to CDMOs, CMOs, and CROs has become an effective strategy for pharmaceutical drug quality testing. This shift is driven by the need for specialized testing services, such as LC-MS/MS, HPLC, and next-generation sequencing, which ensure product safety and regulatory compliance. Moreover, the globalization of clinical trials and the emphasis on personalized medicine are pushing pharmaceutical companies to partner with CROs that can meet diverse testing requirements across different regions and regulatory landscapes.

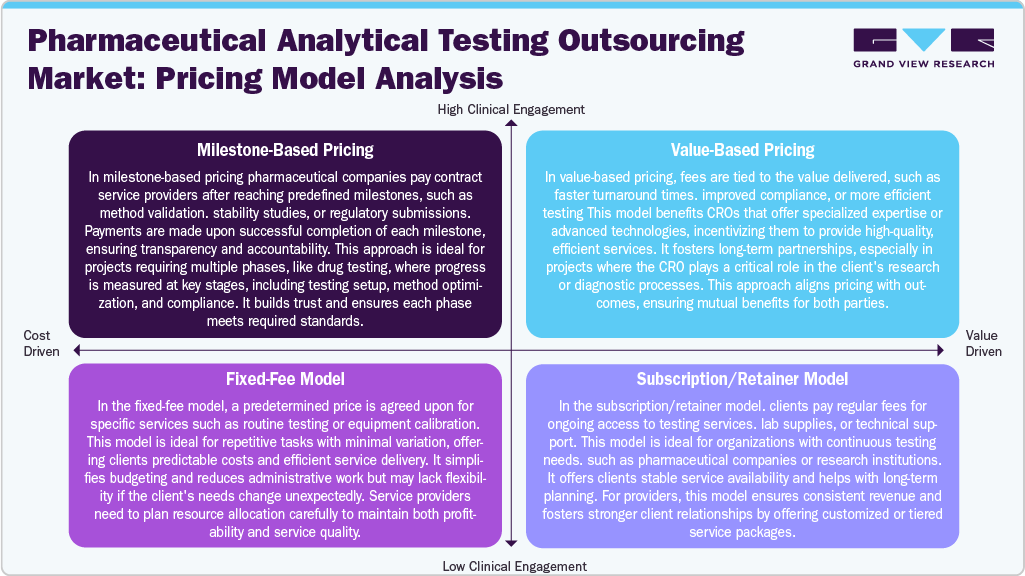

The growing complexity of drug development further accelerates the demand for advanced analytical techniques, essential in developing complex biologics and gene therapies. Outsourcing companies that provide high-precision testing services, including stability testing and bioanalytical assays, are positioned to support these innovative drug classes. With increasing budget constraints, pharmaceutical companies seek cost-effective outsourcing models, such as milestone-based and subscription pricing, allowing greater flexibility and scalability in testing services. In addition, as regulatory standards evolve, the need for pharmaceutical analytical testing outsourcing companies with expertise in international quality and compliance standards continues to rise, creating opportunities for companies to focus on core R&D while leveraging the specialized capabilities of outsourced partners.

Technological innovations play a crucial role in shaping the pharmaceutical analytical testing market. Automation, robotics, and artificial intelligence are transforming the testing processes employed by outsourcing firms, enhancing efficiency, minimizing manual errors, and speeding up turnaround times. Besides, digital platforms like Laboratory Information Management Systems (LIMS) support improving transparency, tracking, and regulatory compliance, further boosting the demand for testing services.

Moreover, as the demand for biologics and gene therapies grows, the outsourcing companies are expected to witness rising demand for testing solutions. Furthermore, the increasing focus on sustainability in the pharmaceutical sector presents an opportunity for CROs to adopt eco-friendly testing practices that appeal to clients with a focus on green chemistry. With these trends, outsourcing companies that invest in advanced technologies, expand into emerging markets, and align with sustainability goals are poised to capitalize on the growing demand for pharmaceutical analytical testing outsourcing services.

Impact of U.S. Tariffs on the Global Pharmaceutical Analytical Testing Outsourcing Market

The introduction of U.S. tariffs on imported lab equipment, reagents, and consumables has increased operational costs for pharmaceutical analytical testing outsourcing providers. Many tools and materials, such as testing kits, chromatography equipment, and chemical reagents, are imported from countries like China and EU nations. With these tariffs, CDMOs, CMOs, and CROs in the U.S. face higher expenses, which often result in increased service fees for pharmaceutical companies relying on outsourced testing.

This cost increase puts pressure on smaller pharmaceutical companies with limited budgets, potentially slowing early-stage drug development and reducing the amount of work outsourced. To manage these challenges, the pharmaceutical analytical testing outsourcing companiesare exploring tariff-free regions and shifting to local suppliers where possible. In addition, they are renegotiating contracts or adjusting prices to cope with rising costs, which can affect profit margins and pricing strategies. As a result, the tariffs are pushing outsourcing companiesand pharmaceutical companies to rethink their supply chain and outsourcing decisions to minimize financial strain.

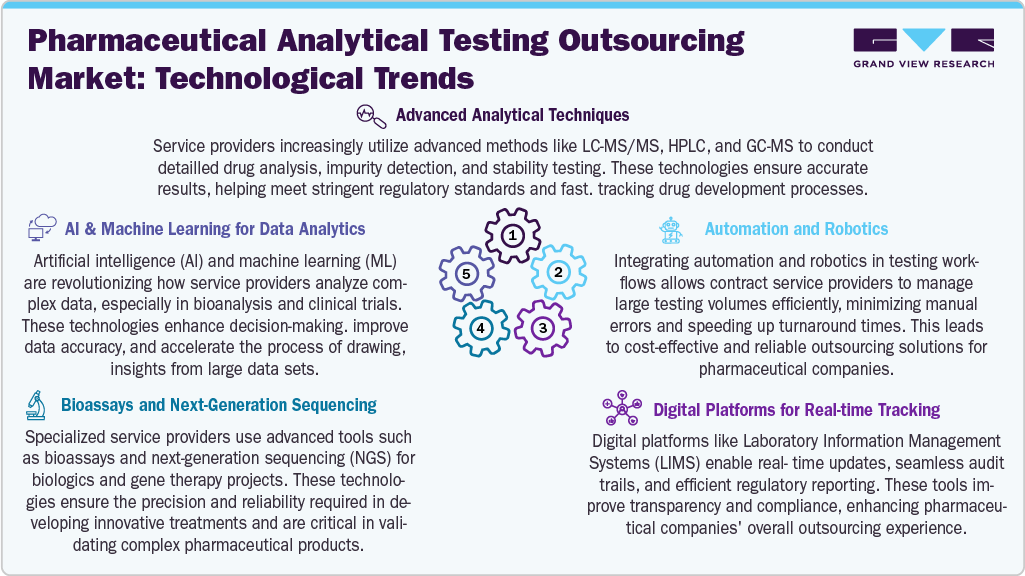

Technological Advancements

Technological advancements play a major role in improving outsourcing services for pharmaceutical analytical testing. Outsourcing companies are increasingly using advanced techniques such as LC-MS/MS, HPLC, and GC-MS to perform detailed drug analysis, impurity detection, and stability testing for pharmaceutical companies. These technologies support the outsourcing companies to deliver accurate and timely results, which are essential for meeting regulatory requirements and accelerating drug development timelines.

For instance, CROs are also using automation and robotics to handle large volumes of testing efficiently. These tools reduce manual errors and improve turnaround times, making outsourcing more reliable and cost-effective for pharmaceutical companies. AI and machine learning support CROs in analyzing complex data sets, especially in bioanalysis and clinical trial support, helping to improve the quality and speed of decision-making.

Digital platforms like Laboratory Information Management Systems (LIMS) help outsourced labs provide real-time updates, manage audit trails, and ensure smooth regulatory reporting. In addition, CROs are using advanced tools like bioassays and next-generation sequencing for biologics and gene therapy projects, which require high levels of precision. By adopting these technologies, CROs offer pharmaceutical companies a strong outsourcing solution that improves efficiency, reduces in-house burden, and supports faster time to market.

Pricing Model Analysis

Pricing Models in the Pharmaceutical Analytical Testing Outsourcing Market

The pricing structure in the pharmaceutical analytical testing outsourcing market is evolving to meet the increasing complexity of drug development and regulatory expectations. Milestone-based pricing is commonly adopted for multi-stage projects such as method development, validation, and long-term stability studies. This model aligns payments with the completion of specific deliverables, helping pharmaceutical sponsors manage timelines and quality benchmarks effectively. Besides, fixed-fee pricing remains a standard approach for routine testing services like raw material analysis, dissolution testing, and microbial limits testing. While it offers budget predictability, it requires clear project definitions to avoid scope variations. In addition, value-based pricing is gaining attention, especially for projects tied to regulatory submissions or accelerated approval timelines, where compensation is linked to successful outcomes and timely data delivery.

In addition, subscription and retainer-based models are gaining traction among pharmaceutical companies with continuous testing needs. These models involve scheduled payments for sustained access to CRO services and laboratory infrastructure, supporting resource planning and long-term collaboration. With varying testing volumes, regulatory pathways, and product complexities, these pricing strategies allow CROs to tailor offerings that align with clients’ development goals and compliance requirements.

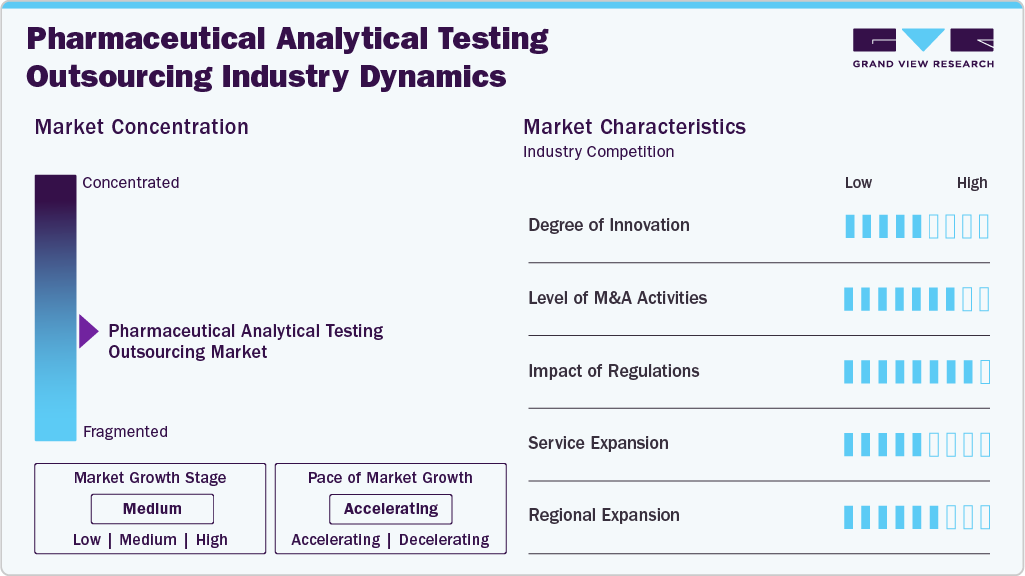

Market Concentration & Characteristics

The pharmaceutical analytical testing outsourcing market growth stage is medium, and growth is accelerating. The market is characterized by the degree of innovation, level of M&A activities, regulatory impact, service substitutes, and regional expansion.

The pharmaceutical analytical testing outsourcing market demonstrates a moderate to high degree of innovation, driven by the continuous introduction of novel testing methodologies, automation tools, and data management systems. Innovations in high-throughput screening, real-time data analytics, and advanced bioanalytical techniques support more accurate and efficient testing processes. Providers are investing in specialized capabilities, such as stability testing for complex biologics and biosimilars, to meet evolving client demands and support advanced drug development.

Regulatory compliance is a defining aspect of the market, with evolving guidelines from bodies such as the U.S. FDA, EMA, and ICH significantly shaping outsourcing trends. Stricter requirements for drug safety, efficacy, and manufacturing practices are prompting pharmaceutical companies to rely on external partners with strong regulatory expertise. Regulatory harmonization across global markets has also influenced the adoption of standardized analytical protocols, reinforcing the need for qualified service providers with international compliance capabilities.

The market is witnessing steady merger and acquisition (M&A) activity, with companies aiming to expand service offerings, enhance geographic reach, and acquire technological capabilities. Larger companies are acquiring smaller, specialized analytical testing firms to strengthen their presence in high-growth areas such as biologics and personalized medicine. These consolidations also help streamline operations and offer end-to-end solutions to clients.

Service expansion is a key trend in the market as outsourcing partners diversify their portfolios to provide comprehensive analytical solutions. Providers are enhancing capabilities across critical service lines such as microbiology, method development, impurity profiling, extractables, and leachables testing. The demand for full-service outsourcing from early-stage drug development to commercial release testing has encouraged a more integrated approach among vendors.

The market is growing in many regions due to the presence of advanced CMOs and CDMOs. The focus on personalized care is also rising. In addition, the fast development of new products, growing need for certain types of tests, and the presence of pharmaceutical companies are helping the market grow. Improved efficiency and medical knowledge in these regions are further supporting this growth.

Service Insights

The bioanalytical testing segment dominated the market, accounting for a revenue share of 38.44% in 2024. Bioanalytical testing covers both clinical and non-clinical studies. Method development and validation is further broken down into extractable and leachable studies, technical consulting, impurity method development, and other related services. Stability testing includes testing drug substances, validation of stability-indicating methods, photostability testing, accelerated stability testing, and more.

This growth is driven by the rising number of clinical trials and the growing presence of new pharmaceutical companies. Many smaller firms do not have the tools or skilled teams needed for detailed testing, so they turn to specialized service providers. These providers have experience in handling complex testing, ensuring accurate and timely results. In addition, the growing focus on biologics, biosimilars, and personalized medicines, which require careful analysis, continues to increase the demand for bioanalytical testing services.

The method development and validation segment are expected to grow significantly during the forecast period. The method development is widely used to select and analytical techniques for assessing the specific characteristics of a drug substance or product. Analytical methods like HPLC, GC, MS, and various forms of spectroscopy play a vital role in method development. Besides, the growing complexity of drug formulations has increased the need for validation protocols. Furthermore, method development is essential for ensuring regulatory compliance, drug quality, and patient safety, which are anticipated to fuel the market growth.

End Use Insights

The pharmaceutical companies segment accounted for the largest market share in 2024. Many drug manufacturers prefer to outsource testing to cut costs and speed up development. With rules and quality standards becoming more demanding, outsourcing gives these companies access to advanced tools and experienced professionals without building their facilities. This helps them stay focused on developing new drugs. Also, many small pharmaceutical companies do not have in-house testing capabilities. To manage this, they often work with contract research organizations (CROs) for support. Outsourcing helps save time and lets these companies concentrate on their core work, further supporting segment growth.

The biopharmaceutical companies’ segment is expected to grow at a significant CAGR during the forecast period. Rising demand for testing in biopharmaceutical companies to improve productivity, characterize biologics and biosimilars, and maintain real-time product quality control is driving this growth. Biopharmaceutical testing requires specialized staff, advanced tools, and strict regulatory documentation. Many companies outsource these services to experienced providers to save time and manage costs efficiently. The increase in the development of complex biologics further supports the need for reliable analytical testing partners.

Regional Insights

North America pharmaceutical analytical testing outsourcing marketdominated the global market in 2024, holding a revenue share of 52.91%. The market growth is driven by the presence of key market players, the adoption of advanced analytical testing technologies, and a well-established regulatory framework. The region's pharmaceutical companies are increasingly outsourcing testing services to enhance efficiency, reduce operational costs, and manage the growing complexity of drug development. In addition, the demand for high-quality, complex pharmaceuticals continues to rise, pushing the need for reliable and specialized testing services.

The growth in this market is also supported by the increasing number of pharmaceutical industries in the U.S. and Canada and major market players in the region. The shift toward outsourcing, particularly with original equipment manufacturers turning to electronics manufacturing service providers, further drives market expansion. Together, these factors contribute significantly to the ongoing growth of North America's pharmaceutical analytical testing outsourcing market.

U.S. Pharmaceutical Analytical Testing Outsourcing Market Trends

The U.S. pharmaceutical analytical testing outsourcing market is experiencing significant growth, driven by major pharmaceutical companies, CROs, CDMOs, and CMOs, is supported by a robust regulatory framework for innovation and quality standards. The increasing complexity of drug development and stringent regulatory requirements have led pharmaceutical companies to outsource analytical testing services to enhance efficiency and reduce operational costs.

For instance, in March 2024, Pace Analytical Services announced the acquisition of a laboratory facility in Lebanon, New Jersey, from Curia. This acquisition aimed to support emerging drug development partners by providing rapid and expert development and commercial analytical laboratory services across the biopharma industry. Such strategic initiatives underscore the growing trend of outsourcing analytical testing services in the U.S., reflecting the industry's commitment to enhancing capabilities and meeting the evolving demands of pharmaceutical development.

Canada pharmaceutical analytical testing outsourcing market is growing steadily, driven by a strong healthcare infrastructure and an increasing demand for outsourced services in the pharmaceutical sector. The country benefits from its well-established regulatory framework and proximity to the U.S. market, making it an attractive hub for pharmaceutical companies seeking reliable and cost-effective testing solutions. Furthermore, Canada's focus on innovation and research in the pharmaceutical industry, with numerous contract service providers has bolstered the market for analytical testing services. With pharmaceutical companies in Canada continuing to expand their product pipelines, the need for specialized analytical testing services, particularly in drug development and regulatory compliance, is expected to drive further market growth.

Europe Pharmaceutical Analytical Testing Outsourcing Market Trends

Europe is experiencing steady growth in the pharmaceutical analytical testing outsourcing market, driven by a combination of strong academic research, advanced healthcare infrastructure, and a regulatory environment that supports innovation in drug development. Countries such as Germany, the UK, and France are key players in the market, with robust pharmaceutical industries that continue to expand their demand for outsourced testing services. The European Medicines Agency (EMA) plays a significant role in regulating and approving pharmaceutical products, ensuring that testing services adhere to high standards. Furthermore, European research institutions and CROs are at the forefront of developing new methodologies and technologies for analytical testing, contributing to the growth of the outsourcing market. Collaborative efforts and EU-funded programs further enhance cross-border partnerships and foster innovation in analytical testing, ensuring Europe remains a key player in the global pharmaceutical testing landscape.

The pharmaceutical analytical testing outsourcing market in Germany held the largest share in 2024. The country’s growth is supported by its advanced research infrastructure, a strong pharmaceutical industry, and an enabling regulatory environment. The country benefits from collaborations between academic institutions such as the Fraunhofer Institute and Max Planck Institute, as well as private pharmaceutical companies, fostering the development of advanced testing technologies. The Federal Institute for Drugs and Medical Devices (BfArM) manages Germany's regulatory framework, which ensures rigorous quality standards for analytical testing services. The increasing demand for precision medicine and the growing number of pharmaceutical and biotechnology companies in the region drive the need for outsourced testing services. Public-private partnerships also encourage innovation in drug development, positioning Germany as a key contributor to the global pharmaceutical testing market.

The UK pharmaceutical analytical testing outsourcing market in Europe, driven by its robust pharmaceutical and biotechnology industries and a strong research infrastructure. The regulatory framework, overseen by the Medicines and Healthcare products Regulatory Agency (MHRA), ensures that pharmaceutical testing services adhere to stringent standards, fostering market growth. The growing demand for personalized medicine has increased the need for outsourced analytical testing services, particularly as pharmaceutical companies seek more precise and reliable testing methods. Moreover, the UK benefits from the presence of major pharmaceutical companies and an active collaboration between academic institutions and industry players, which further strengthens its position in the global pharmaceutical testing market. The country’s focus on advancing precision medicine and the increasing need for specialized testing for biologics and biosimilars continue to drive the market, positioning the UK as a key contributor to pharmaceutical analytical testing outsourcing.

Asia Pacific Pharmaceutical Analytical Testing Outsourcing Market Trends

Asia Pacific is experiencing significant growth in the pharmaceutical analytical testing outsourcing market, driven by increasing demand for high-quality testing services, the expansion of pharmaceutical industries, and a rising focus on precision medicine. Countries such as China, Japan, and India are leading the adoption of advanced testing technologies and outsourcing pharmaceutical analytical services. The region's growing healthcare infrastructure and increasing pharmaceutical companies contribute to this expansion. Moreover, the demand for regulatory-compliant, high-end testing services is propelling market growth, with companies increasingly outsourcing testing to leverage specialized expertise and improve efficiency.

For instance, in December 2023, Sterling Accuris Diagnostics, a leading chain of NABL-accredited pathology laboratories, acquired Ahmedabad-based Vaibhav Analytical Services, a provider of analytical testing services, including pharmaceutical/drug testing. This acquisition expanded Sterling Accuris' services offered to fields such as pharmaceutical analytical testing. Vaibhav Analytical Services operates its NABL-accredited laboratory, ensuring strict compliance with international standards for pharmaceutical testing at Ahmedabad and services clients from across India. The Nigerian Government (NAFDAC) has also approved the company to become a CRIA-authorized laboratory. This strategic move aligns with Sterling Accuris' commitment to advance healthcare through innovation and excellence in diagnostics and analytical testing services.

The pharmaceutical analytical testing outsourcing market in China is driven by the expanding pharmaceutical sector and the growing demand for high-quality testing services. Many pharmaceutical companies, especially smaller ones, use specialized contract service providers to handle their analytical testing needs. This helps them meet complex regulatory requirements and accelerate their product development processes. The country’s robust regulatory framework and government support create a favorable environment for these partnerships. By working with experienced testing service providers, Chinese pharmaceutical companies can focus more on their core research and development activities while ensuring compliance with international standards. These factors are driving the continued growth of the outsourcing market in China. The regulatory authority overseeing this market is the National Medical Products Administration (NMPA), which ensures that pharmaceutical testing services meet the necessary safety and quality standards. The NMPA is key in approving clinical trials, testing procedures, and commercializing pharmaceutical products in China.

The pharmaceutical analytical testing outsourcing market in Japan isdriven by strong government support, a well-established healthcare sector, and a highly advanced pharmaceutical industry. The country's focus on high-quality drug development and stringent regulatory standards increases the demand for outsourced analytical testing services. Leading research institutions such as the University of Tokyo and RIKEN contribute to developing innovative testing solutions, further supporting Japan's position in the region's pharmaceutical analytical testing outsourcing market. With a focus on precision medicine and regulatory compliance, Japan is expected to continue growing in the outsourcing market in the coming years.

India pharmaceutical analytical testing outsourcing market growth isdriven by a robust pharmaceutical industry, cost-effective services, and an expanding regulatory framework. The country is becoming a popular destination for pharmaceutical companies worldwide looking to outsource their testing needs due to its competitive pricing and skilled workforce. India's growing focus on quality, compliance with international standards, and the presence of experienced CROs fosters an environment conducive to outsourcing. Government support, such as initiatives to improve healthcare infrastructure and regulations, further bolsters the market's growth. With a strong emphasis on meeting global standards and enhancing the efficiency of drug development processes, India is set to continue its expansion in the market.

Latin America Pharmaceutical Analytical Testing Outsourcing Market Trends

Latin America pharmaceutical analytical testing outsourcing market is expanding steadily, supported by the region's growing pharmaceutical industry and the need for cost-effective, high-quality testing services. Countries such as Brazil and Argentina are emerging as key contributors, with pharmaceutical companies increasingly outsourcing analytical testing to improve efficiency and meet international quality standards. Government efforts to strengthen healthcare infrastructure, coupled with the presence of experienced local CROs, are fostering market development. In addition, collaborations between global firms and regional service providers enhance testing capabilities, supporting broader access to advanced pharmaceutical testing solutions across Latin America.

Brazil pharmaceutical analytical testing outsourcing market growth is attributed to changing regulations, rising demand for new medicines, and the need for better product quality. Several companies are working with local testing service providers to meet regulatory standards and speed up drug development. Growing clinical trial activity and support from the government are also helping this market expand. In addition, the availability of skilled professionals and improved laboratory infrastructure makes Brazil a reliable outsourcing option. Local service providers are also forming partnerships with global firms to offer a wider range of services. The country’s growing focus on biosimilars and generics is creating new opportunities in analytical testing. Together, these trends contribute to the positive outlook of the outsourcing market in Brazil.

Middle East & Africa Pharmaceutical Analytical Testing Outsourcing Market Trends

The Middle East and Africa pharmaceutical analytical testing outsourcing market is developing steadily, supported by growing pharmaceutical investments, evolving regulatory frameworks, and the need to meet global quality standards. Countries such as the UAE and Saudi Arabia encourage outsourcing partnerships to strengthen local drug development capabilities and speed up testing processes. The expansion of local manufacturing and increased clinical trial activities also drive demand for specialized analytical services. In addition, collaborations with international CROs and government efforts to boost healthcare infrastructure are helping the region become more active in the global pharmaceutical outsourcing.

South Africa pharmaceutical analytical testing outsourcing market is driven by the growing demand for drug production, increasing government initiatives, and rising needs for specialized testing services among pharmaceutical companies. In addition, the evolving market dynamics, along with efforts to improve the accessibility of pharmaceutical products in underserved regions, are expected to further support the market's growth. The increasing complexity of pharmaceutical products and the need for regulatory compliance are also driving pharmaceutical companies to outsource analytical testing services to specialized providers. With a focus on strengthening local capabilities, South Africa's pharmaceutical sector continues to experience positive growth in the outsourcing market.

Key Pharmaceutical Analytical Testing Outsourcing Company Insights

Key players in the market are focusing on securing regulatory approvals for innovative testing solutions, expanding their product portfolios, and forming strategic collaborations to strengthen their market presence.

Key Pharmaceutical Analytical Testing Outsourcing Companies:

The following are the leading companies in the pharmaceutical analytical testing outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- SGS Société Générale de Surveillance SA

- Labcorp

- Eurofins Scientific

- Pace Analytical Services LLC

- Intertek Group plc

- Thermo Fisher Scientific Inc.

- Wuxi AppTec

- BA Sciences

- Charles River Laboratories

- West Pharmaceutical Services, Inc

Recent Developments

-

In September 2024, Pace Life Sciences, LLC acquired Catalent Inc.’s Center of Excellence for Small Molecule Analytical Services in Research Triangle Park (RTP), North Carolina. This acquisition expands Pace’s capabilities in pharmaceutical analytical testing, enabling the company to support biopharma and pharma clients with services across early-stage development to commercialization. The acquisition will strengthens Pace’s national network and reinforce its position as a full-service analytical outsourcing provider.

-

In March 2024, LGM Pharma announced the expansion of its Analytical Testing Services (ATS) as part of its broader CDMO portfolio. This development aims to meet the growing demand for outsourced pharmaceutical testing by offering tailored solutions in analytical method development, validation, and quality control. The expansion supports pharmaceutical companies seeking comprehensive and efficient testing services to accelerate drug development and ensure regulatory compliance.

-

In December 2023, Agno Pharma enhanced its pharmaceutical testing and drug development capabilities by acquiring Lubrizol Particle Sciences Inc. This acquisition includes advanced drug product formulation technology and the Bethlehem development and manufacturing site. This strategic move strengthens Agno Pharma’s ability to offer comprehensive pharmaceutical analytical testing services, addressing the rising demand for innovative drug testing and formulation solutions.

Pharmaceutical Analytical Testing Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 9.70 billion

Revenue forecast in 2030

USD 14.56 billion

Growth rate

CAGR of 8.5% from 2025 to 2030

Historical Year

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Thailand; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

SGS Société Générale de Surveillance SA; Labcorp; Eurofins Scientific; Pace Analytical Services LLC; Intertek Group plc; Thermo Fisher Scientific Inc.; Wuxi AppTec; BA Sciences; Charles River Laboratories; West Pharmaceutical Services, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Analytical Testing Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical analytical testing outsourcing market report based on service, end use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Bioanalytical Testing

-

Clinical

-

Non-Clinical

-

-

Method Development & Validation

-

Extractable & Leachable

-

Impurity Method

-

Technical Consulting

-

Others

-

-

Stability Testing

-

Drug Substance

-

Stability Indicating Method Validation

-

Accelerated Stability Testing

-

Photostability Testing

-

Others

-

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biopharmaceutical Companies

-

Contract Research Organizations

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical analytical testing outsourcing market size was estimated at USD 8.96 billion in 2024 and is expected to reach USD 9.70 billion in 2025.

b. The global pharmaceutical analytical testing outsourcing market is expected to grow at a compound annual growth rate of 8.61% from 2025 to 2030 to reach USD 14.56 billion by 2030.

b. North America dominated the pharmaceutical analytical testing outsourcing market with a share of 52.91% in 2024. The regional growth is driven by the increasing presence of key market players, the adoption of advanced analytical testing technologies, and a well-established regulatory framework. Besides, the pharmaceutical companies in the region are increasingly outsourcing testing services to enhance efficiency, reduce operational costs, and manage the growing complexity of drug development

b. Some key players operating in the pharmaceutical analytical testing outsourcing market include SGS Société Générale de Surveillance SA, Labcorp, Eurofins Scientific, Pace Analytical Services LLC, Intertek Group plc, PPD Inc (Thermo Fisher Scientific Inc.), Wuxi AppTec, BA Sciences, Charles River Laboratories, West Pharmaceutical Services, Inc

b. Key factors that are driving the pharmaceutical analytical testing outsourcing market growth include increasing demand for analytical drugs, biosimilars, and biopharmaceutical products, growing R&D investments, rising demand for product safety and quality, and changing regulations for in-vivo and in-vitro tests.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.