- Home

- »

- Advanced Interior Materials

- »

-

Pharmaceutical Coating Equipment Market Size Report, 2030GVR Report cover

![Pharmaceutical Coating Equipment Market Size, Share & Trends Report]()

Pharmaceutical Coating Equipment Market (2023 - 2030) Size, Share & Trends Analysis Report By Product Type (Perforated Coating Pan, Standard Coating Pan), By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-970-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Coating Equipment Market Summary

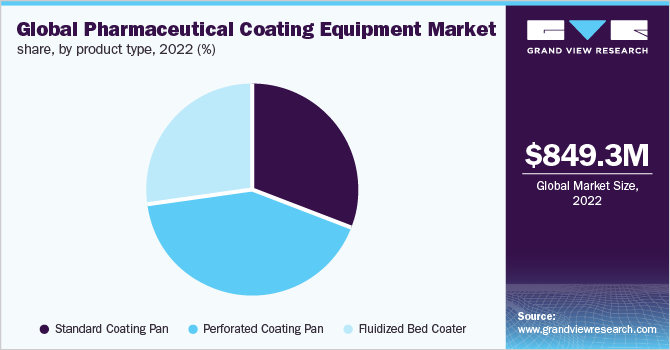

The global pharmaceutical coating equipment market size was estimated at USD 849.3 million in 2022 and is projected to reach USD 1,272.7 million by 2030, growing at a CAGR of 5.2% from 2023 to 2030. The expeditious growth of the pharmaceutical industry, rapid adoption of orphan drugs, increasing research and development (R&D) investment activities and resurgence of COVID-19 infection is anticipated to drive the market growth.

Key Market Trends & Insights

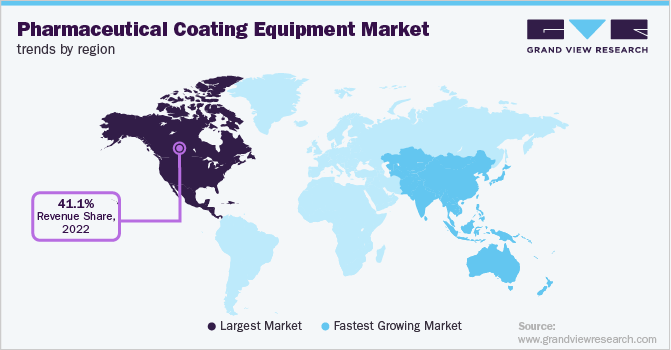

- North America region dominated the market and accounted for 41.1% in 2022.

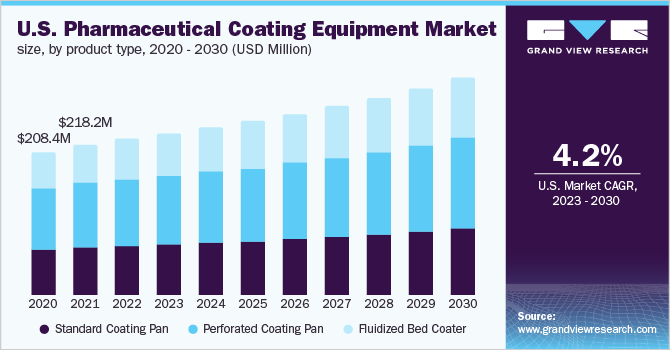

- U.S is expected to register a CAGR of 4.2% in the North American region over the forecast period.

- Asia Pacific region is projected to emerge as the fastest-growing market and is estimated to register a CAGR of 6.6% over the forecast period.

- By technology, the The film coating equipment dominated the market and accounted for 43.6% of the global revenue share in 2022.

- By product, the The standard coating pan equipment segment dominated the market and accounted for 31.3% of the global revenue share in 2022.

Market Size & Forecast

- 2022 Market Size: USD 849.3 Million

- 2030 Projected Market Size: USD 1,272.7 Million

- CAGR (2023-2030): 5.2%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The COVID-19 pandemic is changing the market in the U.S., as businesses in this industry undertook strategic acquisitions and capacity development to satisfy the rising demand for pharmaceutical products. The resurgence of COVID-19 in the U.S. in 2022 coupled with the approval of 32 novel drugs by the Food and Drug Administration (FDA) is expected to boost demand for drugs thereby aiding market demand.Pharmaceutical coating demand increased considerably during the pandemic as pharmaceutical companies and governments around the world worked hard to combat the COVID-19 pandemic. Furthermore, generics are gaining popularity globally. This is owing to a high number of medications having their patent protection expiring and healthcare policies favoring generics. Given the economic savings, governments around the world are encouraging the use of generic medications thereby creating upswings for market growth.

The pharmaceutical industry segment is driven by a rise in the prevalence of diseases that need tablet-based formulations for treatment, an increase in demand for pharmaceutical tablet coatings, and an increase in the number of drugs marketed as tablet formulations. Manufacturers of pharmaceutical tablet coatings are generating incremental opportunities in the global market.

The high growth rates in demand are attributed to factors such as the rapidly expanding middle class, government incentives for the provision of drugs at lower cost, expansions by private firms, and governments allowing FDI penetration in untapped markets. Leading coating manufacturers adopt dual/multiple sourcing strategies for a stable and continuous supply of raw materials. This, in turn, is expected to propel the demand for the pharmaceutical coating market.

Technology Insights

The film coating equipment dominated the market and accounted for 43.6% of the global revenue share in 2022. Film-coated tablets are in high demand in the pharmaceutical sector due to their reduced processing time and relatively thin coats when compared to other forms of coatings. Pharmaceutical uses of tablet film coatings have increased in recent years, generating value-added potential for producers.

The sugar-coating process involves a number of processes, including sealing, sub-coating, polishing, dyeing, and polishing. Sugar coating is a good method for coating pills since it reduces the possibility of medication blunders. It uses pigments/colors to identify and enhances patient compliance through aesthetic appeal.

Dip coating is applied to the tablet cores by dipping them into the coating liquid. Dip coating lines are also low-waste systems, as any surplus paint simply drops back into the dip tank for use in the next cycle of the application. It is inexpensive to set up and operate, yet it can make films with exceptional regularity.

The organic film coating segment is estimated to register a CAGR of 4.0% over the forecast period. As most polymers are soluble in a wide range of organic solvents, the organic solvent-based coating offers a choice of usable polymer options. In addition, pharmaceutical industries are paying attention to developing formulations with an organic film coating.

Product Type Insights

The standard coating pan equipment segment dominated the market and accounted for 31.3% of the global revenue share in 2022. The standard coating pan, which is also known as the conventional pan system is a common accessory in most pharmaceutical industries as it provides faster coating and an even distribution of the coating solution.

Many pharmaceutical companies choose perforated coating pans. This type of tablet coating equipment often features a fully or partially perforated drum. The drum of this tablet coater, like the standard coating pan, spins on a horizontal axis. The drying of coating material by a perforated coating system is better as compared to other conventional methods.

The fluidized bed coater technology segment is estimated to register a CAGR of 6.1% over the forecast period. Fluidized bed processes are one of the most efficient methods for producing thick-film coatings. They offer 100% transfer efficiency as well as cheaper initial and ongoing maintenance expenses. They may also cover an entire rack of components in a single dip.

The process is highly effective because it uses core particles that are not completely flat and uses small droplet sizes to coat them. This guarantees that the coating solution atomizes and sticks to the particles' surfaces without producing agglomeration. Fluidized bed coating can also generate high-quality, homogenous coatings that are highly resistant to moisture and abrasion.

Regional Insights

North America region dominated the market and accounted for 41.1% in 2022. The development of innovative pharmaceutical products, generics, and biosimilars, coupled with the profitable presence of key competitors with huge production capacities, will drive the market for pharmaceutical coating in North America.

The U.S is expected to register a CAGR of 4.2% in the North American region over the forecast period. The presence of a large base of geriatric population in the country, sophisticated healthcare infrastructure, and relatively higher disposable income levels of patients, are some vital drivers of healthcare settings in the country that are expected to boost the pharmaceutical coating equipment market.

Asia Pacific region is projected to emerge as the fastest-growing market and is estimated to register a CAGR of 6.6% over the forecast period. An increase in the number of companies setting up manufacturing units in the region and favorable government regulations coupled with low labor and manufacturing costs are projected to drive the market. Furthermore, growing healthcare infrastructure, including hospitals and clinics, coupled with an increasing number of people opting for home care facilities, and rising medical tourism in the region.

Central and South America region is expected to register a CAGR of 5.8% over the forecast period. Pharmaceuticals and the healthcare sector will see robust demand owing to the aging population on account of longer life expectancy and lower birth rates coupled with rising instances of chronic diseases and expanding healthcare coverage. Moreover, an increase in collaborations between pharmaceutical companies and outsourcing companies in Latin America for developing COVID-19 treatments is boosting the market growth.

Key Companies & Market Share Insights

The manufacturers adopted several strategies, including acquisitions, mergers, joint ventures, new product developments, and geographical expansions, to enhance market penetration and cater to the changing technological requirements of various coating such as sugar, film, seafood, and Organic Film Coating, dip, and vacuum dip coating. For instance, in October 2021, Colorcon Inc., a global player in pharmaceutical specialty excipients and film coatings, acquired Ideal Cures, which provides tablet and capsule coatings to the pharmaceutical and allied industries.

The shifting focus of pharmaceutical manufacturing to emerging markets along with the increasing outsourcing of operations to other countries present significant opportunities for market growth. Additionally, the rising focus on technological advancements in niche market areas also offers significant growth opportunities for players operating in the pharmaceutical coating market. Some of the prominent players in the global pharmaceutical coating equipment market include:

-

Ohara Technologies

-

ACG

-

Glatt GmbH

-

Romaco Group

-

Thomas Processing LLC

-

GEA Group Aktiengesellschaft

-

Syntegon Technology GmbH

-

L.B. Bohle Maschinen und Verfahren GmbH

-

DIOSNA (LINXIS Group)

-

GEBRÜDER LÖDIGE MASCHINENBAU GMBH

Pharmaceutical Coating Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 887.5 million

Revenue forecast in 2030

USD 1,272.7 million

Growth Rate

CAGR of 5.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Product, technology, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; Italy; U.K.; China; Japan; India; South Korea; Brazil, Argentina, South Africa, Saudi Arabia

Key companies profiled

Ohara Technologies; ACG; Glatt GmbH; Romaco Group; Thomas Processing LLC; GEA Group Aktiengesellschaft; Syntegon Technology GmbH; L.B. Bohle Maschinen und Verfahren GmbH; DIOSNA (LINXIS Group); GEBRÜDER LÖDIGE MASCHINENBAU GMBH; Freund-Vector Corporation; I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A.; SaintyCo.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

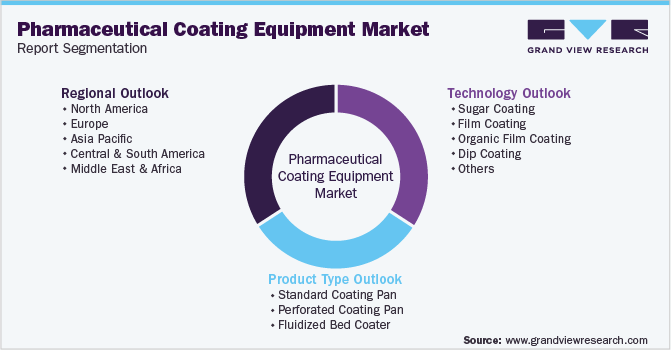

Global Pharmaceutical Coating Equipment Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical coating equipment market based on product type, technology, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Sugar Coating

-

Film Coating

-

Organic Film Coating

-

Dip Coating

-

Others

-

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard Coating Pan

-

Perforated Coating Pan

-

Fluidized Bed Coater

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical coating equipment market size was estimated at USD 849.3 million in 2022 and is expected to be USD 887.5 million in 2023

b. The pharmaceutical coating equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.2 % from 2023 to 2030 to reach USD 1,272.7 million by 2030

b. North America dominated the pharmaceutical coating equipment market with a revenue share of 41.1 % in 2022. The development of innovative pharmaceutical products, coupled with the profitable presence of key competitors with huge production capacities, will drive the market for pharmaceutical coating in North America.

b. Some of the key players operating in the pharmaceutical coating equipment market include: Ohara Technologies , ACG , Glatt GmbH,Romaco Group, Thomas Processing LLC, GEA Group Aktiengesellschaft, Syntegon Technology GmbH, L.B. Bohle Maschinen und Verfahren GmbH, DIOSNA (LINXIS Group), GEBRÜDER LÖDIGE MASCHINENBAU GMBH, Freund-Vector Corporation, I.M.A. INDUSTRIA MACCHINE AUTOMATICHE S.P.A., SaintyCo.

b. Key factors that are driving the pharmaceutical coating equipment market growth include Expeditious growth of the pharmaceutical industry, rapid adoption of orphan drugs, increasing research and development (R&D) investment activities is anticipated to drive the market growth

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.