- Home

- »

- Food Additives & Nutricosmetics

- »

-

Pharmaceutical Grade Lactose Market Size Report, 2030GVR Report cover

![Pharmaceutical Grade Lactose Market Size, Share & Trends Report]()

Pharmaceutical Grade Lactose Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Crystalline Monohydrate Lactose, Inhalation Lactose, Granulated Lactose, Spray Dried Lactose), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-765-0

- Number of Report Pages: 142

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

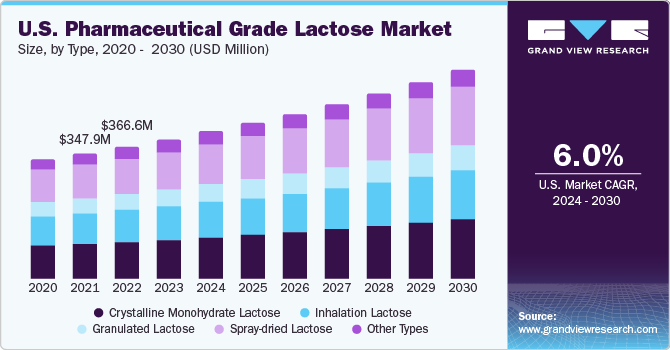

The global pharmaceutical grade lactose market size was estimated at USD 1.96 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 5.5% from 2024 to 2030. The increasing spending on the healthcare industry throughout the world is poised to have a positive impact on the global market. The industry is competitive, wherein several companies compete in this market, supplying products to various end-users worldwide. Product launches, expansions, and research & development efforts are also crucial to gain a competitive advantage. For instance, in February 2023, MEGGLE GmbH & Co. KG expanded its distribution network through agreements with exclusive distributors, such as its partnership with Barentz for the distribution of its pharmaceutical grades of lactose in the U.S. Such strategic initiatives collectively position the company to continue to play a major role in the industry.

Lactose, a type of sugar found in milk and milk products, consists of glucose and galactose, two simple sugars. The process of breaking down lactose occurs in the small intestine, facilitated by an enzyme known as lactase. Individuals who lack sufficient lactase production experience undigested lactose passing through the small intestine. This can lead to symptoms including bloating, gas, diarrhea, and cramps. Lactose is used in the pharmaceutical industry in many ways, especially as an excipient. According to the National Institutes of Health (Government of the U.S.), it is found in more than 20% of various prescription medicines and over 6% of over-the-counter (OTC) medicines.

It has several properties that make it ideal for use in tablets, capsules, oral solutions, and intravenous solution formulations. It is a good flow agent, which makes it easy to handle and process. It is also a good binder, which helps hold tablets and capsules together. In addition, it is a good disintegrant, which helps tablets and capsules to break down quickly in the stomach. Apart from tablets, it is also used in the formulation of capsules, oral liquids, powders, and intravenous solutions. The specific use of lactose in a pharmaceutical product varies depending on the drug and desired formulation. However, it is a versatile excipient that can be used in a variety of ways to improve the quality and safety of pharmaceutical products.

Market Dynamics

Increasing spending on the healthcare/pharmaceutical sector throughout the world is poised to have a positive impact on the global pharmaceutical lactose industry. Health spending indicators play a crucial role in monitoring resource allocation, guiding the development of health policies, and enhancing transparency and accountability within health systems. According to the Association of the British Pharmaceutical Industry (ABPI), the U.S., China, India, Japan, Germany, and France were some of the biggest pharmaceutical markets in 2022.

The increasing pharmaceutical spending in these countries by their respective governments is expected to fuel the demand for pharmaceutical-grade lactose. Furthermore, renowned for producing cost-effective vaccines and generic medications, India has established itself as the leading global supplier of generic drugs. With an impressive growth trajectory, the Indian pharmaceutical industry currently holds the third position in global pharmaceutical production, by volume.

Type Insights

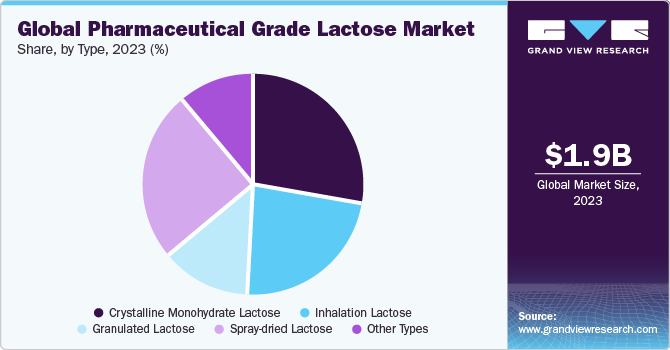

The crystalline monohydrate lactose type segment dominated the market with a revenue share of 28.0% in 2022. This is attributable to its high purity, solubility, and flow properties, which make the product a popular choice for manufacturers aiming to ensure the safety and efficacy of their pharmaceutical products. Inhalation lactose is specifically designed for use in the formulation of dry powder inhalers (DPIs). It is used as a carrier for active pharmaceutical ingredients (APIs) in these formulations. It is typically manufactured through an extensive process that involves spray drying and sieving to obtain particles of a specific size range.

The lactose particles used in DPIs are usually in the range of 15–90 microns to carry out efficient delivery of inhaler medicine to the lungs. Spray-dried lactose is used in the pharmaceutical industry. It is spray-dried to form small, free-flowing particles and is primarily used as a filler or carrier in various formulations. The spray-drying process involves the atomization of a lactose solution into a hot air stream, which evaporates the solvent and forms dry lactose particles. The resulting particles are typically in the range of 10–200 microns and have a high surface area and porosity. This makes them excellent carriers for active ingredients.

Regional Insights

North America dominated the industry with a revenue share of 28.9% in 2022. This is attributed to the presence of well-established players across the region, such as Pfizer, Johnson & Johnson, and Merck. The use of lactose-induced infant formula has also been linked to improved digestion and the prevention of gastrointestinal issues in infants. As healthcare providers and parents become increasingly aware of the benefits of infant formula, the demand for this product is expected to continue to increase. In Asia Pacific, the market is propelled by a range of government initiatives aimed at making prescription drugs more affordable for the population and facilitating a conducive environment for foreign investments. Asia Pacific market stands apart from Western markets due to the existence of numerous small-scale players equipped with in-line manufacturing capabilities. Over the forecast period, the product market in this region is expected to experience notable growth, primarily driven by favorable government regulations and presence of cost-effective labor and raw materials.

The pharmaceutical industry is growing in Europe on account of the rising aging population, which has led to an increase in demand for medicines and healthcare services. The country also has a strong foundation for research & development, with many universities, research centers, and biotech companies contributing to innovation and new drug development. The European Union (EU) has also implemented regulations and incentives to support the growth of industry and attract investments. Thus, all these factors are contributing to the pharmaceutical industry’s growth in this region, which, in turn, is expected to drive product demand, which is majorly used in tablets and capsules.

Key Companies & Market Share Insights

Key players penetrating the regions are involved in broadening their product portfolio and global presence. Various partnerships and distribution agreements are undertaken by these manufacturing companies to meet the rising product demand in new geographical markets. Moreover, companies are investing in R&D activities to develop new products with higher quality and purity. This gives the manufacturers a competitive advantage over other companies. For instance, in September 2022, DFE Pharma opened a new Center of Excellence in India to serve its customers in the country. In addition, the company has forged strategic partnerships and collaborations with industry players to accelerate innovations and develop highly comprehensive solutions for its customers.

Key Pharmaceutical Grade Lactose Companies:

- ARMOR PROTEINES

- BASF Corporation

- Charotar Casein Company

- DFE Pharma

- Fengchen Group Co., Ltd.

- Alpavit

- Kavya Pharma

- Kerry Group plc

- Lactalis Ingredients

- Lactose (India) Limited

- MEGGLE GmbH & Co. KG

- FrieslandCampina

- Surfachem Group Ltd.

Pharmaceutical Grade Lactose Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.06 billion

Revenue forecast in 2030

USD 2.82 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in tons, revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Switzerland; Russia; Turkey; Poland; The Netherlands; China; India; Japan; South Korea; Pakistan; Bangladesh; Indonesia; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Egypt

Key companies profiled

ARMOR PROTEINES; BASF Corp.; Charotar Casein Company; DFE Pharma; Fengchen Group Co. Ltd.; Alpavit; Kavya Pharma; Kerry Group plc; Lactalis Ingredients; Lactose (India) Ltd.; MEGGLE GmbH & Co. KG; FrieslandCampina; Surfachem Group Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Grade Lactose Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical grade lactose market report based on type and region:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Crystalline Monohydrate Lactose

-

Inhalation Lactose

-

Granulated Lactose

-

Spray-dried Lactose

-

Other Types

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Switzerland

-

The Netherlands

-

Poland

-

Russia

-

Turkey

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Pakistan

-

Bangladesh

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Egypt

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical grade lactose market size was estimated at USD 1.96 billion in 2023 and is expected to reach USD 2.06 billion in 2024

b. The global pharmaceutical grade lactose market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 2.82 billion by 2030

b. North America dominated the pharmaceutical grade lactose market with a share of 28.9% in 2023. This is attributable to rising awareness about the benefits of lactose induced infant formula among parents and healthcare providers

b. Some key players operating in the pharmaceutical grade lactose market include Armor Proteines S.A.S., BASF SE, DFE Pharma, Fengchen Group Co., Ltd, Kerry Group plc, and MEGGLE GmbH & Co. KG, among others.

b. Key factors driving the market growth include increasing spending on the healthcare/pharmaceutical industry worldwide, favorable government initiatives to provide affordable prescription drugs to citizens, and enabling a favorable environment for foreign investments.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.