- Home

- »

- Medical Devices

- »

-

Pharmaceutical Serialization Services Market Report, 2030GVR Report cover

![Pharmaceutical Serialization Services Market Size, Share & Trends Report]()

Pharmaceutical Serialization Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Packaging (Primary Packaging, Secondary Packaging, Tertiary Packaging), By Product, By Technology, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-509-8

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Serialization Services Market Summary

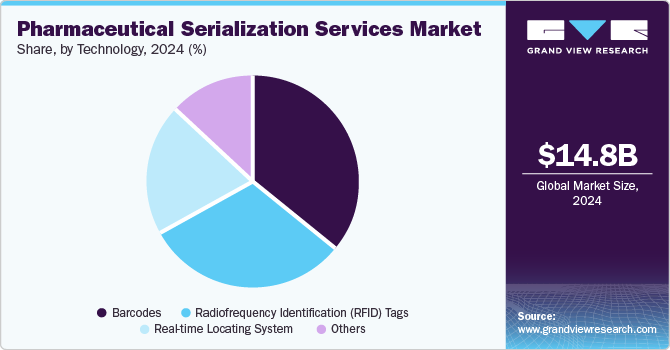

The global pharmaceutical serialization services market size was estimated at USD 14,780.6 million in 2024 and is projected to reach USD 29,352.9 million by 2030, growing at a CAGR of 12.28% from 2025 to 2030. The growth of the market is primarily driven by increasing regulatory requirements, such as those imposing traceability and authentication of drugs throughout the supply chain. Serialization systems play a crucial role in combating counterfeit drugs, ensuring that only genuine products reach consumers.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, China is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, primary packaging accounted for a revenue of USD 6,829.4 million in 2024.

- Secondary Packaging is the most lucrative packaging segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 14,780.6 Million

- 2030 Projected Market Size: USD 29,352.9 Million

- CAGR (2025-2030): 12.28%

- North America: Largest market in 2024

Furthermore, advancements in technology, such as RFID, barcoding, and blockchain, are also enhancing the capabilities of serialization, making the process more efficient.

Furthermore, stringent regulatory requirements imposed by governments worldwide are also one of the factors driving market growth. Laws such as the Drug Supply Chain Security Act (DSCSA) in the U.S. and the Falsified Medicines Directive (FMD) in Europe have made it mandatory for pharmaceutical companies to serialize their products. According to the data published by Clinical Trials Arena in August 2023, the U.S. government imposed new regulations that mandated all prescription drugs be serialized for better traceability and authentication in the U.S. This will require manufacturers, distributors, and retailers to adopt advanced systems to track and verify each unit of medication from production to the final point of sale. These regulations ensure better traceability of drugs, which helps prevent counterfeit products from entering the supply chain and enhances patient safety. Thus, as countries continue to strengthen their regulations on drug traceability, the demand for serialization services is projected to rise in the forthcoming years.

Additionally, rising concern over counterfeit drugs is also boosting the demand for pharmaceutical serialization services. Serialization provides a solution by enabling the identification and verification of every drug unit, thus preventing counterfeit drugs from being distributed to patients. Pharmaceutical companies and regulatory bodies are increasingly focusing on adopting advanced technologies to safeguard the integrity of the supply chain and protect consumers from the dangers associated with counterfeit products. Moreover, the integration of serialization with digital health technologies, such as electronic prescriptions and health tracking apps, is another key driver accelerating overall industry growth.

Market Concentration & Characteristics

The industry is witnessing rapid innovation as companies integrate advanced technologies like blockchain, AI-powered analytics, and cloud-based solutions. These innovations enhance supply chain transparency, prevent counterfeiting, and improve regulatory compliance, making serialization more efficient and scalable.

Mergers and acquisitions are reshaping the industry, with key players acquiring specialized firms to expand capabilities and offer end-to-end traceability solutions. This consolidation strengthens market presence, fosters technological advancements, and accelerates the adoption of serialization solutions globally.

Regulatory frameworks, such as the U.S. DSCSA and EU FMD, continue to drive market growth, compelling pharmaceutical companies to implement robust serialization systems. Stricter compliance requirements ensure drug authenticity, improve supply chain security, and reduce counterfeit risks.

Companies are expanding their service portfolios beyond compliance, offering data-driven insights, predictive analytics, and supply chain optimization tools. These value-added services help pharmaceutical firms enhance operational efficiency and gain deeper visibility into product movement.

Regional expansion is accelerating, particularly in Asia-Pacific and Latin America, where governments are enforcing stricter serialization mandates. The growing demand for pharmaceutical traceability in emerging markets is driving investments in serialization infrastructure and digital tracking solutions.

Packaging Insights

The primary packaging segment captured the highest market share of 41.54% in the pharmaceutical serialization services industry in 2024. The growth is mainly owing to its crucial role in ensuring the safety and authenticity of products. This segment includes the serialization of bottles, blister packs, and other immediate packaging forms, which are the first point of contact between the drug and the consumer. As regulations require every individual package to be traceable, primary packaging has become a critical area as it helps to prevent counterfeit drugs from reaching the market. Thus, increasing focus on compliance, along with the need for enhanced security at the packaging level, is also one of the factors driving segment growth.

The secondary packaging segment is projected to experience the fastest growth due to increasing focus on enhancing supply chain security and meeting regulatory requirements. This segment is gaining traction as it provides additional layers of security, enabling better aggregation and tracking of serialized units. The rising demand for anti-counterfeiting measures, along with the need for improved inventory management and traceability, is driving the rapid adoption of these services in the secondary packaging sector.

Product Insights

The hardware segment dominated the pharmaceutical serialization services industry in 2024. Hardware components such as printers, scanners, and labeling machines are essential for implementing serialization systems, ensuring that every unit is properly tagged with unique identifiers. Moreover, the increasing need for compliance with stringent regulatory requirements, along with the growing demand for real-time tracking and authentication of drugs, is further driving the adoption of advanced hardware solutions.

The software segment is anticipated to witness the highest growth rate during the forecast period. The growth is primarily attributed to its role in managing and integrating serialized data across the supply chain. Advanced software solutions enable real-time tracking, data analysis, and reporting, ensuring compliance with regulatory requirements and enhancing supply chain efficiency. As pharmaceutical companies increasingly adopt digital solutions for serialization, the demand for robust software that can handle large volumes of data is projected to grow in the upcoming years. This shift towards more sophisticated software tools is driving the rapid expansion of the software segment.

Technology Insights

The barcodes segment dominated the pharmaceutical serialization services industry in 2024. The growth is owing to their simplicity, cost-effectiveness, and widespread adoption in tracking products. Barcodes, particularly 2D barcodes, enable efficient and accurate identification and authentication of drugs at various stages of the supply chain. Their ability to store a large amount of data in a small space makes them ideal for serialization, ensuring compliance with regulatory standards while accelerating seamless tracking and inventory management.

The radiofrequency identification (RFID) tags segment is expected to witness the fastest growth over the estimated period. The growth is attributed to their ability to provide enhanced tracking capabilities and improve supply chain efficiency. RFID tags can be read without direct line-of-sight, allowing for faster and more accurate scanning of products at various points in the distribution process. This technology is particularly valuable in preventing counterfeiting, streamlining inventory management, and offering real-time tracking of products.

Regional Insights

North America pharmaceutical sterilization market accounted for the largest share of 43.67% in 2024, due to the region’s stringent regulatory frameworks, such as the Drug Supply Chain Security Act (DSCSA), which mandates the serialization of pharmaceutical products for traceability and anti-counterfeiting. Moreover, the growing focus on patient safety, along with the region’s advanced healthcare infrastructure and high adoption of cutting-edge technologies, has further boosted the demand for serialization solutions.

U.S. Pharmaceutical Serialization Services Market Trends

The pharmaceutical serialization services market in the U.S. is boosted due to an increasing need for enhanced supply chain visibility and operational efficiency. Pharmaceutical companies are significantly investing in advanced serialization technologies to streamline their operations and reduce risks associated with counterfeit drugs. The rise in consumer demand for greater product transparency and the ability to track pharmaceuticals in real time has also played a significant role in driving the market growth.

Europe Pharmaceutical Serialization Services Market Trends

The pharmaceutical serialization services market in Europe is experiencing lucrative growth due to the region's expanding pharmaceutical industry and evolving regulatory environment. Europe is a hub for pharmaceutical manufacturing and research which is further driving the demand for advanced serialized services.

The UK pharmaceutical serialization services market held a significant share in 2024. The country needs to comply with both European and national regulations which aim at improving drug traceability and combating counterfeit medicines. The implementation of the Falsified Medicines Directive (FMD) led to the widespread adoption of serialization technologies, including barcoding and RFID, across pharmaceutical companies and distributors. The UK's strong healthcare infrastructure and its active role in the global pharmaceutical industry further boost the demand for robust serialization systems, ensuring product safety and transparency in the supply chain.

The pharmaceutical serialization services market in France is witnessing significant growth due to the country’s commitment to ensuring drug safety through compliance with the Falsified Medicines Directive (FMD). As a major hub for the pharmaceutical sector, France’s pharmaceutical companies are increasingly adopting serialization solutions to protect patients from counterfeit products and enhance supply chain efficiency. Moreover, the growing focus on technological integration, such as RFID and blockchain, is further accelerating the country’s market’s growth.

Germany pharmaceutical serialization services market is anticipated to grow significantly over the forecast period due to its robust pharmaceutical manufacturing industry.) The country’s advanced technological landscape, which supports the widespread use of serialization solutions, is further helping to enhance the integrity and security of the drug supply chain. Germany’s proactive approach to responding to counterfeit drugs, combined with its high adoption rate of innovative tracking technologies, is also driving the country’s serialization services.

Asia Pacific Pharmaceutical Serialization Services Market Trends

The pharmaceutical serialization services market in Asia Pacific is projected to grow at the highest CAGR over the forecast period. The growth of the market is mainly due to increasing regulatory pressures and rising concerns about counterfeit drugs in emerging economies. Countries such as China, India, and Japan are adopting serialization technologies to comply with local regulations aimed at ensuring the authenticity and safety of pharmaceutical products. As the region's pharmaceutical industry expands, the need for efficient supply chain management and traceability solutions becomes more critical, driving significant investments in serialization technologies.

China pharmaceutical serialization services market is expected to grow over the forecast period. The growth is driven due to the government's stringent efforts to tackle the growing issue of counterfeit medicines. The implementation of regulatory measures, such as the China Food and Drug Administration (CFDA) regulations, has pushed local pharmaceutical companies to adopt serialization systems to ensure better traceability and compliance with national standards. With the increasing demand for transparent and secure drug distribution, the market is experiencing a shift towards more advanced serialization technologies.

The pharmaceutical serialization services market in Japan is witnessing significant growth over the forecast period. The growth is due to the country’s advanced technological capabilities and commitment to patient safety. The Japanese government’s regulations, including efforts to monitor and control counterfeit drug distribution, have led pharmaceutical companies to adopt serialization solutions. Japan’s pharmaceutical industry, known for its innovation, is increasingly integrating advanced serialization technologies such as RFID and 2D barcodes to ensure the authenticity of drugs.

India pharmaceutical serialization services market is witnessing considerable growth due to the country’s large pharmaceutical manufacturing base and the increasing need to comply with international regulations. As India continues to be a major supplier of generic drugs globally, implementing serialization systems ensures that products meet the standards required by markets such as the U.S. and Europe. The government’s efforts to combat counterfeit drugs and improve supply chain visibility have further pushed the adoption of serialization technologies.

Latin America Pharmaceutical Serialization Services Market Trends

The pharmaceutical serialization services market in Latin America is projected to grow over the forecast period. The growth in the region is due to an increasing focus on regulatory compliance and improving drug safety across the region. Several countries are introducing stricter regulations aimed at combating counterfeit drugs, which is pushing pharmaceutical companies to adopt serialization systems. Pharmaceutical industries in Brazil and Argentina are investing significantly in serialization technologies to enhance supply chain traceability and ensure the authenticity of products.

Brazil pharmaceutical serialization services market is expected to grow over the forecast period due to the country’s increasing pharmaceutical production, and expanding healthcare sector. The Brazilian government's push for increased transparency and the integration of advanced technologies like RFID and barcodes are driving the adoption of serialization solutions. With Brazil being a major pharmaceutical manufacturing hub in the region, the need for efficient tracking and authentication systems is paramount, creating a strong demand for serialization services in the country.

Key Pharmaceutical Serialization Services Company Insights

Key players operating in the pharmaceutical serialization services market are undertaking several initiatives to strengthen their market position and meet the growing demand for secure and compliant supply chains. Several companies are investing in research and development activities to innovate and improve serialization technologies, such as RFID, 2D barcodes, and blockchain, to enhance traceability and reduce counterfeit risks. In addition, strategic partnerships and acquisitions by market players to expand service offerings and geographic reach, especially in emerging markets are also driving the market growth. For instance, in June 2024, OPTEL entered into a partnership agreement with ERM to enhance end-to-end traceability in digital supply chains. This collaboration aims to help businesses improve transparency, sustainability, and regulatory compliance.

Key Pharmaceutical Serialization Services Companies:

The following are the leading companies in the pharmaceutical serialization services market. These companies collectively hold the largest market share and dictate industry trends.

- Systech International

- OPTEL Group

- Arvato Systems

- SEA Vision

- LSPedia

- Innovatum. Inc.

- Wipotec

- Mettler-Toledo

- ZetesAtlas for Pharma

- Abacus Medicine

Recent Developments

-

In August 2024, LSPedia entered into a partnership agreement with Pharma Logistics to improve pharmaceutical supply chain traceability and reverse distribution. This collaboration focuses on turnkey compliance, improved data visibility, and greater operational efficiency. By combining expertise, they aim to streamline regulatory compliance and optimize supply chain management.

-

In September 2024, Arvato Systems entered into a partnership agreement with Advanco, aimed to offer a powerful serialization solution for the pharmaceutical industry. By integrating advanco’s ARC platform with Arvato Systems' CSDB platform, they provide enhanced compliance and efficiency. Such collaborations expand options for customers while optimizing costs through personalized solutions.

Pharmaceutical Sterilization Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 16.45 billion

Revenue forecast in 2030

USD 29.35 billion

Growth rate

CAGR of 12.28% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Packaging, product, technology, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; Saudi Arabia, UAE; Kuwait

Key companies profiled

Systech International, OPTEL Group, Arvato Systems, SEA Vision, LSPedia, Innovatum. Inc., Wipotec, Mettler-Toledo, ZetesAtlas for Pharma, Abacus Medicine

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Serialization Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmaceutical serialization services market report on the basis of packaging, product, technology, and region:

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary Packaging

-

Secondary Packaging

-

Tertiary Packaging

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Barcodes

-

Radiofrequency Identification (RFID) Tags

-

Real-time Locating System

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical serialization services market size was estimated at USD 14.78 billion in 2024 and is expected to reach USD 16.45 billion in 2025.

b. The global pharmaceutical serialization services market is expected to grow at a compound annual growth rate of 12.28% from 2025 to 2030 to reach USD 29.35 billion by 2030.

b. North America dominated the pharmaceutical serialization services market with a share of 43.67% in 2024. The growth in the regions market is mainly due to stringent regulatory requirements coupled with presence of various market players.

b. Some key players operating in the pharmaceutical serialization services market include Systech International, OPTEL Group, Arvato Systems, SEA Vision, LSPedia, Innovatum. Inc., Wipotec, Mettler-Toledo, ZetesAtlas for Pharma, and Abacus Medicine.

b. Key factors that are driving the market growth includes rising concern over counterfeit drugs, stringent regulatory requirements imposed by governments, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.