- Home

- »

- Clinical Diagnostics

- »

-

Pharmaceutical Sterility Testing Market, Industry Report 2033GVR Report cover

![Pharmaceutical Sterility Testing Market Size, Share & Trends Report]()

Pharmaceutical Sterility Testing Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Outsourcing, In-house), By Test (Sterility Testing, Bioburden Testing, Bacterial Endotoxin Testing), By Product, By Sample, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-425-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Pharmaceutical Sterility Testing Market Summary

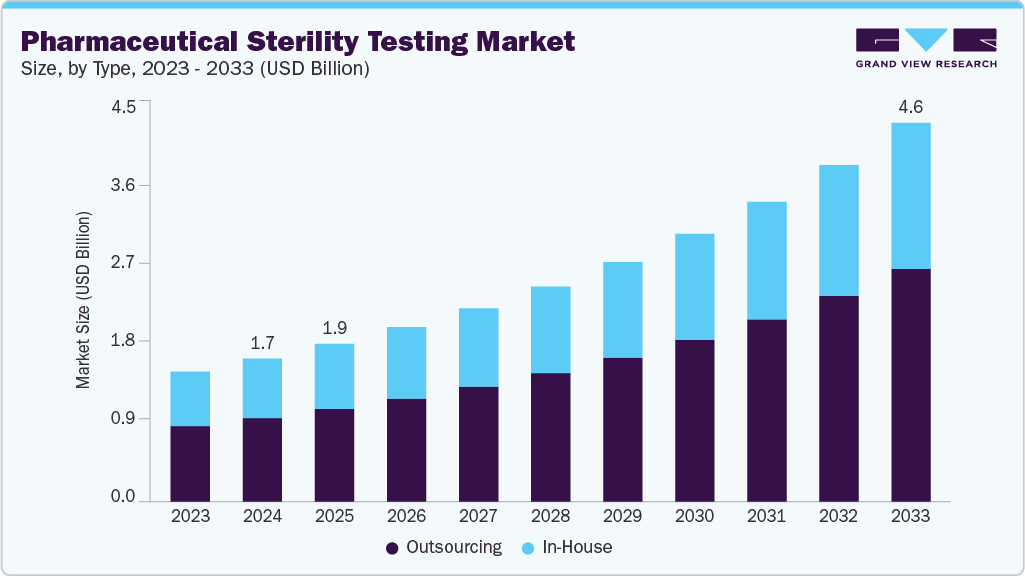

The global pharmaceutical sterility testing market size was estimated at USD 1.75 billion in 2024 and is projected to reach USD 4.64 billion by 2033, growing at a CAGR of 11.58% from 2025 to 2033. Increasing government investments, R&D activities, a growing number of drug launches, and a rising focus on quality & sterility are expected to drive the market growth.

Key Market Trends & Insights

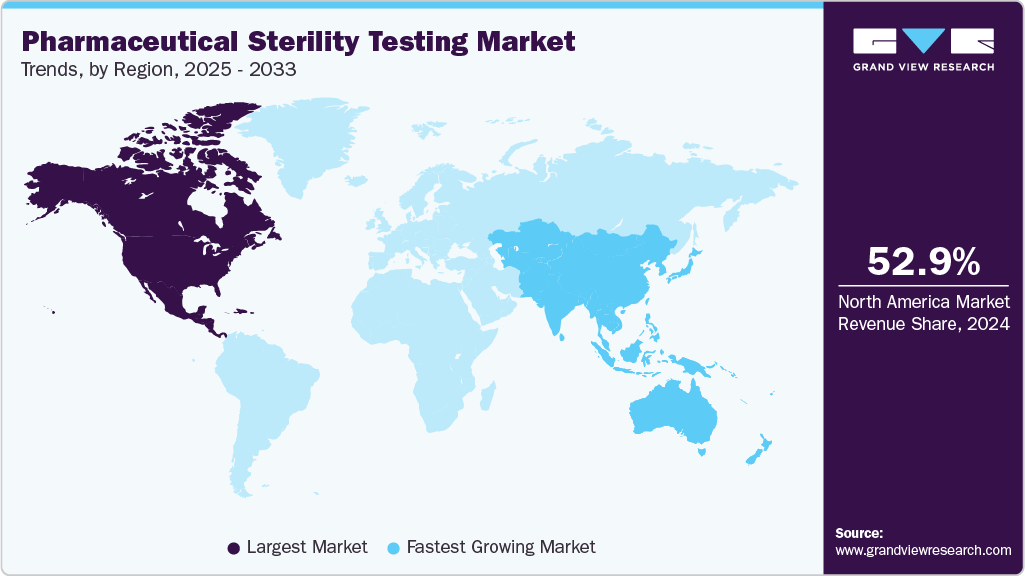

- The North America pharmaceutical sterility testing market held the largest share of 52.88% of the global market in 2024.

- The pharmaceutical sterility testing industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the outsourcing segment led the market with the largest revenue share of 58.50% in 2024.

- Based on test type, the bioburden testing segment led the market with the largest revenue share in 2024.

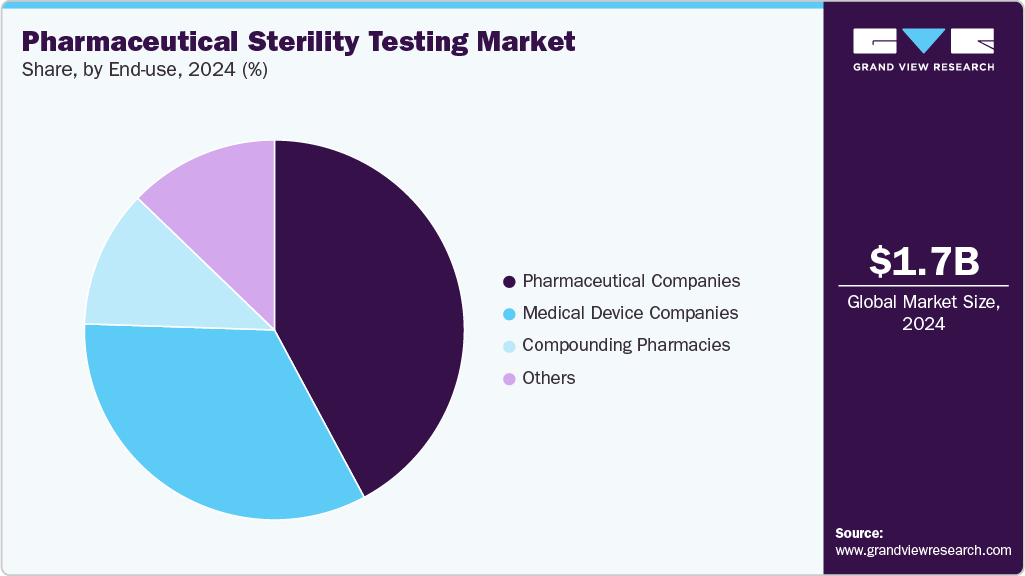

- By end use, the medical device companies segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 1.75 Billion

- 2033 Projected Market Size: USD 4.64 Billion

- CAGR (2025-2033): 11.58%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

The development of comprehensive sterility testing procedures is regulated with stringent policies and quality control standards. Governments in developing economies, such as India and China, are increasingly focusing on providing cost-effective, high-quality medications. The Government of India allocated over USD 8.4 billion for the period from 2021-2022 to 2025-2026 to strengthen the country's healthcare infrastructure. Furthermore, the Government of India invested over USD 4.4 billion in the National Health Mission (NHM) for FY 2023-24, reflecting a decrease of 1% from the previous year. The objectives of the NHM are to enhance the public healthcare system and improve efficiency in utilizing all available resources. The NHM has also established state-level targets for reducing the incidence of communicable and noncommunicable diseases. Additionally, since 2014, 100.0% Foreign Direct Investment (FDI) has been permitted in the healthcare sector, attracting significant foreign investment to date. Currently, India boasts the highest number of U.S. FDA-approved manufacturing facilities, with 665 plants located outside the U.S. As a result, demand for sterility testing services and products is expected to rise over the forecast period.

The increasing emphasis on R&D activities in the pharmaceutical industry profoundly affects the pharmaceutical sterility testing market. As pharmaceutical companies actively engage in the discovering and developing innovative and advanced drug formulations, there is a rising demand for robust sterility testing protocols to ensure the safety and efficacy of these products. R&D efforts drive the development of new pharmaceuticals, biologics, and vaccines, requiring comprehensive sterility testing methodologies to comply with regulatory requirements.

An increasing number of drug launches worldwide is expected to positively impact the market. As pharmaceutical companies bring a wider range of new drugs to market, there is a corresponding rise in the demand for rigorous sterility testing protocols. Each drug must undergo comprehensive testing to comply with strict safety and quality standards, whether for treating existing conditions or tackling new medical challenges. Therefore, the rise in novel drug launches has created unprecedented growth opportunities for the market.

Opportunity Analysis

The growing demand for injectable drugs, biologics, and personalized medicines presents new growth opportunities in the pharmaceutical sterility testing market. Laboratories that expand their capabilities in rapid testing, regulatory documentation support, and environmental monitoring integration can transition from being vendors to strategic partners. There is also significant potential in regional markets like Southeast Asia and Latin America, where infrastructure gaps exist but regulatory compliance is becoming stricter. Furthermore, CROs and CDMOs that invest in technology-driven, full-spectrum sterility assurance can position themselves as premium players meeting global GMP standards.

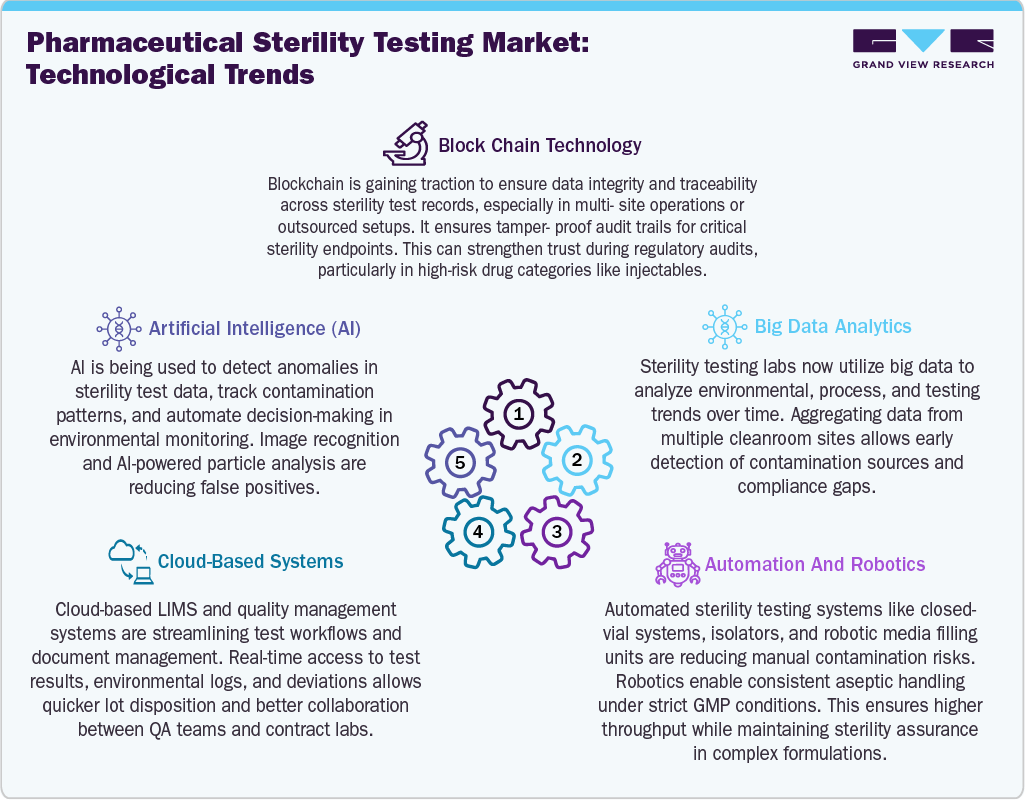

Technological Advancements

The pharmaceutical sterility testing market is undergoing a significant shift toward automation, rapid methods, and contamination-free systems. Closed-vial sterility testing platforms, isolators, and robotic environmental sampling tools are minimizing human error and enhancing consistency in aseptic validation. Technologies like rapid microbial detection (RMMs), real-time particle monitoring, and AI-supported trend analytics are improving quality assurance while adhering to strict global regulatory expectations. As biologics, cell therapies, and complex injectables grow, these advanced systems are no longer optional but essential for labs aiming to efficiently oversee modern sterile products.

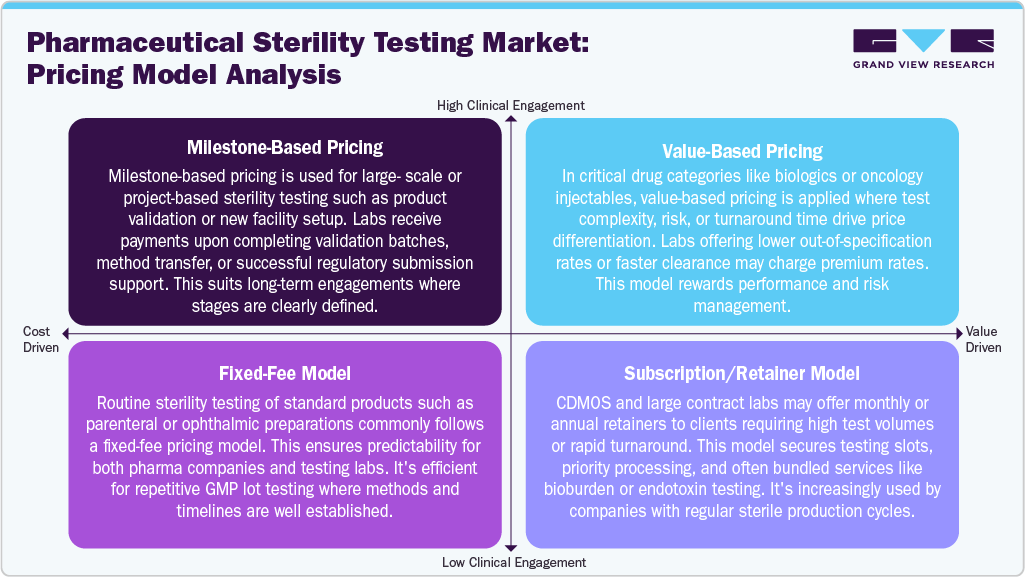

Pricing Analysis

Pricing in sterility testing is evolving beyond traditional per-test fees into more flexible, client-driven frameworks. Labs now offer fixed-fee packages for routine GMP testing, project-based pricing for validation services, and premium value-based pricing for high-risk or expedited batches. Retainer models are emerging in long-term CDMO alliances to guarantee testing capacity for fast-moving sterile drug pipelines. These pricing innovations help contract labs differentiate in a commoditized space and align better with the operational pressures of pharma and biotech sponsors.

Type Insights

Based on type, the pharmaceutical sterility testing industry is categorized into in-house and outsourcing. The outsourcing segment accounted for the largest revenue share of 58.50% in 2024. Outsourcing sterility testing is considered an attractive option for several small- and medium-sized pharmaceutical and medical device companies, which may lack the infrastructure to conduct quality sterility testing. Consequently, most of these companies prefer to outsource sterility testing services to meet the FDA requirements, which is expected to drive the segment’s growth.

The in-house pharmaceutical sterility testing segment is anticipated to grow during the forecast period. The growth is driven by increasing demands for product safety and a rising need for testing services that assess the compatibility and validation of products with routine quality testing and control. Additionally, in-house sterility testing necessitates high levels of control regarding Good Laboratory Practices (GLP), Good Manufacturing Practices (GMP), and employee and environmental practices.

Product Insights

Based on product, the market is divided into kits and reagents, instruments, and services. The kits and reagents segment held the largest market share in 2024. In pharmaceuticals and medical devices, a new, fresh kit is required each time for performing sterility testing. This segment is driven by increasing consumption of kits and reagents used in sterility testing, a rising prevalence of diseases, growing R&D investments, the development of advanced and cost-effective technologies, and expanding applications of sterility and molecular testing. Additionally, the rising demand for new therapeutics globally is expected to further bolster market growth.

The service segment is anticipated to grow at the second fastest CAGR over the forecast period. The increasing prevalence of diseases, heightened R&D activities, growing government investments in the healthcare industry, expanding drug pipelines, and an increasing emphasis on quality and sterility are projected to drive the market growth.

Test Type Insights

Based on test type, the market is segregated into sterility testing, bioburden testing, and bacterial endotoxin testing. Sterility testing is further bifurcated into membrane filtration, direct inoculation, and product flush. The bioburden testing segment held the largest revenue share in 2024. The bioburden testing segment is driven by strict quality control processes and the demand for testing that quantifies microbial contamination of a product at various stages of production, from initial manufacturing to final distribution. The pharmaceutical and medical industries for quality control of pharmaceutical and medical products. It is conducted for sterile drugs, biologics, and all medical devices, including classes I, II, and III. This ensures that pharmaceuticals and medical devices comply with the stringent health and safety regulations established by Title 21 of the Code of Federal Regulations in the USA and by ISO 11737.

Additionally, the sterility testing segment of the pharmaceutical sterility testing industry is anticipated to witness the fastest CAGR during the forecast period. Sterility testing is commonly employed to verify the sterility of products in the pharmaceutical, biopharmaceutical, and medical device industries. The segment's growth can be attributed to the industry's need for sterility testing during the sterilization validation process, as well as for routine release testing.

Sample Insights

Based on sample, the market is segmented into pharmaceuticals, medical devices, and biopharmaceuticals. Pharmaceuticals held the largest share of the pharmaceutical sterility testing industry in 2024. The pharmaceutical industry is subject to strict regulatory requirements, and sterility testing is crucial to ensure compliance with standards such as Good Manufacturing Practices (GMP). Outsourcing sterility testing to specialized laboratories enables pharmaceutical companies to meet these stringent regulatory requirements without heavily investing in specialized facilities and personnel. Pharmaceuticals include various dosage forms, such as parenteral solutions, aerosols, ointments, eye drops, and other formulations.

The biopharmaceuticals segment is expected to grow at the fastest CAGR over the forecast period. The biopharmaceutical sector, including biologics and biosimilars, has been expanding. These products often require specialized testing services, including sterility testing. There is a growing demand for biologics and biosimilar drugs in the U.S. as they are highly effective in treating serious diseases like cancer, autoimmune diseases, neurological disorders, and others. The COVID-19 pandemic increased the demand for vaccines in the country, and due to this, in July 2022, the U.S. government secured 3.2 million doses of the Novavax COVID-19 Vaccine. Such initiatives drive the demand for biopharmaceutical sterility testing.

End-use Insights

Based on end use, the market is divided into compounding pharmacies, medical device companies, pharmaceutical companies, and others. The medical device companies held the largest market share in 2024. By outsourcing noncore activities like sterility testing, medical device companies can concentrate on their core competencies, such as research, development, and manufacturing. This focus can lead to increased efficiency and innovation. Furthermore, sterility testing for medical devices can be complex, requiring specialized expertise and facilities. Outsourcing to specialized testing laboratories with experienced personnel and advanced technologies ensures accurate and reliable results. It can also help mitigate risks associated with contamination and ensure that testing is conducted by experts focusing on quality assurance.

The compounding pharmacies are expected to grow at the fastest CAGR over the forecast period. These pharmacies prepare customized dosages of sterile drugs, which must meet the stringent requirements and standards of sterility. Sterility testing helps compounding pharmacies maintain control and consistency while reducing risks associated with manufacturing in an aseptic environment.

Regional Insights

North America accounted for the largest revenue share of 52.88% in the pharmaceutical sterility testing market in 2024. This is attributed to the increasing number of pharmaceutical industries and the presence of a number of major market players within the U.S. and Canada. The market expansion can be ascribed to the existence of technologically advanced CROs & CDMOs and an upsurge in the allocation of grants. The increasing prevalence of diverse diseases has led to additional investments in clinical research throughout the projected period. Furthermore, heightened drug development endeavors, strategic measures like innovation & acquisitions, the presence of pharmaceutical and biotech firms, and a surge in the number of clinical trials in the region are key factors propelling market growth.

U.S. Pharmaceutical Sterility Testing Market Trends

The pharmaceutical sterility testing industry in the U.S. held the largest revenue share in 2024. An increase in R&D activities and a rise in the number of drug approvals in the country are among the major factors supporting market growth.

Europe Pharmaceutical Sterility Testing Market Trends

The pharmaceutical sterility testing industry in Europe is expected to grow significantly due to growing regulations. These regulatory bodies regularly conduct inspections to ensure compliance with the manufacturing units and contract manufacturing units with quality standards, which are expected to contribute to the increasing demand for pharmaceutical sterility testing in this region.

The pharmaceutical sterility testing market in Germany held the largest share in 2024, due to the increased demand for improved product designs and related services. Technological advancements and high-quality clinical resources are among the key factors driving market growth during the forecast period.

The UK pharmaceutical sterility testing market is anticipated to grow over the forecast period. The UK is of prime importance for pharmaceutical companies, which is expected to contribute to extensive R&D initiatives and clinical trials being undertaken to address the challenges posed by various diseases.

Asia Pacific Pharmaceutical Sterility Testing Market Trends

The Asia Pacific pharmaceutical sterility testing industry is expected to grow the fastest over the forecast period, driven by numerous developed countries investing in Asia Pacific nations and various amendments made by regulatory agencies to facilitate local manufacturing and contract services. The increasing healthcare demand due to a rising population is also anticipated to accelerate the drug approval process, indirectly supporting the market growth. Furthermore, the harmonization of regulatory standards in these regions with the International Council for Harmonization of Technical Requirements for Pharmaceuticals for Human Use (ICH) standards is expected to fuel market growth.

The pharmaceutical sterility testing market in China held the largest share in 2024. Additionally, the country has become an appealing destination for outsourcing clinical trials due to its large population, diverse patient demographics, and cost-effectiveness. Consequently, domestic and international pharmaceutical companies outsource their clinical trials to Contract Research Organizations (CROs) in China, which is driving the demand for sterility testing services.

The Japan pharmaceutical sterility testing market is expected to grow over the forecast period due to the commencement of development and manufacturing services for messenger ribonucleic acid pharmaceuticals, biopharmaceuticals produced through gene & cell therapies, and mammalian cell cultures.

The pharmaceutical sterility testing market in India is anticipated to grow at a significant CAGR over the forecast period. This growth can be attributed to low costs, the availability of industry experts, and the presence of WHO-cGMP-compliant facilities. Additionally, increasing government funding for R&D aimed at accelerating new product development is likely to enhance the number of new drugs, thereby promoting the demand for pharmaceutical sterility testing in India.

Key Pharmaceutical Sterility Testing Company Insights

Several key players are pursuing various strategic initiatives to enhance their market position, providing diverse services to customers. The main strategies adopted by companies include service launches, mergers & acquisitions, joint ventures, partnerships, and agreements, along with expansions, to increase market presence and revenue while gaining a competitive edge that drives the market growth.

Key Pharmaceutical Sterility Testing Companies:

The following are the leading companies in the pharmaceutical sterility testings market. These companies collectively hold the largest market share and dictate industry trends.

- Pacific Biolabs

- Steris Plc

- Boston Analytical

- Sotera Health Company (Nelson Labs)

- Sartorius Ag

- Solvias Ag

- SGS SA

- Labcorp

- Pace Analytical

- Charles River Laboratories

- Thermo Fisher Scientific, Inc.

- Rapid Micro Biosystems, Inc.

- Almac Group

- Labor LS SE & Co. KG

Recent Developments

-

In January 2024, Rapid Micro Biosystems, Inc. announced the launch of the Growth Direct Rapid Sterility application by mid-2024.

-

In August 2023, Pace Analytical Services improved its capabilities by adding advanced hydrocarbon analytical support and expanding sediment & tissue testing with the acquisition of Alpha Analytical.

-

In May 2023, Thermo Fisher Scientific, Inc. announced the launch of a sterile drug facility in Singapore. It would help deliver new vaccines and medicines in the Asia Pacific market.

Pharmaceutical Sterility Testing Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.93 billion

Revenue forecast in 2033

USD 4.64 billion

Growth rate

CAGR of 11.58% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, test type, sample, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Pacific Biolabs; Steris Plc; Boston Analytical; Nelson Laboratories, LLC (Sotera Health); Sartorius AG; SOLVIAS AG; SGS SA; Labcorp; Pace Analytical; Charles River Laboratories; Thermo Fisher Scientific, Inc.; Rapid Micro Biosystems; Almac Group;Labor LS SE & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pharmaceutical Sterility Testing Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pharmaceutical sterility testing market report based on type, product, test type, sample, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

In-House

-

Outsourcing

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Kits and Reagents

-

Instruments

-

Services

-

-

Test Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Sterility Testing

-

Membrane Filtration

-

Direct Inoculation

-

Product Flush

-

-

Bioburden Testing

-

Bacterial Endotoxin Testing

-

-

Sample Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharmaceuticals

-

Medical Devices

-

Biopharmaceuticals

-

-

End-use Outlook (Revenue, USD Million, 2021 - 2033)

-

Compounding Pharmacies

-

Medical Device Companies

-

Pharmaceutical Companies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmaceutical sterility testing market size was estimated at USD 1.75 billion in 2024 and is expected to reach USD 1.93 billion in 2025.

b. The global pharmaceutical testing sterility market is expected to grow at a compound annual growth rate of 11.58% from 2025 to 2033 to reach USD 4.64 billion by 2033.

b. North America dominated the Pharmaceutical sterility testing market with a share of 52.88% in 2024. This is attributed to the increasing number of pharmaceutical industries within the U.S. & Canada, and the increasing presence of the number of major market players this region is expected to contribute significantly to the market growth.

b. Some key players operating in the pharmaceutical testing sterility market include SPacific Biolabs, Steris Plc, Boston Analytical, Nelson Laboratories, LLC (Sotera Health), Sartorius AG, SOLVIAS AG, SGS SA, Labcorp, Pace Analytical, and others.

b. Key factors that are driving the market growth include increasing government investments in the healthcare industry, increasing R&D activities, increasing the number of drug launches, and increasing focus on quality and sterility.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.