- Home

- »

- Biotechnology

- »

-

Pharmacokinetics Services Market Size, Share Report, 2030GVR Report cover

![Pharmacokinetics Services Market Size, Share & Trends Report]()

Pharmacokinetics Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Type (Small Molecules), By Application (SMEs) By End-use (Biotechnology & Pharmaceutical Companies) By Region, And Segment Forecasts

- Report ID: GVR-2-68038-375-1

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

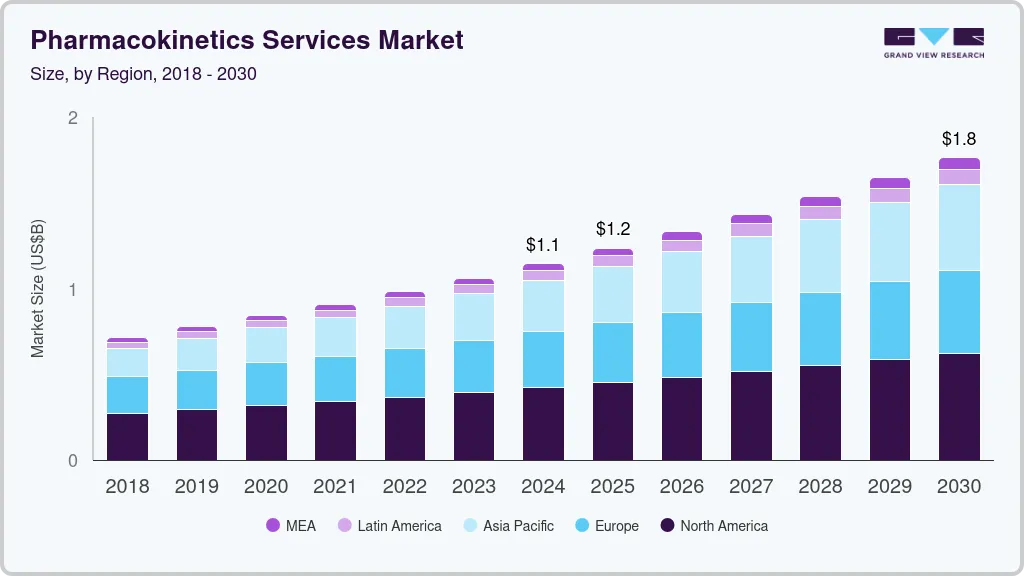

The global pharmacokinetics services market size was estimated at USD 1,145.3 million in 2024 and is projected to reach USD 1,762.4 million by 2030, growing at a CAGR of 7.4% from 2025 to 2030. Poor pharmacokinetics (PK) of therapeutics is one of the key reasons for higher drug attrition. To reduce concerns about high drug attrition, researchers are embracing the trend of PK investigation of novel moieties at each development stage. Implementing predictive preclinical pharmacokinetics/ pharmacodynamics (PK/PD) models in various clinical trial stages is a promising way to address major bottlenecks in the pharmaceutical development process. This is primarily because PK studies identify potential challenges early and assist in required modifications and other development strategies to mitigate drug development challenges.

Increasing awareness among physicians, surgeons, and patients about the advantages of pharmacokinetic and toxicological studies to address various issues such as human equivalent doses and no observed effect levels services has boosted the market. Over the past decades, PK has gained significant prominence in drug discovery. Having understood the role of pharmacokinetics in pharmaceutical development, government and regulatory bodies are undertaking focused efforts to standardize pharmacokinetic protocols.

In the past years, regulatory requirements for clinical pharmacokinetic data have been progressively evolving to address the drug candidate's safety implications. PK study helps to determine the initial amount of dosage that can be administered to study the therapeutic effects as well as potential side effects of the drug. This factor has played a vital role in reshaping this market.PK/PD analysis has helped progress drug development from preclinical studies to rapid and efficient in-man studies. The use of human in vivo and in vitro models for studying pharmacokinetics variability in the clinical development phase has been demonstrated for various pharmaceuticals. During drug development, phase I trials are the first opportunity to study the PK of a drug. They are performed on patients with cancer or healthy volunteers and are designed to determine an acceptable and safe dose for the later stages of clinical trials.

The gradual evolution of drug development into sound pharmacology has prompted several companies to broaden their service portfolio to maintain their competitive edge in the market. This is evident through the presence of a large number of companies with a broad service portfolio to serve various pharmaceutical development phases. Moreover, PK studies are interfacing with other drug discovery functions, such as toxicology, clinical pharmacology, and marketing. This interface has lucratively bolstered the adoption of PK services within the pharmaceutical industry. Certain limitations of in vitro PK studies, such as the inability of available experiments and protocols to predict complete interactions of target and drug candidate, are expected to hamper market growth during the forecast period.

Drug Type Insights

Based on drug type, the market is bifurcated into small and large (biopharmaceuticals) molecules. Small molecule dominated the market with a revenue share of 76.7% in 2022 and is expected to expand at the fastest CAGR of 7.8% over the forecast period, owing to high market penetration, growing market of generics, and their small size, which enables them to pass through the digestive tract easily, this means that the active substances can be absorbed into the bloodstream quickly and spread throughout the body. It uses chromatographic techniques combined with spectroscopic assays to study molecules of smaller atomic weight and drug metabolism and the amount of drug compounds in urine, blood, saliva, and tissue.

Although PK analysis for large molecules is estimated to hold a relatively smaller share in the pharmacokinetics services market than small molecules, this segment is anticipated to grow at a significant CAGR. This growth is majorly due to rising demand for biologics and biosimilars, which has prompted CROs to invest in broadening their PK analysis service portfolio for large moieties.

Large-molecule pharmacokinetic techniques include measurement of proteins, peptide interactions, and mostly greater weight molecules, such as IgE antibodies. They also include immunogenicity assays, Electrochemiluminescence (ECL) assays, vaccine potency support, and various other assays like ELISA.

End-use Insights

Based on end use, the market is segmented into biotechnology & pharmaceutical companies, academic & government research institutes, and others. Academic & government research institutes dominated the market with a market share of 45.0% in 2022 owing to extensive R&D public and private investment.

Biotechnology and pharmaceutical companies are expected to grow at the fastest CAGR of 7.6% over the forecast period owing to increased clinical trials due to the high prevalence of diseases. According to ClinicalTrials.gov, about 458,068 registered clinical studies are currently being conducted in the 50 states of the U.S.

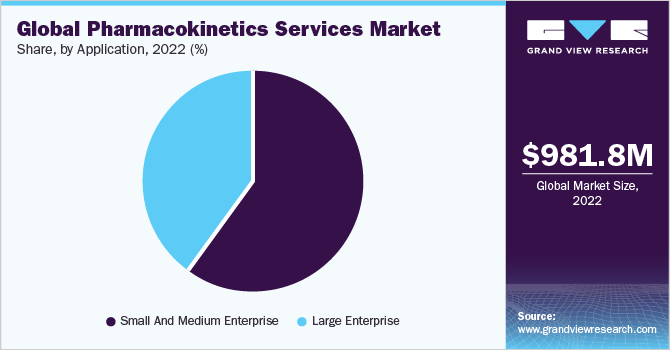

Application Insights

Based on application, the market is segmented into small & medium enterprises and large enterprises. Small & medium enterprises dominated the market with a revenue share of 59.6% in 2022, owing to government support through funding, various programs, and flexibility to take risks to fulfill customer needs and adapt to new technology.

The large enterprise segment is expected to grow at the fastest CAGR of 7.7% over the forecast period, owing to increased demand for safer pharmaceutical drugs with higher absorption, distribution, metabolism, and excretion (ADME) rates. Moreover, the increasing prevalence of various diseases and the emergence of new ones, such as COVID-19, is expected to drive the demand for this segment further.

Regional Insights

North America dominated the market with a revenue share of 37.3% in 2022, owing to the presence of a large number of prominent pharmaceutical companies in the region. Several strategic alliances have been observed between major U.S.-based drug manufacturers and CROs that offer PK investigation services in the region. An effective regulatory structure of drug development processes, including PKPD and toxicology studies in the region, is one of the crucial factors enabling North America’s dominance.

Asia Pacific is estimated to expand at the fastest CAGR of 9.2% over the forecast period, owing to the perpetual business expansion of CROs in this region. Asian countries offer low operating and manufacturing costs in comparison to developed economies. Governments in developing economies such as China, India, Indonesia, and Taiwan are adopting policies to attract foreign investments to their manufacturing industries by reducing trade barriers and tariffs to create more employment opportunities. Moreover, there is a strong presence of potential subject bodies in Asia Pacific. These two factors are expected to drive the growth of pharmacokinetic services in Asian economies.

Key Companies & Market Share Insights

The service providers in this market are engaged in mutually beneficial partnerships with several prominent pharmaceutical and biopharmaceutical companies across the globe. Furthermore, these service providers are focusing on meeting the demand of pharmaceutical developers and enhancing their market position. For instance, in May 2022, Evotec SE announced they had made a strategic equity investment in Tubulis GmbH. Tubulis, a German-based company, is all set to expand its platform technologies to treat solid tumors with highly targeted therapeutics.

In March 2023, Certara, Inc. announced the launch of Simcyp PBPK Simulator Version 22, expanding its therapeutic types and ability to simulate experimental scenarios for new patients. It also includes updated features of the company’s population-based modeling and simulation platform. Some of the players in the global pharmacokinetics services market are:

-

Evotec AG

-

Certara, L.P.

-

Pacific BioLabs

-

GVK Biosciences Private Limited

-

Shanghai Medicilon Inc.

-

Pharmaceutical Product Development, LLC

-

Charles River Laboratories International, Inc.

-

PAREXEL International Corporation

-

Eurofins Scientific, Inc

-

Frontage Labs

-

SGS SA

-

LGC Limited

-

Creative Bioarray

Pharmacokinetics Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,235.9 million

Revenue forecast in 2030

USD 1,762.4 million

Growth rate

CAGR of 7.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Evotec AG; Certara, L.P; Pacific BioLabs: GVK Biosciences Private Limited; Shanghai Medicilon Inc; Pharmaceutical Product Development, LLC; Charles River Laboratories International, Inc; PAREXEL International Corporation; Eurofins Scientific, Inc; Frontage Labs; SGS SA; LGC Limited; Creative Bioarray.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

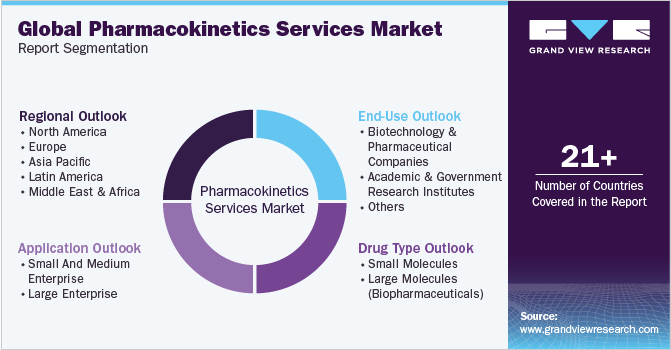

Global Pharmacokinetics Services Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pharmacokinetics services market report based on application, drug type, end-use, and region:

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Molecules

-

Large Molecules (Biopharmaceuticals)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Small And Medium Enterprise

-

Large Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Biotechnology & Pharmaceutical Companies

-

Academic & Government Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global pharmacokinetics services market size was estimated at USD 981.8 million in 2022 and is expected to reach USD 1,060.7 million in 2023.

b. The global pharmacokinetics market is expected to grow at a compound annual growth rate of 7.5% from 2023 to 2030 to reach USD 1,762.4 million by 2030.

b. Small molecules dominated the pharmacokinetics market with a share of 76.7% in 2022. This is primarily because of the high penetration of small molecules and expanding popularity of generics.

b. Some key players operating in the pharmacokinetics market include Evotec AG; Certara, L.P.; Pacific BioLabs; Pharmaceutical Product Development, LLC; Charles River Laboratories International, Inc.; PAREXEL International Corporation; Eurofins Scientific, Inc.; Frontage Labs; SGS SA; LGC Limited; and Creative Bioarray.

b. Key factors that are driving the pharmacokinetics market growth include the rising concern of drug attrition rate among drug developers and a significant increase in the number of candidate programs for clinical trial studies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.