- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Philippines Dietary Supplements Market Size Report, 2030GVR Report cover

![Philippines Dietary Supplements Market Size, Share & Trends Report]()

Philippines Dietary Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Ingredients (Vitamins, Botanicals, Minerals), By Form, By Type, By Application, By End Use, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-675-3

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Philippines Dietary Supplements Market Summary

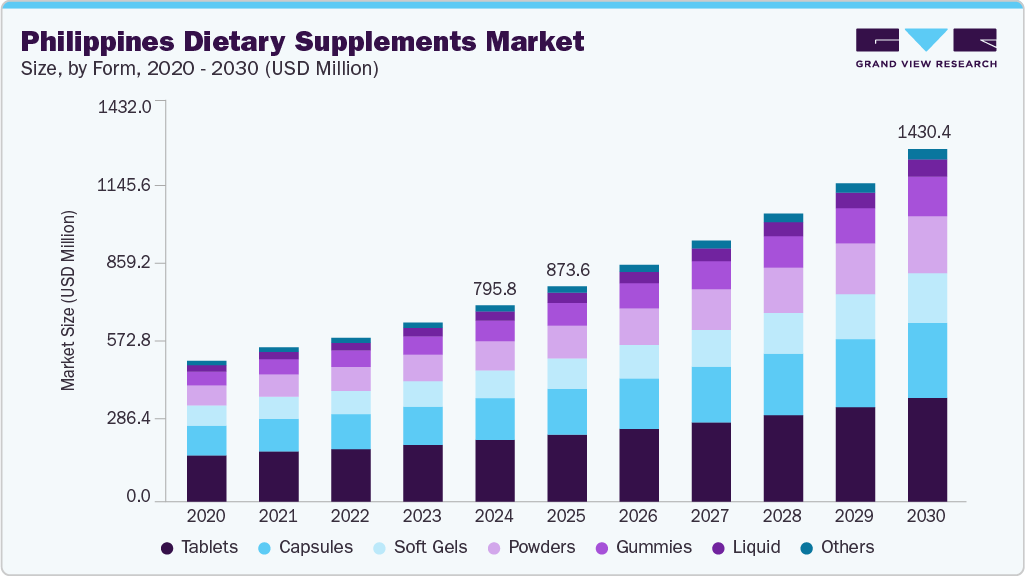

The Philippines dietary supplements market size was estimated at USD 795.8 million in 2024 and is projected to reach USD 1,430.4 million by 2030, growing at a CAGR of 10.4% from 2025 to 2030. The market growth is fueled by rising health consciousness, increasing prevalence of lifestyle-related diseases, and a growing preference for preventive healthcare.

Key Market Trends & Insights

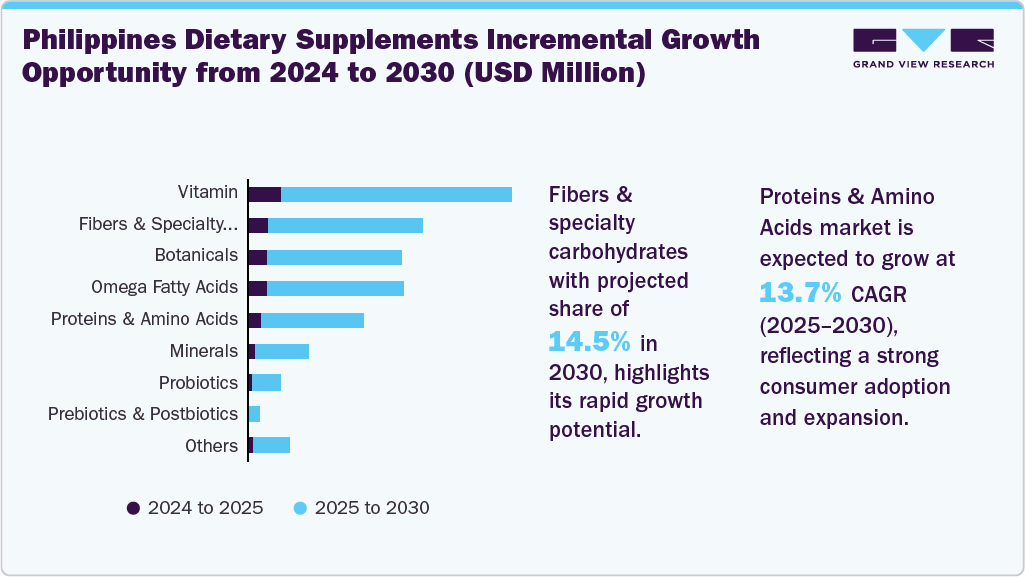

- By ingredients, the vitamin segment held the highest market share of 31.3% in 2024.

- Based on form, the tablet segment held the highest market share in 2024.

- Based on type, the prescribed segment is expected to grow at a significant CAGR from 2025 to 2030 in terms of revenue.

- Based on application, the immunity segment held the highest market share in 2024.

- By end use, the geriatric segment is expected to grow at a considerable CAGR of 10.9% from 2025 to 2030 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 795.8 Million

- 2030 Projected Market Size: USD 1,430.4 Million

- CAGR (2025 - 2030): 10.4%

Consumers are increasingly turning to vitamins, herbal supplements, and functional nutrition products to support immunity, manage chronic conditions, and enhance overall well-being. The surge in e-commerce, urbanization, and disposable income-especially among younger demographics-further amplifies demand.

A growing preference for herbal and natural formulations, deeply rooted in cultural practices, is boosting demand for botanical supplements. The proliferation of e-commerce platforms and hybrid retail models has widened product accessibility, even to remote areas. Rising disposable incomes and urbanization have empowered health-conscious younger consumers to seek preventive care solutions actively. Additionally, government-backed health and wellness campaigns and a surge in functional health trends-such as supplements for immunity, digestive health, and stress relief-are shaping consumer behavior. Companies are also increasingly targeting specific demographics, including children, pregnant women, and the elderly, expanding market reach and segmentation.

The increasing incidence of lifestyle-related diseases-such as diabetes, hypertension, and obesity-is prompting consumers to seek nutritional support beyond conventional medicine. Urbanization and a fast-paced lifestyle have also led to dietary gaps, which supplements are increasingly used to fill. Moreover, the influence of global wellness trends, celebrity endorsements, and social media marketing has significantly boosted consumer interest and trust in supplement brands. The market is also benefiting from the expansion of retail pharmacy chains and specialty health stores, which are actively acquiring smaller outlets to reach underserved areas. In addition, the growing popularity of sports nutrition and fitness culture among younger demographics drives demand for protein powders, amino acids, and performance-enhancing supplements, further diversifying the market landscape.

Consumer Insights

The dietary supplement market in the Philippines is growing steadily, shaped by consumer preferences that vary significantly across age groups and gender. These preferences are influenced by lifestyle, health concerns, and purchasing behavior. Understanding these distinctions is key for brands and healthcare providers aiming to connect with Filipino consumers in a meaningful way.

Older adults, aged 60 and above, prioritize supplements that support bone strength, joint health, heart function, and digestion. They often face challenges with swallowing pills, so they tend to prefer liquid supplements or smaller tablets. Their supplement consumption is typically guided by medical advice or longstanding habits, and they rely heavily on brick-and-mortar pharmacies for their purchases. The health concerns of this group are more specific and chronic, driving demand for targeted formulations with proven benefits.

Consumer Demographics

Gender also plays a major role in shaping consumer behavior in the Philippine supplement industry. Filipino men, across all age groups, are more likely to use supplements that support physical performance, such as protein powders and general multivitamins. They tend to buy from pharmacies or physical stores and focus on energy, immunity, and workout recovery. In contrast, women often prioritize supplements for beauty and wellness, with high demand for products containing collagen, glutathione, probiotics, and vitamins that promote skin and hair health. Women are also more likely to explore newer supplement categories and are influenced by digital marketing and product reviews found online.

Ingredients Insights

Vitamin dominated the Philippines dietary supplements market and accounted for a share of 31.3% in 2024. A growing awareness of preventive healthcare has encouraged individuals to incorporate vitamins into their daily routines to boost immunity, energy, and overall wellness. This shift is particularly evident in urban centers, where busy lifestyles and dietary gaps have made supplementation a practical solution for maintaining health. The country’s expanding geriatric population has also played a pivotal role. Older adults increasingly rely on vitamin supplements to manage age-related conditions such as weakened immunity, bone density loss, and vision decline. According to national statistics, the proportion of senior citizens has steadily risen, amplifying demand for targeted vitamin formulations.

The proteins and amino acids segment is expected to experience the fastest CAGR from 2025 to 2030. The segment growth is driven by a surge in fitness culture, sports nutrition awareness, and demand for muscle recovery and performance-enhancing products. Younger consumers, particularly in urban areas, are increasingly adopting active lifestyles and turning to protein powders, BCAAs, and amino acid blends to support workout routines and body composition goals. This trend is further amplified by the influence of social media, fitness influencers, and the growing popularity of gym memberships and wellness apps.

Form Insights

Tablets dominated the market and accounted for a share of 31.4% in 2024, owing to their convenience, affordability, and widespread consumer familiarity. Tablets are easy to store, transport, and consume, making them a preferred format for daily supplementation, especially among working adults and the elderly. Their longer shelf life and precise dosage also contribute to consistent usage and trust among consumers. Additionally, manufacturers favor tablets due to lower production costs and scalability, allowing for mass distribution across pharmacies, supermarkets, and online platforms.

The gummies segment is expected to experience the fastest CAGR from 2025 to 2030. The segment growth is driven by its appeal across age groups and its blend of taste and functionality. Consumers increasingly favor gummies for their ease of consumption, especially among children and adults who dislike swallowing pills. The format’s versatility allows for the inclusion of a wide range of nutrients-such as multivitamins, probiotics, and omega-3s-making it a convenient and enjoyable alternative to traditional supplements.

Type Insights

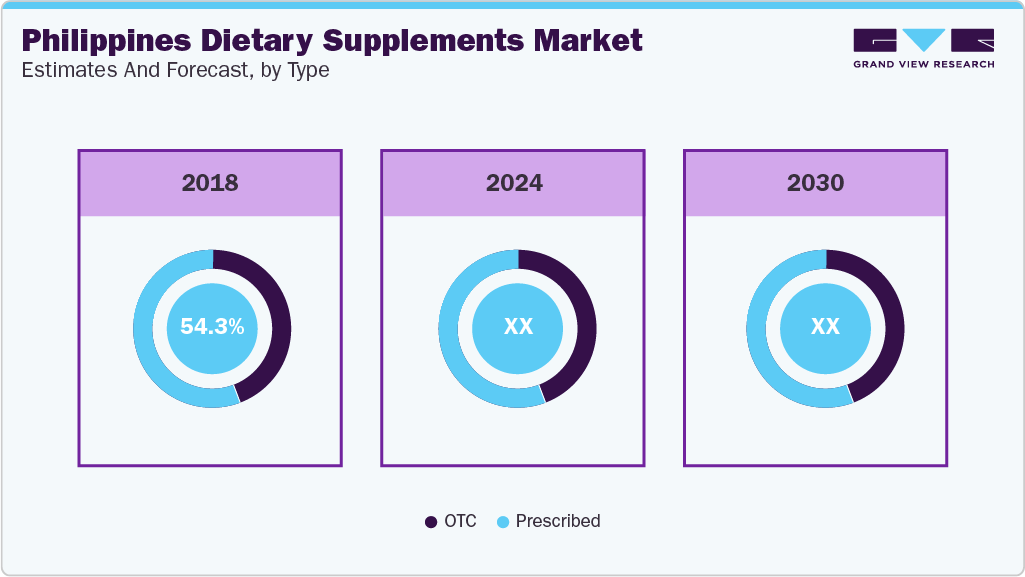

Prescribed supplements dominated the market and accounted for a share of 55.4% in 2024, owing to their clinical credibility, physician endorsement, and targeted therapeutic use. These supplements are often recommended by healthcare professionals to manage specific deficiencies or chronic conditions, ensuring higher consumer trust and compliance. Their regulated formulations and dosage accuracy make them a preferred choice in clinical settings. Additionally, the rising burden of non-communicable diseases and increased access to healthcare services have led to more frequent prescriptions, especially among aging populations and patients with complex health needs.

The OTC segment is expected to experience a significant CAGR from 2025 to 2030. The segment growth is attributed to the increasing consumer autonomy in health management and the rising popularity of self-care. As health awareness deepens, more individuals are proactively purchasing supplements without prescriptions, especially for general wellness, immunity, and lifestyle-related concerns. The expansion of e-commerce platforms and retail pharmacies has further enhanced accessibility, while aggressive marketing and influencer-driven campaigns have boosted consumer trust in OTC brands.

Application Insights

The immunity segment dominated the Philippines dietary supplements market with a revenue share of 14.4% in 2024. The segment growth is attributed to the heightened public health awareness and a sustained focus on disease prevention. The COVID-19 pandemic significantly reshaped consumer behavior, prompting individuals to prioritize immune health through daily supplementation. Vitamins C and D, zinc, and herbal blends became household staples, driven by their perceived role in strengthening the body’s defenses against infections.

The prenatal health segment is expected to grow at the fastest CAGR from 2025 to 2030. The growth of segment is attributed to the increasing awareness of maternal and fetal nutrition, rising healthcare access, and a growing emphasis on preventive care during pregnancy. This surge is supported by a rising number of women seeking targeted supplements rich in folic acid, iron, calcium, and DHA-nutrients essential for healthy fetal development and maternal well-being. Healthcare professionals are also playing a key role in recommending prenatal supplements, while innovations in product formats like gummies and fortified beverages are making them more appealing and accessible.

End Use Insights

The adults segment accounted for the largest market share of 62.2% in 2024. Rising stress levels, sedentary lifestyles, and dietary imbalances have driven adults to seek nutritional support through supplements. This demographic is also more likely to engage with fitness trends, digital health platforms, and self-care routines, further boosting demand. Additionally, increased disposable income and greater access to information via social media and e-commerce have empowered adults to make informed choices about their health, reinforcing their position as the primary consumer base in the market.

The geriatric segment is anticipated to grow at the fastest CAGR during the forecast period. The country’s aging population and rising awareness of age-related health needs are the significant drivers. Older adults increasingly rely on supplements to manage chronic conditions such as osteoporosis, cardiovascular disease, and cognitive decline. Nutrients like calcium, vitamin D, omega-3 fatty acids, and B-complex vitamins are in high demand for their role in supporting bone health, immunity, and neurological function. Additionally, improved healthcare access and targeted product innovations-such as easy-to-swallow tablets and sugar-free formulations-enhance supplement adoption among seniors.

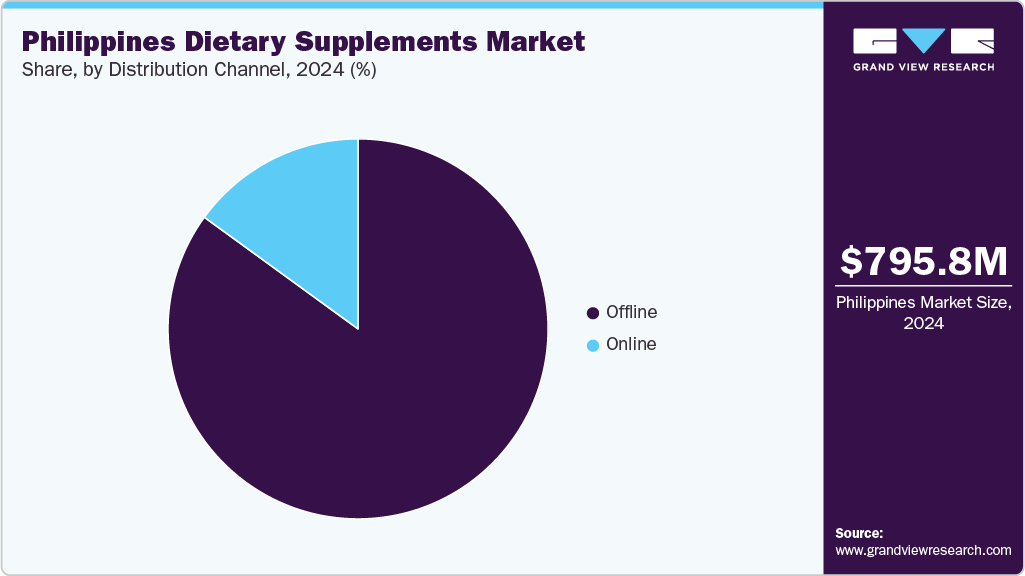

Distribution Channel Insights

The offline distribution segment held largest revenue share of the market in 2024, owing to its widespread reach, consumer trust, and established presence across urban and rural areas. Pharmacies, supermarkets, and specialty health stores remain the primary purchase points for dietary supplements in the Philippines, offering in-person consultation and immediate product availability. Many consumers, particularly older adults and those less digitally inclined, prefer offline channels for the assurance of authenticity and personalized service.

The online distribution segment is projected to experience the fastest CAGR from 2025 to 2030. The segment growth is attributed to the rapid expansion of e-commerce platforms, increased internet penetration, and shifting consumer preferences toward digital convenience. Social media marketing and influencer endorsements have also played a pivotal role in boosting online sales. As digital literacy and mobile commerce continue to rise, the online channel is poised to become a dominant force in supplement distribution.

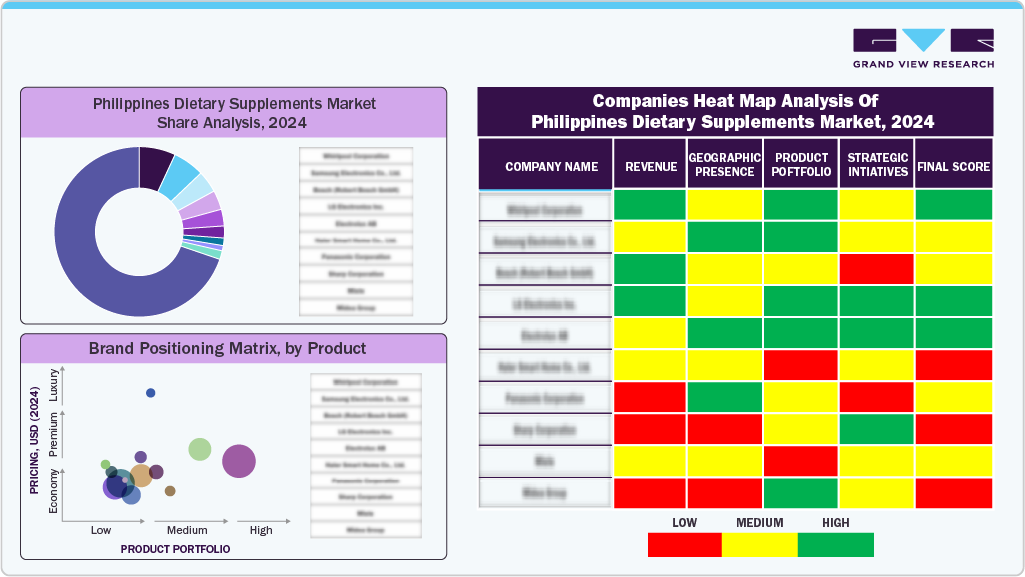

Key Philippines Dietary Supplements Company Insights

Some of the key companies operating in Philippines dietary supplements industry include Unilab, Inc., Amway, Nestlé, and others.

-

Unilab is the largest pharmaceutical and healthcare company in the Philippines, widely recognized for its trusted portfolio of vitamins and dietary supplements. With a strong local presence, Unilab offers a broad range of products. Unilab’s extensive distribution network-spanning pharmacies, supermarkets, and online platforms-ensures nationwide accessibility.

-

USANA is a U.S.-based global leader in science-backed nutritional products and has established a strong foothold in the Philippines since opening its corporate office in Makati in 2009. Known for its CellSentials, Proflavanol, and BiOmega lines, USANA focuses on cellular nutrition and personalized health.

Key Philippines Dietary Supplements Companies:

- Unilab, Inc.

- USANA Health Sciences, Inc.

- Herbalife International of America, Inc.

- Amway Corp

- Nestle

Philippines Dietary Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 873.6 million

Revenue forecast in 2030

USD 1,430.4 million

Growth rate

CAGR of 10.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Ingredients, form, type, application, end use, distribution channel, country

Key companies profiled

Unilab, Inc.; USANA Health Sciences, Inc.; Herbalife International of America, Inc.; Amway Corp; Nestle

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Philippines Dietary Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Philippines dietary supplements market report based on ingredients, form, type, application, end use, and distribution channel:

-

Ingredients Outlook (Revenue, USD Million, 2018 - 2030)

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (Selenium, Chromium, Copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Tablets

-

Capsules

-

Soft Gels

-

Powders

-

Gummies

-

Liquid

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

OTC

-

Prescribed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bone & Joint Health

-

Gastrointestinal Health

-

Immunity

-

Cardiac Health

-

Diabetes

-

Anti-cancer

-

Lungs Detox/Cleanse

-

Skin/ Hair/ Nails

-

Sexual Health

-

Brain/Mental Health

-

Insomnia

-

Menopause

-

Anti-aging

-

Prenatal Health

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Adults

-

Millennials

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen X

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Gen Z

-

Male

-

Female

-

Pregnant Women

-

Non-pregnant Women

-

-

-

Boomers

-

Male

-

Female

-

-

-

Geriatric

-

Children

-

Infants

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Hypermarkets/Supermarkets

-

Pharmacies

-

Specialty Stores

-

Practitioner

-

Others (Direct to Consumer, MLM)

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.