- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Philippines Nutraceuticals Market Size, Industry Report, 2033GVR Report cover

![Philippines Nutraceuticals Market Size, Share & Trends Report]()

Philippines Nutraceuticals Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Dietary Supplements, Functional Food, Functional Beverages, Infant Formula), By Application, By Distribution Channel, And Segment Forecasts

- Report ID: GVR-4-68040-844-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Philippines Nutraceuticals Market Summary

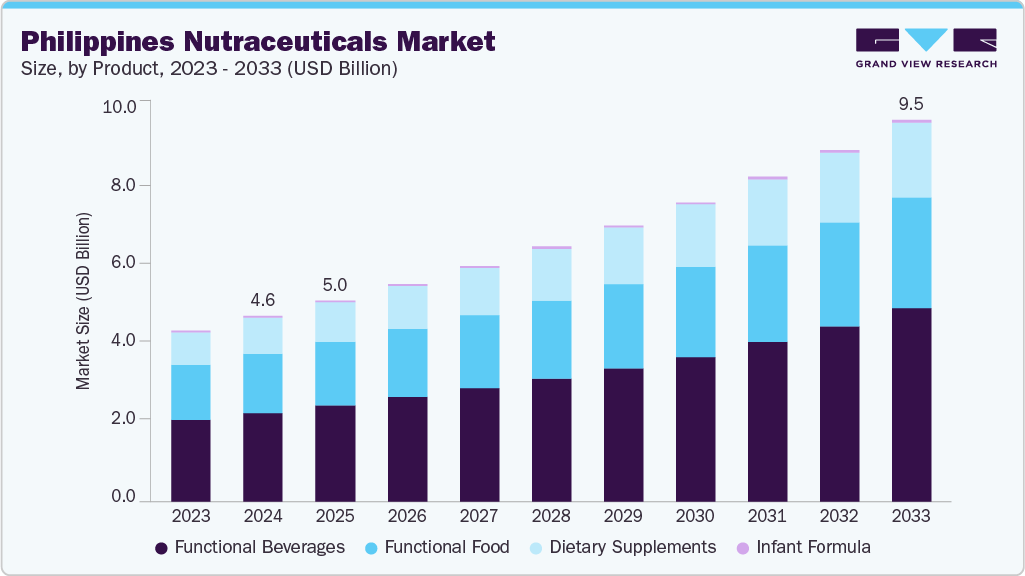

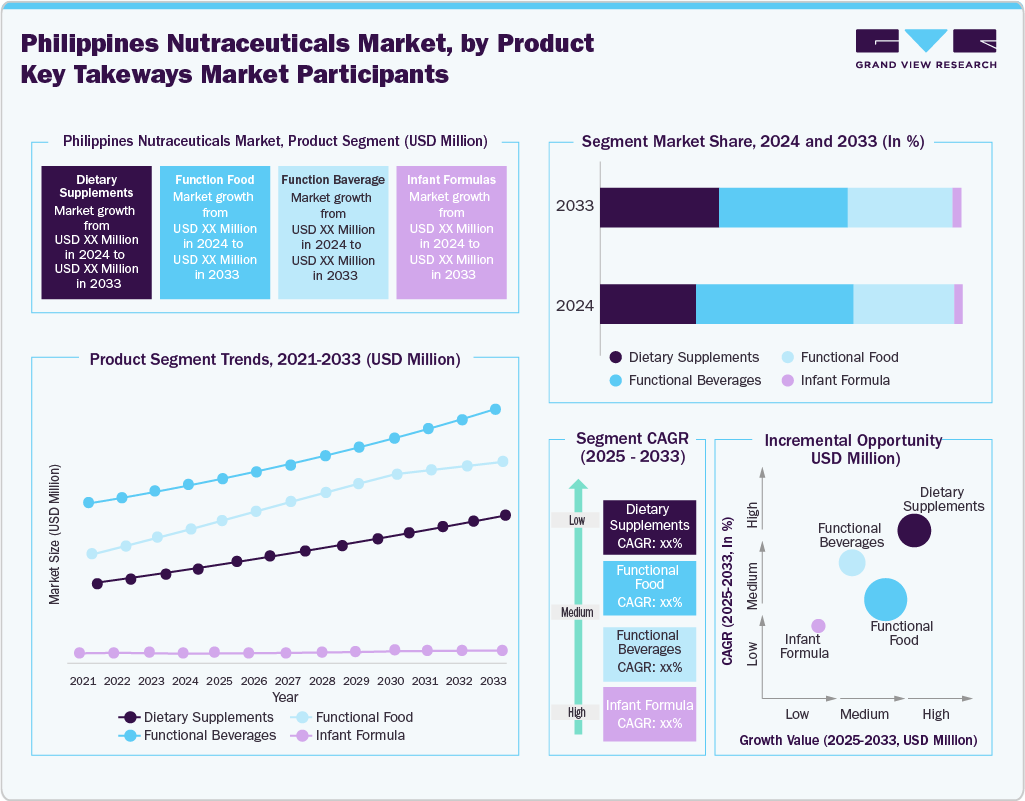

The Philippines nutraceuticals market size was estimated at USD 4.61 billion in 2024 and is projected to reach USD 9.48 billion by 2033, growing at a CAGR of 8.3% from 2025 to 2033. The Philippines nutraceuticals market is being propelled by a distinctive blend of demographic trends, health challenges, evolving consumer preferences, innovation, and improved accessibility.

Key Market Trends & Insights

- By product, the functional beverages segment held the highest market share of 47.9% in 2024.

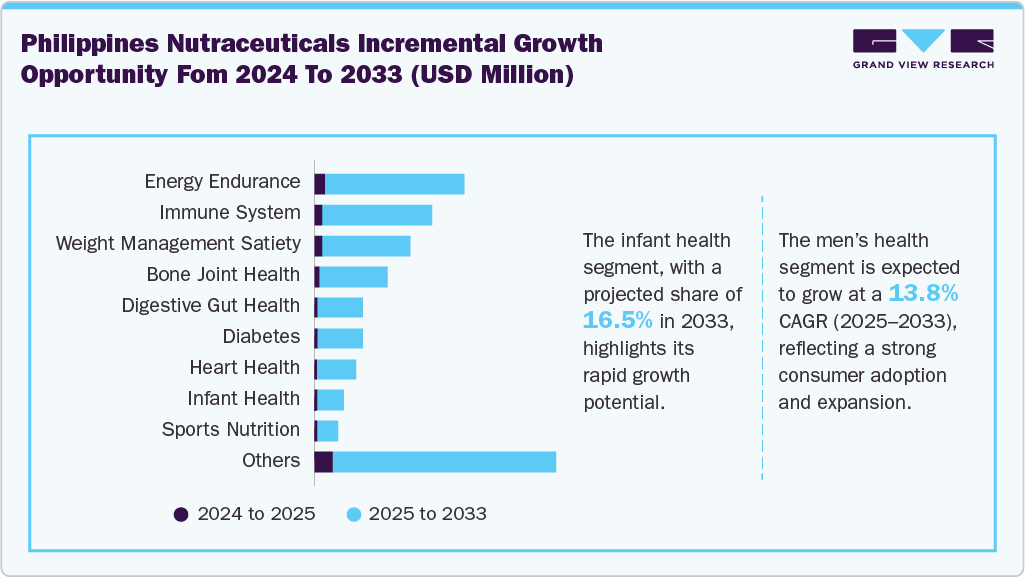

- Based on application, the weight management & satiety segment held the highest market share in 2024.

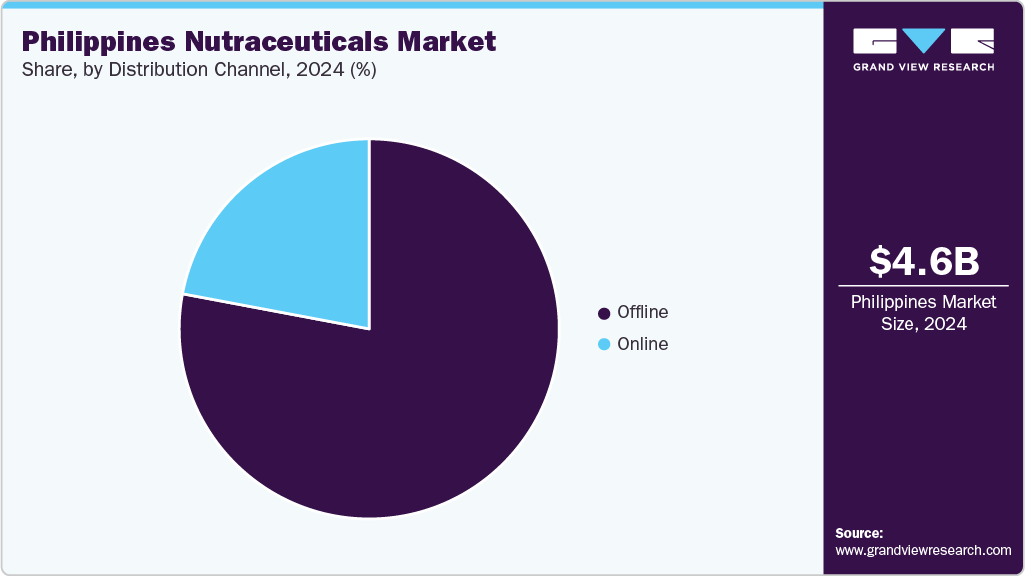

- By distribution channel, the offline segment held the highest market share in 2024.

Market Size & Forecast

- 2025 Market Size: USD 4.61 Billion

- 2033 Projected Market Size: USD 9.48 Billion

- CAGR (2026-2033): 8.3%

Filipino consumers are showing a strong preference for natural and transparent product formulations. In June 2024, the Department of Science and Technology’s National Innovation for Climate-Resilient Agriculture and Fisheries (DOST-NICER) program launched “SPC-FUEL for Health.” This initiative aims to develop functional foods derived from sugarcane, pulses, and cacao, signaling significant public investment in evidence-based nutraceutical innovation and quality control. Local companies leveraging traditional ingredients such as malunggay (Moringa), turmeric, and virgin coconut oil have reported rapid market uptake, benefiting from longstanding consumer trust and the growing clean-label movement.

Growing health concerns and demographic changes in the Philippines are broadening the nutraceuticals market and causing physicians and pharmacies to adapt their stocking preferences. Expanded e‑commerce and in‑store distribution, and appealing delivery formats such as gummies, powders, and ready‑to‑drink shots have broadened product reach. Filipino consumers are also moving toward personalized regimens based on these access gains. In October 2023, microbiome specialist Leucine Rich Bio introduced its BugSpeaks at‑home gut‑microbiome kit via Philippine distributor Cognoa International, marking the country’s first consumer‑focused gut‑profiling service and enabling tailored probiotic strategies based on individual microbial profiles.

Consumer Insights

In the Philippines, a strong focus on preventive health is driving the nutraceuticals industry. Since the COVID-19 pandemic, consumers have consistently increased their supplement intake to boost immunity and improve overall wellness. Vitamins D, zinc, and multivitamins remain top-selling categories in urban and rural pharmacies. Reflecting this trend, Leni P. Olmedo, president of the Philippines Health and Dietary Supplement Association, noted that the sector grew by approximately 7% in 2023, underscoring the sustained consumer commitment to preventive health and wellness post-pandemic.

The expansion of distribution channels has significantly lowered barriers for consumers to try and repurchase these products. E-commerce platforms such as Shopee, Lazada, and Amazon, along with social-commerce channels such as Instagram, Viber, and TikTok, have created thousands of new points of sale nationwide. With appealing product formats such as gummies, powders, and ready-to-drink shots, this digital growth has extended product availability to remote provinces, fueling further market expansion. Digital payments expanded rapidly in 2023, with mobile wallets and real-time transfers accounting for 52.8% of all retail transactions, simplifying the buying process and increasing consumer trust in purchasing supplements online. Furthermore, flash sale events and personalized e-marketing campaigns on these platforms have motivated consumers to explore new brands, resulting in high repeat purchase rates for best-selling supplements.

Product Insights

The functional beverages segment dominated the Philippines nutraceuticals industry with the largest share of 47.9% in 2024 and is expected to grow at the fastest CAGR over the forecast period. Functional beverages, such as ready-to-drink juices, fortified waters, energy drinks, and sports drinks, are driven by busy lifestyles, rising health awareness, and easy availability. Major players such as Nestle and Yakult continue expanding vitamin- and mineral-fortified product lines, combining taste with health benefits. Urbanization and active lifestyles have made RTD functional beverages essential for convenient hydration and targeted nutrition. In June 2024, Yakult Philippines opened a second factory, increasing production capacity to over 1.38 million bottles daily, reflecting strong consumer confidence in digestive health products.

The dietary supplements segment is expected to grow at a significant CAGR of 8.4% from 2025 to 2033. Dietary supplements, including capsules, tablets, powders, and gummies, are experiencing rapid growth fueled by a preventive health mindset, increased health literacy, and the availability of targeted formulations. Consumers are actively looking for products that cater to specific needs such as immunity, joint support, and cognitive health, valuing clear clinical evidence and transparent labeling. Strengthened regulations, including stricter FDA registration and GMP standards, have boosted brand credibility. Meanwhile, digital platforms and physician recommendations are driving trial and repeat purchases in urban and provincial areas. In June 2023, Kirin Holdings collaborated with Theoxis Health Ventures to launch ULTABIO with IMMUSE, a postbiotic-enriched capsule, in the Philippine market. This marked the first Asian introduction of LC-Plasma technology outside Japan, highlighting innovation in immune-boosting supplements.

Application Insights

The weight management & satiety segment held the largest market share in 2024. According to the FNRI National Nutrition Survey, weight management is a major health concern in the Philippines, with 39.8% of adults being overweight or obese as of 2023. This has driven demand for nutraceuticals focused on appetite control and metabolic support, including meal-replacement shakes, fiber supplements, L-carnitine, chromium, and green tea extract, available in convenient formats such as ready-to-drink beverages, powders, and tablets. Affordability and quick results are key factors, with global and local brands promoted through fitness centers, clinics, and social media. In May 2023, Amway Philippines launched BodyKey by Nutrilite Meal Replacement Shakes, featuring plant-based, high-protein (17g) and fiber-rich (5g) formulas in flavors such as Chocolate, Café Latte, and Berry.

The men’s health segment is projected to experience the fastest CAGR from 2025 to 2033. The men’s health segment in the Philippines is evolving from traditional muscle-building supplements to a broader focus on overall wellness. Men aged 25 to 54 are prioritizing energy, sexual vitality, cardiovascular health, and healthy aging. This shift is driven by changing cultural views, rising incomes, and better access to fitness facilities. Once niche, male-targeted supplements such as multivitamins, herbal tonics, and testosterone blends are now widely available in pharmacies, e-commerce, and wellness centers. Lifestyle factors also play a role, as urban men balance high-stress jobs with growing awareness of health issues such as hypertension and fatigue. Demand is rising for convenient, effective supplements tailored to age-specific needs. Marketing often emphasizes performance and aspirational goals, appealing especially to millennials and Gen X consumers.

Distribution Channel Insights

The offline distribution segment dominated the Philippines nutraceuticals market in 2024. Offline retail, especially pharmacies, drugstores, and health stores, continues to lead the Philippine nutraceutical industry due to its accessibility, consumer trust, and regulatory compliance. Many Filipinos, particularly older adults and those in rural areas, prefer face-to-face purchases to consult pharmacists and avoid counterfeit products commonly found online.

Pharmacies also influence buying decisions through healthcare professional recommendations and prescription bundling. Major chains such as Mercury Drug, Southstar Drug, and Rose Pharmacy operate thousands of branches nationwide, including remote areas with limited online delivery. These stores often serve as primary health access points and use effective product placement, in-store sampling, wellness kiosks, and promotions to engage customers. In March 2025, Latvia-based Sole Pharma entered the Philippine market with six targeted supplements. Their products are available at major drugstores, including Mercury Drug, Watson’s, Rose’s Pharmacy, and Allgreen RX.

The online segment is anticipated to experience the fastest CAGR from 2025 to 2033. The e-commerce channel in the Philippines is rapidly growing, driven by increased digital literacy, mobile shopping, and home delivery convenience. Younger consumers favor online platforms such as Shopee, Lazada, Watsons Online, and TikTok Shop for their wide product selection, competitive prices, and personalized experiences. Features such as flash sales, free shipping, and loyalty rewards boost purchases. Online sales also lower entry barriers for niche and emerging brands, enabling SMEs and global companies to launch products without high retail costs. This growth is supported by digital wallets such as GCash and Maya, which expand access even in semi-urban areas.

Key Companies & Market Share Insights

Some of the key players in the Philippines nutraceuticals market include Amway Philippines, L.L.C., Abbott., Yakult. and others.

-

Abbott offers wellness and medical-nutrition products for all ages. Renowned for clinical efficacy and global expertise, the brand is highly trusted by healthcare professionals and popular among older adults and chronic patients.

Key Philippines Nutraceuticals Companies:

- Nestlé

- Amway Philippines, L.L.C.

- Nutricia

- Yakult.

- Abbott.

- Herbalife International of America, Inc.

- Unilab, Inc.

Recent Developments

-

In May 2025, Herbalife launched ImmuLift in the Philippines, an immunity-boosting drink for adults. It features a unique blend including clinically researched EpiCor, Vitamin C, D3, Selenium, and Zinc to support daily wellness and natural defenses.

-

In March 2025, Unilab launched the Philippines' first Marvel-themed vitamins, PowerCEEZ and UHP SuperGROW, for children aged 4-12 as part of its 80th anniversary.

-

In April 2024, the University of St. La Salle and Herbanext Laboratories signed a research agreement to develop functional foods in the Philippines. The project focuses on reinventing Lagundi Tea and mung beans to support individuals with gout and hyperuricemia.

Philippines Nutraceuticals Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5.0 billion

Revenue forecast in 2033

USD 9.48 billion

Growth rate

CAGR of 8.3% from 2025 to 2033

Actuals

2021 - 2024

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, and distribution channel

Key companies profiled

Nestlé; Amway Philippines, L.L.C.; Nutricia; Yakult.; Abbott; Herbalife International of America, Inc.; Unilab, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Philippines Nutraceuticals Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the Philippines nutraceuticals market report based on product, application, and distribution channel:

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Dietary Supplements

-

Tablets

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Capsules

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Soft Gels

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Powders

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Gummies

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Liquid

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

Others

-

Vitamin

-

Multivitamin

-

Vitamin A

-

Vitamin B

-

Vitamin C

-

Vitamin D

-

Vitamin K

-

Vitamin E

-

-

Botanicals

-

Minerals

-

Calcium

-

Potassium

-

Magnesium

-

Iron

-

Zinc

-

Others (selenium, chromium, copper)

-

-

Proteins & Amino Acids

-

Collagen

-

Others

-

-

Fibers & Specialty Carbohydrates

-

Omega Fatty Acids

-

Probiotics

-

Prebiotics & Postbiotics

-

Others

-

-

-

Functional Food

-

Vegetable and Seed Oil

-

Sweet Biscuits, Snack Bars and Fruit Snacks

-

Dairy

-

Baby Food

-

Breakfast Cereals

-

Others

-

-

Functional Beverages

-

Energy drink

-

Sports drink

-

Others (Functional dairy based beverages, kombucha, kefir, probiotic drinks, and functional water)

-

-

Infant Formula

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Allergy & Intolerance

-

Healthy Ageing

-

Bone & Joint health

-

Cancer Prevention

-

Children's Health

-

Cognitive Health

-

Diabetes

-

Digestive / Gut Health

-

Energy & Endurance

-

Eye Health

-

Heart Health

-

Immune System

-

Infant Health

-

Inflammation

-

Maternal Health

-

Men's Health

-

Nutricosmetics

-

Oral care

-

Personalized Nutrition

-

Post Pregnancy Health

-

Sexual Health

-

Skin Health

-

Sports Nutrition

-

Weight Management & Satiety

-

Women's Health

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Supermarkets & Hypermarkets

-

Pharmacies

-

Specialty Stores

-

Practioner

-

Grocery Stores

-

Others

-

-

Online

-

Amazon

-

Other Online Retail Stores

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.