- Home

- »

- Next Generation Technologies

- »

-

Philippines Remittance Market Size & Share Report, 2022-2030GVR Report cover

![Philippines Remittance Market Size, Share & Trends Report]()

Philippines Remittance Market (2022 - 2030) Size, Share & Trends Analysis Report By Mode Of Transfer (Digital, Traditional (Non-digital)), By Type, By Channel (Banks, Online Platforms (Wallets)), By End Use, And Segment Forecasts

- Report ID: GVR-4-68039-979-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

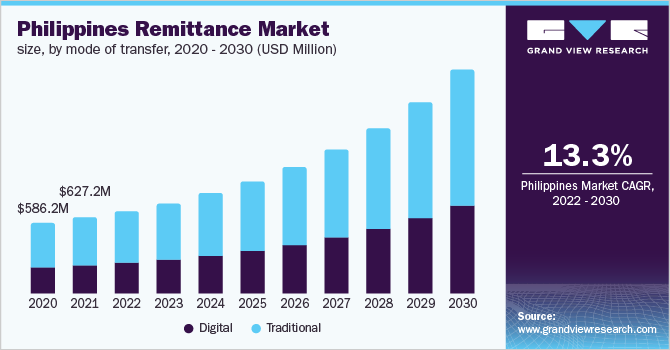

The Philippines remittance market size was valued at USD 0.63 billion in 2021 and is expected to grow at a Compound Annual Growth Rate (CAGR) of 13.3% from 2022 to 2030. The increasing migration of Filipino citizens to other countries can be attributed to the growth. Furthermore, the high dependency of Filipinos on remittance can also be considered as one of the major factors driving the market’s growth. For instance, according to World Bank, the remittance inflows to the Philippines contributed 10% to its Gross Domestic Product (GDP). Moreover, according to the World Bank Migration and Development Report in 2020, Filipinos remitted over USD 33 billion in 2019.

Furthermore, the growing technological advancements in the banking and finance industry, such as the integration of blockchain technology in remittance platforms, have created new growth opportunities for the industry. These digitally enabled remittance platforms enable Filipinos to conduct real-time cross-border money transfers seamlessly. For instance, in September 2021, Western Union, a financial services company, and Cebuana Lhuillier, a money transfer service provider based in the Philippines, launched Digital Money Transfer Services. With this introduction, Western Union enabled customers to receive and send money transactions through the Cebuana Lhuillier Mobile Application called eCebuana.

The market is growing owing to the easy educational loans for higher studies resulting in the migration of students for educational purposes. For instance, the Unified Student Financial Assistance System for Tertiary Education (UniFAST) offers educational subsidies and short-term & long-term student loan programs to Filipino students. The students migrate for higher education to other countries, which increases the outward remittance of the country. Thus, the overall increase in the migration of students and well-educated individuals from the Philippines is expected to drive the growth of the market over the forecast period.

Furthermore, the increasing dominance of the market players in the country is another major factor responsible for the growth. The companies providing remittance services are increasingly involved in expanding their businesses to the Philippines owing to the huge remittance market in the country. For instance, in July 2022, Maxitransfers LLC., a remittance service provider, announced its expansion to Vietnam and the Philippines. This expansion helped immigrant communities in the U.S. to send remittances to their families with Maxitransfers LLC.

However, though the market is growing, the inadequate anti-money laundering governance in the Philippines is expected to restrain the growth of the market. For instance, The Financial Action Task Force (FATF) recorded the Philippines on its gray list in 2000, and even after the Philippines passed the Anti-Terrorism Act and Anti-Money Laundering Act of 2020, the FATF still has the Philippines on its gray list.

The Philippines is highly dependent on remittance and has a lesser set of regulations for fintech companies, making it vulnerable to money laundering. However, the country is working on the regulations, and according to the Philippine Anti-Money Laundering Council, the country can exit the list by 2023.

COVID-19 Impact Analysis

The COVID-19 pandemic adversely affected the Philippines remittance market. The drop in the cash remittance of the country was observed owing to the lockdowns and the social distancing norms in the initial phase of the pandemic. The loss in the jobs of the employees was another major factor in declining the growth, but as soon as the lockdowns were released, the market resumed its steady growth. The global investments in the remittance service providing companies during the pandemic resulted in the introduction of digital remittance services in the country, thereby encouraging further growth of the industry.

Mode of Transfer Insights

The traditional (non-digital) segment dominated with a revenue share of more than 61.0% in 2021. The growth can be attributed to the ease in the transfer of money by just depositing cash or paying with debit cards and other payment methods while sending the remittance. Additionally, traditional remittances help receivers to collect the remittance amount in cash without having a bank account.

Furthermore, according to Bangko Sentral NG Pilipinas, bank account penetration in the Philippines stood at 28.6% in 2019. Hence, individuals in the Philippines with lesser bank accounts are expected to drive the traditional segment over the forecast period.

The digital remittance segment is expected to register the fastest growth over the forecast period. Digital remittance enables individuals to send remittances using a digital platform that results in sending remittances remotely. Furthermore, the growth of the digital segment can be attributed to its benefits, such as faster money transfers and lower transactional charges as compared to traditional remittances.

Moreover, the increasing launches of digital remittance platforms in the Philippines are expected to drive the further growth of the segment. For instance, in August 2021, PeraHub, the Philippines-based financial services hub, partnered with Brankas, an Indonesian open API technology vendor, to build PERA HUB Conex, a digital remittance platform. This platform is expected to offer services such as international and domestic remittances, among others.

Type Insights

The inward remittance segment accounted for the largest revenue share of more than 61.0% in 2021. The increasing migration of Filipinos in search of better job opportunities and higher education is expected to drive the growth of the segment. For instance, according to the World Data Atlas, the net migration rate of the Philippines was -0.63 (migrants per thousand population) in 2020. The growth can also be attributed to the availability of plenty of cheaper remittance options, such as digital remittances used by migrants to send money to their families in the Philippines.

The outward remittance segment is anticipated to register significant growth over the forecast period. The outward remittances segment includes sending money out of the country. The segment in the Philippines is growing owing to the availability of several remittance service providers enabling businesses and individual customers to send money from the Philippines to any other country. Additionally, the increased migration of students for higher education from the Philippines to other nations fuels the growth of the segment.

Channel Insights

The Money Transfer Operators (MTO) segment held the largest revenue share of more than 58.0% in 2021. MTOs are the financial companies assisting individuals in cross-border processing remittances. The increasing inward and outward remittances across the country are expected to drive the segment's growth.

The increasing partnerships and collaboration between MTOs for broadening their service are also expected to drive the growth of the segment. For instance, in February 2019, Xpress Money, a money transfer operator, partnered with LBC Express (LBC), a Philippines-based courier company. This partnership was aimed at broadening the reach of remittance services in the Philippines.

The online platforms (wallets) segment is anticipated to register the fastest growth over the forecast period. The technological advancements in artificial intelligence and blockchain technology are expected to drive the growth of the segment. For instance, in April 2019, Western Union, partnered with Coins.ph, a blockchain start-up.

This partnership was aimed at enabling Filipinos to receive easy remittances. Additionally, the increasing penetration of smartphones and the internet in the Philippines has driven the adoption of online platforms for processing and receiving remittances digitally.

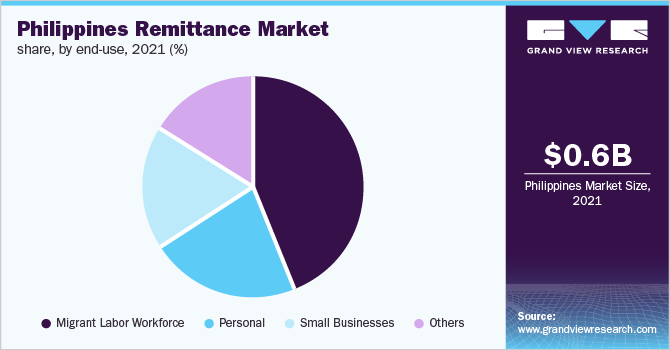

End-use Insights

The migrant labor workforce segment dominated with a revenue share of more than 43.0%, attributed to the increasing migration of Filipinos to other countries. For instance, according to the Philippines Statistics Authority, the number of Overseas Filipino Workers (OFWs) stood at 1.77 million from April to September 2020. Hence, the vast number of OFWs are expected to send remittances to their families, thereby driving the growth of the segment over the forecast period.

The personal segment is anticipated to register the fastest growth over the forecast period. The huge migration of the individuals of the Philippines results in the sending and receiving of remittances for personal use. The personal use of remittance includes the use of the money received for daily expenses or another non-commercial usage. The growth can also be attributed to the increasing launches of digital remittance platforms in the country that enable individuals to send and receive money instantly with lower fees charged.

For instance, in August 2022, Philippines-based wallet provider and cryptocurrency exchange platform Coins.ph, along with Asian Net’s OK Remit, a Japan-based money transfer company, introduced On-Demand Liquidity (ODL) service on RippleNet. With this introduction, the company enabled customers for low-cost, instant cross-border payments from Japan to Philippines.

Key Companies & Market Share Insights

The market can be considered moderately fragmented. The major players are involved in pursuing a variety of strategies, including strategic partnerships & joint ventures, mergers & acquisitions, product innovation, and geographical expansions as part of their efforts to strengthen their market position. The key players are focusing on offering digital and blockchain-based remittance services to the customer, enabling them for faster cross-border transfers. Additionally, other players are focusing on broadening their network to enable customers to send money throughout the Philippines and other countries.

The major players are facing fierce competition in the industry and are implanting several strategies to gain market share. The product development strategies include the integration of blockchain technology for faster remittances. For instance, in July 2022, Qatar National Bank announced the launch of Direct Remittance services for money transfers from Qatar to the Philippines through RippleNet. With the introduction of direct remittance services, the bank enabled its customers to send faster cross-border payments. Some prominent players in the Philippines remittance market include:

-

PayPal Holdings, Inc.

-

Worldremit Group Limited

-

Union Bank of the Philippines

-

The Western Union Company

-

MoneyGram International, Inc.

-

Cebuana Lhuillier

-

LBC Express Holdings

-

MLhuillier

-

Palawan Pawnshop

-

RD Pawnshop

Philippines Remittance Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 0.68 billion

Revenue forecast in 2030

USD 1.84 billion

Growth rate

CAGR of 13.3% from 2022 to 2030

Base year of estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Mode of transfer, type, channel, end-use

Country scope

Philippines

Key companies profiled

PayPal Holdings, Inc.; Worldremit Group Limited; Union Bank of the Philippines; The Western Union Company; MoneyGram International, Inc.; Cebuana Lhuillier; LBC Express Holdings; MLhuillier; Palawan Pawnshop; RD Pawnshop

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Philippines Remittance Market Segmentation

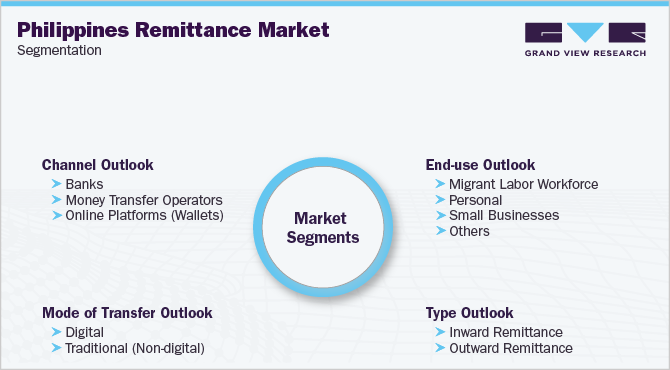

The report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the Philippines remittance market report based on mode of transfer, type, channel, and end-use.

-

Mode of Transfer Outlook (Revenue, USD Million, 2017 - 2030)

-

Digital

-

Traditional (Non-digital)

-

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Inward Remittance

-

Outward Remittance

-

-

Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Banks

-

Money Transfer Operators

-

Online Platforms (Wallets)

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Migrant Labor Workforce

-

Personal

-

Small Businesses

-

Others

-

Frequently Asked Questions About This Report

b. The Philippines remittance market is expected to grow at a compound annual growth rate of 13.3% from 2022 to 2030 to reach USD 1.84 billion by 2030.

b. The traditional (non-digital) segment dominated the market in 2021 and accounted for a revenue share of more than 61.80%. The growth of the traditional (non-digital) segment can be attributed to the ease in the transfer of money by just depositing cash or paying with debit cards and other payment methods while sending the remittance

b. The Philippines remittance market size was estimated at USD 0.63 billion in 2021 and is expected to reach USD 0.68 billion in 2022.

b. Some key players operating in the Philippines remittance market include PayPal Holdings, Inc.; Worldremit Group Limited; Union Bank of the Philippines; The Western Union Company; MoneyGram International, Inc.; Cebuana Lhuillier; LBC Express Holdings; MLhuillier; Palawan Pawnshop; RD Pawnshop

b. Key factors that are driving the market growth include the increasing remittances on account of migration activities and partnerships between companies boosting remittance services

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.