- Home

- »

- Medical Devices

- »

-

Physiotherapy Equipment Market Size & Share Report, 2030GVR Report cover

![Physiotherapy Equipment Market Size, Share & Trends Report]()

Physiotherapy Equipment Market Size, Share & Trends Analysis Report By Application (Neurology, Musculoskeletal), By Type (Hydrotherapy, Cryotherapy), By Demographics, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-476-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Physiotherapy Equipment Market Trends

The global physiotherapy equipment market size was estimated at USD 20.9 billion in 2023 and is projected to grow at a CAGR of 7.2% from 2024 to 2030. Increasing cases of road accidents and injuries and the rising number of rehabilitation centers are expected to drive the demand for physiotherapy devices. Improper eating habits and a stressful lifestyle that result in discomfort in the ligaments, nerves, muscles, back, & neck, as well as a growing prevalence of stroke & Parkinson's disease, are expected to fuel the market. According to the World Stroke Organization Report 2022 , 1 in 4 people over age 25 suffers from a stroke in their lifetime. Every year, more than 15% of all strokes occur in people 15-50 years of age and over 62% of all strokes occur in people under 70 years of age. Due to the added benefits of physical therapy, physicians have begun prescribing it to patients, which has resulted in an increase in demand for physical therapy equipment.

The market growth is expected to be driven by an aging population and the rising prevalence of cardiovascular, neurological, and musculoskeletal diseases, not only in developed nations but also in emerging economies such as India and China. As per the WHO study published in March 2023, globally, there are more than 54 million individuals affected by dementia, with more than 59% residing in low- and middle-income nations. Alzheimer’s disease, the most prevalent form of dementia, is estimated to account for 60-70% of dementia cases, which arise from various brain-affecting diseases and injuries. These conditions lead to the deterioration of cognitive functions and speech-motor skills, often necessitating ongoing care and support. The utilization of physiotherapy equipment can help reduce the level of care required for these patients.

Musculoskeletal disorders result in limited mobility and are a significant cause of disability. For instance, as per the Annals of Medicine and Surgery article published in December 2021, the prevalence of work-related musculoskeletal disorders among surveyed participants was 64.0% in Northwest Ethiopia. Additionally, according to Work-Related Musculoskeletal Disorders, statistics and report published in March 2021, approximately 470 thousand individuals experienced new or long-standing work-related musculoskeletal disorders in Great Britain in 2021. Hence, the increasing prevalence of musculoskeletal disorders and arthritis is projected to drive up the demand for physiotherapy equipment, consequently propelling market expansion.

Furthermore, the rising prevalence of neurological disorders in the population is the primary driver behind the increasing demand for neurology rehabilitation physiotherapy equipment. For instance, according to the International Journal and Environmental Research and Public Health article published in July 2022, the most commonly utilized physiotherapy interventions for elderly individuals with neurological disorders include balance and gait training, occupational therapy, traditional physiotherapy techniques, walking and treadmill exercises, and upper limb robot-assisted therapy.

The strategic initiatives taken by key companies including acquisitions and product launches, significantly contribute to market growth. For instance, in April 2021, the National Office of Thermalism and Hydrotherapy (ONTH) launched its mobile applications on hydrotherapy 'Tunisia Wellness'. Such launches boost the utility of physiotherapy equipment, thereby accelerating market growth, which has contributed to enhance the functionality of physiotherapy equipment, thereby propelling the growth of the market.

The growing prevalence of musculoskeletal disorders is also propelling the demand for physiotherapy equipment. Musculoskeletal conditions encompass a wide range of diseases and conditions affecting the muscles, bones, joints, and connective tissues, leading to pain, mobility limitations, and reduced functioning. These conditions include low back pain, neck pain, fractures, osteoarthritis, amputations, rheumatoid arthritis, and other musculoskeletal issues. As per the Light Spring Home Care statistics, June 2023, globally, about 350 million people suffer from arthritis. Moreover, according to the Centers for Disease Control and Prevention (CDC), more than 54 million persons (about 1 in 4) in the U.S. have an arthritis diagnosis.

Market Concentration & Characteristics

The market growth stage is medium, and pace of the market growth is accelerating. The physiotherapy equipment market is characterized by a moderate-to-high degree of growth owing to rising investment in R&D programs and increased demand for physiotherapy equipment.

The market is characterized by a high degree of innovation owing to advancements such as the integration of artificial intelligence (AI) and machine learning for personalized therapy, wearable technologies, and virtual reality (VR). These innovations have expanded the capabilities of physiotherapy treatments, enhancing treatment efficacy and patient engagement. According to the Intelligent Health updates of May 2023, AI-enabled physiotherapy leverages advanced motion-tracking technology through computer vision to accurately analyze human motion during musculoskeletal physiotherapy exercises in real time. This innovative approach eliminates the need for physical contact with patients, offering valuable insights that can enhance treatment effectiveness and optimize clinic operations worldwide.

The market is also characterized by a medium level of merger and acquisition (M&A) activity by the leading players. Through M&A activity, these companies can expand their product portfolio, enter new territories, enhance their technological capabilities, and strengthen their market position. For instance , in September 2023, Performance Health acquired Sissel France. Through this acquisition Performance Health would expand the companies’ product offerings in France while growing its portfolio of brands, solidifying its presence in the industry and expanding its customer base & market reach.

The market is flourishing owing to stringent regulatory standards imposed by government bodies and organizations. These regulations ensure that physiotherapy equipment meets specific safety, quality, and performance standards to protect patients. Innovations such as robotic-assisted therapy devices, wearable technology for remote monitoring, and advanced imaging systems have revolutionized physiotherapy practices. For instance, in May 2022, ManaMed received FDA approval for its ManaSport ultrasound therapy Class II device in the U.S. This innovative equipment utilizes ultrasound therapy to treat soft-tissue injuries and alleviate pain.

Many companies are adopting various strategies, which include collaboration, product expansion, and partnerships, to strengthen their market position For instance, in July 2023, Fujifilm launched the Sonosite ST system, specifically designed and engineered to cater to the needs of busy proceduralists. This point-of-care ultrasound system (POCUS) boasts a new 21-inch all-touchscreen interface and a large 10” by 7.5” image area. It also offers automated setting optimization for each type of examination and features such as Auto Steep Needle Profiling (SNP).

Hospitals and outpatient facilities are the key end users of physiotherapy equipment due to the comprehensive healthcare services they provide, including rehabilitative care. Physiotherapy plays a crucial role in the recovery and rehabilitation of patients who have undergone surgeries, suffered injuries, or are managing chronic conditions. Hospitals often have dedicated physiotherapy departments or units where patients receive specialized care from physiotherapists using various equipment such as cryotherapy machines, ultrasound therapy devices, electrotherapy tools, and more.

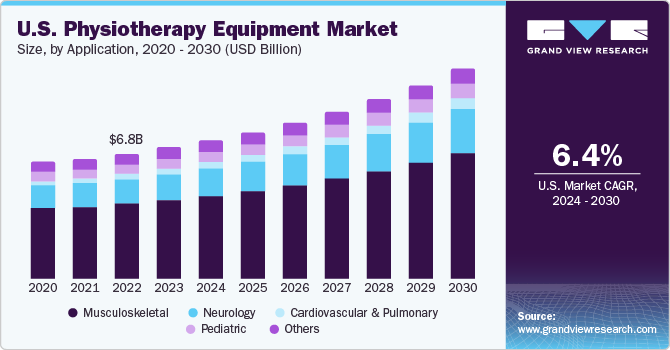

Application Insights

Based on application, the musculoskeletal segment led the market and accounted for 60.2% of the global revenue in 2023. The growth is attributed to the rising prevalence of musculoskeletal disorders, growing geriatric population, product launches & technological advancements. As per the WHO estimates, in July 2022, over 1.70 billion individuals globally are diagnosed with musculoskeletal diseases. Additionally, the rising frequency of accidents has increased the demand for physiotherapy to treat musculoskeletal diseases and to improve flexibility, muscle strength, and movement control.

The cardiovascular and pulmonary segment is expected to witness a maximum CAGR over the forecast period due to the rising adoption of physical therapy services in developing nations such as China, India, Brazil, etc. The premature death rate due to CVD in high-income countries is 4% in comparison with 42% in low-income countries. Physical therapies are beneficial for patients with pulmonary fibrosis, heart valve replacement, post-coronary bypass surgery, and coronary stent placement.

The incidence of cardiovascular and pulmonary diseases has increased considerably, resulting in a major cost burden in most countries worldwide. CVDs are the leading cause of death worldwide. According to the British Heart Foundation report published in January 2024, approximately 620 million individuals are diagnosed with heart and circulatory diseases globally and is expected to rise due to changing lifestyles, increasing geriatric population, and enhanced survival rates following heart attacks and strokes.

Type Insights

Based on type, the ultrasound segment accounted for largest market revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. The growth is attributed to the increasing prevalence of lifestyle & chronic diseases, and growing applications of ultrasound therapy in the treatment of different disorders. For instance, according to the National Center for Biotechnology Information’s study published in April 2024, approximately 20 million cancer cases were registered in 2022.

Ultrasound devices are highly suitable for physiotherapeutic treatment due to their gentle and non-thermal nature, as well as their ability to enhance the healing process of soft tissues. Moreover, the ultrasound segment is expected to experience significant growth during the forecast period due to its ability to improve blood flow to the affected area, thereby accelerating the resolution of inflammation and promoting collagen production during tissue healing.

Additionally, the segment is expected to grow with the continuous clinical studies to establish the efficacy & safety profile for ultrasound in specific applications. For instance, in November 2021, the Shantou Institute of Ultrasonic Instruments Co., Ltd. in China launched the Apogee 6 series of color Doppler ultrasound imaging solutions, including the Apogee 6500 and Apogee 6200 color Doppler ultrasound systems. These systems offer a comprehensive range of applications for abdominal, cardiac, musculoskeletal, vascular, OB/GYN, and urological clinical needs.

Demographic Insights

The non-geriatric population held the largest market share in 2023 owing to the increasing hospital stays and visits. Non-geriatric patients requiring hospital care majorly include adults with spinal cord and domestic or accidental injuries due to motor or workplace mishaps. According to WHO, accidents are the largest contributor to spinal cord injury cases worldwide. Domestic and workplace mishaps are the second-largest contributors to the rise in non-geriatric inpatient treatment. About 34% of individuals suffer from domestic mishaps and 45% from road accidents in the U.K., which is expected to propel the growth of the market.

The geriatric population segment is anticipated to grow at the fastest CAGR during the forecast period due to rapidly rise in aging populations. According to WHO study published in October 2022, by 2030, 1 out of every 6 individuals globally is anticipated to be aged 60 or older. During this period, the proportion of the population aged 60 years and above is projected to rise from 1 billion in 2020 to nearly 1.5 billion by 2030. The global population of individuals aged 60 years and older is set to double and reach over 2.0 billion by 2050. Moreover, the number of people aged 80 years or older is anticipated to triple between 2020 and 2050 and reach a total of 426 million.

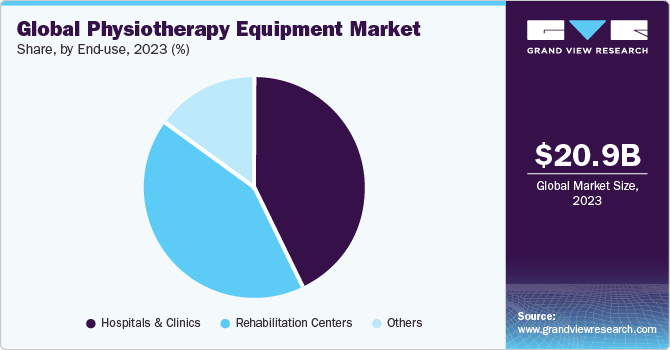

End-use Insights

The hospitals & clinics segment held the largest market share in 2023 pertaining to a large patient pool and implementation of various programs by hospitals. Additionally, due to the high cost of physiotherapy instruments, the majority of patients choose to have the treatments performed in multispecialty hospitals or specialized clinics. Hospitals and clinics are expanding their medical facilities to specialized units that focus on physical therapy or another alternative treatment regimen for patient’s post-trauma or surgery.

The rehabilitation center segment is expected to grow at a lucrative rate with a CAGR of 7.7% over the forecast period. The rising trend of an active lifestyle, and the uptake of sports as a profession by individuals are expected to propel market growth during the forecast period. Availability of physiotherapists and equipment in such institutes is mandatory according to the regulatory bodies for safeguarding the well-being of participants, thereby promoting market growth.

Regional Insights

North America dominated the market with a revenue share of 38.1% in 2023 owing to rising cases of accidents and mishaps, growing incidence of osteoporosis, and growing geriatric population. The presence of numerous hospitals and home care providers for convalescent individuals is further boosting the market growth. The demand for physiotherapy is anticipated to increase due to the growing incidence of chronic illnesses such as Parkinson’s, stroke, paralysis, and spinal injuries.

Moreover, the significant prevalence of cardiovascular diseases, arthritis, neurological disorders, and musculoskeletal conditions has fueled the market for physiotherapy equipment in the region. For instance, based on a study conducted by the National Center for Health Statistics published in January 2022, the prevalence of coronary heart disease has increased from 4.5% in 2020 to nearly 5.0% in 2021 among adults aged 18 years and older in the U.S. Additionally, physiotherapy equipment demand in the U.S. increased with a surge of 1.35 million annual rheumatoid arthritis cases. Thus, the prevalence of rheumatoid arthritis in the U.S. is expected to drive the demand for physiotherapy equipment to manage such conditions .

U.S. Physiotherapy Equipment Market Trends

The physiotherapy equipment market in the U.S. held a significant share of North America's physiotherapy equipment market in 2023, driven by factors such as advancing technologies, and changing patient care strategies. In the U.S., the number of ultrasound unit installations has significantly increased over the years. For instance, in October 2020, GE Healthcare collaborated with St. Luke's University Health Network to install 76 ultrasound systems as part of an AI-powered technology fleet, making it GE Healthcare's largest single-order ultrasound contract in the country worth USD 11 million.

Europe Physiotherapy Equipment Market Trends

The physiotherapy equipment market in Europe is witnessing growth fueled by increased investments in research and development from the public and private sectors. Moreover, the escalating demand for physiotherapy equipment and the prevalence of chronic and pain-related conditions in the region are key drivers expected to further boost market expansion.

The UK physiotherapy equipment market is one of the major markets in the region. The UK has several small and medium sized companies that significantly contribute to the economy. The country has a reputation for quality applications, and thus, in-house manufactured devices are anticipated to witness significant demand in the coming years.

The physiotherapy equipment market in Germany is projected to expand in the forecast period owing to a rapidly aging population, growing prevalence of chronic diseases, presence of a sophisticated healthcare system, a physiotherapy equipment highly qualified workforce, and high healthcare spending. Germany has a lucrative environment for technologically innovative startups such as rehabilitation companies and startups. For instance, Therap.io app was introduced which helps to motivate patients in following their regular exercise and also offers personalized training & guidance in physiotherapy. The app allows an easy communication between patient and therapist. The presence of major market players, such as Siemens Healthcare GmbH, is anticipated to create lucrative opportunities in Germany.

Asia Pacific Physiotherapy Equipment Market Trends

Asia Pacific is expected to witness a remarkable growth over the forecast period. Improving reimbursement scenario for physical therapy, growing aging population, and rising incidence of degenerative neurological, cardiovascular, respiratory & musculoskeletal conditions are poised to surge the market in the Asia Pacific. According to the BMC Public Health study published in May 2023 , the overall prevalence of cardiovascular disease (CVD) was lower among all Asian groups, except Filipinos, compared to non-Hispanic Whites (NHWs). The estimated CVD prevalence among NHWs was over 4%, while it ranged from 2.27% among Chinese individuals to 3.35% among Japanese individuals in Asian groups.

The Japan physiotherapy equipment market is expected to grow at the fastest. The market is expected to expand steadily in the foreseeable future due to the aging population and the ongoing need for advanced medical technologies in Japan. Moreover, the government's initiatives to support the healthcare industry are anticipated to sustain market growth.

The physiotherapy equipment market in China is expected to grow in the Asia Pacific in 2023. Companies interested in entering into China should recognize that they must overcome existing barriers in an ambiguous and changing regulatory environment. The country also offers momentous potential for the U.S. companies interested in expanding and entering into the China physiotherapy equipment market.

Middle East Physiotherapy Equipment Trends

The physiotherapy equipment market is experiencing significant growth attributed to various factors, such as the increasing awareness in the region about chronic disease has led to a substantial number of diagnosed cases, boosting the demand for early disease diagnosis. Furthermore, clinical education through conferences, symposiums, and webinars is becoming crucial in improving the adoption rate of surgical imaging devices. For instance, in January 2024, Royal Philips announced that it is utilizing precision along with a plethora of next-generation innovations and solutions at Arab Health 2024 to support hospitals and health systems in continuously providing patients with high-quality, affordable care in a sustainable manner. This is made possible by new technologies that enhance predictability, collaboration, precision, and integration.

Philips showcased several new innovations at ArabHealth2024, such as next-generation ultrasound systems that boost diagnostic confidence and workflow efficiency, new AI-enabled cloud solutions that improve healthcare efficiency and clinical confidence, and workflow optimization through MR (SmartSpeed) innovations powered by AI. Thus, such initiatives are expected to increase the application & reach and awareness of ultrasound technology in the region, thereby fueling market growth.

Key Physiotherapy Equipment Company Insights

Some of the key players operating in the market include BTL, Patterson Medical, DJO, LLC, EMS Physio Ltd., Dynatronics Corporation, Isokinetic Medical Group, Performance Health, are some of the emerging market participants in the physiotherapy equipment market.

Key Physiotherapy Equipment Companies:

The following are the leading companies in the physiotherapy equipment market. These companies collectively hold the largest market share and dictate industry trends.

- BTL

- EMS Physio Ltd.

- Dynatronics Corporation

- RICHMAR

- Performance Health

- Storx Medical AG

- Zimmer MedizinSysteme GmbH

- ITO Co., Ltd.

- Enraf-Nonius B.V.

- Whitehall Manufacturing

Recent Developments

-

In November 2023, Siemens Healthineers launched ACUSON Maple Ultrasound System which is designed to incorporate 25 advanced features and accommodate 15 transducers that improve user experience and simplify operational processes. The system’s AI-powered tools, combined with an integrated battery providing up to 75 minutes of unplugged scanning, empower clinicians to enhance efficiency through improved consistency in repetitive tasks.

-

In March 2023, the physiotherapy unit at District Hospital in Chhattisgarh, India, was equipped with modern devices such as TENS machine, IFT muscle stimulator, traction machine, SWD, static bicycle, and cordysafe chair to treat severe cases of chronic back pain and stiffness.

-

In January 2023, Hydro Physio joined the ABHI UK Pavilion at Arab Health 2023 with the aim to launch a hypnotherapy system in Middle East. The new Active Hydrotherapy Trainer by Hydro Physio aims to transform the rehabilitation process for patients recovering from injuries or surgeries. This innovative system offers a dedicated and hygienic aquatic therapy space with a treadmill chamber, entrance foyer, and integrated water management equipment.

-

In February 2022, DJO, LLC announced that it has renewed its partnership with the Professional Football Athletic Trainers Society (PFATS). The companies collaborated to advance athlete health and wellness through initiatives such as Join the Club, DJO’s proactive bracing program for high school athletes. Join the Club emphasizes injury prevention by offering high-quality bracing products and raising awareness about the advantages of bracing from a young age.

-

In January 2022, BTL Industries (UK) completed the acquisition of Schepp MedTech (US) to bolster its existing physiotherapy product range with advanced robotics. Through this acquisition, BTL’s strategy is focused on identifying experienced R&D teams whose products could benefit from increased sales.

-

In January 2022, Zynex, Inc. announced that it has expanded its range of pain and rehabilitation products to include post-operative and OA (Osteoarthritis) knee braces. This strategic move aims to cater to a broader market segment and provide comprehensive solutions for individuals recovering from knee surgeries or managing osteoarthritis-related knee pain.

Physiotherapy Equipment Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 22.1 billion

Revenue forecast in 2030

USD 33.5 billion

Growth Rate

CAGR of 7.2% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Report updated

May 2024

Quantitative units

Revenue in USD million/billion & CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, type, demographics, end use, region

Regions covered

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

BTL, EMS Physio Ltd.; Dynatronics Corporation; RICHMAR; Performance Health; Storz Medical AG; Zimmer MedizinSysteme GmbH; ITO Co., Ltd.; Enraf-Nonius B.V.; Whitehall Manufacturing

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Physiotherapy Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global physiotherapy equipment market report based on application, type, demographics, end use and region.

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurology

-

Stroke

-

Spinal cord injuries

-

Parkinson’s disease

-

Multiple sclerosis

-

Cerebral palsy

-

Others

-

-

Musculoskeletal

-

Pediatric

-

Cardiovascular & Pulmonary

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hydrotherapy

-

Cryotherapy

-

Continuous Passive Motion (CPM)

-

Ultrasound

-

Electric Stimulation

-

Heat Therapy

-

Therapeutic Exercise

-

Others

-

Demographics Outlook (Revenue, USD Million, 2018 - 2030)

-

Non-geriatric Population

-

Geriatric Population

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals & Clinics

-

Rehabilitation Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global physiotherapy equipment market size was estimated at USD 20.9 billion in 2023 and is expected to reach USD 22.1 billion in 2024.

b. The global physiotherapy equipment market is expected to grow at a compound annual growth rate of 7.2% from 2024 to 2030 to reach USD 33.5 billion by 2030.

b. North America dominated the physiotherapy equipment market with a share of 38.1% in 2023. This is attributable to the rising cases of accidents and mishaps, the growing incidence of osteoporosis globally, and the increasing geriatric population.

b. Some key players operating in the physiotherapy equipment market are Enraf-Nonius; BTL Industries; EMS Physio Ltd.; Dynatronics Corporation; RICHMAR; Performance Health; Storz Medical AG; Zimmer Medizinsysteme; Whitehall Manufacturing; and ITO Co., Ltd.

b. Key factors that are driving the physiotherapy equipment market growth include unhealthy eating habits and a hectic lifestyle resulting in pain in the ligaments, nerves, muscles, back, and neck and an increasing prevalence of stroke and Parkinson’s disease.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."