Market Size & Trends

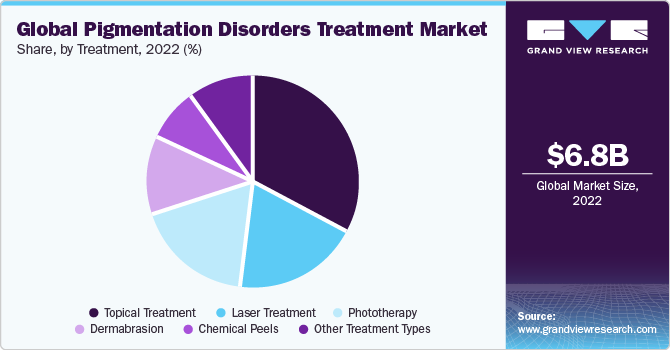

The global pigmentation disorders treatment market size was valued at USD 6.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.87% from 2023 to 2030. The pigmentation disorders treatment market is expected to experience growth due to the increasing prevalence of pigmentation disorders, a growing demand for innovative therapies, and advancements in laser technologies. Moreover, there is a rising demand for safe and effective treatments, fueled by increasing awareness of pigmentation disorders among the population, contributing to the expansion of the market.

The market is expected to grow due to rising demand for safe and efficient treatments. For instance, in May 2022, Clinuvel Pharmaceuticals expanded its therapies, such as afamelanotide, to address pigment loss disorders like vitiligo, particularly in individuals with darker skin tones. This advancement demonstrates the industry's commitment to providing solutions, creating promising growth opportunities for companies operating in this market.

While the COVID-19 pandemic initially had a negative impact on the market, leading to cancellations of non-essential procedures in some countries, the Aesthetic Society's 2021 report highlighted the resilience of aesthetic plastic surgery. As pandemic restrictions eased, there was a surge in demand for cosmetic treatments. Key players in the market are introducing innovative products and gaining approvals for various pigmentation disorder treatments.

Disorder Insights

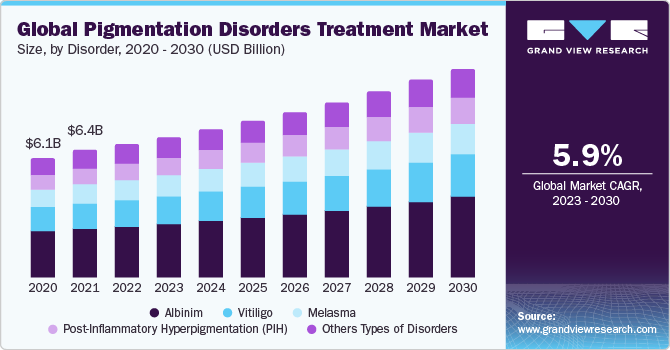

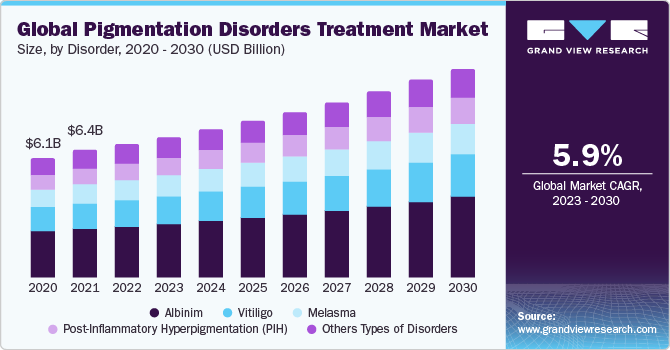

On the basis of the disorder, the market is segmented into melasma, vitiligo, albinism, post-inflammatory hyperpigmentation, and other types of disorders. The albinism segment dominated the market in 2022. According to an article published in August 2022, StatPearls revealed that the American region had the highest prevalence of Oculocutaneous albinism type 2 (1:36,000). With the growing prevalence of albinism in the U.S., there is a rising demand for pigmentation disorder treatments, driving segment growth over the forecast period.

However, the increasing prevalence of melasma is expected to drive segment growth. For instance, an article published in the Journal of Drugs in Dermatology in January 2020 reported that melasma affects a range of individuals, from approximately 8.8% of Latin women in the United States to 40% of women and 20% of men in Southeast Asia. The increasing incidence of melasma is projected to become a significant trend in the pigmentation disorder treatment market.

Treatment Insights

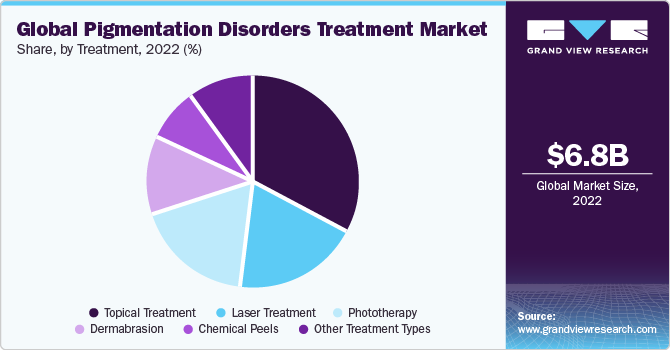

Based on the treatment, the market is segmented into topical treatment, laser treatment, chemical peels, dermabrasion, phototherapy, and other treatment types. The topical treatment segment held the largest market share in 2022. The growth of this segment is being driven by the rising research and development efforts and product launches by prominent industry players. For instance, in July 2022, Ahammune Biosciences partnered with Veeda Clinical Research Limited to conduct clinical trials for AB1001, a topical therapy for vitiligo. This collaboration was with the objective of advancing topical treatment development and is anticipated to enhance segment growth over the forecast period.

Regional Insights

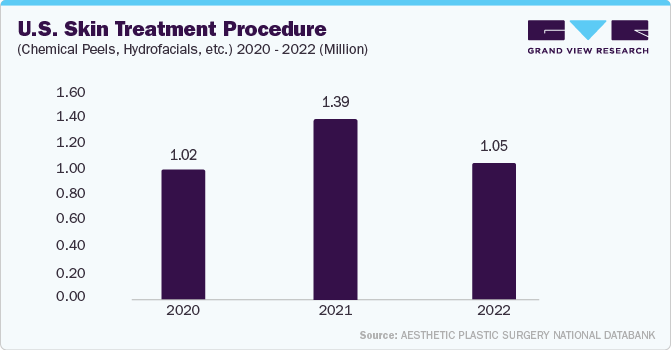

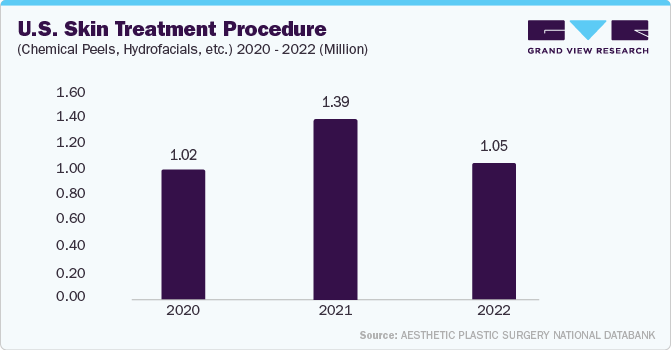

North America dominated the market in 2022. The growth of this region is attributed to the rise in the prevalence of pigmentation disorders, a well-established healthcare infrastructure, a surge in research and development activities, and companies adopting innovative strategies to meet the evolving demands of the market, all of which are expected to fuel the region’s growth. For instance, according to data from the Aesthetic Plastic Surgery National Databank in April 2022, the U.S. recorded about 1,390,149 skin treatment procedures in 2021, which included hydro facials, chemical peels, and others. This high incidence of cosmetics is expected to drive regional growth.

Competitive Insights

Key players operating in the market are Pfizer Inc., L'Oreal SA, Pierre Fabre Group (Pierre Fabre Laboratories), Epionce, Galderma SA, AbbVie Inc. (Allergan Inc.), Candela Corporation, SkinCeuticals, Merz GmbH & Co. KGaA, and DermaMed Solutions LLC. The market participants are working towards new product development, M&A activities, and other strategic alliances to gain new market avenues. In July 2022, the U.S. Food and Drug Administration granted approval to Incyte Corporation for Opzelura (ruxolitinib) cream as a treatment for non-segmental vitiligo in pediatric and adult patients aged 12 and above.S