- Home

- »

- Electronic Devices

- »

-

Pipeline Monitoring System Market, Industry Report, 2033GVR Report cover

![Pipeline Monitoring System Market Size, Share & Trends Report]()

Pipeline Monitoring System Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (PIGs, Smart Ball, LIDAR, Vapor Sensing), By Pipe Type (Metallic, Non-metallic), By Application, By Industry Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-013-7

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pipeline Monitoring System Market Summary

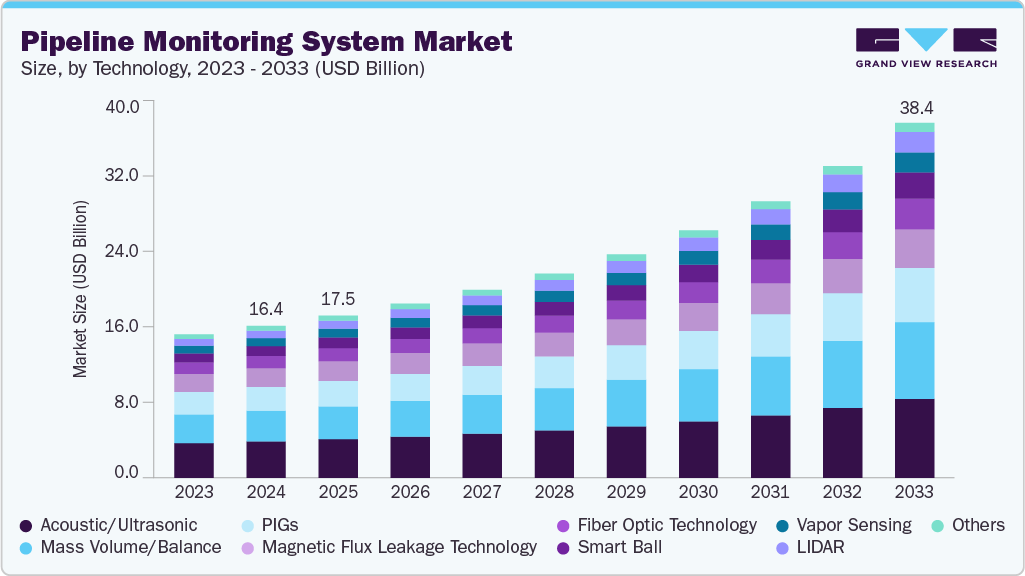

The global pipeline monitoring system market size was estimated at USD 16.43 billion in 2024, and is projected to reach USD 38.36 billion by 2033, growing at a CAGR of 10.3% from 2025 to 2033. The growth is attributed to the increasing pipeline installations utilized for the transportation and distribution of oil and gas supplies globally.

Key Market Trends & Insights

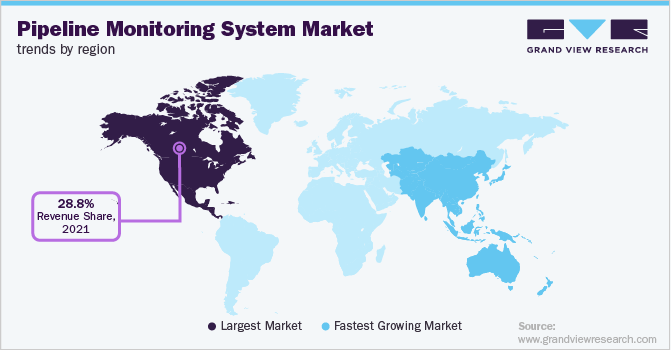

- The North America pipeline monitoring system market accounted for a 27.6% revenue share in 2024.

- The pipeline monitoring system industry in the U.S. held a dominant position in 2024.

- By technology, the acoustic/ultrasonic segment accounted for the largest revenue share of 24.0% in 2024.

- By pipe type, the metallic segment held the largest market share in 2024.

- By application, the leak detection segment dominated the market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 16.43 Billion

- 2033 Projected Market Size: USD 38.36 Billion

- CAGR (2025-2033): 10.3%

- North America: Largest Market in 2024

- Asia Pacific: Fastest-Growing Market in 2024

Moreover, the growing number of cases of leakage due to pipeline corrosion propels the demand for pipeline monitoring systems. Oil and gas manufacturers are rapidly adopting monitoring systems to reduce wastage, minimize environmental footprint, and ensure safety.

The adoption of leak detection systems has ensured safety, feasibility, real-time analysis, and improved performance owing to the improved pipeline infrastructure. Additionally, the installation of pipeline monitoring/detection systems has reduced geo-hazards, thefts, internal leakage, and ruptures. Furthermore, the advent of pigging technology within existing and new pipelines is positively influencing the growth of the market. The pigging technology performs operations such as maintenance, clearing, inspection, clearing, dimensioning, and pipeline testing.

The pipeline monitoring systems are utilized to locate corrosion, flow constrictions, and liquid accumulations, and collect samples by evaluating risk and bacteriological control programs. The pipeline monitoring systems are generally employed within the following applications: plants & refineries, refined products, wet gas & crude pipelines, water & wastewater, offshore platforms, and pipeline terminals. The monitoring/detection systems provide accurate real-time monitoring of internal corrosion, gases, fluids, and oil contamination.

Advancing technological aspects within pipeline infrastructure, such as Human Machine Interface (HMI), Distributed Vibration Sensing (DVS)/Distributed Acoustic Sensing (DAS), Distributed Temperature Sensing (DTS), and Programmable Logic Controller (PLC), have strengthened the downstream process monitoring capabilities, intuitive interface software, and detection algorithms. The improved technological solutions integrated within monitoring systems have significantly propelled the growth of the market.

Manufacturers employ hardware- and software-based methods, classifying leakage detection systems into three primary groups: internal, external, and non-technical methods. The detection/monitoring methods comprise ground penetration radar, pressure point analysis, fiber optic sensor, negative pressure wave, acoustic emission, and dynamic modeling.

The pipeline monitoring system industry has undergone a remarkable evolution across North America and the Asia Pacific, driven by the increased accessibility of improved pipeline infrastructure, technological breakthroughs, and growing demand for oil & gas substances. The Pipeline Monitoring System market is fragmented, with a few players dominating and capturing a significant share of the overall market. These companies have invested an enormous sum of the amount in research and development activities, as the industry is anticipated to grow exponentially in the near future.

Technology Insights

The acoustic/ultrasonic segment led the pipeline monitoring system market, with the largest revenue share of 24.0% in 2024, and is expected to witness a CAGR of over 9% during the forecast period. Acoustic/ultrasonic monitoring technology enables the detection of the location of the leak and flaws based on high-frequency sound waves and noise patterns within an extended range of pipelines. It utilizes acoustic emission sensors, typically based on alterations in the background noise pattern. An acoustic detection device detects leaks by differentiating and characterizing leak sounds from normal water flow, propelling the growth of the market in the forecasted year. However, acoustic monitoring technology fails to detect small leaks that do not produce higher or detectable background noise.

The LiDAR segment is anticipated to witness the fastest growth at a CAGR of 12.6% throughout the forecast period. LiDAR is an optical technology that utilizes a pulsed laser as an illuminating source sent from a transmitter. The reflected laser light from the objects is monitored utilizing a system receiver/ detector and the time of flight (TOF) for developing a distance map. LiDAR acts as a ranging device to measure the distance to a target, mainly identifying absorption, scatter, or re-emission from the objects. When integrated with pipeline monitoring systems, this technology enables a reliable scanning technique to avoid incidents related to oil contamination, leakage, and corrosion within the pipeline. These benefits offered by LiDAR are propelling the adoption of pipeline monitoring systems.

Pipe Type Insights

The metallic pipeline monitoring system market gained a revenue share of 78.5% in 2024 and is expected to grow at the fastest CAGR of over 10.0% throughout the forecast period. Metallic pipes are widely used within oil & gas, petrochemical, refinery, and power plants for manufacturing and transportation purposes.

The utilization of metallic pipes, such as alloy steel pipes, stainless steel pipes, carbon steel pipes, and duplex stainless steel (DSS) pipes, offers high corrosion resistance, weldability, and higher yield & tensile strength. These pipes are ideal for underwater and underground applications, capable of handling high-pressure and temperature conditions, and enabling smoother functioning when integrated with pipeline monitoring systems. These pipes are cost-effective and relatively maintenance-free, resulting in increased adoption of metallic pipes.

Application Insights

The leak detection segment dominated the pipeline monitoring system industry, with a revenue share of 43.5% in 2024, and is expected to grow at a CAGR of over 9.0% during the forecast period. The leak detection solutions enable pipeline operators to improve the effectiveness of their leak detection programs. The leak detection solutions automatically alert the operators in case of pipeline failure to enact immediately to minimize spill duration and volume.

The operators employ leak detection solutions that utilize volume & mass balance meters in, volume & mass balance meters out, combination rate of change, simple rate of change, and computational monitoring systems to provide real-time analysis via land-based and aerial surveillance, monitoring pipelines carrying oil & gas products. Volume and mass balance solutions are employed for detecting smaller leaks, whereas the rate of change and computational monitoring systems are suitable for detecting larger leaks.

The aforementioned leak detection solutions compare the mass and volume at an originating point and at a destination point to identify upsets or potential leaks. The potential leaks or upsets are further identified by scrutinizing operating parameters, such as density, flow, temperature, and pressure within the pipeline.

The pipeline break detection segment is anticipated to witness a significant CAGR of around 10.5% throughout the forecast period. Pipeline break detection solutions identify sudden pipe breaks that occur in water, oil, and gas distribution mains and transmission pipelines. The pipeline break detection solutions measure the pressure and timing of the waves to locate breaks within the pipeline. A pipe break creates tremendous negative pressure waves in both directions away from the break location.

The sudden break's transient approximates the break size and location. Pipe breaks are expensive owing to damage to the infrastructure, the cost of repair, and service interruption. Moreover, locating a break is a complicated and time-consuming task depending on the type of break (internal or external) and the type of pipeline (underwater or underground). These concerns prompt the pipeline operators to incorporate pipeline break detection systems, therefore propelling the growth of the segment.

Industry Vertical Insights

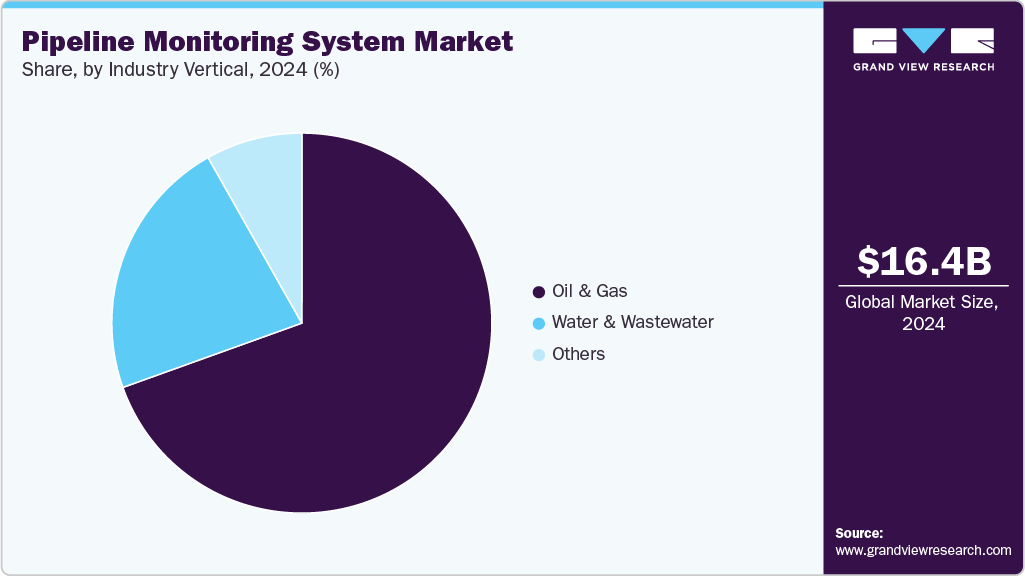

The oil & gas segment dominated the overall market, gaining a revenue share of 69.5% in 2024, and is projected to witness the fastest CAGR growth of 10.7% during the forecast period. The oil & gas segment comprises crude oil, natural gas, biogas fuels, petroleum, and refineries. A pipeline forms the backbone of transportation in the oil and gas industry; therefore, manufacturers are implementing pipeline monitoring systems to ensure safety and prevent mishaps. Moreover, incorporating detection systems minimizes the environmental footprint, reduces waste, and provides real-time analysis, enabling quick error detection and the implementation of solutions.

Furthermore, pipeline detection/monitoring systems have effectively eliminated ruptures, thefts, and internal leakage, propelling the growth of the market in the forecasted year. Moreover, the advent of technologies, such as PIGs, smart balls, acoustic/ultrasonic, magnetic flux leakage technology, fiber optic technology, mass volume/balance, LiDAR, and vapor sensing, within existing and new pipelines is positively influencing the growth of the market. The advent of leak detection solutions has progressively affected the development of the market.

Regional Insights

North America led the pipeline monitoring system market in 2024, with a revenue share of 27.6%. The region is equipped with a highly developed pipeline infrastructure and owns an extensive research and development base, allowing the region to be the top revenue contributor in the worldwide pipeline monitoring systems market during the projected period. A well-established pipeline infrastructure has allowed the speedier implementation of modern technologies.

The significant presence of small and medium players in North America, which offer components and services to the giants such as Emerson Electric Co., Honeywell International Inc., and Rockwell Automation Inc., has also propelled the market growth. The growing technological investments and oil & gas exploration activities in the region fuel the growth of pipeline monitoring systems.

U.S. Pipeline Monitoring System Market Trends

The U.S. is expected to retain its dominance in the pipeline monitoring system industry over the forecast period, owing to a rise in the number of pipelines for crude, petroleum, water, oil, gas, and wastewater for transportation, leading to amplified incorporation of pipeline monitoring systems to preclude the occurrence of leakage, spills, pipe bursts, and contamination. Furthermore, the interstate pipelines managed by the U.S. Department of Transportation and Federal Energy Regulatory Commission (FERC) regulate natural gas transportation, pipelines, and storage to ensure adherence to pipeline safety regulations.

The Pipeline and Hazardous Materials Safety Administration (PHMSA) collaborates with pipeline operators, departments, and agencies to certify pipeline operation security, safety, compliance, and monitoring. It also lays stringent regulations and conducts inspections, ensuring pipeline operators comply with safety regulations.

Asia Pacific Pipeline Monitoring System Industry Trends

The Asia Pacific is expected to develop substantially by the projection period and grow at the fastest CAGR of 11.4%. Significant contributors to the growth of the Asia Pacific market include Huawei Investment and Holding Co. Ltd., ORBCOMM Inc., and ABB Ltd., which have been developing advanced pipeline infrastructure and monitoring systems. The growing investments in oil & gas exploration activities, as well as the construction of pipelines, are propelling the growth of pipeline monitoring systems in the region.

For instance, in April 2021, China Oil & Gas Pipeline Network (also known as PipeChina) commenced the construction of a natural gas trunk line in North China connecting the Power of Siberia project, a gas transmission system. PipeChina invested USD 1.3 billion in the gas pipeline construction, ensuring air quality improvement and promoting economic development.

Key Pipeline Monitoring System Company Insights

Some of the major players in the pipeline monitoring system industry include ABB Ltd., Emerson Electric Co., General Electric Co., Honeywell International Inc., Huawei Investment & Holding Co. Ltd., ORBCOMM Inc., QinetiQ Group Plc, Rockwell Automation Inc., Schneider Electric SE, and Siemens AG, owing to their advanced capabilities in industrial automation, sensing, and real-time communication technologies that enhance pipeline integrity and operational safety. These companies maintain leadership through robust portfolios spanning SCADA platforms, IoT-enabled leak detection sensors, fiber-optic monitoring systems, predictive analytics, and remote surveillance solutions, enabling pipeline operators to detect anomalies early, prevent failures, and ensure regulatory compliance. Their strong R&D investments, global service footprints, cybersecurity-focused solutions, and strategic collaborations with major oil & gas and midstream operators further reinforce their position as trusted providers of scalable, reliable, and intelligent pipeline monitoring systems.

-

ABB Ltd. is a global leader in electrification, automation, and digital solutions, offering a comprehensive portfolio for enhancing the efficiency, reliability, and safety of pipeline operations. The company provides advanced SCADA systems, leak detection technologies, pressure/flow monitoring sensors, and industrial communication platforms that support end-to-end pipeline integrity management. ABB integrates AI-driven analytics, robotics, and cyber-secure control systems to help operators detect anomalies, optimize performance, and minimize downtime. With a strong global footprint and a long-standing presence in the oil & gas and utilities sectors, ABB is recognized for its commitment to innovation, digital transformation, and sustainable infrastructure solutions across complex pipeline networks.

-

Emerson Electric Co. is a leading U.S.-based provider of industrial automation, control systems, and measurement solutions widely used in pipeline monitoring and asset integrity applications. Emerson offers pressure and flow transmitters, acoustic leak detection systems, pipeline SCADA platforms, corrosion monitoring tools, and predictive maintenance software designed to improve safety and operational visibility. The company’s smart automation technologies, backed by its Ovation and DeltaV control architectures, enable real-time data acquisition, remote diagnostics, and advanced process optimization. With strong R&D investment and deep expertise in process industries, Emerson continues to support global pipeline operators through reliable instrumentation, intelligent sensors, and scalable automation infrastructure.

Key Pipeline Monitoring System Companies:

The following are the leading companies in the pipeline monitoring system market. These companies collectively hold the largest market share and dictate industry trends.

- ABB Ltd.

- Emerson Electric Co.

- Generic Electric Co.

- Honeywell International Inc.

- Huawei Investment and Holding Co. Ltd.

- ORBCOMM Inc.

- QinetiQ Group Plc

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

Recent Developments

-

April 2, 2025, ABB Ltd. delivered integrated automation and digital technology for IndianOil’s large pipeline network (covering SCADA/automation, remote data acquisition, and leak-detection capabilities), highlighting ABB’s role in large-scale pipeline monitoring and control deployments.

-

December 2024, Emerson Electric Co. published/updated its PipelineManager software suite (real-time transient modeling, leak detection, and pipeline operational analytics), reaffirming Emerson’s software-centric approach to pipeline leak detection, RTTM, and mixed-product/transient monitoring.

Pipeline Monitoring System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.53 billion

Revenue forecast in 2033

USD 38.36 billion

Growth rate

CAGR of 10.3% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, pipe type, application, industry vertical, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

ABB Ltd.; Emerson Electric Co.; Generic Electric Co.; Honeywell International Inc.; Huawei Investment and Holding Co. Ltd.; ORBCOMM Inc.; QinetiQ Group Plc; Rockwell Automation Inc.; Schneider Electric SE; Siemens AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pipeline Monitoring System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global pipeline monitoring system market report based on technology, pipe type, application, industry vertical, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

PIGs

-

Smart Ball

-

Acoustic/Ultrasonic

-

Magnetic Flux Leakage Technology

-

Fiber Optic Technology

-

Mass Volume/Balance

-

LIDAR

-

Vapor Sensing

-

Others (Beta Foil Technology and Leo Technology)

-

-

Pipe Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Metallic

-

Non-metallic

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Leak Detection

-

Operating Condition

-

Pipeline Break Detection

-

Others

-

-

Industry Vertical Outlook (Revenue, USD Million, 2021 - 2033)

-

Oil & Gas

-

Water & Wastewater

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global pipeline monitoring system market size was estimated at USD 16.43 billion in 2024 and is expected to reach USD 17.53 billion in 2025.

b. The global pipeline monitoring system market size is expected to grow at a significant CAGR of 10.3% to reach USD 38.36 billion in 2033.

b. Some of the players in the market are ABB Ltd., Emerson Electric Co., Generic Electric Co., Honeywell International Inc., Huawei Investment and Holding Co. Ltd., ORBCOMM Inc., QinetiQ Group Plc, Rockwell Automation Inc., Schneider Electric SE, and Siemens AG.

b. North America held the largest market share of 27.6% in 2024. pipeline monitoring systems across North America are undergoing rapid modernization driven by increasing regulatory scrutiny, widespread adoption of IoT-enabled sensors, expansion of remote SCADA integration, and rising investments in advanced leak-detection, predictive maintenance, and cybersecurity solutions to ensure higher safety, reliability, and environmental compliance.

b. The key driving trend in the global pipeline monitoring system market is the rapid shift toward intelligent, IoT-integrated, and AI-enabled monitoring technologies that provide real-time visibility, early leak detection, predictive maintenance, and enhanced cybersecurity across long-distance pipeline networks.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.