- Home

- »

- Medical Devices

- »

-

Pipette Tips Market Size & Share Report, 2022 - 2030GVR Report cover

![Pipette Tips Market Size, Share & Trends Report]()

Pipette Tips Market (2022 - 2030) Size, Share & Trends Analysis Report By Application (Diagnostics & Healthcare, Pharma & Biotech), By Product (Standard, Filtered), By Technology (Non-robotic, Robotic), And Segment Forecasts

- Report ID: GVR-4-68039-940-0

- Number of Report Pages: 111

- Format: PDF

- Historical Range: 2018 - 2020

- Forecast Period: 2022 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

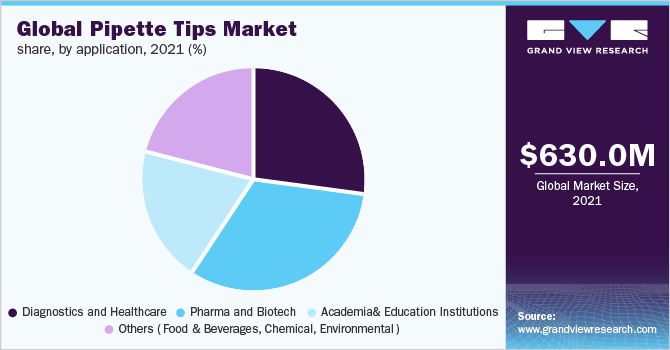

The global pipette tips market size was valued at USD 630.0 million in 2021 and is expected to grow at a compound annual growth rate (CAGR) of 8.0% from 2022 to 2030. Constant innovation in products, increasing demand for R&D, and a rising number of healthcare settings & diagnostics and liquid handling systems are key drivers responsible for the growth of the market. A pipette is a laboratory instrument to transfer a specific volume of liquid. The pipette is joined at the end with a pipette tip, forming an airtight seal between them. A pipette tip helps a pipette to dispense a specific volume of liquid and is mostly made of Polypropylene (PP) and is both disposable and reusable. In addition, there has been an increasing number of innovations in this product category, which is fueling the product demand in this category. The demand for pipette tips like wide orifice tips, gel loading tips, standard, filtered, low-retention, pipette tips, etc., escalated drastically due to the onset of the COVID-19 in 2020 as they were among the crucial laboratory devices used for identifying the presence of the virus. The U.S filter tips product type segment is expected to witness the fastest CAGR over the forecast period. Robotics held the largest share in 2021.

This can be attributed to the rise in liquid handling systems, increasing diagnostics, and research and development. As per Greiner AG, a manufacturer of laboratory supplies & instruments, countries like the U.K. and Germany have a strong technology partnership with universities, research institutes, and the diagnostic, pharmaceutical, and biotechnological industries, which has increased the demand for pipette tips. The automation and robotization of devices are modifying industry and society. Robotic technology is used for the automation of medical devices as well as pipettes for more accurate and minimal errored results.

Automatic pipettes are used for calibration. Automatic pipettes are used in the biological, biochemical, and microbiological teaching and research laboratories to accurately transfer small liquid volumes. Many diagnostics, pharma, and biotech industries require pipettes for testing. They require these devices in large quantities as well, as pipettes are required in each process in analytical labs, quality testing lab department, etc. Robotics has impacted the industrial outlook through automation. Automated pipettes can take the manual labor out of repeated pipetting and can offer various advantages.

Perhaps the most obvious is greatly improved throughput, as the automation frees up time and effort for other tasks. Another benefit is enhanced reproducibility. Automated pipetting removes the variation in pipetting styles of different users. The demand for pipette tips escalated drastically in 2020 due to the outbreak of COVID-19 as daily testing at diagnostic centers for infection detection increased. However, many supply chain bottlenecks were faced as the demand for pipette tips exceeded its supply.

To counter this, key players created additional production capacity for significant laboratory items like pipette tips, to secure the supply of research and diagnostic facilities. During the second half of 2020, a significant increase in sales revenues was witnessed, especially in the USA and Europe. Pipette tips manufacturers like Eppendorf are building a new plant for high-quality laboratory consumables made of functional high-tech polymers. These aforementioned factors played a crucial role in increasing the demand for pipette tips during COVID-19.

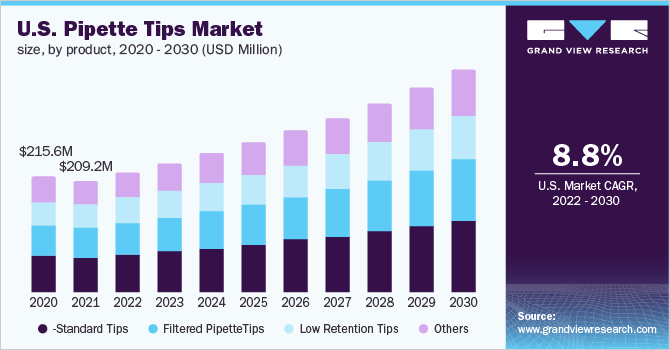

Product Insights

Based on products, the global market has been further categorized into standard tips, filtered pipette tips, low-retention tips, and others (large-volume, extended-length pipette tips, wide orifice tips, and gel loading tips). The standard product segment dominated the market in 2021. The segment accounted for the largest revenue share of more than 32.5% in 2021 and is anticipated to expand further at a healthy growth rate from 2022 to 2030. A standard tip is a multi-purpose tip for many laboratory applications with a variety of performance requirements.

These applications range from high accuracy to reagent dispensing with greater tolerance. Sterile standard tips are available for applications demanding the highest level of purity. Filter tips are the most important pipetting technology. Aerosol barrier tips have also been known as filtering pipette tips, which are equipped with a filter inside the proximal part of the pipette tips to suck viscous samples into the shaft with precision. This not only protects the pipette from other physical damage but also prevents sample cross-contamination due to aerosols. These tips are most beneficial for PCR, qPCR, and sensitive tests.

Technology Insights

The non-robotic pipette tip segment held the largest revenue share of 56.4% in 2021 and is expected to reciprocate significant segmental growth during the forecast period. Non-robotic pipette tips are used with standard or manually-operated pipetting systems. The majority of the laboratories used manually-operated pipetting systems, which directly impacts the demand for standard or non-robotic pipette tips. However, with advancements and automation in the healthcare sector, the demand for automated liquid handling systems has also witnessed growth.

Automated pipetting systems are robotic instruments used to dispense predefined volumes of reagents and samples into vessels, such as test tubes without any manual intervention, thereby ensuring consistent accuracy and reproducibility. Robotic pipette tips can be implemented with automatic liquid handling workstations and can be used for Gel loading, PCR testing DNA testing, etc., which requires high accuracy and minimal contamination. Eppendorf in its 2021 annual report stated that the company has witnessed an increase in the sales of its robotic pipetting systems and has been doubled from 2020. This indicates that the demand for robotic pipettes is also likely to increase.

Application Insights

The pharma and biotech application segment dominated the market in 2021 and accounted for the largest share of more than 32.3% of the global revenue. The segment is projected to expand further at the fastest CAGR retaining its leading position throughout the forecast period. This growth is attributed to the use of pipettes for various research purposes, for accurate transfer of the research sample for conducting any experiment. The global pharmaceutical market is expected to grow in the coming years despite the recent slowdown in key markets across the globe.

The market has experienced significant growth during the past two decades, and pharma revenues worldwide totaled USD 1.27 trillion in 2020. The reasons are a growing aging population, rising income levels, emerging medical conditions, and increasing research expenditure. The prominent pharma industry trends include Artificial Intelligence (AI), additive manufacturing, blockchain, and other Industry 4.0 technologies, which may help in the automation of the industry and help indirectly increase the use of automated pipettes.

Regional Insights

Based on geographies, the market has been further divided into North America, Asia Pacific, Latin America, Europe, Middle East & Africa. North America dominated the global market in 2021 and accounted for the largest share of more than 37.5% of the global revenue. The region is strategically very important for the distribution of pipette tips, as even one regulatory approval can give access to the entire region. In addition, the per capita expenditure on healthcare in countries in this region is higher as compared to developing countries, which aids in the growth of the medical device industry.

This indirectly fuels the growth of pipette tips. Moreover, an increasing number of healthcare research and developments in the region are fueling the market growth. The pharma and biopharma industries are the major contributors to the European economies and this has been possible due to the extensive focus on R&D infrastructure in the region. Increasing collaborations and partnerships of key players with universities, research institutes, and the diagnostic, pharmaceutical, & biotechnological industries have increased the product demand in the region.

Key Companies & Market Share Insights

New product developments, collaborations, regional expansions, and mergers are key strategic initiatives undertaken by market players. For instance, in April 2022, Eppendorf Group, a key market player, announced its expansion by building a new plant for high-quality laboratory consumables made of functional high-tech polymers. In 2022, Moderna, Inc, a biotechnology company pioneering messenger RNA (mRNA) therapeutics and vaccines, and Thermo Fisher Scientific Inc., announced a 15-year strategic collaboration agreement to enable dedicated large-scale manufacturing in the U.S. of Spikevax, Moderna’s COVID-19 vaccine, and other investigational mRNA medicines in its pipeline, which will assist in increased use of essential lab supplies like pipette tips. Some of the prominent players in the global pipette tips market include:

-

Eppendorf

-

Mettler Toledo

-

Thermo Fisher Scientific

-

Sartorius

-

Biotix

-

Corning

-

Greiner Group AG

-

Capp

-

Sarstedt

-

Brand GmbH

Pipette Tips Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 677.15 million

Revenue forecast in 2030

USD 1.3 billion

Growth rate

CAGR of 8.0% from 2022 to 2030

Base year for estimation

2021

Historical data

2018 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, technology, applications, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France, Italy; Spain; China; Japan; India; Australia; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE

Key companies profiled

Thermo-Fisher Scientific; Sartorius AG; Corning Inc.; Mettler Toledo; Eppendorf AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030.’ For this study, Grand View Research has segmented the global pipette tips market report based on product, technology, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard

-

Filtered

-

Low-retention

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Robotic

-

Non-robotic

-

-

Applications Outlook (Revenue, USD Million, 2018 - 2030)

-

Diagnostics and Healthcare

-

Pharma and Biotech

-

Academia and Education

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global pipette tips market size was estimated at USD 630.0 million in 2021 and is expected to reach USD 677.15 million in 2022.

b. The global pipette tips market is expected to grow at a compound annual growth rate of 8.0% from 2022 to 2030 to reach USD 1.3 billion by 2030.

b. North America dominated the pipette tips market with a share of 37% in 2020. This is attributable to rising healthcare investments coupled with automated technology acceptance and constant research and development initiatives.

b. Some key players operating in the pipette tips market include Thermo-Fisher Scientific, Sartorius AG, CORNING INC., Mettler Toledo, Eppendorf AG, and other

b. Key factors that are driving the pipette tips market growth include Constant innovation in products, increasing demand for research and developments, rising number of healthcare settings and diagnostics, and a rising number of liquid handling systems

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.