- Home

- »

- Consumer F&B

- »

-

Plant-based Seafood Market Size, Industry Report, 2030GVR Report cover

![Plant-based Seafood Market Size, Share & Trends Report]()

Plant-based Seafood Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Fish, Prawn And Shrimp), By Source (Soy, Pea), By Distribution Channel (Supermarkets & Hypermarkets, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-553-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Plant-based Seafood Market Size & Trends

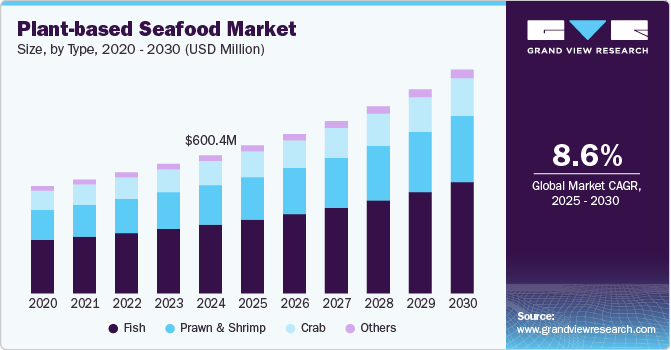

The global plant-based seafood market size was estimated at USD 600.40 million in 2024 and is expected to grow at a CAGR of 8.6% from 2025 to 2030. The demand and consumption of plant-based seafood are on the rise due to a growing awareness of health benefits. Many consumers are shifting towards healthier diets, with plant-based foods being a major component of this transition. Plant-based seafood offers the nutritional benefits of traditional seafood, such as protein and omega-3 fatty acids, without the associated risks of mercury contamination, excessive cholesterol, or saturated fats. Health-conscious individuals are increasingly looking for alternatives that allow them to enjoy seafood flavors while maintaining a diet that supports overall well-being.

Environmental sustainability is another significant driver of the growing plant-based seafood industry. Overfishing, depletion of fish stocks, and the damaging effects of conventional fishing practices on marine ecosystems have raised concerns among consumers. Plant-based seafood provides a more sustainable solution, reducing the need for fishing and helping conserve ocean habitats. As people become more aware of the ecological impact of their food choices, they are opting for alternatives that contribute to environmental preservation.

Ethical considerations also play a crucial role in the rise of plant-based seafood consumption. Many consumers are motivated by concerns over animal welfare, including the suffering of marine animals and the destruction of marine habitats caused by traditional fishing methods. Plant-based seafood appeals to those who want to align their dietary choices with their ethical beliefs, avoid cruelty, and promote sustainable food practices.

Technological advancements have made plant-based seafood more appealing than ever. Innovations in food science have led to the development of products that closely replicate the taste, texture, and appearance of conventional seafood. This makes the transition to plant-based alternatives easier for consumers who still want the sensory experience of eating seafood without contributing to environmental or ethical issues.

Additionally, plant-based seafood offers a viable option for individuals with seafood allergies or dietary restrictions. With rising concerns over allergens, these alternatives provide a safe and enjoyable option for those unable to consume traditional seafood. The broader trend of increasing demand for alternative protein sources also supports the growth of plant-based seafood as consumers adopt flexitarian, vegetarian, or vegan lifestyles.

Type Insights

Plant-based fish accounted for a revenue share of 49.76% of the global revenue in 2024. Many consumers are shifting toward plant-based fish due to health concerns associated with traditional fish, such as mercury contamination, cholesterol, and high-fat content. Plant-based fish offers a safer, cholesterol-free alternative, appealing to individuals seeking healthier diets or following vegetarian, vegan, or flexitarian lifestyles. Additionally, these products are often fortified with essential nutrients like omega-3 fatty acids, mimicking the nutritional benefits of conventional fish.

Concerns about overfishing, marine ecosystem depletion, and ocean pollution have heightened awareness of traditional seafood's environmental impact. Plant-based fish provides a sustainable alternative, helping to preserve marine biodiversity. As consumers grow more eco-conscious, they are increasingly opting for plant-based fish to reduce their environmental footprint.

Plant-based prawn and shrimp is expected to grow at a CAGR of 9.3% from 2025 to 2030. Advancements in food technology have led to the development of plant-based prawn and shrimp products that better replicate the taste, texture, and appearance of traditional shrimp and prawns. This makes the switch to plant-based alternatives easier for consumers who still want to enjoy familiar flavors and textures without compromising on quality.

The increasing presence of plant-based prawn and shrimp products in supermarkets, grocery stores, and restaurants has made them more accessible to a wider audience. Partnerships between plant-based food manufacturers and popular food service chains have introduced these alternatives into mainstream menus, helping to fuel broader adoption.

Source Insights

Soy-based seafood accounted for a revenue share of 52.40% of the global revenue in 2024. Soy is a well-known source of complete plant-based protein, containing all essential amino acids, which makes it highly attractive to health-conscious consumers. Soy-based seafood products provide a nutritious alternative to traditional seafood, often fortified with additional vitamins and nutrients like omega-3 fatty acids, making them appealing for those seeking a plant-based diet without sacrificing nutritional benefits.

Soy is widely available and relatively inexpensive compared to other plant-based protein sources. This affordability makes soy-based seafood products more accessible to a broader range of consumers, contributing to their popularity. The extensive supply chain for soy protein also ensures that these products can be mass-produced at lower costs, promoting their inclusion in various plant-based seafood offerings.

Pea-based seafood is expected to grow at a CAGR of 10.1% from 2025 to 2030. Pea protein is naturally free from common allergens like soy and gluten, making it a safer and more inclusive option for consumers with allergies or dietary restrictions. This allergen-free profile is increasingly appealing to health-conscious consumers looking for clean-label and hypoallergenic plant-based seafood alternatives.

Advancements in food technology have enabled pea protein to closely replicate the texture and mouthfeel of seafood, making it a preferred choice for creating realistic plant-based seafood products. This ability to mimic the flakiness of fish or the chewiness of shrimp has contributed to the rise in consumer interest, as these products increasingly satisfy the sensory experience of traditional seafood.

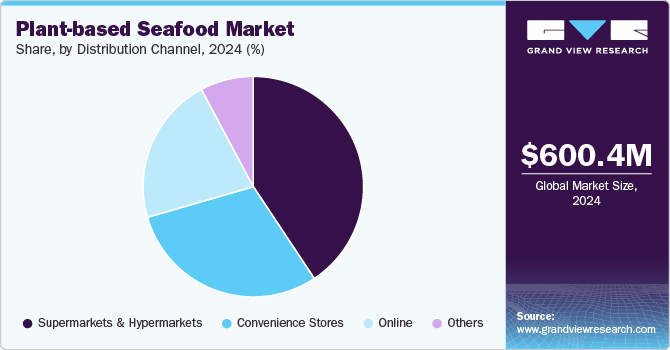

Distribution Channel Insights

The sales of plant-based seafood through supermarkets & hypermarkets accounted for a revenue share of 40.68% in 2024. Supermarkets and hypermarkets have expanded their plant-based product offerings, making seafood more widely available to consumers. As major retailers stock more plant-based seafood brands, these products become more accessible to a larger audience, encouraging trial and repeat purchases.

This broad distribution allows consumers to find plant-based seafood during their regular grocery shopping easily. Supermarkets and hypermarkets often engage in promotional campaigns, in-store tastings, and targeted marketing for plant-based products. These initiatives help raise consumer awareness about the benefits of pea-based seafood, from health and sustainability to allergen-free properties.

The sales of plant-based seafood through online channels are expected to grow at a CAGR of 9.9% from 2025 to 2030. The convenience and accessibility of online shopping have made it an attractive option for consumers looking to try plant-based seafood for the first time. The ability to easily compare products and read customer reviews also contributes to the appeal of online channels. Furthermore, the COVID-19 pandemic has accelerated the shift to online shopping, with many consumers opting to purchase groceries, including plant-based seafood, online to minimize exposure to the virus. Another key trend driving the demand for plant-based seafood through online channels is the increasing number of plant-based seafood brands that are launching and selling their products online. These brands can reach a wider audience and target consumers who are specifically looking for plant-based seafood options.

Regional Insights

The plant-based seafood market in North America accounted for a revenue share of 37.70% of the global market in 2024. Many North American consumers are increasingly adopting healthier and more sustainable diets, including flexitarian, vegetarian, and vegan lifestyles. Concerns over contaminants in traditional seafood, such as mercury and microplastics, as well as the desire to reduce cholesterol and fat intake, have led to rising demand for plant-based seafood alternatives, which are perceived as healthier options.

U.S. Plant-based Seafood Market Trends

The U.S. plant-based seafood market is facing intense competition and innovation. The U.S. market has seen a surge in innovations in plant-based seafood products, with companies improving the taste, texture, and variety of offerings. From plant-based fish fillets to shrimp and crab alternatives, these innovations make plant-based seafood more appealing to mainstream consumers. The increasing availability of these products in grocery stores, supermarkets, and restaurants has further fueled demand across the region.

Europe Plant-based Seafood Market Trends

The plant-based seafood market in Europe is expected to grow at a CAGR of 9.0% during the forecast period. The plant-based movement is rapidly growing in Europe, with a significant number of people adopting vegetarian, vegan, or flexitarian diets. Concerns over animal welfare, food ethics, and the health risks associated with conventional seafood have contributed to this shift. Plant-based seafood offers a viable alternative for consumers who want to reduce or eliminate animal products from their diets without compromising on the taste and experience of eating seafood.

Asia Pacific Plant-based Seafood Market Trends

The Asia Pacific plant-based seafood market is expected to grow at a CAGR of 9.5% from 2025 to 2030. Food tech companies in Asia Pacific are innovating plant-based seafood to replicate regional seafood dishes, such as plant-based shrimp, fish, and crab, tailored to local tastes. These innovations, combined with partnerships with local retailers and restaurants, have made plant-based seafood more accessible and appealing to consumers, driving market growth in the region. Localized products that fit traditional cuisines, such as plant-based sushi or shrimp dumplings, are increasingly popular in urban areas.

Key Plant-based Seafood Company Insights

The plant-based seafood industry is characterized by dynamic competitive dynamics shaped by a combination of factors, including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective, quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Plant-Based Seafood Companies:

The following are the leading companies in the plant-based seafood market. These companies collectively hold the largest market share and dictate industry trends.

- Beyond Meat

- Gardein

- Ocean Hugger Foods

- Good Catch

- Turtle Island Foods

- New Wave Foods

- Miyoko's Creamery

- Daiya Foods

- Kuleana

- Loma Linda

Recent Developments

-

In July 2024, NH Foods, an Osaka-based food processing company, launched a plant-based tuna sashimi alternative in Japan's restaurant market. This new product aims to replicate the aroma and texture of raw tuna, offering consumers an authentic culinary experience. The alt-seafood sector is gradually growing, driven by concerns over marine resource sustainability.

Plant-based Seafood Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 643.52 million

Revenue forecast in 2030

USD 972.19 million

Growth rate

CAGR of 8.6% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, source, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; and South Africa

Key companies profiled

Beyond Meat; Gardein; Ocean Hugger Foods; Good Catch; Turtle Island Foods; New Wave Foods; Miyoko's Creamery; Daiya Foods; Kuleana; Loma Linda

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant-based Seafood Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plant-based seafood market report based on type, source, distribution channel, and region:

-

Type Market Outlook (Revenue, USD Million, 2018 - 2030)

-

Fish

-

Prawn and Shrimp

-

Crab

-

Others

-

-

Source Market Outlook (Revenue, USD Million, 2018 - 2030)

-

Soy

-

Wheat

-

Pea

-

Others

-

-

Distribution Channel Market Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & hypermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Market Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.