- Home

- »

- Next Generation Technologies

- »

-

Plant Phenotyping Equipment Market Size, Industry Report, 2018-2025GVR Report cover

![Plant Phenotyping Equipment Market Size, Share & Trends Report]()

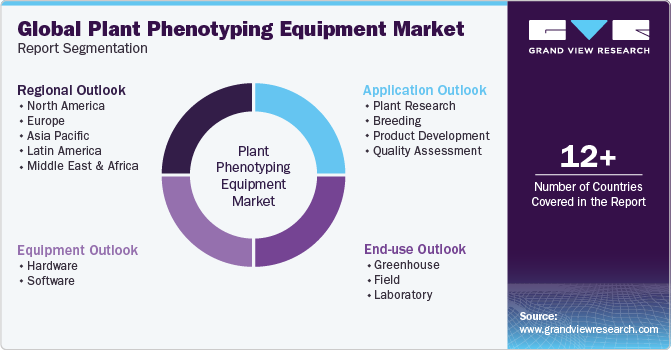

Plant Phenotyping Equipment Market (2023 - 2030) Size, Share & Trends Analysis Report By Equipment (Hardware, Software), By Application (Plant Research, Breeding), By End-use (Greenhouse, Field, Laboratory), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-520-5

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plant Phenotyping Equipment Market Summary

The global plant phenotyping equipment market size was estimated at USD 205.8 million in 2022 and is projected to reach USD 443.4 million by 2030, growing at a CAGR of 10.0% from 2023 to 2030. According to a study by the United Nations Food and Agriculture Organization (FOO), you should double the production of cereals before 2050 to meet the rising demand for food and curb growing competition for crops as sources of industrial, fiber, and bio-energy purposes.

Key Market Trends & Insights

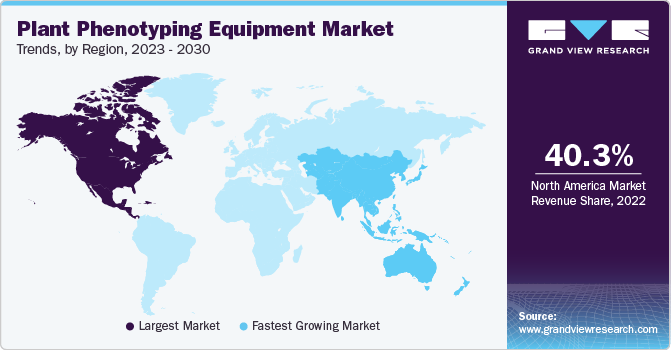

- North America dominated the market with the largest revenue share of 40.3% in 2022.

- Asia Pacific is expected to grow at the fastest CAGR of 12.7% during the forecast period.

- Based on equipment, the hardware segment dominated the market with the highest revenue share of 74.5% in 2022.

- Based on the application, the quality assessment segment held the largest market share of 46.5% in 2022.

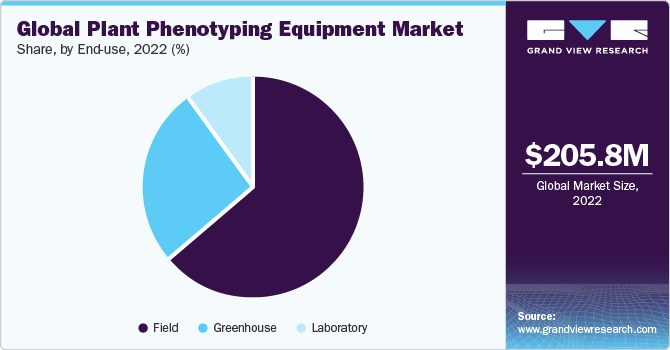

- Based on end-use, the field segment dominated the market with the highest revenue share of 63.6% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 205.8 Million

- 2030 Projected Market Size: USD 443.4 Million

- CAGR (2023-2030): 10.0%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The global demand for agriculture is increasing rapidly due to a growing population. There is a rising need to grow high-yielding crops to meet global food security needs. According to a study conducted by the Intergovernmental Panel on Climate Change (IPCC) in 2016, a high frequency of extreme weather events and global warming would adversely affect livestock, crop, forestry, and aquaculture productivity in the years to come.

The global demand for agriculture is increasing rapidly due to a growing population. There is a rising need to grow high-yielding crops to meet global food security needs. According to a study conducted by the Intergovernmental Panel on Climate Change (IPCC) in 2016, a high frequency of extreme weather events and global warming would adversely affect livestock, crop, forestry, and aquaculture productivity in the years to come.

Innovative methods are required to enhance cereal grains' productivity and quality and meet various environmental challenges. It would lead to a rise in demand for quantitative analysis of plant traits to speed up the selection process of crops better adapted to the soil and environmental conditions.

Researchers have been developing different strategies to develop plants with high nutrient content resistant to diseases and environmental stress. High-throughput, automatic, and reliable phenotyping platforms have been developed to meet ongoing research objectives.

Equipment Insights

Based on equipment, the market has been segmented into hardware and software. The hardware segment dominated the market with the highest revenue share of 74.5% in 2022. Plant phenotyping involves the measurement of various plant characteristics, such as growth rate, size, shape, and physiological parameters. Advancements in imaging technologies like hyperspectral imaging, 3D scanning, and high-resolution cameras have enabled more accurate and detailed data collection, driving the demand for specialized hardware.

On the other hand, the software segment is expected to grow at the fastest CAGR of 11.9% over the forecast period. Plant phenotyping generates massive amounts of data from various sources like cameras, sensors, drones, and satellites. Software tools enable researchers to efficiently analyze and interpret this data, extracting meaningful insights that aid in understanding plant behavior, responses to different environments, and genetic factors.

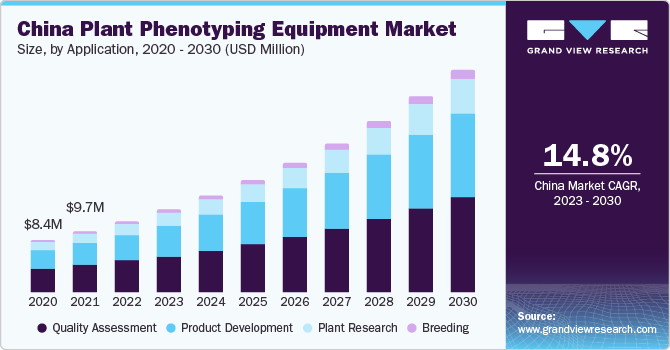

Application Insights

Based on the application, the market has been categorized into plant research, breeding, product development, and quality assessment. The quality assessment segment held the largest market share of 46.5% in 2022. Accurate and reproducible data is essential for valid research outcomes. Quality assessment tools help ensure that the data collected through plant phenotyping equipment is reliable and consistent, reducing the risk of errors and enhancing the credibility of research findings.

Plant phenotyping assists in the complete assessment of complex plant traits. It has a variety of applications in quality assessments, product development, breeding, and research. Developers, breeders, and researchers work intensively at biochemical and molecular levels to enhance management processes and plant cultivars. Their work increasingly necessitates the use of quantitative data on phenotypes. Phenotypic data assists in detecting Quantitative Trait Locus (QTL) and understanding gene functions. Moreover, it provides insights into how pathogens and pests influence phenotypes, how they respond to CO2 or light, and how plants cope with the limitations of nutrients and water.

The product development segment is estimated to exhibit the fastest CAGR of 11.5% over the forecast period. As technology advances, new tools and techniques are available for capturing and analyzing plant data. It has led to the development more sophisticated and specialized plant phenotyping equipment that can provide higher-resolution imaging, multi-spectral analysis, and real-time monitoring.

End-use Insights

The field segment dominated the market with the highest revenue share of 63.6% in 2022. The agriculture industry is transforming with the integration of technology and data-driven approaches. Plant phenotyping equipment allows researchers and farmers to gather detailed data about plant characteristics, growth patterns, and responses to various conditions. This information can be used to develop more resilient and productive crops.

The greenhouse segment is expected to witness the fastest growth of CAGR of 11.2% over the forecast period. This growth can be attributed to the continuous demand for high-throughput phenotyping platforms deployed in greenhouses.

By combining advancements in aeronautics, automatic control technology, and sensing technologies, computing enables the development of field-based and controlled environment-based phenotyping platforms. In recent times, controlled environment-based phenotyping platforms have been sold commercially and have been deployed in greenhouses. These platforms are precisely designed for large-scale phenotyping for a limited range of species comprising small rosette plants, such as primary cereal crops and Arabidopsis.

Regional Insights

North America dominated the market with the largest revenue share of 40.3% in 2022. North America is expected to witness significant growth owing to increasing initiatives taken by the government and private players for advanced technologies. These initiatives include forming associations, such as the North American Plant Phenotyping Network (NAPPN), an association of researchers and scientists working toward accelerating research and development.

Europe launched the European Plant Phenotyping Project (EPPN) to establish a regional phenotyping infrastructure. The network includes projects such as the International Plant Phenotyping Network (IPPN), Deutsche Pflanzen Phänotypisierungs Netzwerk (DPPN), Phenome French Plant Phenotyping Network (FPPN), and the UK Plant Phenomics Network.

Asia Pacific is expected to grow at the fastest CAGR of 12.7% during the forecast period. The region is home to a significant portion of the global population. As the population continues to grow, there is a growing need to increase agricultural productivity to ensure food security. Plant phenotyping equipment offers solutions to optimize crop yields and resource utilization.

Key Companies & Market Share Insights

Strategic alliances undertaken by key participants are boosting the growth of the market. These alliances have established an infrastructure that has facilitated leadership and continuous support in the market.

Key Plant Phenotyping Equipment Companies:

- Phenomix Sciences

- Saga Robotics AS

- Kingsoft Office Software

- PHENOSPEX

- Keygene

- SMO bv

- BASF SE

- Controlled Environments Limited

- EarthSense, Inc.

- Qubit Biology Inc.

- LemnaTec GmbH

- Heinz Walz GmbH

- PSI (Photon Systems Instruments) spol. s r.o.

Recent Developments

-

In September 2022, Royal Van Zanten (RVZ) forged a strategic partnership with Interplant, a spray rose breeder. This collaboration offered cultivators in East Africa an opportunity to tap into RVZ's wide array of floral varieties such as Alstroemeria, Statice, Chrysanthemum, and Limonium. Leveraging Interplant's well-established connections in the East African region, this alliance seeks to extend RVZ's floral offerings to a broader market.

Plant Phenotyping Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 227.6 million

Revenue forecast 2030

USD 443.4 million

Growth rate

CAGR of 10.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

November 2023

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Japan; China; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE

Key companies profiled

Phenomix Sciences; Saga Robotics AS; Kingsoft Office Software; PHENOSPEX; Keygene; SMO bv; BASF SE; Controlled Environments Limited; EarthSense, Inc.; Qubit Biology Inc.; LemnaTec GmbH; Heinz Walz GmbH; PSI (Photon Systems Instruments) spol. s r.o.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plant Phenotyping Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global plant phenotyping equipment market report based on equipment, application, end use, and region:

-

Equipment Outlook (Revenue in USD Million, 2017 - 2030)

-

Hardware

-

Software

-

-

Application Outlook (Revenue in USD Million, 2017 - 2030)

-

Plant Research

-

Breeding

-

Product Development

-

Quality Assessment

-

-

End-use Outlook (Revenue in USD Million, 2017 - 2030)

-

Greenhouse

-

Field

-

Laboratory

-

-

Regional Outlook (Revenue in USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plant phenotyping equipment market size was estimated at USD 205.8 million in 2022 and is expected to reach USD 227.6 million in 2023.

b. The global plant phenotyping equipment market is expected to grow at a compound annual growth rate of 10.0% from 2023 to 2030 to reach USD 443.4 million by 2030.

b. North America dominated the plant phenotyping equipment market with a share of around 40.3% in 2022. This is attributable to the increasing initiatives taken by government and private players for advanced technologies.

b. Some key players operating in the plant phenotyping equipment market include BASF SE; Conviron, EarthSense, Inc.; Heinz Walz GmbH; Qubit Systems Inc.; Keygene; LemnaTec GmbH; Phenomix; Phenospex; Photon Systems Instruments, spol. s r.o.; SMO bvba.

b. Key factors that are driving the market growth include rising demand for food and to curb growing competition for crops as sources of industrial, fiber, and bio-energy purposes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.