- Home

- »

- Next Generation Technologies

- »

-

3D Scanning Market Size & Share, Industry Report, 2030GVR Report cover

![3D Scanning Market Size, Share & Trends Report]()

3D Scanning Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Laser Scanner, Structured Light Scanner), By Range (Short, Medium, Long), By Component, By Type, By Technology, By Application, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-334-8

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

3D Scanning Market Summary

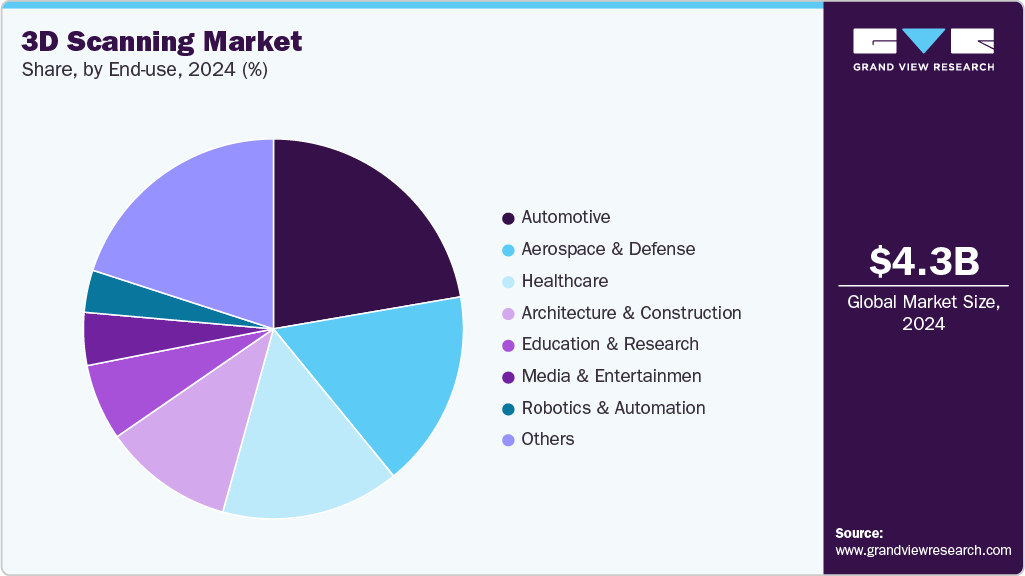

The global 3D scanning market size was estimated at USD 4,280.2 million in 2024 and is projected to reach USD 7,510.5 million by 2030, growing at a CAGR of 10.1% from 2025 to 2030. The 3D scanning market is shifting toward integrated hardware-software ecosystems, with companies bundling scanners and advanced visualization platforms to deliver end-to-end solutions.

Market Size & Trends:

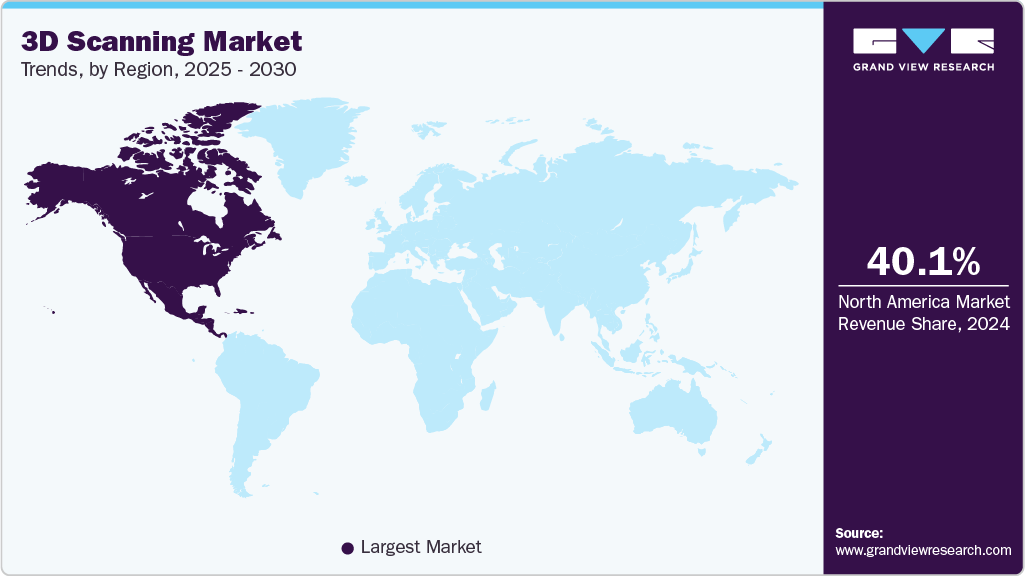

- North America 3D scanning market leads the global market, accounting for the largest share of 40.1% in 2024.

- The U.S. is the largest contributor to the 3D scanning market in North America.

- By product, laser scanners segment accounted for the dominant share of 45.3% in 2024.

- By range, short-range scanning segment accounted for the dominant share in 2024.

- By component, the hardware segment has maintained dominance in the 3D scanning market.

Key Market Statistics:

- 2024 Market Size: USD 4,280.2 Million

- 2030 Estimated Market Size: USD 7,510.5 Million

- CAGR(2025-2030): 10.1%

- North America: Largest market in 2024

This trend meets the rising demand for seamless workflows in industries like manufacturing, healthcare, and construction. Integration boosts usability, speeds up processing, and improves data accuracy, aligning with broader digital transformation goals. As a result, interoperability and ecosystem compatibility are becoming key differentiators. For example, in February 2025, Scantech (Hangzhou) Co., Ltd partnered with InnovMetric Software Inc. to integrate PolyWorks software with its 3D scanners, providing comprehensive solutions that enhance industrial productivity.The 3D scanning market features high-precision scanners with versatile capabilities for diverse industries. These scanners handle complex surfaces and deliver detailed, accurate measurements. Their adaptability supports applications across manufacturing, healthcare, and cultural preservation.

There is increasing emphasis on reliability and accuracy. Devices perform well in various environments, from fieldwork to laboratory settings. Companies developing such advanced scanners are expanding their product portfolios to meet growing industry demands, driving broader adoption by addressing multiple professional requirements. For instance, in April 2025, Artec 3D, a developer and manufacturer of 3D scanning hardware and software in Luxembourg introduced its high-precision Artec Point 3D scanner to the Indian market in partnership with Altem Technologies, targeting industries such as aerospace, healthcare, and manufacturing. This collaboration supports industrial digitization and innovation, enhancing applications such as reverse engineering, inspection, and product design.

Advanced LiDAR technology uses laser pulses to capture highly detailed spatial data, which significantly improves the precision of 3D scanning. This technology allows scanners to measure distances with greater accuracy compared to traditional methods. Industries such as automotive and aerospace benefit from this increased precision, especially in quality control and design processes. LiDAR also enhances scanning efficiency by speeding up data collection, reducing the time needed for complex scans. Faster scanning lowers operational costs and boosts productivity for businesses. Recent developments have made LiDAR sensors smaller, more affordable, and easier to integrate into various devices. These improvements are encouraging wider adoption of 3D scanning across multiple sectors. Advanced LiDAR technology is transforming 3D scanning into a more precise, efficient, and accessible tool for many industries.

Product Insights

Laser scanners segment accounted for the dominant share of 45.3% in 2024, because they provide highly accurate and detailed measurements. They are favored in industries such as manufacturing and construction for their precision and speed. Their ability to capture complex surfaces with reliability makes them the preferred choice for many applications. Laser scanners excel in environments where exact data is critical. Their established technology and consistent performance help them maintain a strong market presence. This dominance is supported by ongoing advancements that enhance scanning capabilities. Companies investing in laser scanning technology continue to improve their offerings, reinforcing this lead.

Optical scanners are growing rapidly in the 3D scanning market due to their affordability and ease of use. They offer non-contact scanning with good resolution, which appeals to sectors such as healthcare and entertainment. Optical scanners benefit from continuous improvements in sensor technology and image processing. These enhancements allow them to deliver faster and more flexible scanning solutions. Their versatility makes them suitable for a wider range of applications. As a result, optical scanners are steadily increasing their market share and influence. Emerging startups and tech firms are actively developing innovative optical scanning products to expand this growth.

Range Insights

Short-range scanning segment accounted for the dominant share in 2024, due to its high precision and suitability for detailed close-up work. It is widely used in industries such as electronics, medical imaging, and quality inspection where accuracy is crucial. Short-range scanners can capture fine details with excellent resolution, making them ideal for small objects. Their compact size and ease of use also contribute to their popularity. Many manufacturers prefer short-range scanners for prototyping and design validation. Continuous improvements in sensor technology support this dominance. Overall, short-range scanners meet the demand for precision in many specialized applications.

Long-range scanning is growing rapidly because it allows scanning of large objects and environments from a distance. It is increasingly used in construction, surveying, and outdoor mapping where capturing wide areas quickly is essential. Advances in laser and LiDAR technology have enhanced the accuracy and speed of long-range scanners. Their ability to cover large distances without losing detail makes them valuable for infrastructure and landscape projects. Long-range scanners also benefit from improved portability and real-time data processing. Long-range scanning is gaining more applications and market share as these technologies develop. Many companies are investing in long-range solutions to address growing demand in large-scale industries.

Component Insights

The hardware segment has maintained dominance in the 3D scanning market due to strong demand for high-precision scanning devices. Technological advancements in laser and structured light scanners have improved speed and accuracy. Industries such as automotive, aerospace, and healthcare continue to rely on robust hardware for critical measurement applications. The availability of portable and handheld scanners has expanded use cases in field environments. Hardware providers have focused on durability and ease of integration with downstream applications. Investment in R&D has led to reduced costs and improved functionality of scanning equipment. Demand from quality control and inspection processes has further supported hardware growth. Strong distribution networks and global manufacturing partnerships have sustained the segment’s leading position.

The software segment in the 3D scanning market is experiencing notable growth driven by the need for better data processing and analysis. Advancements in AI and machine learning have enhanced point cloud interpretation and modeling accuracy. Growing interest in virtual design, simulation, and reverse engineering has increased reliance on specialized 3D software. Cloud-based solutions have made collaboration and storage more efficient for remote teams. Software updates have enabled compatibility with a wider range of hardware devices. Industries are seeking automation in post-processing tasks to reduce manual intervention. The rise of metaverse applications and digital twins has expanded the scope for 3D scanning software. Partnerships between hardware firms and software developers have further accelerated innovation and adoption.

Type Insights

Tripod-mounted 3D scanners have dominated the market due to their high precision and stability in fixed environments. These systems are widely used in industries requiring detailed and accurate measurements, such as aerospace and automotive. Their ability to capture large objects with minimal distortion makes them suitable for complex inspection tasks. Integration with advanced software enhances their scanning resolution and reliability. Manufacturers prefer tripod-mounted units for in-house quality control and reverse engineering. Their strong presence in established industrial workflows has helped maintain their dominant position. They are especially favored in applications where consistent environmental conditions can be controlled.

Portable CMM-based 3D scanners are experiencing significant growth due to their flexibility and ease of use. They enable precise measurements in environments where fixed systems are impractical. The demand for on-site inspection and real-time data capture supports their expanding adoption. Industries value their ability to scan parts of various sizes and shapes directly on the shop floor. Advances in probe accuracy and wireless connectivity have improved efficiency and usability. Their role in speeding up inspection processes is driving wider market acceptance. Ongoing innovations are making these systems more compact and cost-effective for broader deployment.

Technology Insights

Laser triangulation has dominated the 3D scanning market due to its high accuracy and fast data acquisition. It is widely used in applications requiring detailed surface inspection, such as industrial manufacturing and quality control. The technique works well for short- to medium-range scanning, making it ideal for capturing intricate geometries. Continued enhancements in sensor resolution have improved its effectiveness in detecting small defects. Its compatibility with a variety of materials and finishes increases its versatility across industries. Manufacturers benefit from its reliability and relatively low operating cost. Its established performance and integration into automated systems have helped it maintain a leading position.

Laser pulse-based 3D scanning is gaining traction due to its suitability for long-range and outdoor applications. This method is commonly used in construction, mining, and large-scale surveying projects. It can measure distances by calculating the time it takes for laser pulses to return, allowing for accurate scans over hundreds of meters. Advancements in signal processing have increased the precision and speed of data collection. These scanners can operate in challenging lighting and weather conditions, expanding their practical use cases. Growing infrastructure projects and demand for geospatial data are supporting its adoption. Its expanding role in large-area mapping and digital twin creation is accelerating market growth.

Application Insights

Reverse engineering segment dominated the 3D scanning market in 2024, due to its extensive use in product redesign and quality analysis. Industries such as automotive, aerospace, and consumer electronics rely heavily on 3D scanning to replicate and modify existing parts. It enables accurate capture of legacy components that lack CAD documentation. The method supports efficient prototyping by converting physical models into digital designs. Consistent improvements in scanning resolution and software integration have streamlined the reverse engineering process. Manufacturers benefit from reduced production time and cost through accurate part replication. Its central role in innovation and product improvement continues to support its dominance.

Virtual simulation is seeing growing adoption in the 3D scanning market as industries aim to enhance digital design workflows. It allows users to simulate product performance and interactions before physical production. Integration of 3D scanned data improves the realism and reliability of simulation models. The approach is widely used in industries focusing on predictive analysis, such as healthcare, defense, and industrial automation. Cloud-based simulation tools and real-time rendering have expanded accessibility. The rising demand for digital twins and immersive design validation supports this growth. Its contribution to reducing development errors and accelerating innovation is driving increased usage.

End Use Insights

The automotive industry dominated the 3D scanning market in 2024, due to its constant demand for precision in design and manufacturing. 3D scanning supports efficient inspection of complex components and surface geometries. It helps ensure tight tolerances in engine parts, body panels, and assemblies. Reverse engineering of legacy parts is widely practiced to maintain and replicate older vehicle components. Automotive OEMs use 3D scanning to streamline prototyping and speed up product development. Integration with CAD and simulation tools further enhances its utility in this sector. The industry's focus on quality, efficiency, and innovation has reinforced its dominant market role.

Healthcare is emerging as a growing segment in the 3D scanning market driven by demand for patient-specific solutions. The technology is increasingly used in prosthetics, orthotics, and dental applications. High-resolution scanning allows for accurate modeling of anatomical structures. Surgeons use 3D scans for preoperative planning and custom implant design. Advancements in portable and non-invasive scanners have improved adoption in clinical settings. The push toward personalized medicine is accelerating demand for precise medical modeling. Its ability to improve outcomes and streamline medical workflows is supporting ongoing market growth.

Regional Insights

North America 3D scanning market leads the global market, accounting for the largest share of 40.1% in 2024.North America holds a strong position in the 3D scanning market due to the presence of advanced manufacturing industries. Sectors such as aerospace, automotive, and healthcare heavily invest in precision measurement technologies. Government support and private sector initiatives encourage innovation through R&D and technology deployment. Increasing use of 3D scanning in quality control and prototyping has sustained demand. The region also benefits from the presence of leading 3D scanning solution providers across multiple industries.

U.S. 3D Scanning Market Trends

The U.S. is the largest contributor to the 3D scanning market in North America. High demand from automotive, defense, and medical device industries drives market growth. Strong digital infrastructure supports simulation and digital twins with scanned data. The country is home to key software and hardware manufacturers who frequently launch updated solutions. Education and research institutions also contribute to adoption through training and pilot programs.

Europe 3D Scanning Market Trends

Europe's 3D scanning market is driven by strong engineering and industrial design traditions. Countries such as Germany, France, and the UK utilize 3D scanning in automotive, aerospace, and cultural heritage preservation. Emphasis on innovation and sustainability supports scanning in reverse engineering and product lifecycle management. Regulatory support for digitization and precision inspection encourages wider use. The presence of high-tech manufacturing hubs keeps demand steady across the region.

Asia Pacific 3D Scanning Market Trends

The Asia Pacific region is experiencing rapid growth in the 3D scanning market due to expanding industrial bases. China, Japan, South Korea, and India are adopting scanning for automotive, electronics, and healthcare applications. Increased investment in infrastructure and smart manufacturing is driving regional demand. Local players are entering the market, offering cost-effective solutions tailored to domestic industries. Rising awareness and training initiatives are further accelerating adoption.

Key 3D Scanning Company Insights

Some of the key companies in the 3D scanning market include 3D Systems, Inc., Artec 3D, CREAFORM, FARO, Hexagon AB, Konica Minolta, Inc. and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

3D Systems, Inc. has contributed significantly to the development of 3D scanning through its integrated hardware and software solutions. The company offers a range of structured light and laser-based scanners designed for reverse engineering, inspection, and design. Its Geomagic software suite enhances scanned data processing and modeling. 3D Systems supports industries such as healthcare, aerospace, and manufacturing. Continuous innovation in scan accuracy and usability keeps the company relevant in advanced applications.

-

Artec 3D is known for high-performance handheld 3D scanners used in industrial design, forensics, and healthcare. Its scanners employ structured light technology, offering real-time processing and high-resolution capture. Artec Studio software improves workflow with advanced AI-driven features. The company focuses on portability, speed, and precision to meet a variety of professional needs. Artec's consistent product updates and global reach have strengthened its role in the 3D scanning market.

Key 3D Scanning Companies:

The following are the leading companies in the 3D scanning market. These companies collectively hold the largest market share and dictate industry trends.

- 3D Systems, Inc.

- Artec 3D

- CREAFORM

- FARO

- Hexagon AB

- Konica Minolta, Inc.

- Nikon Metrology NV

- Perceptron, Inc. (Atlas Copco AB)

- Trimble Inc.

- ZEISS

Recent Developments

-

In May 2024, Hexagon's manufacturing intelligence division introduced innovative handheld 3D scanning technology devices, ATLASCAN Max and MARVELSCAN, to enhance its diverse product line of manufacturing inspection devices. These devices are ideal for measuring parts in various inspection settings such as rail, automotive, industrial equipment, and general manufacturing.

-

In November 2023, Artec 3D introduced the latest 3D scanner Micro II, an automated desktop 3D scanner designed for capturing small parts with the precision of 5 microns. The company aims to double the precision and enhance the scanning capacity through the automated one-click process, by the launch of Micro II.

3D Scanning Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4,647.5 million

Revenue forecast in 2030

USD 7,510.5 million

Growth rate

CAGR of 10.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segment scope

Product, range, component, type, technology, application, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

3D Systems, Inc.; Artec 3D; CREAFORM; FARO; Hexagon AB; Konica Minolta, Inc.; Nikon Metrology NV; Perceptron, Inc. (Atlas Copco AB); Trimble Inc.; ZEISS

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global 3D Scanning Market Report Segmentation

This report offers revenue growth forecasts at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global 3D scanning market report based on product, range, component, type, technology, application, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Laser Scanner

-

Structured Light Scanner

-

Optical Scanner

-

Others

-

-

Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Short-Range

-

Medium Range

-

Long-Range

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Tripod Mounted

-

Fixed CMM Based

-

Portable CMM Based

-

Desktop

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Laser Triangulation

-

Pattern Fringe Triangulation

-

Laser Pulse Based

-

Laser Phase-shift Based

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Reverse Engineering

-

Quality Control & Inspection

-

Virtual Simulation

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Aerospace & Defense

-

Healthcare

-

Architecture & Construction

-

Education & Research

-

Media & Entertainment

-

Robotics & Automation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.