- Home

- »

- Plastics, Polymers & Resins

- »

-

Plastic Lidding Films Market Size, Industry Report, 2033GVR Report cover

![Plastic Lidding Films Market Size, Share & Trends Report]()

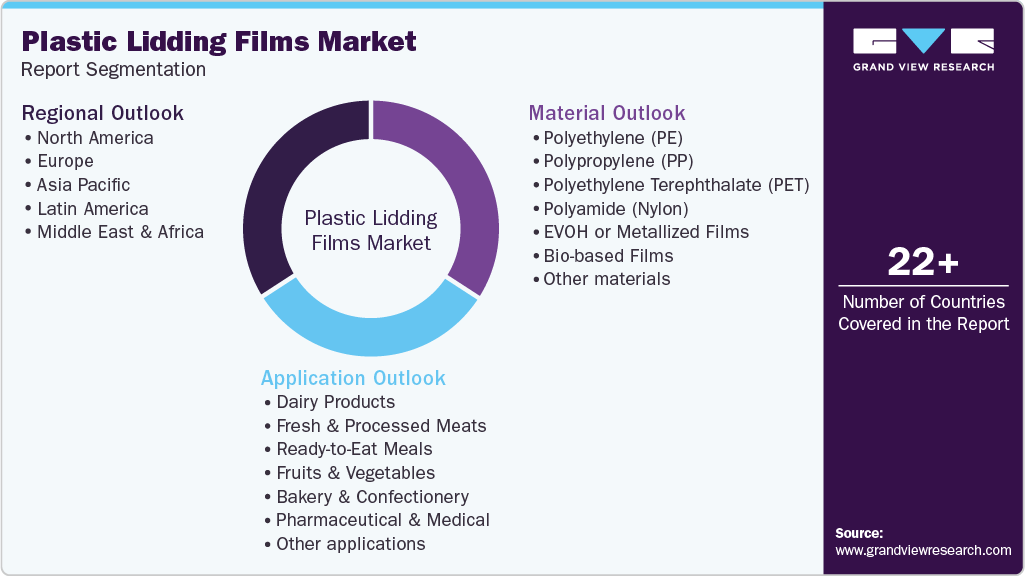

Plastic Lidding Films Market (2025 - 2033 ) Size, Share & Trends Analysis Report By Material (PE, PP, PET), By Application (Dairy Products, Fresh & Processed Meats, Ready-to-Eat Meals), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-629-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Plastic Lidding Films Market Summary

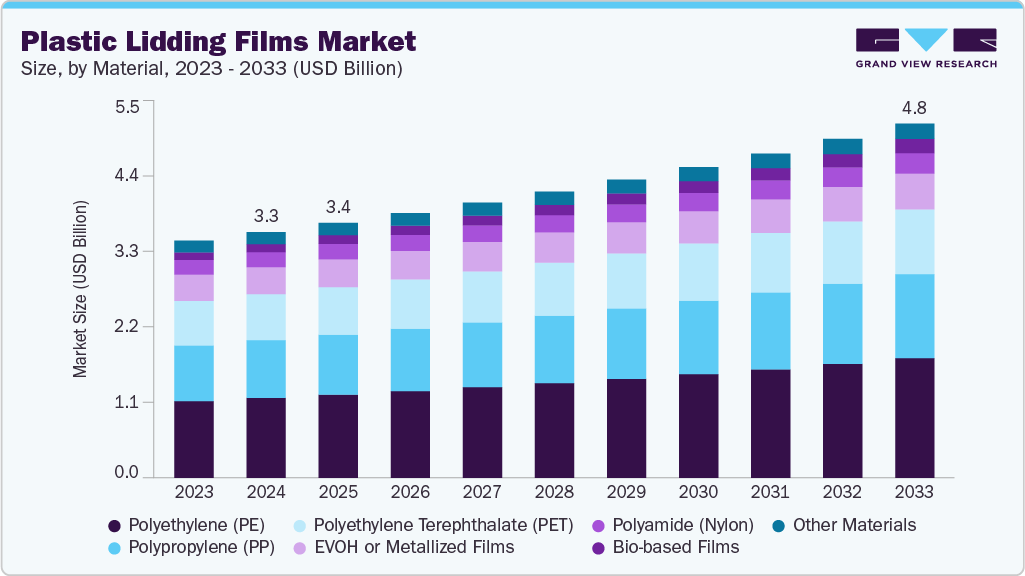

The global plastic lidding films market size was estimated at USD 3.29 billion in 2024 and is expected to reach USD 4.83 billion by 2033, growing at a CAGR of 4.4% from 2025 to 2033. Growing e-commerce activity is boosting demand for durable plastic lidding films that protect products during long-distance shipping.

Key Market Trends & Insights

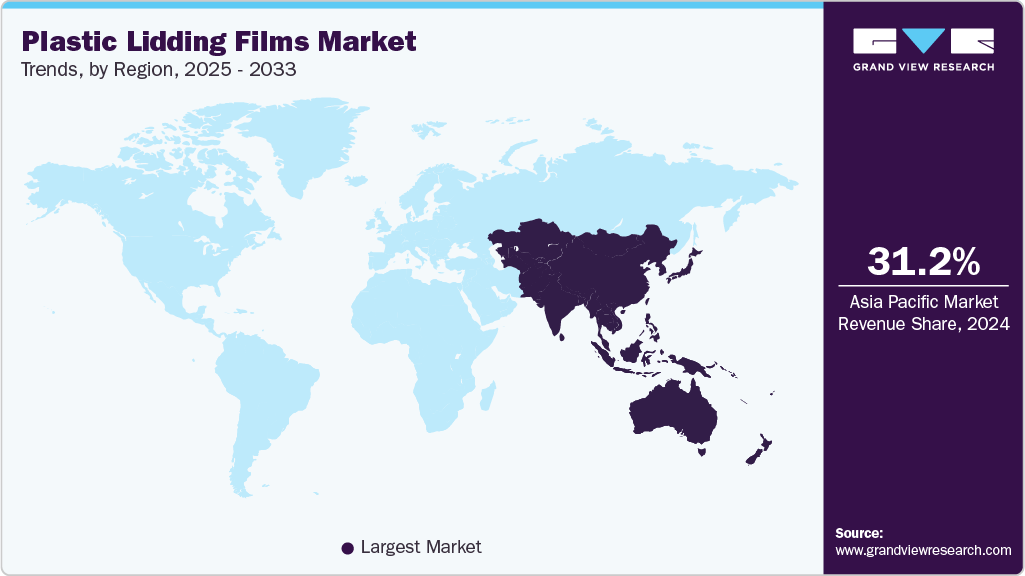

- Asia Pacific dominated the plastic lidding films market with the largest revenue share of 31.19% in 2024.

- The plastic lidding films market in India is expected to grow at a substantial CAGR of 5.6% from 2025 to 2033.

- By material, the bio-based films segment is expected to grow at fastest CAGR of 6.4% from 2025 to 2033 in terms of revenue.

- By application, the ready-to-eat meals segment is expected to grow at a considerable CAGR of 5.4% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 3.29 billion

- 2033 Projected Market Size: USD 4.83 billion

- CAGR (2025-2033): 4.4%

- Asia Pacific: Largest market in 2024

Manufacturers are responding by developing tear-resistant, lightweight films that reduce return rates and shipping costs. The plastic lidding films market is undergoing a significant shift toward sustainable and recyclable materials, largely driven by regulatory and consumer pressure. Manufacturers are increasingly incorporating mono-material structures and bio-based polymers into their product lines to address environmental concerns without compromising barrier properties.

This trend aligns with the broader transition toward circular packaging systems, especially in the food and beverage industry, where shelf-life preservation and brand aesthetics must coexist with eco-compliance.

Drivers, Opportunities & Restraints

Rising demand for convenient and ready-to-eat food products is a key driver accelerating the adoption of plastic lidding films globally. These films offer critical advantages such as extended shelf life, tamper resistance, and high clarity, making them indispensable in modern food packaging. As urbanization and dual-income households grow, especially across Asia Pacific and Latin America, the emphasis on portable and resealable packaging is compelling manufacturers and retailers to invest in high-performance lidding solutions.

There is a compelling growth opportunity in developing high-barrier, microwave-safe lidding films tailored for premium frozen and refrigerated meals. As consumers seek quick meals that do not compromise on quality or safety, brands are exploring advanced film technologies such as co-extruded polypropylene or PET-based laminates that can withstand extreme temperature changes. This niche remains underexploited in emerging markets, presenting a profitable segment for innovation-driven players looking to differentiate their offerings.

The market faces challenges from increasing scrutiny over plastic waste and shifting regulatory frameworks targeting single-use plastics. Stringent compliance requirements, particularly in the European Union and parts of North America, are compelling manufacturers to either redesign existing SKUs or invest in recycling infrastructure, both of which demand significant capital and time.

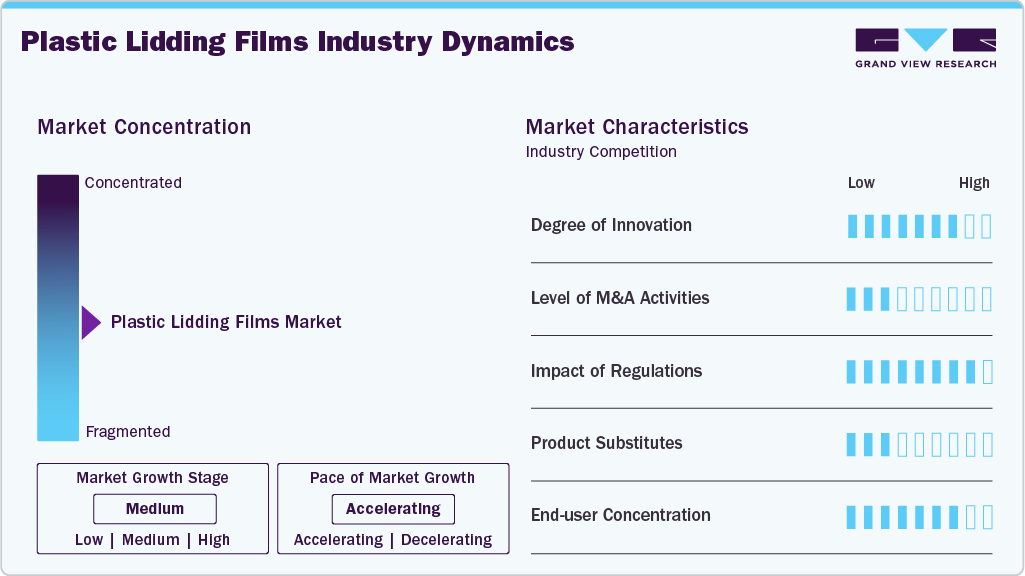

Market Concentration & Characteristics

The market growth stage of the plastic lidding films market is medium, and the pace is accelerating. The market exhibits market slight fragmentation, with key players dominating the industry landscape. Major companies like BOSTIK INC., Parkside Flexibles, KM Packaging Services Ltd., Ecoplast Ltd, Terinex Flexibles Ltd, SUKI CREATIONS PVT. LTD., Sunimprof Rottaprint SRL, Multi-Plastics, Inc., Cosmo Films, Bison Bag, and others play a significant role in shaping the market dynamics. These leading players often drive innovation within the market, introducing new products, technologies, and end uses to meet evolving industry demands.

The plastic lidding films market is seeing rising competition from innovative materials such as compostable bioplastics (PLA, PHA), paper-laminated films, and even metal foil-based lids. These alternatives address growing demand for sustainability by offering compatible barrier properties while reducing environmental footprint. From a cost and performance perspective, bioplastic lidding is closing the gap with conventional polyethylene (PE) and polypropylene (PP) films, making substitution economically viable at scale. As brand owners and retailers push green packaging, these substitutes are becoming mainstream, prompting legacy film manufacturers to rethink product portfolios.

Evolving regulation, particularly in the EU under the Single-Use Plastics Directive and similar packaging laws in North America, is exerting significant pressure on traditional plastic lidding films. Stricter mandates on recyclability, content thresholds (e.g., mandated recycled content), and extended producer responsibility (EPR) fees are reshaping industry cost structures. These regulatory forces drive innovation and investment in compliant film chemistries, but also elevate supply chain complexity and cost for non-compliant materials. As a result, producers are increasingly aligning with certified recyclability standards and pre-emptive voluntary phase-outs.

Material Insights & Trends

Polyethylene (PE) dominated the plastic lidding films market across the material segmentation in terms of revenue, accounting for a market share of 32.78% in 2024. Cost efficiency and versatility underpin the growth of PE lidding films, making them the preferred choice for high-volume, price-sensitive applications. Their excellent sealability and puncture resistance support automated packaging lines, reducing throughput interruptions and scrap rates. Additionally, advancements in low-density and linear low-density PE blends are enhancing film toughness while maintaining flexibility. As brand owners seek to optimize cost structures without sacrificing performance, PE continues to capture a significant share of entry-level and mid-tier packaging segments.

The polypropylene (PP) segment is anticipated to grow at a significant CAGR of 4.6% through the forecast period, owing to its superior heat resistance and clarity, which appeal to microwaveable and hot-fill packaging formats. Its higher melting point allows brands to market lidded containers as ready-to-heat solutions, tapping into consumer demand for convenience. Recent investments in metallocene catalysts have also improved PP film uniformity and seal strength, expanding its application to premium food trays and barrier applications.

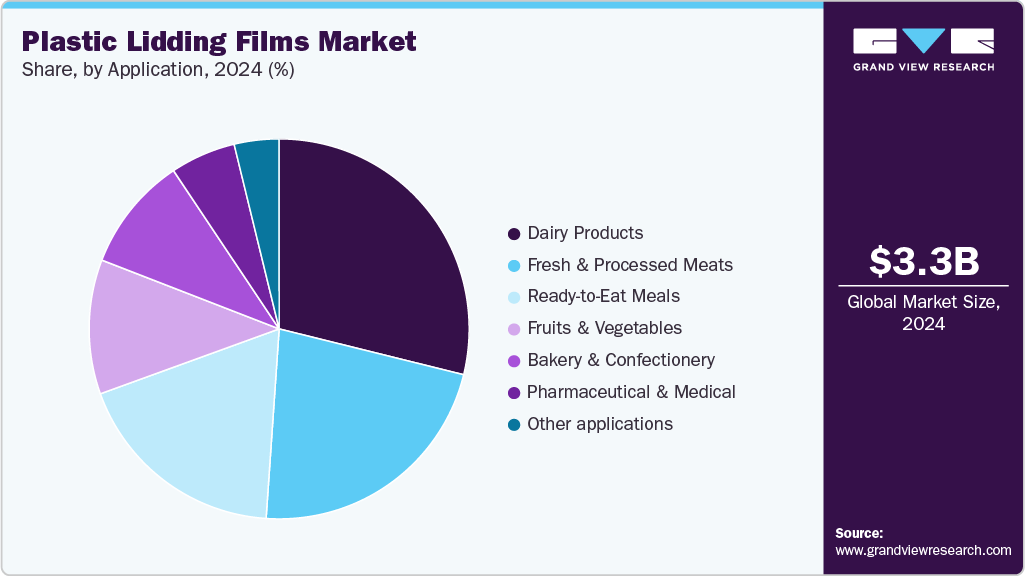

Application Insights & Trends

Dairy products led the plastic lidding films market across the application segmentation in terms of revenue, accounting for a market share of 28.88% in 2024. Stringent shelf-life requirements and strict hygiene standards are driving dairy processors to adopt lidding films with multilayer barrier architectures. These films inhibit oxygen and moisture ingress, preserving freshness in high-value products such as flavored yogurts and cheese spreads. With clean-label trends on the rise, film formulations now emphasize minimal additive content and transparent labeling areas to showcase product quality. Dairy brands are increasingly partnering with film suppliers to co-develop tailored barrier solutions that extend shelf life while aligning with evolving regulatory norms.

The ready-to-eat meals segment is expected to expand at a substantial CAGR of 5.4% through the forecast period. The surge in demand for ready-to-eat (RTE) meals, particularly among urban working professionals and single-person households, is a strong catalyst for the plastic lidding films market. These films provide essential barrier protection and heat-seal properties, enabling microwave compatibility and extended shelf life, key requirements for RTE meal packaging. As foodservice brands and retailers increasingly adopt centralized kitchen models, there is a growing reliance on high-performance lidding films to ensure food integrity during transportation and retail display.

Regional Insights & Trends

Asia Pacific led the plastic lidding films market with as revenue share of 31.19% in 2024. Rapid modernization of food retail, including the proliferation of convenience stores and e-commerce grocery platforms, is driving demand for lightweight, seal-tight lidding films across APAC. Manufacturers are responding with cost-effective PP/PE formulations that meet shelf-life requirements. Meanwhile, regional waste management improvements and national plastic bans are nudging producers toward recyclable and partially bio-based substrates.

China’s market is propelled by rising urban middle-class purchasing packaged ready meals and snack trays, boosting demand for visually appealing, high-performance lidding films. The government’s “National Sword” policy and extended producer responsibility (EPR) extensions are compelling local manufacturers to pivot to recyclable film formats. At the same time, significant investment in machinery and automation is enhancing scalable, low-cost domestic output.

North America Plastic Lidding Films Market Trends

Demand is surging for high-barrier, microwave-safe lidding solutions as consumers prefer ready-to-eat meals and convenience packaging. Sustainability mandates and corporate ESG targets push manufacturers toward recyclable mono-material lidding films. Furthermore, strategic alliances across the supply chain are accelerating innovation in performance-grade films tailored for refrigerated and frozen applications.

U.S. Plastic Lidding Films Market Trends

In the U.S., growth is fueled by robust foodservice and retail chains investing in premium film technologies, hermetically sealable, high-clarity films, to extend shelf life and reduce food waste. Increasing pressure from state-level recycled content and labeling laws (e.g., California’s SB 343) incentivizes industry investment in closed-loop packaging systems. Domestic production capacity expansion is also reducing reliance on imports, enhancing supply chain agility.

Europe Plastic Lidding Films Market Trends

Europe leads in regulatory-driven adoption of recyclable and compostable lidding films, as the EU’s Packaging and Packaging Waste Regulation enforces design-for-recycling principles. Consumer preferences are shifting heavily toward eco-labelled packaging, prompting rapid uptake of bio-based and mono-polymer films. This environment encourages R&D partnerships across industry and academia to develop compliant, high-barrier solutions.

Plastic Lidding Films Company Insights

The Plastic Lidding Films Market is highly competitive, with several key players dominating the landscape. Major companies include BOSTIK INC., Parkside Flexibles, KM Packaging Services Ltd., Ecoplast Ltd, Terinex Flexibles Ltd, and SUKI CREATIONS PVT. LTD., Sunimprof Rottaprint SRL, Multi-Plastics, Inc., Cosmo Films, and Bison Bag. The plastic lidding films market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key Plastic Lidding Films Companies:

The following are the leading companies in the plastic lidding films market. These companies collectively hold the largest market share and dictate industry trends.

- BOSTIK INC.

- Parkside Flexibles

- KM Packaging Services Ltd.

- Ecoplast Ltd

- Terinex Flexibles Ltd

- SUKI CREATIONS PVT. LTD.

- Sunimprof Rottaprint SRL

- Multi-Plastics, Inc.

- Cosmo Films

- Bison Bag

Recent Developments

-

In December 2024, Bostik, the adhesive division of Arkema, and Brückner Maschinenbau, a global cast extrusion line manufacturer, partnered to develop a coextruded, peelable BOPET lidding film aimed at improving production efficiency, consumer convenience, and sustainability.

-

In January 2025, Parkside expanded its lidding film solutions to include recyclable and compostable options for food packaging. The new films include Popflex, a monopolymer film that can be recycled when sealed to a PET tray.

Plastic Lidding Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.42 billion

Revenue forecast in 2033

USD 4.83 billion

Growth rate

CAGR of 4.4% from 2025 to 2033

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Material, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

BOSTIK INC.; Parkside Flexibles; KM Packaging Services Ltd.; Ecoplast Ltd; Terinex Flexibles Ltd; SUKI CREATIONS PVT. LTD.; Sunimprof Rottaprint SRL; Multi-Plastics, Inc.; Cosmo Films; Bison Bag

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Plastic Lidding Films Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For the purpose of this study, Grand View Research has segmented the plastic lidding films market report on the basis of material, application, end use, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyethylene Terephthalate (PET)

-

Polyamide (Nylon)

-

EVOH or Metallized Films

-

Bio-based Films

-

Other materials

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Dairy Products

-

Fresh & Processed Meats

-

Ready-to-Eat Meals

-

Fruits & Vegetables

-

Bakery & Confectionery

-

Pharmaceutical & Medical

-

Other applications

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global plastic lidding films market size was estimated at USD 3.29 billion in 2024 and is expected to reach USD 3.42 billion in 2025.

b. The global plastic lidding films market is expected to grow at a compound annual growth rate of 4.4% from 2025 to 2033 to reach USD 4.83 billion by 2033.

b. Polyethylene (PE) dominated the plastic lidding films market across the material segmentation in terms of revenue, accounting for a market share of 32.78% in 2024. Cost efficiency and versatility underpin the growth of PE lidding films, making them the preferred choice for high-volume, price-sensitive applications.

b. Some key players operating in the Plastic Lidding Films market include BOSTIK INC., Parkside Flexibles, KM Packaging Services Ltd., Ecoplast Ltd, Terinex Flexibles Ltd, and SUKI CREATIONS PVT. LTD., Sunimprof Rottaprint SRL, Multi-Plastics, Inc., Cosmo Films, and Bison Bag.

b. Growing e-commerce activity is boosting demand for durable plastic lidding films that protect products during long-distance shipping. Manufacturers are responding by developing tear-resistant, lightweight films that reduce return rates and shipping costs

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.