- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Plating on Plastics Market Size, Share, Industry Report, 2030GVR Report cover

![Plating on Plastics Market Size, Share & Trends Report]()

Plating on Plastics Market (2024 - 2030) Size, Share & Trends Analysis Report By Plating, By Application (Automotive, Building & Construction, Utilities, Electronics), By Plastics, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-930-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Plating on Plastics Market Size & Trends

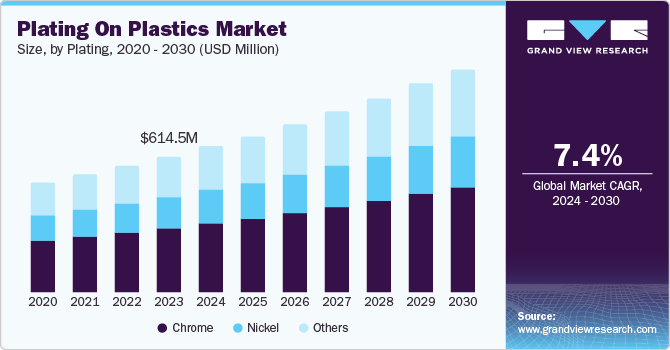

The global plating on plastics market size was valued at USD 614.5 million in 2023 and is projected to grow at a CAGR of 7.4% from 2024 to 2030. This growth is driven by several factors, including the increasing demand for lightweight and durable materials in the automotive and electronics industries. Plating on Plastics (POP) offers a cost-effective solution for achieving the desired aesthetic and functional properties without the added weight of metal components. Additionally, advancements in plating technologies have improved the adhesion and durability of metal coatings on plastic substrates, further boosting their adoption.

Environmental regulations and the push for sustainable manufacturing practices are also encouraging the use of plating on plastics, as it can reduce the overall environmental impact compared to traditional metal plating processes. Furthermore, the rising consumer preference for high-quality, aesthetically pleasing products in consumer electronics and home appliances is fueling the demand for plated plastic components. These factors collectively contribute to the robust growth prospects of the market.

Moreover, numerous developments and advances in plating on plastics over the years, thanks to electroplating technology, have enhanced product quality. A double nickel layer is used for plating to improve resistance and corrosion protection. The increased demand for strong, lightweight alternatives in various industries, along with consumer recognition of lightweight vehicles' performance and environmental advantages, has led to a higher requirement for plating on plastics, driving the market growth.

Furthermore, plating on plastics is utilized in various manufacturing industries as it offers a metal surface while maintaining the material's structure, influencing market trends. Not many sectors employ the innovative approach of coating plastics with metals to enhance product quality. Plating technology improves the appearance of materials and elevates their overall quality. It reduces the need for grinding and meets equipment specifications, leading to increased plastic plating demand during the forecast period.

Plating Insights

The chrome plating segment dominated the market and accounted for a share of 46.1% in 2023 attributed to the widespread use of chrome plating for enhancing plastic parts by giving them a high-quality, aesthetically pleasing finish that enhances the visual appeal of plastic components. In addition, it offers excellent corrosion resistance and durability, making it a preferred choice for applications requiring both functionality and aesthetics. The automotive industry, in particular, benefits from chrome plating due to its ability to provide a metallic finish to plastic parts, reducing the overall weight of vehicles while maintaining a premium look.

The nickel product segment is anticipated to grow at a CAGR of 6.7% from 2024 to 2030 owing to the increasing demand for nickel-plated plastic components in various industries such as electronics, automotive, and aerospace. Nickel is preferred for many uses as it enhances the corrosion resistance and wear of plastic parts. The electronics industry, in particular, is driving the demand for nickel-plated plastics due to the need for reliable and long-lasting components in devices such as smartphones, tablets, and other consumer electronics.

Plastics Insights

The Acrylonitrile Butadiene Styrene (ABS) plastics segment accounted for 69.6% of market revenue in 2023 due to the widespread use of ABS plastics in various industries, including automotive, electronics, and consumer goods. ABS plastics are favored for their excellent mechanical properties, such as high impact resistance, toughness, and ease of processing. These characteristics make ABS an ideal substrate for plating, as it can withstand the rigors of the plating process while providing a smooth and durable surface for metal coatings. The automotive industry, in particular, relies heavily on ABS plastics for components such as grilles, emblems, and interior trims, where both aesthetic appeal and functional performance are crucial. The electronics industry also benefits from using ABS plastics in housings and enclosures for devices, where a plated finish can enhance appearance and durability.

The Acrylonitrile Butadiene Styrene/Polycarbonate (ABS/PC) plastics segment is anticipated to experience the fastest growth from 2024 to 2030 attributed to the unique combination of properties offered by ABS/PC blends, which include the toughness and impact resistance of ABS with the high heat resistance and dimensional stability of polycarbonate. In the automotive sector, ABS/PC plastics are used in components such as exterior trims, mirror housings, and interior parts, where durability and aesthetic appeal are essential. The electronics industry also utilizes ABS/PC plastics for components that require high heat resistance and structural integrity, such as connectors and housings.

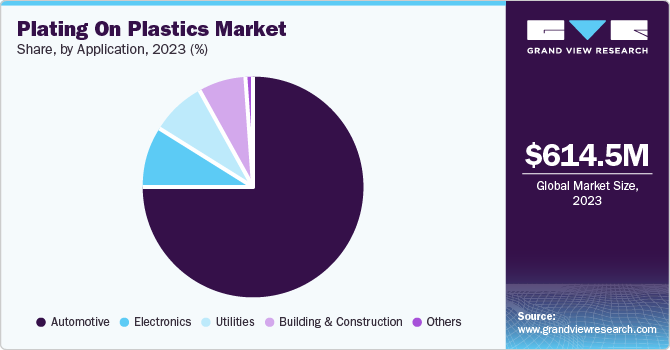

Application Insights

The automotive application segment dominated the market in 2023. The factors for the growth of the application are attributed to the plating plastics utilized to add metallic coatings to plastic components to enhance their appearance and offer functional benefits. Due to its ability to comply with rigorous regulations, this method has become well-known. Furthermore, manufacturers can imitate the look of metal components while cutting down on weight and expenses. Metallic coatings, such as nickel or chrome, can be used on plastic parts to prolong the lifespan of automobile components. This improves the overall reliability and efficiency of automotive systems. Thus, the heavy utilization of products in the automotive sector and the overall growing automotive sector have greatly impacted the demand for plating on plastics products and grown the segment significantly.

The electronics application segment is expected to grow fastest from 2024 to 2030. Carbon fiber plating is predominantly utilized in the electronics sector to reduce electrical conductivity as needed. It is commonly used in electronic gadgets such as transmitters, semiconductors, etc. The increasing electronic industry is quickly increasing the need for plating on plastic coating in the semiconductor sector, as it is extensively used for controlling and guiding conductivity in semiconductors. This is also leading to a rise in the need for carbon fiber plating, consequently boosting the demand for plating on plastics and thus propelling the overall application.

Regional Insights

The North American plating on plastics market for plating on plastics was identified as highly profitable in 2023. The growth of personal disposable income is anticipated to be a significant driver for the Plating on Plastics industry in North America in the coming years. Individuals with higher disposable income are likely to invest in electronic devices such as computers, tablets, and high-end products that incorporate advanced technologies. This trend may also lead to increased demand for customized cars in the region.

U.S. Plating on Plastics Market Trends

The U.S. plating on plastics market dominated North America market in 2023 due to the demand for lightweight materials in automotive applications, aesthetic appeal with functional benefits, stringent environmental regulations, consumer awareness, advancements in plating technology, and expanding applications across various industries.

Europe Plating on Plastics Market Trends

Europe plating on plastics market dominated the global market with a revenue share of 32.5% in 2023. The existence of contemporary industrial infrastructure and a strong focus on sustainable practices are boosting the region's market dynamics. Stringent environmental regulations are pushing to adopt plating on plastics as a sustainable substitute for traditional metal plating. Advanced manufacturing capacities and an increase in the use of eco-friendly solutions are fueling the growth of plating on plastics market figures in Europe.

Germany plating on plastics market is expected to grow rapidly from 2024 to 2030 due to automotive giants in the country, which are one of the largest consumers of plated plastics. In addition, the aesthetic appeals in automotive applications and consumer electronics have propelled the demand for plating on plastics in the country. Emerging markets are expected to provide huge opportunities for the plating on plastics industry in the country.

Asia Pacific Plating on Plastics Market Trends

The Asia Pacific plating on plastics market is expected to grow at a CAGR of 8.3% from 2024 to 2030. This growth is driven by the increasing electronics and automotive manufacturing sectors. The rapid development of industrial infrastructure is leading to the introduction of advanced technology, which will boost growth in this region soon.

China plating on plastics market held a substantial market share in 2023 owing to growth in automotive production, expansion of the electronics sector, environmental regulations promoting sustainability, changing consumer preferences for aesthetics and quality, technological advancements in electroplating, and strong infrastructure development supporting manufacturing.

Key Plating on Plastics Company Insights

Some of the key companies in the plating on plastics market include MPC Plating Inc., Element Solutions Inc., and Philips Plating Corporation, among many others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Phillips Plating Corporation is a supplier in the plating on plastics industry, focusing on cutting-edge electroplating methods that improve the appearance and performance of plastic parts. The company provides a variety of products such as decorative chrome plating, nickel plating, and other surface finishes that are commonly utilized in automotive, consumer electronics, and various industrial sectors.

-

DuPont, a renowned science and technology company, is recognized for its solutions in multiple sectors such as electronics, automotive, and consumer goods. DuPont provides enhanced materials including conductive inks, specialty coatings, and adhesion promoters in the plating on plastics industry to improve plastic substrates' performance and appearance for both decorative and functional purposes.

Key Plating on Plastics Companies:

The following are the leading companies in the plating on plastics market. These companies collectively hold the largest market share and dictate industry trends.

- MKS | Atotech

- Galva Decoparts Pvt. Ltd.

- Phillips Plating Corporation

- Precision Plating (Aust) Pty Ltd.

- MPC Plating Inc

- Quality Plated Products Ltd

- Sharrets Plating Inc.

- Element Solutions Inc

- Leader Plating on Plastc Ltd.

- JCU CORPORATION

- Dymax

- Cybershield, Inc.

- ENS Technology

- DuPont

Recent Developments

-

In April 2024, SABIC and Cybershield announced a partnership to optimize the plating process for high-heat ULTEM resins. SABIC leveraged its expertise in molding these materials, while Cybershield contributed its knowledge of plating quality. This collaboration is expected to drive increased adoption of ULTEM resins in aerospace components requiring electromagnetic interference (EMI) shielding, such as avionics control modules for commercial aircraft.

-

In March 2023, Plastribution Group, a leading UK distributor of plastics raw materials, announced the acquisition of Eagle Plastics, a Leicester-based supplier specializing in plastic sheets for POP, POS, shop displays, and mirrored plastic applications. The acquisition is expected to bolster Plastribution's product offerings and expand its market reach.

Plating on Plastics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 659.1 million

Revenue forecast in 2030

USD 1.01 billion

Growth rate

CAGR of 7.4% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

December 2024

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Plating, Plastics, Application, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Germany, UK, China, India, Brazil, Saudi Arabia

Key companies profiled

MKS | Atotech; Galva Decoparts Pvt. Ltd.; Phillips Plating Corporation; Precision Plating (Aust) Pty Ltd.; MPC Plating Inc; Quality Plated Products Ltd; Sharrets Plating Inc.; Element Solutions Inc; Leader Plating on Plastc Ltd.; JCU CORPORATION; Dymax; Cybershield, Inc.; ENS Technology; DuPont

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

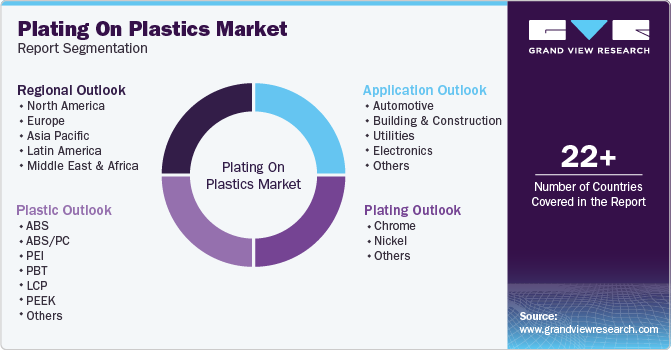

Global Plating on Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global plating on plastics market report based on plating, plastic, application and region.

-

Plating Outlook (Revenue, USD Million, 2018 - 2030)

-

Chrome

-

Nickel

-

Others

-

-

Plastic Outlook (Revenue, USD Million, 2018 - 2030)

-

ABS

-

ABS/PC

-

PEI

-

PBT

-

LCP

-

PEEK

-

PP

-

Nylon/Polyamide

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Building & Construction

-

Utilities

-

Electronics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

UK

-

-

Asia Pacific

-

China

-

India

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.