- Home

- »

- Homecare & Decor

- »

-

Door Handles Market Size, Share And Growth Report, 2030GVR Report cover

![Door Handles Market Size, Share & Trends Report]()

Door Handles Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Lever Handles, Door Knobs), By Material (Metal, Plastic), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-307-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Door Handles Market Summary

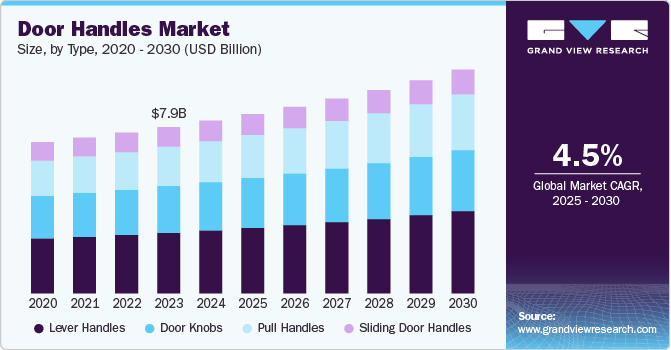

The global door handles market size was estimated at USD 8.14 billion in 2024 and is projected to reach USD 10.55 billion by 2030, growing at a CAGR of 4.5% from 2025 to 2030. The market is witnessing robust growth, driven by several macroeconomic factors and evolving consumer preferences.

Key Market Trends & Insights

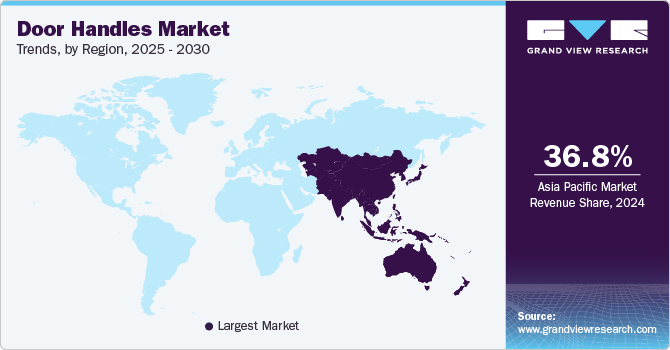

- Asia Pacific door handles market accounted for a global revenue share of around 36.82% in the year 2024.

- By type, the lever handles segment accounted for a market share of 36.24% in 2024.

- By material, the metal segment held a market share of 53.16% in 2024.

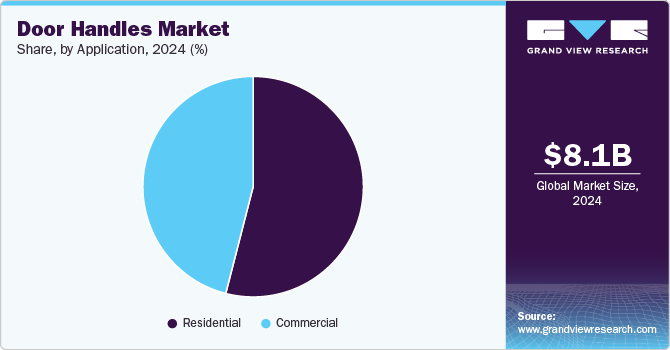

- By application, the residential segment accounted for a market share of 54.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 8.14 Billion

- 2030 Projected Market Size: USD 10.55 Billion

- CAGR (2025-2030): 4.5%

- Asia Pacific: Largest market in 2024

One of the key drivers of this market is the ongoing boom in the construction and real estate industries, particularly in developing regions such as Asia-Pacific, the Middle East, and Latin America. As urbanization accelerates and disposable incomes rise, demand for residential, commercial, and industrial infrastructure is expanding rapidly. Consequently, the need for high-quality, durable door hardware, including handles, is growing as builders and homeowners seek to incorporate aesthetically appealing and functional solutions into their properties.

According to findings from the Home Improvement Research Institute’s (HIRI) 2023 Project Decision Study, 79% of homeowners now undertake multiple home improvement projects each year, marking a significant shift in consumer behavior. The average number of projects completed has increased from 2.7 in 2015 to 3.4 in 2023, highlighting a growing trend toward frequent renovations and upgrades. This heightened activity in home improvement is expected to substantially contribute to the escalating demand for door handles among residential consumers. As homeowners continue to engage in multiple enhancement initiatives, the need for updated and stylish fixtures becomes more pronounced, positioning door handles as a key product benefiting from the sustained rise in residential improvement projects.

Technological innovation is also playing a pivotal role in the expansion of the door handles industry. Smart home technologies and advancements in security systems have led to the development of digital door handles with features like biometric access, RFID (Radio-Frequency Identification) locks, and Bluetooth-enabled systems. These innovations are becoming increasingly popular among tech-savvy consumers and security-conscious businesses, which is expected to drive further demand. As smart homes and automated building management systems become more prevalent, manufacturers are likely to see increasing opportunities for high-margin, value-added products.

Shifts in consumer preferences toward interior design and home improvement trends are fueling demand for customized and designer door handles. As more homeowners become conscious of their interior decor, door handles are no longer seen merely as functional hardware but as essential components of the overall design. This has led to increased demand for door handles made from premium materials such as brass, stainless steel, and bronze, along with more intricate designs. Manufacturers are capitalizing on this trend by offering a wide array of styles, finishes, and materials to meet the growing appetite for personalization and high-end design in both the residential and commercial sectors.

Knob-style door handles are gaining increasing acceptance among consumers due to their compact structure and availability of various appropriate designs for every infrastructure. Some of the prominent designs trending in the market are polished nickel, matte texture, brass and bronze finishes, and crystal and satin looks available in various geometric shapes and patterns. Some of the companies offering such products are ASSA ABLOY and Carlisle Brass Ltd.

Moreover, rising investments in the real estate sector and sales of new homes are expected to drive industry growth over the forecast period. The rise in government initiatives in several nations aimed at encouraging affordable housing for the lower-income population is a significant element driving the industry growth. Furthermore, technological improvements and modernization in production techniques, as well as an increase in research and development activities, are expected to generate new opportunities for market players to expand their portfolios and generate new revenue streams. In 2023, 4.09 million existing homes were sold, as reported by the National Association of REALTORS. In addition, the U.S. Census Bureau recorded a seasonally adjusted annual rate of 619,000 sales of new single-family houses in May 2024. This surge in both existing and new home sales has directly fueled the increasing demand for door handles as residential construction and renovations continue to rise in response to market growth. The steady turnover of properties, combined with new builds, underscores the heightened need for high-quality fixtures, contributing to the ever-growing demand in this sector.

Type Insights

Lever handles accounted for a market share of 36.24% in 2024. The growth of this segment is largely attributed to the rising consumer preference for lever door handles, driven by their compact design and durability. In response to diverse market needs, manufacturers and distributors have introduced an array of lever handles with varied designs catering to different architectural styles. Lever door handles also offer a broad selection of backplate options, allowing for multiple functional applications. Widely utilized across European markets, lever handles are particularly favored for external door installations, further reinforcing their demand.

The demand for pull door handles is projected to grow at a CAGR of 5.4% from 2025 to 2030. The segment's growth is driven by the ease of functionality and widespread availability of pull door handles. Industry leaders are consistently investing in research and development to produce cost-effective, highly efficient, and premium pull handles crafted from a variety of composite materials. Enhanced designs, innovative patterns, and the use of durable, aesthetically appealing materials are expected to further drive revenue growth within the pull door handle segment.

Material Insights

The metal door handles held a market share of 53.16% in 2024. The high share of the segment is credited to the growing demand for metal handles on account of their physical properties, such as durability, lifespan, and design flexibility. The design of these door handles depends on customization requirements from customers, such as application, size, and design of the product. These products' corrosion resistance, along with their improved looks, make them an excellent choice for security applications. Metal handles are fire- and impact-resistant, adding to the overall structure's robustness.

The demand for fiber door handles is anticipated to grow at a CAGR of 3.9% from 2025 to 2030. The growth of the segment is significantly bolstered by the surge in the demand for composite handles from commercial and residential applications. Customers are approaching manufacturing companies with their customizations and designs to process fiber handles as per their requirements. Shortly, customer desire for personalized and sleek designed products will aid in the segment growth.

Application Insights

The residential demand for door handles accounted for a market share of 54.0% in 2024. The demand for door handles in the residential segment is primarily driven by a surge in home renovations, new constructions, and growing consumer emphasis on home aesthetics and security. As homeowners increasingly seek to upgrade their living spaces, there is a heightened focus on premium fixtures, including door handles that combine functionality with design appeal. In addition, the trend toward smart homes and modern infrastructure has led to a demand for door handles that offer advanced features such as keyless entry, antimicrobial finishes, and enhanced durability, further contributing to the segment's growth.

The demand for door handles for commercial applications is projected to grow at a CAGR of 4.9% from 2025 to 2030. In the commercial sector, the growing demand for door handles is fueled by expanding infrastructure projects, modernization of office spaces, and a focus on compliance with safety and accessibility standards. Commercial buildings, hotels, and retail spaces require robust and durable door handles that can withstand heavy usage while maintaining high-security standards. As per Statistics Canada, total investment in building construction in Canada reached USD 20.9 billion. This increasing investment, along with the rising demand in commercial real estate and construction, is expected to drive the demand for building materials and products, including door handles. As the commercial construction sector expands, the need for durable, high-quality fixtures is anticipated to grow in parallel, further supporting market growth in this segment.

Furthermore, as businesses aim to create aesthetically cohesive environments, the demand for custom-designed, high-quality door handles has risen. Technological advancements, such as electronic and biometric access control integrated into door handles, are also driving growth in this segment.

Regional Insights

The door handles market in North America held a share of 20.69% of the global revenue in 2024. In the broader North American market, the door handles segment is benefiting from a combination of urbanization and rising disposable incomes, which fuel home renovation and new construction projects. As cities expand and residential areas develop, the demand for door hardware is expected to surge. Companies like Allegion and ASSA ABLOY are at the forefront, introducing innovative solutions that blend security and design. The trend towards custom and designer door handles is gaining momentum, with consumers increasingly seeking personalized hardware options that complement their interior aesthetics. Moreover, advancements in manufacturing technologies, such as CNC machining and 3D printing, are enabling companies to produce intricate designs and durable products, further driving market growth.

U.S. Door Handles Market Trends

The door handles market in the U.S. is expected to grow at a CAGR of 4.0% from 2025 to 2030. The market in the U.S. is experiencing robust growth, primarily driven by the booming real estate sector and increasing consumer demand for high-quality, aesthetically pleasing hardware. The market has seen significant investment in both residential and commercial properties, leading to an increased need for durable and stylish door handles. Major players such as Schlage, Kwikset, and Baldwin are innovating their product offerings, focusing on smart technology integration, such as keyless entry systems and biometric locks, which cater to the rising trend of home automation. Furthermore, the growing preference for eco-friendly materials has prompted manufacturers to adopt sustainable practices in their production processes, thus aligning with broader environmental objectives.

Asia Pacific Door Handles Market Trends

Asia Pacific door handles market accounted for a global revenue share of around 36.82% in the year 2024. In the Asia Pacific region, the market is experiencing rapid expansion, propelled by urbanization and rising living standards across emerging economies such as India and China. As the real estate market flourishes, there is an increasing demand for door hardware that combines traditional craftsmanship with modern technology. Local manufacturers are stepping up to compete with global brands by offering products that cater to local aesthetics and preferences while also incorporating innovative features such as touchless entry and automated locking systems. Companies like Godrej and Omega are notable players, investing in R&D to develop advanced materials, such as corrosion-resistant alloys, which enhance product longevity. Furthermore, the growing awareness of home security is driving consumers to prioritize high-security door handles, further stimulating market growth in this dynamic region.

Europe Door Handles Market Trends

The door handles market in Europe is projected to grow at a CAGR of 4.6% from 2025 to 2030. The European market is characterized by a strong emphasis on design and functionality, driven by the region's rich architectural heritage and a preference for high-quality materials. The resurgence of the construction industry, particularly in countries like Germany and the UK, is fostering demand for premium door handles that reflect contemporary design trends. European manufacturers, such as FSB and HOPPE, are leading the way by integrating sustainable materials and advanced locking mechanisms into their products. In addition, the rise of smart home technologies is reshaping consumer expectations, with a growing interest in connected door handle solutions that enhance security and convenience. The focus on energy efficiency and eco-friendly practices within the construction sector also underscores the need for door handles that align with sustainability goals.

Key Door Handles Company Insights

The competitive landscape of the door handles industry is characterized by a diverse array of players ranging from established multinational corporations to agile local manufacturers, each vying for a market share in an increasingly dynamic environment. Leading companies such as Schlage, Kwikset, and ASSA ABLOY dominate the market, leveraging their strong brand recognition, extensive distribution networks, and comprehensive product portfolios that cater to various consumer preferences and architectural styles.

Innovation plays a pivotal role in maintaining a competitive edge; therefore, these key players are heavily investing in research and development to integrate advanced technologies, such as smart locks and biometric systems, into their offerings. This trend toward technological integration is reshaping the market as consumers prioritize security, convenience, and energy efficiency in their purchasing decisions.

Moreover, the market is witnessing a surge in the adoption of sustainable practices, with manufacturers increasingly focusing on eco-friendly materials and production methods to align with consumer demands for environmentally responsible products. This has resulted in the emergence of niche players that specialize in sustainable and custom-designed door hardware, further intensifying competition.

Key Door Handles Companies:

The following are the leading companies in the door handles market. These companies collectively hold the largest market share and dictate industry trends.

- Assa Abloy AB

- The Häfele Group

- Allegion Plc

- Aarkay Vox

- Hoppe Holding AG

- Emtek Products Inc.

- Kuriki Manufacture Co.

- Ace Hardware Corp.

- West INX Ltd.

- Sugatsune America, Inc.

Recent Developments

-

In January 2024, Hafele launched the Oaplus Series of Designer Lever Handles, an innovative addition designed to enhance both the aesthetic appeal and value of well-arranged spaces. This new collection reflects a commitment to efficiency and elegance, embodying the principles of contemporary architectural design. The term "Oaplus" is derived from the Sanskrit word "Upal," meaning "precious stone," and each handle is meticulously crafted to complement and elevate modern architectural doors. Through this release, Hafele continues to showcase its dedication to quality and design excellence in the hardware market.

-

Emtek is set to unveil its latest door hardware collection, the SELECT Walnut Knobs, and Levers, on Tuesday, September 17. This launch represents a significant expansion of Emtek’s SELECT program, introducing a sumptuous walnut finish that enhances the brand’s already extensive customization options. As with all products within the Emtek range, the SELECT Walnut Knobs and Levers prioritize personalization, enabling consumers to curate their hardware according to individual preferences. Customers can seamlessly mix and match various finishes, handle designs, and rosette styles-the decorative backplate upon which the knob or lever is mounted-resulting in a multitude of unique combinations.

Door Handles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.46 billion

Revenue forecast in 2030

USD 10.55 billion

Growth Rate

CAGR of 4.5% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, material, application, region

Regional scope

North America, Europe, Asia Pacific, Central & South America, Middle East & Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, India, Japan, Australia & New Zealand, South Korea, Brazil, and South Africa

Key companies profiled

Assa Abloy AB, The Häfele Group, Allegion Plc, Aarkay Vox, Hoppe Holding AG, Emtek Products Inc., Kuriki Manufacture Co., Ace Hardware Corp., West INX Ltd., and Sugatsune America, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

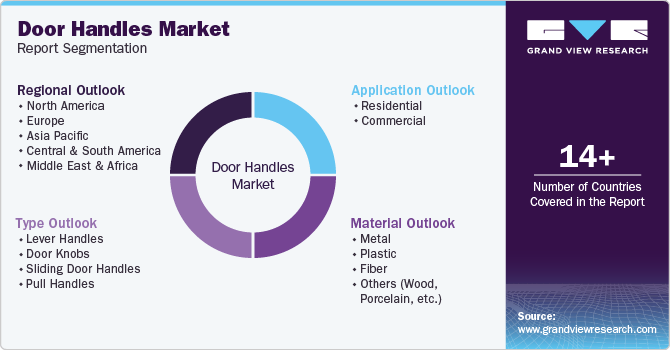

Global Door Handles Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global door handles market based on type, material, application, and region.

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lever Handles

-

Door Knobs

-

Sliding Door Handles

-

Pull Handles

-

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Metal

-

Plastic

-

Fiber

-

Others (Wood, Porcelain, etc.)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global door handles market was estimated at USD 8.14 billion in 2024 and is expected to reach USD 8.46 billion in 2025.

b. The global door handles market is expected to grow at a compound annual growth rate of 4.5% from 2025 to 2030, reaching USD 10.55 billion by 2030.

b. Asia Pacific dominated the door handles market with a share of 36.82% in 2024. The regional market is experiencing rapid expansion, propelled by urbanization and rising living standards across emerging economies such as India and China. As the real estate market flourishes, there is an increasing demand for door hardware that combines traditional craftsmanship with modern technology.

b. Some of the key players operating in the door handle market include Assa Abloy AB, The Häfele Group, Allegion Plc, Aarkay Vox, Hoppe Holding AG, Emtek Products Inc., Kuriki Manufacture Co., Ace Hardware Corp., West INX Ltd., and Sugatsune America, Inc.

b. The growth of the global door handles market is majorly driven by the ongoing boom in the construction and real estate industries, particularly in developing regions such as Asia-Pacific, the Middle East, and Latin America.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.