- Home

- »

- Communication Services

- »

-

Player Tracking System Market Size & Share Report, 2030GVR Report cover

![Player Tracking System Market Size, Share & Trends Report]()

Player Tracking System Market (2025 - 2030) Size, Share & Trends Analysis Report By Offering (Solution, Services), By Technology (Optical, Wearables), By End Use (Individual, Team Sports), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-527-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Player Tracking System Market Summary

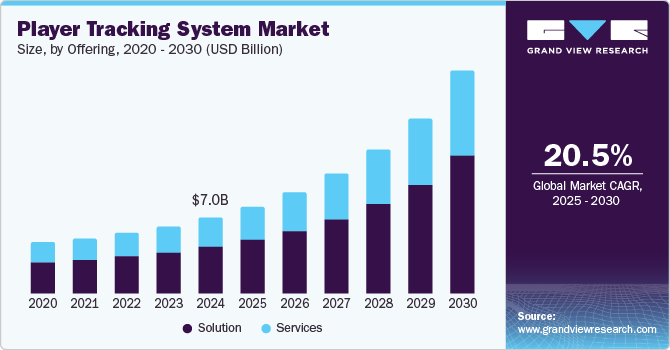

The global player tracking system market size was valued at USD 7.02 billion in 2024 and is projected to reach USD 20.44 billion by 2030, growing at a CAGR of 20.5% from 2025 to 2030. The market growth can primarily be attributed to the steadily rising focus on tracking players across different sporting disciplines and monitoring their physical metrics in real time.

Key Market Trends & Insights

- North America accounted for the largest revenue share of 36.2% in the global market in 2024

- In 2024, the U.S. led market revenue due to rising grassroots sports participation and growing use of performance tracking.

- By offering, The solution segment accounted for a leading revenue share of 61.6% in 2024.

- By technology, In 2024, the optical segment topped revenue due to its high demand for advanced performance-tracking benefits.

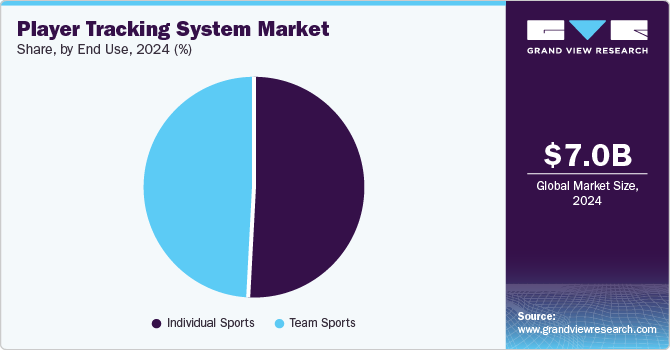

- By End Use, In 2024, individual sports dominated the market as rising interest drove adoption of tracking tools to boost performance and prevent injuries.

Market Size & Forecast

- 2024 Market Size: USD 7.02 Billion

- 2030 Projected Market Size: USD 20.44 Billion

- CAGR (2025-2030): 20.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Coaching teams of individual athletes, associations, and clubs have realized the importance of collecting and analyzing on-field data to ensure continual performance improvements. These technologies have emerged as an effective tool to optimize team-level training curriculums and track individual players' performance levels.

By monitoring player movements and physical exertion, teams can better understand player workload and identify potential injury risks, creating a proactive approach to maintaining player health. Solution providers are mainly focused on undertaking partnerships with different sports associations to expand the use of their products. For instance, in October 2024, the A-Leagues professional soccer league in Australia and New Zealand announced a partnership extension with Stats Perform.

A player tracking system is a technology used in sports to monitor and analyze the movements and performance of players during games and training sessions. These systems leverage various technologies, including wearables, sensors, and video analytics, to collect data, providing valuable insights into player performance, strategies, and overall game dynamics. For instance, in soccer, GPS trackers can monitor and record important metrics in real-time, such as a player's speed and acceleration, distance covered, and impact from tackles. The coaching staff can then utilize this data during matches to plan and modify team formation and strategies, make substitutions, and suggest changes to player positions. Teams in renowned global leagues such as the Premier League (England), La Liga (Spain), Bundesliga (Germany), and MLS (the U.S.) have partnered with leading technology providers and analytics companies to gain an advantage over their opponents in terms of tactics and player performance.

Team owners and coaches globally have recognized the importance of data in optimizing player and team performance and ensuring that their teams can remain competitive. Moreover, player tracking systems have become vital to boost fan engagement by offering an enhanced viewing experience, including detailed statistics and player tracking data through broadcasts and online platforms. Teams use this data to create more compelling content for their supporters and audience. Innovations in wearable technology, GPS, and computer vision have made tracking systems more accurate and accessible in recent years. In September 2024, Fitogether, a South Korean provider of live player tracking solutions, announced that it had secured an investment worth USD 7.2 million to expand its Electronic Performance Tracking System (EPTS) offering in the U.S. and Qatar. The company further announced its partnership with Aspire Academy, a leading Qatar-based soccer academy that provides state-of-the-art training facilities to teams. This would allow European clubs and national team coaching staffs to leverage advanced player-tracking tools to optimize team management strategies and player development.

Offering Insights

The solution segment accounted for a leading revenue share of 61.6% in 2024. Notable products utilized in player tracking include GPS-based systems, optical tracking systems, inertial measurement units (IMUs), and video analysis software. These technologies enable coaches to make informed decisions using empirical data, optimize training schedules as per player requirements, and refine tactics by gaining comprehensive player information. Developments and innovations by market players are expected to boost the demand for such solutions among teams and associations. For instance, in April 2024, Vodafone, in partnership with the Welsh Rugby Union, announced the launch of a new feature on its ‘PLAYER.Connect’ platform. This feature would allow female players to view concussion data and menstrual cycle data simultaneously, enabling them to understand the impact of the menstrual cycle on their performance, recovery, and well-being. Real-time player tracking aids coaches and the support staff design ideal strategies to prevent serious injuries and ensure player fitness during training sessions and tournaments. Moreover, individual players' kinetic and metabolic demands can be determined using tracking tools to ensure that injured players recover faster.

The services segment is expected to grow substantially from 2025 to 2030. Player tracking system providers generally offer a suite of integration, maintenance, and deployment services to ensure that their products function effectively and meet the specific requirements of sports teams and organizations. For instance, integration services connect the player tracking system with existing software platforms, such as team management tools, video analysis software, and health monitoring systems, to create a unified data ecosystem. The growing popularity of cloud-based systems has further aided segment growth, as this deployment enables remote access to data and analytics, ensuring scalability and flexibility for the organization. Companies also frequently conduct training sessions for coaches, analysts, and other staff members to familiarize them with the system's features, functionalities, and data interpretation. To maintain regulatory compliance and integrate new features, market players constantly provide updates and patches to their products, ensuring that their customers can take advantage of the latest features.

Technology Insights

The optical segment accounted for a leading revenue share in 2024, with its high demand propelled by the various benefits this technology offers players and team coaches in tracking performance. Optical tracking systems leverage several cameras and complementary software to monitor players and mark their coordinates efficiently. A statistical algorithm then generates comprehensive and accurate insights regarding the weaknesses and strengths of players that can potentially affect overall team performance. This technology is particularly useful in team sports, where multiple players must be tracked simultaneously.

Optical systems can be conveniently installed in stadiums as well as training fields. They involve high-definition cameras and advanced processing software to constantly monitor individual players' distance, acceleration, stamina, and speed. Additionally, they can produce high-quality videos of entire matches and training sessions, which are vital during match breaks, post-match discussions, and analysis sessions. Second Spectrum is a prominent name that offers its products to several professional sports leagues, including the NBA and the Premier League. It uses multiple camera setups and advanced machine-learning algorithms to track player movements and interactions with the ball. The solution further provides video analysis tools for coaches and analysts, making it a helpful resource for in-depth post-game analysis and live strategy.

The wearables segment is anticipated to advance at the fastest CAGR from 2025 to 2030. This system generally comprises a chest vest and a tracking device. Generally, four sensors are utilized in these solutions, which include a magnetometer, an accelerometer, a GPS module, and a gyro. Each individual sensor performs an important role in tracking player performance and helps provide a more complete view to the coaching staff. For instance, GPS sensors are used to track an athlete's position on the field and measure distance covered, speed, and acceleration in real time. GPS is particularly effective for team sports, where large fields must be constantly monitored to understand player movement patterns.

In recent years, some wearables have also started measuring body temperature, sweat levels, or hydration status via the integration of skin temperature and hydration sensors, which are useful in situations that demand intense activity by players. These sensors help coaches and medical teams monitor signs of overheating or dehydration, especially in endurance sports or extreme conditions. hDrop Technologies is a U.S.-based company in this space that develops wearable devices for athletes to enable them to improve performance. The company's flagship product is the hDrop Gen 2, a reusable sensor that tracks sweat rate and electrolyte concentration in real time. Such developments and innovations are expected to shape market expansion in the coming years positively.

End Use Insights

The individual sports segment accounted for a larger share in 2024. The growing popularity of sports such as tennis, golf, shooting, and archery has increased player admission rates, encouraging coaches and training staff to leverage tracking solutions to enhance performance, prevent injuries, and improve the mental conditioning of athletes. Data from tracking systems can help athletes visualize their performances, analyze their mental states during competitions, and develop strategies for mental resilience. Some systems offer biofeedback capabilities, enabling athletes to understand and control physiological responses such as heart rate during their performance. Established and new market entrants have been focusing on offering products that can continuously monitor player metrics and recommend changes or modifications. For instance, in tennis, Baseline Vision is a solution that offers real-time feedback regarding the player's net clearance, ball speed and placement, and fitness data. This helps players improve their technique and understand their weaknesses, enhancing their performance levels.

The team sports segment is expected to advance significantly during the forecast period. The demand for player tracking systems among basketball, football, soccer, and rugby teams has steadily grown with technological advancements and increasing awareness among teams in lower leagues. Furthermore, these solutions offer benefits that enhance performance, strategy, and overall team dynamics. Tracking systems help monitor player workload and exertion levels, allowing teams to manage training intensity and reduce the risk of injuries. Additionally, detailed movement analysis can highlight improper techniques or imbalances, providing opportunities for corrective training to prevent injuries.

The increasing tactical nature of team sports has further heightened the importance of tracking systems, as they enable coaches to analyze player positioning and movements during games, leading to better tactical planning and adjustments based on opponent behavior. For instance, in April 2024, LOSC Lille, a French football club competing in Ligue 1, announced its partnership with STATSports, making it its official GPS performance tracking partner. The partnership enables Lille to leverage STATSports' advanced GPS technology and state-of-the-art data analysis software to prevent player injuries and optimize their performance.

Regional Insights

North America accounted for the largest revenue share of 36.2% in the global market in 2024, aided by the increasing pace of technology adoption in sports and several major industry players in the region. North America hosts several globally popular leagues, including the National Basketball Association (NBA), Major League Baseball (MLB), Major League Soccer (MLS), National Hockey League (NHL), and the National Football League (NFL). Furthermore, the extensive popularity of university sports has encouraged academic institutions to collaborate with player-tracking system providers to enhance their competitiveness and boost their chances of success against other colleges. As participation in youth and amateur sports continues to rise in the U.S. and Canada, there is a steadily growing interest in adopting tracking technologies to improve training and development regimens, aiding market expansion in the region.

U.S. Player Tracking System Market Trends

The U.S. accounted for a dominant revenue share in 2024, aided by the rising popularity of various team and individual sports at the grassroots level and awareness regarding the benefits of tracking performance metrics among youth and professional coaching teams. Universities are investing in innovative systems to better understand player performance and enhance their training programs. With the rise of college athletics and the growing focus on student-athletes health, performance tracking has become a major area of interest. Companies are collaborating with leading national athletes and teams across sports such as tennis, golf, basketball, and soccer to promote their products and boost their regional footprint.

Europe Player Tracking System Market Trends

Europe accounted for a substantial share in 2024, on account of the well-established sports culture in the region and the presence of several major sports associations, particularly in the UK, France, Germany, Spain, and Italy. The popularity of both individual and team sports remains high, leading to the extensive demand of technological solutions that can improve player performance, lower injury risks, and optimize team tactics. In June 2024, the Union of European Football Associations (UEFA), the governing body of European football, announced its partnership with Genius Sports to provide player tracking data for matches in the Europa League, European qualifiers, and the Nations League. This agreement spans 1,350 matches and would use AI-enabled cameras deployed across more than 140 stadiums in the region. Such developments are expected to maintain a steady growth pace of the regional market.

Asia Pacific Player Tracking System Market Trends

The Asia Pacific region is expected to advance at the fastest CAGR from 2025 to 2030, aided by the increasing integration of technology in the rapidly expanding sports industry and the continued adoption of smart devices. Team sports such as cricket and soccer are very popular among most regional economies, while there has also been a surge in the audience for individual sports such as tennis. As a result, governments in countries such as India, China, and Japan aim to improve player development at the grassroots level to bring them on level terms with international performance standards.

Key Player Tracking System Company Insights

All the players have a diversified customer base and enhanced regional reach. To defend their position in the market, they are striking various strategic agreements, forming strategic partnerships, and launching innovative products and services.

For instance, a deal between STATSports Group and the Chinese Football Association envisages STATSports Group providing a GPS-based player tracking system for Chinese football players. STATSports Group has also entered into a long-term partnership to provide a GPS-based player tracking system for Australia’s national soccer team. Similarly, Catapult Group has formed a strategic alliance with Romanian Football Federation (FRF), Confederation of African Football, and French Football Federation (FFF) to provide a wearable player tracking system and technology services. Meanwhile, in January 2019, ChyronHego introduced a player tracking system involving Click effects PRIME graphics authoring system and TRACAB optical tracking system to track the players’ movements graphically. Some of the prominent players in the player tracking system market include:

-

KINEXON is a technology company specializing in developing real-time location and tracking solutions for sports, logistics, and industrial applications. It leverages advanced sensor technologies, IoT (Internet of Things), and data analytics to provide insights that enhance performance, safety, and operational efficiency. The company mainly caters to the automotive, aerospace, logistics, and machinery & equipment verticals. Through the KINEXON Sports division, the company provides systems for real-time tracking of athletes during training and competitions.

-

STATSports is an Ireland-based company that develops GPS-powered player tracking and analytics solutions for the sports industry. The company specializes in advanced GPS tracking devices that athletes wear during training and competitions.

Key Player Tracking System Companies:

The following are the leading companies in the player tracking system market. These companies collectively hold the largest market share and dictate industry trends.

- Catapult Group International Ltd

- Chyron

- JOHAN Sports

- KINEXON GmbH

- PlayGineering

- Polar Electro

- SPT Group Pty Ltd.

- Stats Perform

- STATSports Group

- Xampion

- Zebra Technologies Corp.

Recent Developments

-

In October 2024, Club Brugge KV, the 2023-24 Belgian Pro League champions, announced a multi-year deal that has made STATSports the official GPS performance tracking partner of the soccer club. As part of this agreement, Club Brugge will deploy STATSports’ advanced systems at their Belfius Basecamp training ground and their home ground of Jan Breydel Stadium. This development is expected to enable coaches to track players during their games and training sessions seamlessly.

-

In September 2024, KINEXON Sports announced an expanded partnership agreement with FC Bayern Basketball, the 2023-24 German champions.

-

In June 2024, Catapult announced an exclusive multi-year agreement with the Brazilian Football Confederation (CBF) to optimize player performance in the country’s national setup.

Player Tracking System Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.05 billion

Revenue forecast in 2030

USD 20.44 billion

Growth Rate

CAGR of 20.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, technology, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Catapult Group International Ltd; Chyron; JOHAN Sports; KINEXON GmbH; PlayGineering; Polar Electro; SPT Group Pty Ltd.; Stats Perform; STATSports Group; Xampion; Zebra Technologies Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Player Tracking System Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global player tracking system market report based on offering, technology, end use, and region:

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Solution

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Optical

-

Wearable

-

Industrial

-

Satellite

-

Others

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual Sports

-

Tennis

-

Golf

-

Others

-

-

Team Sports

-

Football

-

Basketball

-

Rugby

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.