- Home

- »

- Healthcare IT

- »

-

PMS And Menstrual Health Supplements Market Report, 2030GVR Report cover

![PMS And Menstrual Health Supplements Market Size, Share & Trends Report]()

PMS And Menstrual Health Supplements Market Size, Share & Trends Analysis Report By Product, By Consumer Group, By Formulation, By Sales Channel, By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-008-6

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global PMS and menstrual health supplements market size was valued at USD 22.6 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. Premenstrual syndrome (PMS) includes physical and psychological symptoms that are clinically significant during the luteal phase of the menstrual cycle and cause severe distress and functional impairment. According to the NIH data, 20% of women experience symptoms that are severe enough to interfere with their daily activities, while the other 80% only experience symptoms that are mild to moderate. A study from Egypt discovered a correlation between PMS and consuming too much food with high sugar. Hence, it is evident that lifestyle factors significantly relate to PMS. The increased understanding of luteal phase therapy is one of the key reasons influencing the market expansion.

The prevalence of PMS is also witnessing a significant rise that contributes to the industry expansion. In addition, the emergence of the COVID-19 pandemic boosted awareness regarding physical, mental, and emotional health, which made the patients understand the value of supplements available in the market, thus influencing the market revenue. According to ISTG, there has been a 35% increase in demand for menstrual hygiene products since the COVID-19 outbreak started. Furthermore, easy accessibility to e-commerce makes things better for the industry growth in terms of revenue. Moreover, leading players are focusing more on research and development that boosts the effectiveness of nutritional supplements to help patients in managing premenstrual syndrome.

According to a report published by the NIH in 2021, after getting COVID-19 vaccines, some women have reported missing or having irregular menstrual cycles, heavier-than-normal bleeding, and other menstrual abnormalities. This led to the emergence of menstrual supplements in the market, thus making COVID-19 a positive factor in driving the market. However, a rise in demand for immune health supplements and increased focus of people to combat COVID-19 disease have led to a decline in the demand for PMS supplements to some extent.

Looni, a U.S.-based company, launched a menstrual health supplement in 2021 to help with hormone imbalance. Balance Mood Complex is available in capsule form and tends to work as a hormone stabilizer to effectively lower mood swings and irritations. Power Gummies, India's most valuable nutraceutical company, has developed a formula for PMS relief that includes chasteberry, vitamin C, passionflower, and citrus bioflavonoids, which is gaining popularity and contributing to the growth of the PMS supplement market.

Additionally, initiatives by public and private organizations to improve female health and education contribute to the industry expansion. The Menstruation Equity for All Act of 2021, proposed by U.S. Congresswoman Grace Meng, intends to increase the availability and affordability of essential menstrual products, such as tampons, pads, and other supplies, for a range of groups of women and girls. In order to ensure that all women and girls around the world have access to reproductive health services and information, including maternal health and family planning, JOICEP, a Japanese non-governmental organization, introduced the LADY program in 2018.

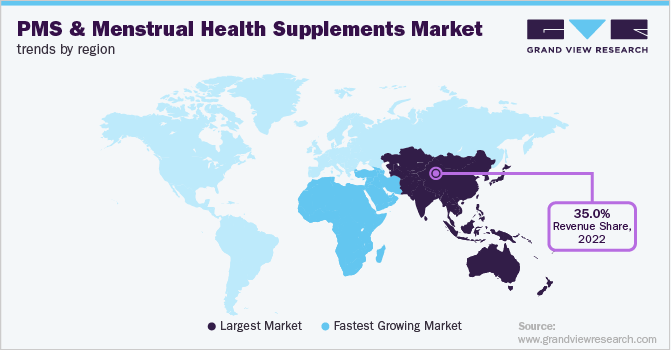

Asia Pacific held a significant share in 2022. The key growth driver for the market is the rising number of women who experience menstrual discomfort in countries such as China and Japan. Iran (98%) reported the highest prevalence of PMS, while France (12%) recorded the lowest prevalence. A social media campaign was started by the two menstrual health companies, Marea and Saalt, to provide low-income women with period hygiene products and guide them with proper information, which ultimately aids in increasing the understanding and awareness regarding the premenstrual syndrome condition. With such initiatives, women are getting proper guidance and knowledge to deal with PMS, and thus, the use of supplements as a preventive measure is increasing.

Product Insights

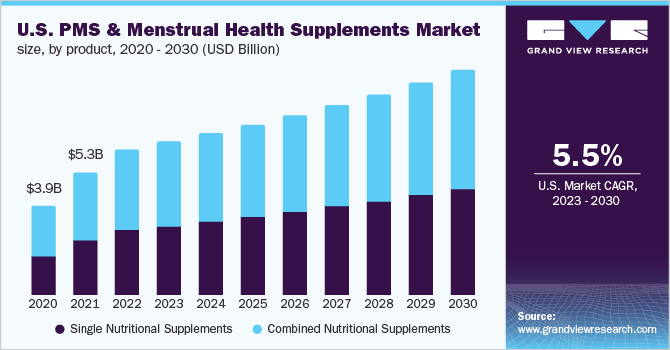

Combined nutritional supplements captured a dominant revenue share of over 50.0% in 2022. Certain vitamins and minerals must be taken together to relieve PMS symptoms. Effective combinations include magnesium and vitamin D3, omega 3 and vitamin E, and magnesium and zinc. To prevent undesirable consequences, patients should always consult the doctor for better safety. Combination medications eliminate the need for patients to remember to take multiple supplements on a daily basis. Furthermore, years of research show that combination supplements are effective in terms of therapeutic response, and they can be easily used with proper consultation.

Single nutritional supplements are expected to grow significantly over the forecast period. They offer reliability, which makes them better options to recommend by physicians too. To ensure good nutrition, physicians are highly recommending the consumption of supplements in the diet. Vitamins are the most essential nutrients that show positive effects on the physical and psychological symptoms of PMS. As per the NCBI report, high dose of Vitamin D supplementation can reduce the prevalence of PMS. In the U.S., the use of nutritional supplements is pervasive and undeniably on the growth. The expansion of the supplement market is most likely fueled by the widespread availability and aggressive marketing by industry leaders.

Consumer Group Insights

The PMS segment held the largest share of over 55.0% in 2022 and will continue to grow in the coming years. Factors contributing to this growth are the effectiveness of nutritional supplements on premenstrual syndrome. Studies show calcium and vitamin B6 offer better results in PMS treatment. Additionally, there are some herbal supplements in the market that are used to cope with PMS symptoms. Some herbal supplements such as black cohosh, chaste berry, and evening primrose oil are commonly used. Supplements that can work effectively such as phytoestrogens, calcium, dehydroepiandrosterone, vitamins, bioidentical hormone, and omega-3s are trending in demand.

Perimenopause symptoms can be controlled with the intake of lots of vegetables and fruits, however, it may be necessary to take supplements to cope with the conditions. As a result, the use of supplements in the treatment of perimenopause symptoms is gaining popularity. Perimenopause supplements are typically a blend of botanicals, vitamins, and minerals that are used to alleviate one or more symptoms that women experience during perimenopause.

Formulation Insights

The tablet/capsules segment held the largest revenue share of over 45.0% in 2022. One of the major factors that contribute to the growth of this segment is the ease of use and increased awareness. As per the NCIB report, the most common formulation for oral administration is capsule. Tablets/capsules offer longer shelf life, act quickly and effectively, and can be sugar coated, making them more palatable.

Softgels are gaining huge popularity, which makes them the second-best choice for patients. Softgels are made of gelatins, which are easy to digest and dissolve within minutes of reaching the stomach. DM Pharma, an Indian pharmaceutical company, is promoting the quality of life for women suffering from PMS by providing black cohosh soft gelatin capsules that contain substances similar to female hormones. Nowadays, vitamin injections are gaining popularity, however, the USFDA consider injections to be drugs and not supplements, which hinders their growth in the supplement market.

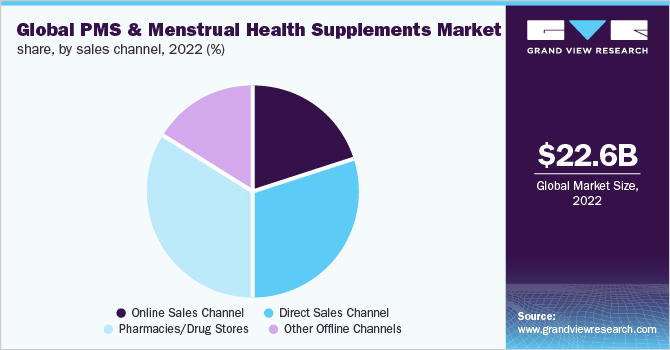

Sales Channel Insights

Pharmacies/drug stores held the largest revenue share of over 30.0% in 2022. Pharmacies or drug stores generate more sales because they are readily available, and one can buy supplements in a very simple manner within various pharmacy layouts. Furthermore, with the help of pharmacy stores, patients no longer have to wait 3-4 business days for medicines, making this channel more feasible and reliable.

The online segment is expected to grow significantly in the upcoming years. Easy access to the internet plays a crucial role in expanding the online market. The COVID-19 pandemic has developed online purchasing habits and thus, e-commerce platforms are going to increase more significantly. According to an industry report, a survey conducted in India in March 2022 found that nearly 51% of respondents who use nutraceuticals or dietary supplements purchased them online.

Regional Insights

Asia Pacific captured the largest revenue share of over 35.0% in 2022. China captured the largest revenue share in 2022, followed by India and Japan. An increase in the demand for supplements and other natural supplements is fueling growth. Asia Pacific is known for traditional medicines or supplements. Dong quai is a popular PMS supplement in the Asia Pacific region, particularly in China. Inochinohaha White, a Japanese herbal supplement, is widely used to treat anxiety associated with premenstrual syndrome in women.

The MEA is estimated to witness the fastest growth during the forecast period. As per the article published by BMC women’s health in 2021, Iran has the highest prevalence of PMS, and thus, it plays a crucial role in increasing the demand for supplements. High stress in adolescents due to physiological changes, educational pressure, and sexual health are additional reasons behind the rising prevalence, which encourages more frequent use of PMS supplements, thus boosting overall industry growth.

Key Companies & Market Share Insights

The market is highly competitive. Various companies across the globe are investing in R&D to develop more effective supplements and meet market demands. For instance, Power Gummies launched a unique variant called That Time Of The Month Gummies in 2021 with the goal of revolutionizing the way women manage menstrual health. Recently, Looni, a U.S.-based company, launched the menstrual health supplement Balance Beam Mood Complex to address menstrual health and hormone imbalance. Some prominent players in the global PMS and menstrual health supplements market include:

-

Herbalife International of America, Inc.

-

Pharmavite LLC

-

Nature’s Bounty

-

Amway

-

GNC Holdings, Inc.

-

USANA Health Sciences, Inc.

-

GlaxoSmithKline Plc

-

MetP Pharma AG

-

RBK Nutraceuticals Pty Ltd.

-

Archer Daniels Midland

-

Power Gummies

-

Looni

-

DM Pharma

PMS And Menstrual Health Supplements Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 23.8 billion

Revenue forecast in 2030

USD 35.0 billion

Growth rate

CAGR of 5.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, consumer group, formulation, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Herbalife International of America, Inc.; Pharmavite LLC; Nature’s Bounty; Amway; GNC Holdings, Inc.; USANA Health Sciences, Inc.; GlaxoSmithKline Plc; MetP Pharma AG; RBK Nutraceuticals Pty Ltd.; Archer Daniels Midland; Power Gummies; Looni; DM Pharma

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global PMS And Menstrual Health Supplements Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global PMS and menstrual health supplements market report on the basis of product, consumer group, formulation, sales channel, and region:

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Single Nutritional Supplements

-

Vitamins

-

Minerals

-

Herbal Supplements

-

Others

-

Combined Nutritional Supplements

-

-

Consumer Group Outlook (Revenue, USD Billion, 2017 - 2030)

-

Premenstrual Syndrome (PMS)

-

Perimenopause

-

-

Formulation Outlook (Revenue, USD Billion, 2017 - 2030)

-

Capsules/Tablets

-

Powder

-

Softgels

-

Others

-

-

Sales Channel Outlook (Revenue, USD Billion, 2017 - 2030)

-

Online Sales Channel

-

Direct Sales Channel

-

Pharmacies/Drug Stores

-

Other Offline Channels

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

Italy

-

France

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

Australia

-

South Korea

-

India

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global PMS and menstrual health supplements market size was estimated at USD 22.6 billion in 2022 and is expected to reach USD 23.8 billion in 2023.

b. The global PMS and menstrual health supplements market is expected to grow at a compound annual growth rate of 5.7% from 2023 to 2030 to reach USD 35.0 billion by 2030.

b. Combined nutritional supplements dominated the market with a share of 54.5% in 2022 owing to the many advantages offered by these supplements to maintain multiple conditions

b. Some key players operating in the PMS and menstrual health supplements market are Herbalife International of America, Inc, Pharmavite LLC, Nature’s Bounty, Amway, GNC Holdings, Inc. USANA Health Sciences, Inc., GlaxoSmithKline Plc

b. Increasing awareness about PMS and other menstrual disorders and the growing prevalence of PMS globally are key factors anticipated to drive the demand for supplements.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."