- Home

- »

- Advanced Interior Materials

- »

-

Pneumatic Conveying System Market Size Report, 2030GVR Report cover

![Pneumatic Conveying System Market Size, Share & Trends Report]()

Pneumatic Conveying System Market (2024 - 2030) Size, Share & Trends Analysis Report By Operating Principle Type (Dilute Phase, Dense Phase), By Technology, By End Use, By Region, And Segment Forecasts

- Report ID: 978-1-68038-518-2

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Pneumatic Conveying System Market Trends

The global pneumatic conveying systems market size was valued at USD 32.57 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Rise in industrialization in emerging economies, expansion of recycling and waste treatment industries, and an upswing in the demand for energy-efficient systems have helped the global pneumatic conveying systems market gain traction in the past few years. Rising concerns related to the health and safety of consumers are compelling manufacturers across many industries to use automated pneumatic conveying systems as they ensure the hygiene of products by preventing contamination of materials being used.

Additionally, the lockdown's potential effects are currently unknown, and company es' ability to recover financially depends entirely on the cash they have set aside. As a result, manufacturers of pneumatic conveying systems can only afford a complete lockdown for a limited period of time before players must change their investment strategies. For instance, a number of market participants ceased production for several weeks in order to cut costs, and a select number of participant’s also implemented staff leave policies in order to survive the Covid-19 health crisis.

Furthermore, technological developments in the field of pneumatic conveyance and the availability of advanced products equipped with intelligent control technology are leading to increased uptake of these systems. Additionally, the usage of pneumatic conveying systems in material handling industries has also been on a rise, which is poised to bolster the growth of thepneumatic conveying systems market over the forecast period. Pneumatic conveyors are used in a variety of industries because they increase output, cut down on production stoppages, guarantee cost savings, and improve product quality in areas like packaging, coating, and final product quality. Pneumatic conveyors are being more widely used across a range of end-use sectors as a result of these advantages.

Conventional conveyors are prone to dust and foreign particles entering the systems, resulting in quality degradation of materials and consecutive losses incurring from material that is left unsuitable for use for the desired purpose. This is another factor why pneumatic conveyors are increasingly replacing conventional conveyors in some industries as product contamination continues to be a major area of concern for end-users. Industries such as ceramics, food processing, pharmaceutical, and rubber and plastic are investing considerably in procuring pneumatic conveyors to step up their production capacities to meet increasing demands. As industries continue to face extremely competitive environments, pneumatic conveyors are being installed to avoid losses and enhance the quality of products. This is further likely to impel the growth of the pneumatic conveying systems market.

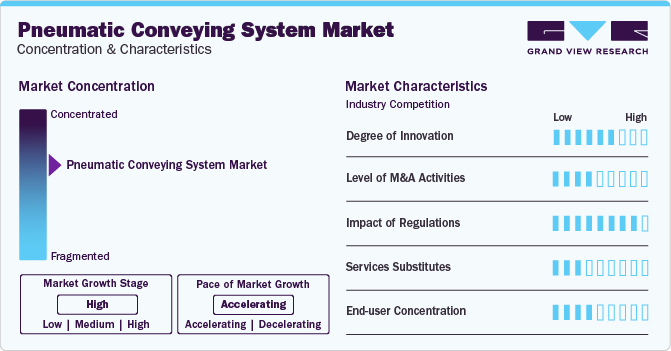

Market Concentration & Characteristics

The current stage of market growth for pneumatic conveying systems is moderate, and the growth rate is slow. The pneumatic conveying systems market growth can be attributed to the expansion of industrialization in emerging economies, the development of recycling and waste treatment sectors, and a growing demand for energy-efficient systems.

The pneumatic conveying systems market is also characterized by product launches, mergers & and acquisitions (M&A), and market expansion activity by prominent manufacturers. This is due to several factors such as the launch of technologically advanced products and the utilization of product development software to improve the operational efficiency of the software to maintain a strong brand position in the market.

Pneumatic conveying systems are widely used in the food and beverages sector and the chemical industry thus there are regulatory norms for various products. Therefore, selecting the vacuum convening units is based on the materials undergoing contact with the vacuum unit which is to be approved by a regulatory body such as the FDA/USDA, OSHA or local authorities among others to avoid any chances of corrosion, contamination, or gases emission while the usage of toxic chemicals.

There is a moderate presence of replacements for pneumatic conveying systems. A notable challenge to the market arises from the emergence and adoption of tubular drag conveyors which are more efficient, require less power, and are cost-effective in operation. Pneumatic conveying systems have many components that require more electricity, maintenance, and repair costs thus counterparts are preferred.

End-user concentration is a significant factor in the market. There is an increase in the demand for high-performance, cost-effective pneumatic conveying systems that consume less electrical power, thus the key players in the market are majorly focusing on developing advanced pneumatic conveying systems that offer high operational efficiency by consuming less electricity.

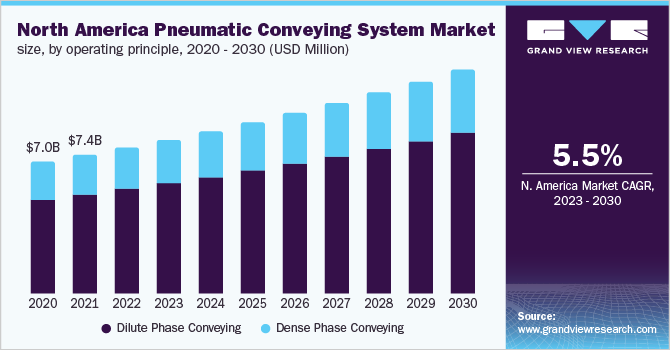

Operating Principal Insights

Based on the operating principle, the pneumatic conveying systems market has been segmented into the dilute phase conveying and dense phase conveying. The dilute phase conveying segment held the largest share of over 73.11% of the overall revenue in 2022. It is also expected to expand at a CAGR of 5.9% during the forecast period.

Pneumatic conveying systems based on the dilute phase operating principle are estimated to witness significant growth over the forecast period as these systems are widely used for incessant conveying in some industries, wherein dilapidation and abrasion of materials are not major concerns. Dilute phase pneumatic conveyors are ideal for low-density non-fragile and non-abrasive materials. They are also known to be the most cost-effective, versatile, and simplest systems. Owing to these aforementioned factors, they are gaining popularity in high-pressure settings.

The dense phase conveying segment is anticipated to grow at CAGR of 26.89% during the forecast period. Pneumatic conveying systems based on dense phase operating principles are the most ideal solutions for the low- or high-rate transfer of friable or abrasive materials. Owing to low speed and air volumes that these systems operate at, they avert fragile materials and mixtures from breaking down, making them indispensable in a large set of industries. Thus, the demand for these systems is also anticipated to experience a high growth rate over the forecast period.

Technology Insights

Based on technology, the pneumatic conveying systems market has been segmented into positive pressure, vacuum, and combination systems. Of these, the positive pressure system segment accounted for 49.94% market revenue in 2022 and expected to witness growth over the forecast period. This growth can be attributed to the ability of positive pressure systems to operate at high pressures as compared to other types of conveying systems. Additionally, they are suitable for conveying heavy materials over long distances, which is one of the most prominent factors projected to drive the market over the forecast period.

Vacuum systems utilize high vacuum pumps that are easy to design and require less maintenance. The segment is likely to post a CAGR of 5.8% over the forecast period, owing to its ability to utilize a vacuum to conveyor position the material on the desired stack point, coupled with its ability to convey materials to a single destination from multiple sources.

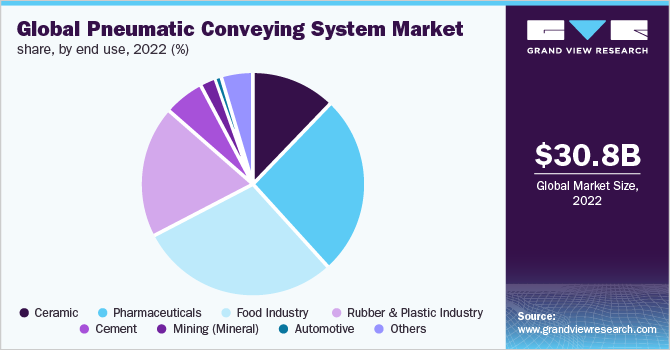

End-use Insights

Based on end-use, the pneumatic conveying systems market has been classified into ceramic, pharmaceuticals, food, rubber and plastic, cement, mining (mineral), and others. The food industry represented over 28.0% of the overall revenue in 2018. Pneumatic conveyors are gaining popularity in the industry owing to their benefits such as high reliability, increased productivity, reduced risk of material spillage, low energy consumption, and low operational and maintenance costs.

The residential segment is expected to witness significant growth over the forecast period, Surge in disposable income coupled with lower housing interest rates in emerging economies is also expected to bode well for market growth over the forecast period. Additionally, rapid urbanization across tier-II cities in emerging economies is expected to drive the demand for architectural services over the forecast period. Moreover, the demand for services such as urban planning services and project management services is expected to increase among architects to better manage their smart cities projects.

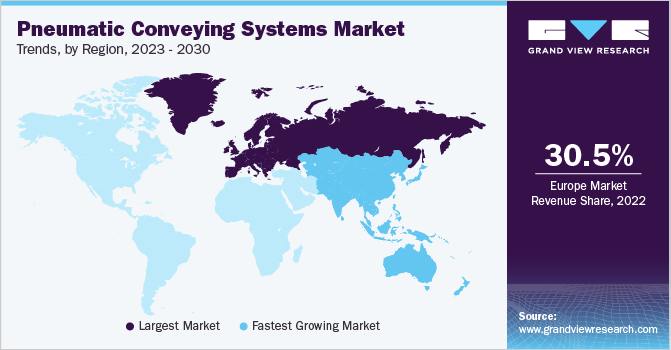

Regional Insights

Europe held the dominant share of over 30.50% of the total market in terms of revenue in 2022. The regional market is anticipated to register significant growth over the forecast period, thanks to rising demand for hygienic methods in the food transfer and production industry. The Food Industry & Drug Administration (FDA) has introduced several regulations regarding indirect contaminants in food. This is projected to positively influence the demand for pneumatic conveying systems in the region over the forecast period.

Asia Pacific is expected to exhibit the highest CAGR of 6.3% over the forecast period. The thriving pharmaceutical industry in the Asia Pacific area is predicted to boost demand for pneumatic conveying systems. The region has saw a considerable increase in the number of facilities devoted to the production of biosimilars and vaccines, especially in poor nations. Governments in these countries have been actively involved in practices promoting better healthcare facilities and the overall development of associated industries. A notable rise in growth opportunities due to this scenario is attracting many pharmaceuticals manufacturers to emerging countries. This shift of the pharmaceutical manufacturing sector from developed to developing regions is likely to fuel the demand for pneumatic conveying systems market in APAC.

Key Companies & Market Share Insights

Some of the key players operating in the market include Atlas Copco AB, Dynamic Air Inc.Schenck Process Holding GmbH and Coperion GmbH among others.

-

Atlas Copco AB offers industrial productivity solutions globally. The company focuses on manufacturing a range of products, including air treatment systems, compressors, assembly systems, and industrial power tools. The products offered by the company aim to help customers improve productivity, enhance ergonomics, and ensure energy efficiency and safety in various industrial processes.

-

Dynamic Air Inc. manufactures conveyors and conveying equipment. Their product range includes pressure and vacuum conveying systems, aerators, lump breakers, air-activated gravity conveyors, air blenders, bag breakers, bag compactors, bin aerators, bin dischargers, bin vent filters, blower packages, and diverter valves. Besides, the company has strong global distribution and sales channels for a variety of material-handling equipment and conveying products.

-

Nilfisk Group,Nol-Tec Systems andPneumatic Conveying, Inc. are some of the emerging market participants in the pneumatic conveying systems market.

-

Nilfisk Group offers premium cleaning products, and pneumatic conveyor systems among others. The company has consistently adapted to evolving market and customer needs through innovative solutions. With a global sales force and established channels, the company has built strong customer relations and partnerships worldwide. Further, the company is committed to staying at the forefront of technological advancements to meet future customer requirements.

-

Nol-Tec Systems operates as a global provider of equipment and systems for handling bulk materials. The company's expertise lies in various areas such as dense and dilute phase pneumatic conveying, weighing, and batching, pneumatic blending, as well as storage and unloading. Additionally, it offers automation and control integration services. The company's approach to innovative design is rooted in thoughtful insights, industry experience, and technical knowledge. The company is working in collaboration with clients, to develop advanced products in the market.

Key Pneumatic Conveying Systems Companies:

- Atlas Copco AB

- Coperion GmbH

- Cyclonaire Corporation

- Dongyang P & F

- Dynamic Air Inc.

- Flexicon Corporation

- Gericke AG

- Nol-Tec Systems Inc.

- VAC-U-MAX

- Schenck Process Holding GmbH

- Pneumatic Conveying, Inc.

- Nilfisk Group

- Gericke AG

- Flexicon Corporation

Recent Developments

-

In December 2022, VAC-U-MAX announced its partnership with Western Process Equipment. As per this partnership, Western Process Equipment was entrusted to represent the pneumatic conveying product line of VAC-U-MAX in Manitoba, Alberta, Saskatchewan, and British Columbia. The company’s product line comprises custom and &-engineered vacuum conveying systems, bulk bag loading & unloading systems, batch & continuous process automation systems, vacuum conveyor systems, bag dump stations, batch weighing systems, and packaging machine & feeder refill systems, among others.

-

In July 2022, Schenck Process announced plans to collaborate with Storage & Transfer Technologies for introducing a new lime injection system for electric arc furnace steel plants across the world. The key objective of this collaboration was to deliver a safe, efficient, precise, and reliable operation with the help of the company’s robust expertise in lime manufacturing, lime conveyance, and the steel industry.

-

In January 2022, Schenck Process Europe GmbH, the pneumatic conveying system manufacturer announced the partnership with theBlackhawk Equipment Corp (Lontra) to utilize the company’s compressor technology. The integration of Schenck Process’s technology and Lontra’s blower is expected to save the energy utilized.

-

In April 2021, the Air-Tec System underwent a strategic partnership with Neoplast to promote Italian technology-based pneumatic conveying systems utilized for bulk material handling in emerging economies of the Asia Pacific such as Nepal, Sri Lanka,Bangladesh, Maldives and India.

Pneumatic Conveying Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 34.44 billion

Revenue forecast in 2030

USD 48.37 billion

Growth rate

CAGR of 5.8% from 2023 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Operating principle type, technology, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany, Rest of Europe; China; India; Japan; South Korea; Singapore; Rest of APAC; Brazil; Mexico; Rest of Latin America; Middle East & Africa

Key companies profiled

Atlas Copco AB; Coperion GmbH; Cyclonaire Corporation; Dongyang P & F; Dynamic Air Inc.; Flexicon Corporation; Gericke AG; VAC-U-MAX; Schenck Process Holding GmbH; Pneumatic Conveying, Inc.; Nol-Tec Systems Inc.; Nilfisk Group; Gericke AG; Flexicon Corporation

Customization scope

Free report customization (equivalent to up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pneumatic Conveying Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pneumatic conveying systems market report based on operating principle, technology, end-use, and region:

-

Operating Principle Outlook (Revenue, USD Million, 2018 - 2030)

-

Dilute Phase Conveying

-

Dense Phase Conveying

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Positive Pressure Systems

-

Vacuum Systems

-

Combination Systems

-

-

End-Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceramic

-

Pharmaceuticals

-

Food Industry

-

Rubber and Plastic Industry

-

Cement

-

Mining (Mineral)

-

Automotive

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

The U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Spain

-

Denmark

-

Eastern Europe

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Southeast Asia

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

U.A.E.

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The pneumatic conveying systems market size was estimated at USD 30,818.8 million in 2022 and is expected to reach USD 32,572.4 million in 2023.

b. The pneumatic conveying systems market is expected to grow at a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 48,365.6 million by 2030.

b. Food industry dominated the pneumatic conveying systems market with a share of 29.2% in 2022. This is attributable to benefits offered such as high reliability, reduced risk of material spillage, low energy consumption, and low operational and maintenance costs.

b. Some key players operating in the pneumatic conveying systems market include Atlas Copco AB, Coperion GmbH, Cyclonaire Corporation, DongYang P & F, Dynamic Air Inc., Flexicon Corporation, and Gericke AG, among others.

b. Key factors that are driving the pneumatic conveying systems market growth include a rise in industrialization in emerging economies, expansion of recycling and waste treatment industries, and an upswing in the demand for energy-efficient systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.