- Home

- »

- Medical Devices

- »

-

Podiatry Services Market Size & Share, Industry Report, 2030GVR Report cover

![Podiatry Services Market Size, Share & Trends Report]()

Podiatry Services Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (General Podiatry, Podiatry Surgery, Sports Podiatry, Podopediatrics), By Facility (Hospitals & OPDs, Podiatry Offices/Clinics, Podiatry Office/Clinics), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-440-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Podiatry Services Market Summary

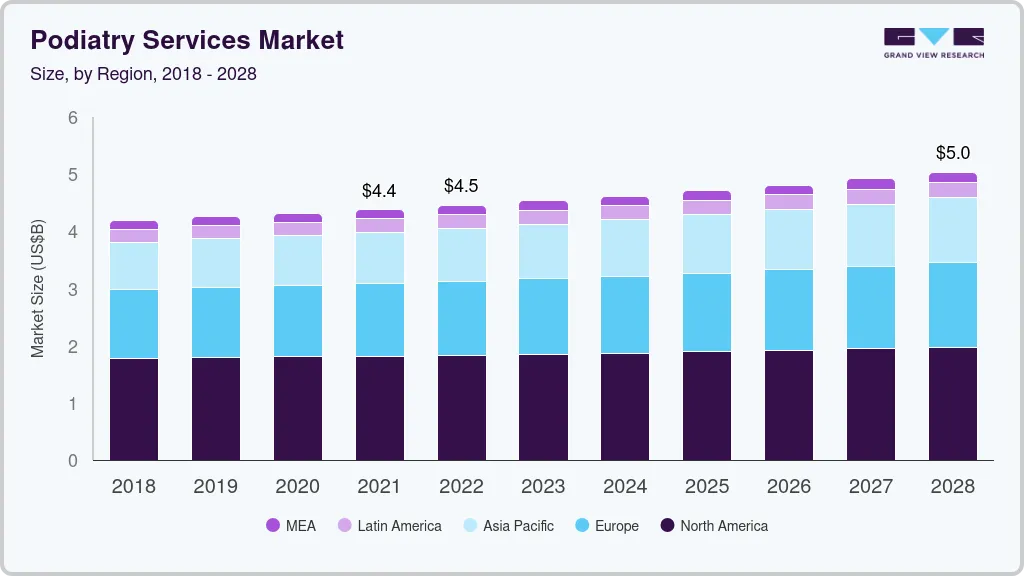

The global podiatry services market size was estimated at USD 4.53 billion in 2023 and is projected to reach USD 5.29 billion by 2030, growing at a CAGR of 2.3% from 2024 to 2030. The market growth is driven by the rising prevalence of chronic conditions such as diabetes and arthritis, significantly increasing the demand for specialized foot care.

Key Market Trends & Insights

- North America podiatry services market accounted for 41.8% of the global market revenue in 2023.

- The U.S. podiatry services market dominated the North America market in 2023

- By type, the general podiatry segment accounted for 44.1% of the market revenue in 2023.

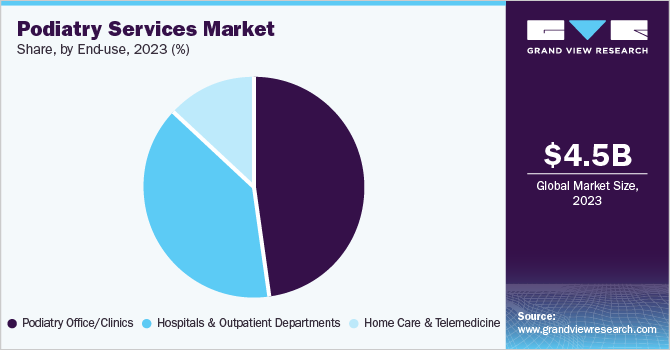

- By facility, the podiatry office/clinic segment dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 4.53 Billion

- 2030 Projected Market Size: USD 5.29 Billion

- CAGR (2024-2030): 2.3%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

In addition, there is a growing awareness of the importance of foot health and hygiene, encouraging more individuals to seek podiatric services. Technological advancements in diagnostic and treatment methods, such as advanced imaging modalities, further enhance the capabilities of podiatrists, making treatments more effective and accessible. Technological advancements, including advanced imaging techniques and minimally invasive procedures, enhance precision and effectiveness of podiatric treatments. The market is expected to grow further due to the increasing adoption of telemedicine and home care services, making podiatric care more accessible. Establishing specialized clinics and rehabilitation centers, along with government initiatives to include podiatry services in healthcare insurance, is expected to continue to support market expansion.

Type Insights

The general podiatry segment accounted for 44.1% of the market revenue in 2023. This segment includes routine foot care, treatment of common foot ailments such as bunions, calluses, and ingrown toenails, and preventive care for patients with chronic conditions like diabetes. The high prevalence of these conditions and the growing awareness of foot health contribute to its dominance.

The sports podiatry segment is expected to grow at a CAGR of 3.4% from 2024 to 2030. The increasing participation in sports and fitness activities and the rising incidence of sports-related injuries drive the demand for specialized sports podiatry services. Moreover, the integration of advanced technologies in treatment, such as laser therapies and telemedicine, enhances the appeal of sports podiatry services.

Facility Insights

The podiatry office/clinic segment dominated the market in 2023 attributed to its high accessibility and convenience, as well as the personalized care it provides. Additionally, the increasing number of podiatry clinics and the growing awareness of foot health contribute to the strong market presence of podiatry clinics.

The hospitals & outpatient departments segment is expected to grow fastest over the forecast period. This growth is driven by the increasing integration of podiatry services into general healthcare settings, which allows for comprehensive care and better management of complex foot and ankle conditions. Hospitals and outpatient departments often have advanced diagnostic and treatment facilities, which attract patients with severe or multifaceted conditions. Moreover, the trend towards multidisciplinary care, where podiatrists collaborate with other healthcare professionals, is further boosting the demand for podiatry services in these settings.

Regional Insights

North America podiatry services market accounted for 41.8% of the global market revenue in 2023 driven by the high prevalence of chronic conditions such as diabetes and arthritis, which necessitate specialized foot care. The region benefits from advanced healthcare infrastructure, high awareness about foot health, and significant healthcare expenditure. Additionally, numerous podiatry clinics and a strong network of healthcare professionals contribute to the market growth.

U.S. Podiatry Services Market Trends

The U.S. podiatry services market dominated the North America market in 2023 attributed to the well-established healthcare system and the high incidence of foot-related issues among its population. The U.S. market is characterized by a high demand for preventive and therapeutic podiatric services, driven by the aging population and the increasing prevalence of diabetes. Moreover, technological advancements and the integration of telemedicine have further enhanced the accessibility and quality of podiatric care in the country.

Asia Pacific Podiatry Services Market Trends

The Asia Pacific podiatry services market is projected to grow at the fastest rate over the forecast period. The increasing prevalence of diabetes and other chronic conditions in the region fuels this rapid growth. Additionally, rising healthcare awareness and improving healthcare infrastructure are contributing to the market expansion. Countries like India and China are seeing significant investments in healthcare, which is expected to boost the demand for podiatric services.

China, as a major player in Asia Pacific, is experiencing substantial growth in its podiatry services market. The increasing incidence of diabetes and the aging population are the primary drivers of this growth. The Chinese government's initiatives to improve healthcare access and the rising awareness about foot health are also contributing to the market expansion. Furthermore, the adoption of advanced diagnostic and treatment technologies is enhancing the quality of podiatric care in the country.

Europe Podiatry Services Market Trends

The European podiatry services market is expected to grow at a CAGR of 2.6% from 2024 to 2030 driven by the high prevalence of chronic conditions such as diabetes and arthritis, particularly among the aging population. Europe benefits from a well-established healthcare system and high awareness about foot health. The increasing adoption of advanced treatment methods and integrating podiatry services into general healthcare settings are also contributing to the market growth.

The UK podiatry services market is expected to experience steady growth in the coming years, driven by the high prevalence of foot-related issues and the aging population. The National Health Service (NHS) plays a significant role in providing accessible podiatric care. Additionally, the increasing awareness about foot health and the adoption of advanced treatment methods are contributing to the market expansion.

Latin America Podiatry Services Market Trends

The Latin American podiatry services market is witnessing growth due to the increasing prevalence of diabetes and other chronic conditions. Countries like Brazil and Mexico are seeing significant investments in healthcare infrastructure, which is expected to boost the demand for podiatric services.

Key Podiatry Services Company Insights

The global podiatry services market is driven by major companies such as Massachusetts General Hospital, Kaiser Permanente, The London Podiatry Center, The Royal Free Hospital, and Fortis Healthcare, among others.

-

Kaiser Permanente provides extensive podiatric care through its network of hospitals and clinics. Known for its preventive care programs, Kaiser Permanente focuses on managing chronic conditions such as diabetes, which significantly impact foot health.

-

The London Podiatry Centre specializes in both routine and complex podiatric treatments. The center is equipped with state-of-the-art diagnostic and therapeutic technologies, catering to patients with diverse foot and ankle issues.

Key Podiatry Services Companies:

The following are the leading companies in the podiatry services market. These companies collectively hold the largest market share and dictate industry trends..

- Massachusetts General Hospital

- Kaiser Permanente

- The London Podiatry Center

- The Royal Free Hospital

- Fortis Healthcare

- Beijing Puhua International Hospital

- Schoen Clinic

- AKA Optics SAS

- Seven Hills Hospitals

- Wockhardt Hospitals

- Apollo Hospitals

- Europe Hospitals - St-Michel Site

- Mediclinic Middle East

Recent Developments

-

In January 2024, CUC Inc., a subsidiary of M3 Inc., announced its acquisition of a controlling around 80% stake in Albaron Podiatry Holdings LLC. Albaron operates a premier podiatry service platform known as Beyond Podiatry. The acquisition aligned with CUC Inc.'s strategic expansion in the healthcare sector and was expected to provide Beyond Podiatry with enhanced resources to further elevate its comprehensive support services for podiatrists.

Podiatry Services Market Scope

Report Attribute

Details

Market size value in 2024

USD 4.62 billion

Revenue forecast in 2030

USD 5.29 billion

Growth rate

CAGR of 2.3% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, facility

Key companies profiled

Massachusetts General Hospital, Kaiser Permanente, The London Podiatry Center, The Royal Free Hospital, Fortis Healthcare, Beijing Puhua International Hospital, Schoen Clinic, AKA Optics SAS, Seven Hills Hospitals, Wockhardt Hospitals, Apollo Hospitals, Europe Hospitals - St-Michel Site, Mediclinic Middle East

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Podiatry Services Market Report Segmentation

This report forecasts revenue & volume growth of the podiatry services market and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global podiatry services market report based on type, facility, and region:

-

Type Outlook (Revenue, USD Million, 2024 - 2030)

-

General Podiatry

-

Podiatry Surgery

-

Sports Podiatry

-

Podopediatrics

-

-

Facility Outlook (Revenue, USD Million, 2024 - 2030)

-

Hospitals & Outpatient Departments

-

Podiatry Office/Clinics

-

Home Care & Telemedicine

-

-

Regional Outlook (Revenue, USD Million, 2024 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The podiatry offices/clinics segment dominated the podiatry services market and accounted for the largest revenue share of 49.1% in 2020.

b. In 2020, North America dominated the podiatry services market and accounted for the largest revenue share of 41.8%.

b. The global podiatry services market size was estimated at USD 4.3 billion in 2020 and is expected to reach USD 4.4 billion in 2021.

b. The global podiatry services market is expected to grow at a compound annual growth rate of 1.9% from 2021 to 2028 to reach USD 5.0 billion by 2028.

b. The general podiatry segment dominated the podiatry services market and accounted for the largest revenue share of 44.9% in 2020.

b. Some of the renowned hospitals & clinics in the podiatry services market are Massachusetts General Hospital, Kaiser Permanente, The London Podiatry Center, The Royal Free Hospital, Fortis Healthcare, Beijing Puhua International Hospital, and Schoen Clinic, among many others.

b. Key factors that are driving the podiatry services market growth include the growing prevalence of foot problems especially in diabetic and geriatric population which is around 6.3% and 24% respectively, and the growing awareness and preventive approach in children’s foot problem.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.