- Home

- »

- Advanced Interior Materials

- »

-

Point of Exit PFAS Treatment Systems Market Report, 2033GVR Report cover

![Point of Exit PFAS Treatment Systems Market Size, Share & Trends Report]()

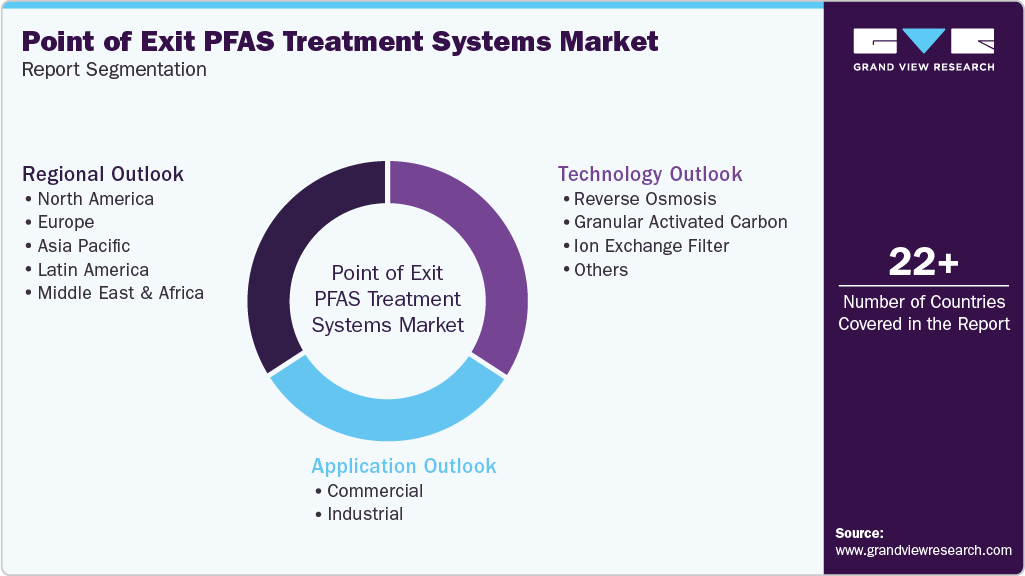

Point of Exit PFAS Treatment Systems Market (2025 - 2033) Size, Share & Trends Analysis Report By Technology (Reverse Osmosis, Granular Activated Carbon), By Application (Commercial, Industrial), By Region, and Segment Forecasts

- Report ID: GVR-4-68040-652-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Point of Exit PFAS Treatment Systems Market Summary

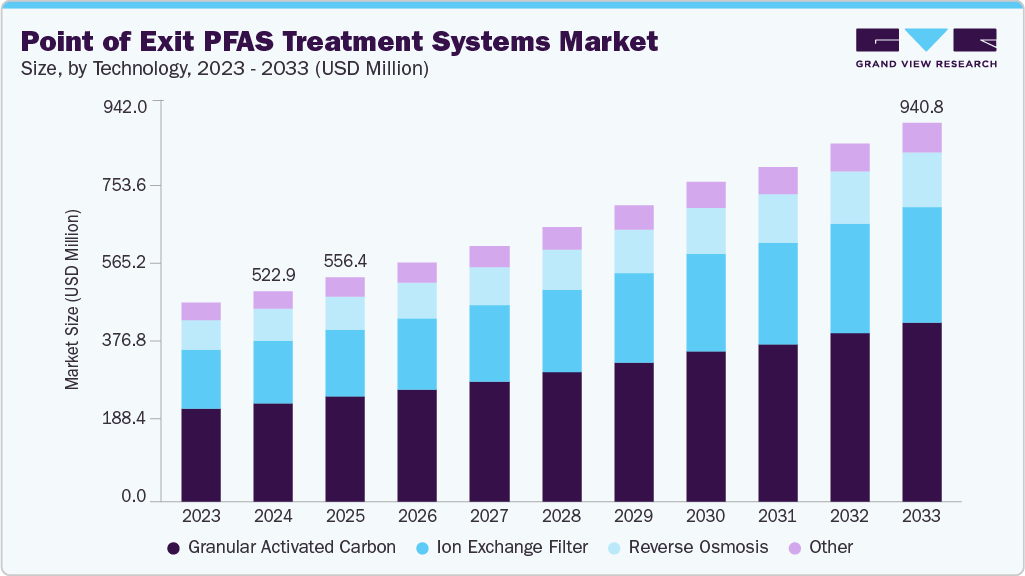

The global point of exit PFAS treatment systems market size was estimated at USD 522.9 million in 2024 and is anticipated to reach USD 940.8 million by 2033, growing at a CAGR of 6.8% from 2025 to 2033. The market is witnessing increased demand across a diverse range of commercial and industrial sectors as regulatory authorities intensify oversight of per- and polyfluoroalkyl substances (PFAS) discharge into drinking and process water systems.

Key Market Trends & Insights

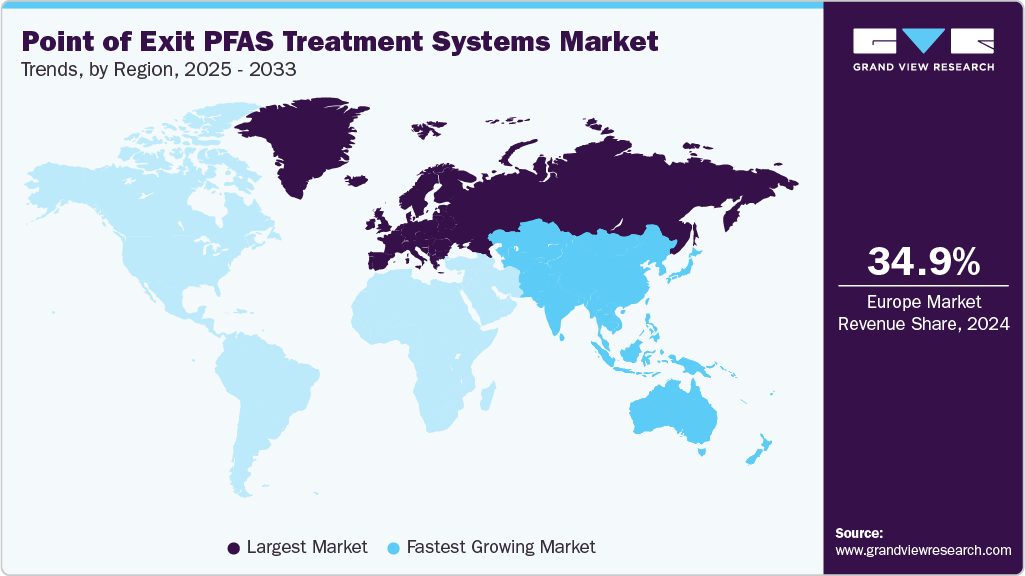

- Europe dominated the point of exit PFAS treatment systems market with the largest revenue share of 34.9% in 2024.

- The point of exit PFAS treatment systems market in the U.S. is expected to grow at a substantial CAGR of 7.7% from 2025 to 2033.

- By technology, Ion exchange filter segment is expected to grow at a considerable CAGR of 7.1% from 2025 to 2033 in terms of revenue.

- By application, commercial segment is expected to grow at a considerable CAGR of 7.5% from 2025 to 2033 in terms of revenue.

Market Size & Forecast

- 2024 Market Size: USD 522.9 Million

- 2033 Projected Market Size: USD 940.8 Million

- CAGR (2025-2033): 6.8%

- Europe: Largest market in 2024

- North America: Fastest growing region

Key End Use industries driving adoption include semiconductors, EV battery manufacturing, electroplating and polishing, paper mills, and wire manufacturing-all of which are known to involve PFAS either in their processes or waste streams. Industrialization and urban expansion have led to increased PFAS discharge into water bodies, driving demand for localized treatment at the point of use. In developing regions, lack of centralized water treatment systems boosts the need for decentralized solutions like point of exit systems.

In addition, rising consumer preference for self-managed water purification and growing investments in smart water technologies are boosting the market. Supportive government initiatives and funding for PFAS remediation are also contributing significantly to global market growth.

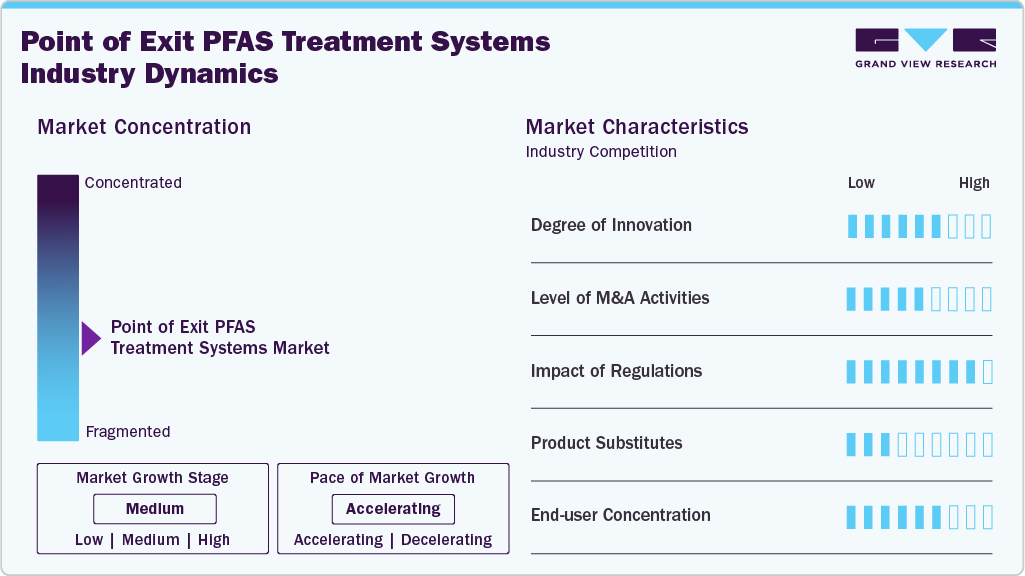

Market Concentration & Characteristics

The global point of exit PFAS treatment systems industry shows a moderately fragmented structure, with several international and local firms competing. Companies are emphasizing product advancements, collaborations, and acquisitions to enhance their market reach. Regional differences in regulations and the lack of uniform technology standards prevent full market consolidation. As a result, competition remains strong, encouraging ongoing innovation and tailored solutions.

The point of exit PFAS treatment industry is driven by continuous innovation in filtration and adsorption technologies. Companies are investing in advanced materials like nanotechnology-based filters and hybrid systems. Innovation is also focused on improving energy efficiency and reducing maintenance needs. These advancements aim to enhance system performance while keeping costs manageable for End Users.

Mergers and acquisitions are playing a key role in shaping the competitive landscape of the market. Larger firms are acquiring niche technology providers to expand their product portfolio and geographic presence. M&A activity is also helping companies integrate complementary technologies for better performance. This consolidation trend reflects the growing strategic importance of PFAS treatment capabilities.

Government regulations are a major driver shaping the point of exit PFAS treatment systems industry across non-residential sectors. Regulatory agencies worldwide-particularly in the U.S., Europe, and parts of Asia-are implementing stringent limits on PFAS concentrations in drinking and process water. These evolving standards are compelling commercial, industrial, and institutional facilities to adopt advanced POE solutions to ensure compliance. In response, manufacturers are accelerating innovation and securing certifications to meet regulatory benchmarks, especially in high-risk industries such as semiconductors, paper mills, electroplating, and medical device manufacturing, where PFAS use and discharge are prevalent.

Drivers, Opportunities & Restraints

Stricter PFAS regulations across industries such as semiconductors, paper mills, electroplating, and EV battery manufacturing are driving the adoption of point of exit treatment systems. Regulatory limits on PFAS discharge and contamination in process and utility water are pushing facilities to deploy localized solutions to ensure compliance and avoid liability.

Rising PFAS awareness in emerging industrial economies and increased government funding for contamination control present significant growth opportunities. Adoption is expected to rise in sectors like plastic films, cosmetics, waterproof outerwear, and wire manufacturing, especially with the development of modular, IoT-enabled POE systems tailored for process-specific needs.

High installation and maintenance costs remain a key barrier, particularly for smaller commercial and processing facilities. In addition, the lack of standardized certification for PFAS filtration technologies creates uncertainty, while challenges in safe disposal of used filter media add complexity and cost to long-term operation.

Technology Insights

Ion exchange filters segment is expected to grow at the fastest CAGR of 7.1% from 2025 to 2033 in terms of revenue. The granular activated carbon (GAC) segment led the market with the largest revenue share of 46.8% in 2024, due to its proven efficiency in adsorbing long-chain PFAS compounds. Its low operating cost and ease of integration into existing systems enhance its appeal. GAC is widely accepted by regulatory bodies, making it a preferred choice for compliance. Its scalability also supports both commercial and industrial applications globally.

The Ion exchange filters segment is anticipated to grow at the fastest CAGR during the forecast period, due to their superior performance in removing short-chain PFAS, which are harder to treat. These systems offer high selectivity and rapid treatment rates, making them ideal for point of exit use. Growing demand for compact and high-efficiency solutions drives their adoption in commercial and industrial setups. Technological advancements are also improving their cost-effectiveness and lifespan.

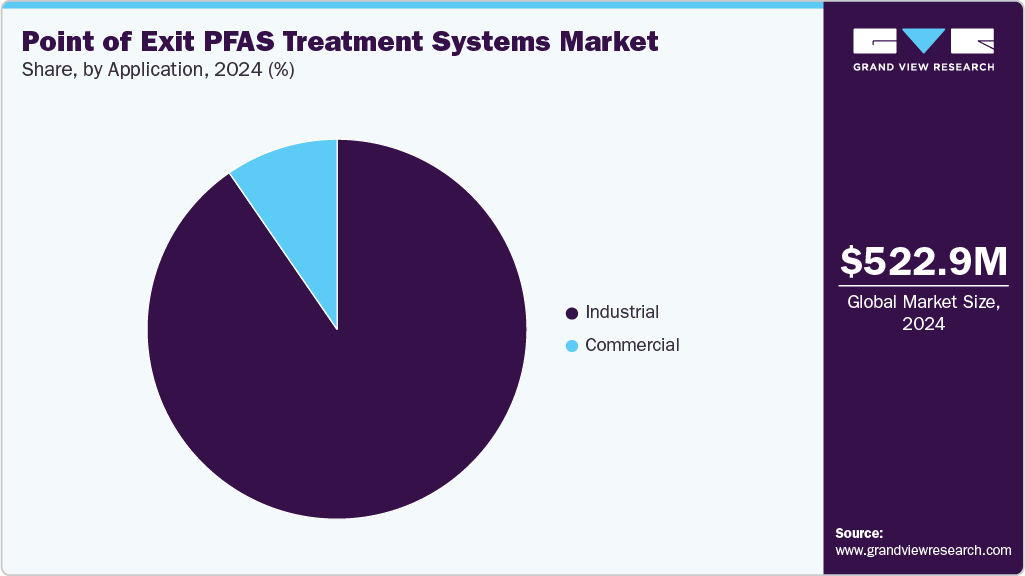

Application Insights

The commercial segment is expected to grow at the fastest CAGR of 7.5% from 2025 to 2033 in terms of revenue. The industrial segment led the market with the largest revenue share of 90.4% in 2024. The industrial sector leads the global point of exit PFAS treatment systems industry due to widespread PFAS usage in manufacturing. Industries such as chemicals, textiles, and electronics discharge PFAS-contaminated wastewater, necessitating on-site treatment. Strict environmental regulations compel facilities to install point of exit systems for compliance. Their ability to handle high-volume water treatment makes them ideal for industrial use.

The commercial segment is anticipated to grow at the fastest CAGR during the forecast period, driven by increased awareness of PFAS contamination in hospitality, healthcare, and office facilities. Businesses are prioritizing water safety to meet customer and employee health standards. Growing pressure from local regulations and sustainability goals supports wider adoption. Compact, efficient systems tailored for commercial settings are further boosting demand.

Regional Insights

The point of exit PFAS treatment systems market in North America is anticipated to grow at the fastest CAGR of 5.8% during the forecast period, propelled by rising PFAS contamination incidents and heightened public health concerns. The U.S. EPA's strict regulatory actions and funding for PFAS remediation are fueling the adoption of point of exit systems. The region’s strong regulatory enforcement and high public awareness are expected to sustain steady market growth over the coming years.

U.S. Point of Exit PFAS Treatment Systems Market Trends

The point of exit PFAS treatment systems market in the U.S. is growing due to heightened regulatory enforcement and industry accountability regarding PFAS discharge and contamination. The EPA’s recent regulations are prompting sectors such as semiconductors, medical instruments, paper mills, and electroplating to implement localized treatment solutions at facility exit points.

The Canada point of exit PFAS treatment systems market is expanding as more communities’ face challenges with emerging contaminants in water. Federal and provincial efforts to enhance water safety are encouraging use of individual treatment units.

Europe Point of Exit PFAS Treatment Systems Market Trends

Europe dominated the point of exit PFAS treatment systems market with the largest revenue share of 34.9% in 2024, due to stringent environmental regulations and proactive PFAS phase-out policies. Countries like Germany, the Netherlands, and Sweden have enforced tight limits on PFAS in water. Strong institutional frameworks and public support for clean water initiatives drive demand. High adoption of advanced filtration technologies supports the region’s leadership position.

The point of exit PFAS treatment systems market in Germany is experiencing growth due to heightened regulatory focus on industrial water safety. Increased detection of PFAS near industrial zones, airports, and military sites is driving demand for localized treatment solutions across sectors such as chemical manufacturing, leather processing, and metal finishing.

The UK point of exit PFAS treatment systems market is expanding as new drinking water regulations-effective from 2025-set stricter limits on PFAS concentrations. Rising detection of PFAS in raw water sources near industrial and commercial zones has driven demand for localized treatment solutions across sectors such as printing, textiles, cosmetics, and manufacturing.

Asia Pacific Point of Exit PFAS Treatment Systems Market Trends

The point of exit PFAS treatment systems market in Asia Pacific is witnessing steady growth as industrial expansion and urbanization contribute to PFAS pollution. Countries like China, Japan, and Australia are increasing regulatory focus on water quality. Public and private investments in water treatment infrastructure are rising.

The China point of exit PFAS treatment systems market is growing due to increasing PFAS detection in water sources near industrial hubs such as textile mills, chemical plants, and electronics manufacturing zones. The government’s push for stricter water quality standards and localized compliance is driving the adoption of POE systems in commercial and industrial facilities.

The point of exit PFAS treatment systems market in India is witnessing rising demand for point of exit PFAS treatment systems amid growing concerns over industrial wastewater discharge and the presence of PFAS in groundwater near tanneries, textile mills, and packaging industries.

Middle East & Africa Point of Exit PFAS Treatment Systems Market Trends

The point of exit PFAS treatment systems market in the Middle East & Africa is experiencing growth due to rising concerns over groundwater contamination and scarce clean water sources. Countries like the UAE and South Africa are implementing water quality regulations targeting emerging pollutants. Point of exit systems are gaining popularity in commercial and industrial sectors. Government initiatives and foreign investments are aiding technology deployment.

The UAE point of exit PFAS treatment systems market is witnessing growth due to the rise in PFAS contamination in desalinated and groundwater sources, particularly near industrial zones and military sites.

Latin America Point of Exit PFAS Treatment Systems Market Trends

The point of exit PFAS treatment systems market in Latin America growth is driven by increased awareness of water contamination risks in urban and industrial areas. Brazil and Mexico are actively investing in water safety initiatives and treatment technologies. Limited access to centralized water purification in some regions promotes point of exit adoption. International collaborations and aid programs also support market expansion.

The Brazil point of exit PFAS treatment systems market is witnessing growth due to increasing concerns over chemical contamination in water sources near industrial zones, tanneries, and paper manufacturing sites. Emerging legislative efforts to monitor and regulate PFAS discharge are encouraging commercial and industrial facilities to implement localized treatment solutions.

Key Point of Exit PFAS Treatment Systems Companies Insights

Some of the key players operating in the market include Culligan Water., DuPont, Pentair plc.

-

Culligan Water is a provider of water treatment solutions, offering point of use, point of entry, and point of exit systems for various applications. The company supplies PFAS filtration technologies used in commercial and industrial settings, including activated carbon and reverse osmosis systems. Culligan operates through a network of dealers and service providers across multiple regions, including North America, Europe, and the Middle East. The company’s offerings are aligned with regulatory requirements for emerging contaminants like PFAS.

-

DuPont operates across several key segments including Water Solutions, Electronics & Industrial, and Mobility & Materials, with its Water Solutions division being instrumental in the PFAS treatment market. It offers advanced purification technologies such as reverse osmosis membranes, ion exchange resins, and ultrafiltration systems used in municipal, industrial, and residential applications. In addition to POE PFAS systems, DuPont provides solutions for wastewater reuse, seawater desalination, and zero-liquid discharge operations.

Key Point of Exit PFAS Treatment Systems Companies:

The following are the leading companies in the point of exit PFAS treatment systems market. These companies collectively hold the largest market share and dictate industry trends.

- Revive Environmental Technology, LLC.

- DuPont

- Pentair plc.

- Aquasana

- Culligan Water

- Ion Exchange

- AECOM

- Calgon Carbon Corporation

- EcoWater Systems LLC

- Toshiba

- Thermax

- Arvia Technology

- Saltworks Technologies Inc.

- Xylem

- Veolia

Recent Developments

-

In May 2025, AqueoUS Vets introduced the FoamPro system, a foam fractionation technology designed to treat PFAS-contaminated water using an energy-efficient, vacuum-based process. The system offers a modular, plug-and-play design capable of handling various flow rates and challenging waste types, including firefighting foam residues and landfill runoff. Field performance showed it could remove over 99% of specific PFAS compounds like PFOS and PFOA. This launch expands the company’s treatment offerings with a practical solution for industrial and municipal PFAS mitigation.

-

In June 2024, AECOM partnered with Aquatech to advance the use of its DE-FLUORO™ technology, designed for effective PFAS destruction. This electrochemical process has been tested in the field and can treat various complex waste streams, including firefighting foam residues and leachate. Aquatech will manage the end-to-end deployment, from assessment to on-site implementation. The collaboration aims to make sustainable PFAS treatment more accessible and scalable for communities and industries.

Point of Exit PFAS Treatment Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 556.4 million

Revenue forecast in 2033

USD 940.8 million

Growth rate

CAGR of 6.8% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; UK; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Revive Environmental Technology, LLC.; DuPont; Pentair plc; Aquasana; Culligan Water; Ion Exchange; AECOM; Calgon Carbon Corporation; EcoWater Systems LLC; Toshiba; Thermax; Arvia Technology; Saltworks Technologies Inc.; Xylem; Veolia

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point of Exit PFAS Treatment Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global point of exit PFAS treatment systems market report based on technology, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2021 - 2033)

-

Reverse Osmosis

-

Granular Activated Carbon

-

Ion Exchange Filter

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Commercial

-

Industrial

-

Surgical & medical instruments

-

waterproof outerwear

-

Broad woven fabric mills

-

Perfumes & cosmetics

-

Plastic films

-

Carpets and rugs

-

Paints and varnishing

-

Paper mills

-

EV battery manufacturing

-

Packaging paper & plastic

-

Commercial printing

-

Leather & Hide tanning

-

Wire manufacturing

-

Electroplating/polishing

-

Semiconductor

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global point of exit PFAS treatment systems market size was estimated at USD 522.9 million in 2024 and is expected to be USD 556.4 million in 2025.

b. The global point of exit PFAS treatment systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2033 to reach USD 940.8 million by 2033.

b. The industrial application segment led the market and accounted for over 90.4% of the global revenue in 2024. The industrial sector leads the global point of exit PFAS treatment systems market due to widespread PFAS usage in manufacturing. Industries such as chemicals, textiles, and electronics discharge PFAS-contaminated wastewater, necessitating on-site treatment.

b. Some of the key players operating in the point of exit PFAS treatment systems market include Revive Environmental Technology, LLC.; DuPont; Pentair plc; Aquasana; Culligan Water; Ion Exchange; AECOM; Calgon Carbon Corporation; EcoWater Systems LLC; Toshiba; Thermax; Arvia Technology; Saltworks Technologies Inc.; Xylem; Veolia

b. Key factors driving the point of exit PFAS treatment systems market include stringent regulatory limits on PFAS levels, increased detection near industrial sites, rising health concerns, and the need for localized, compliant water treatment solutions across commercial and industrial sectors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.