- Home

- »

- Medical Devices

- »

-

Point Of Care CT Imaging Market Size & Share Report, 2030GVR Report cover

![Point Of Care CT Imaging Market Size, Share & Trends Report]()

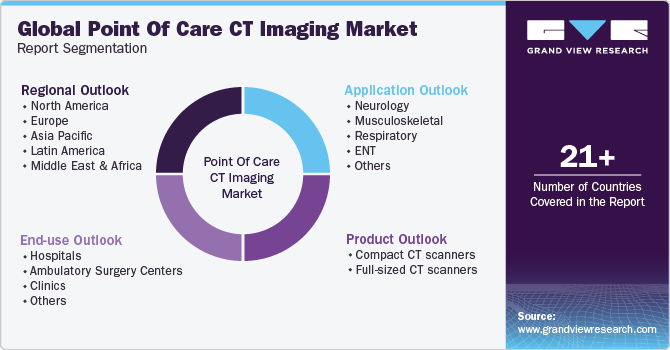

Point Of Care CT Imaging Market Size, Share & Trends Analysis Report By Product (Compact CT Scanner, Full-sized CT Scanner), By Application (Neurology, Respiratory), By End-use (Hospitals, ASCs), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-023-5

- Number of Report Pages: 190

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Point Of Care CT Imaging Market Trends

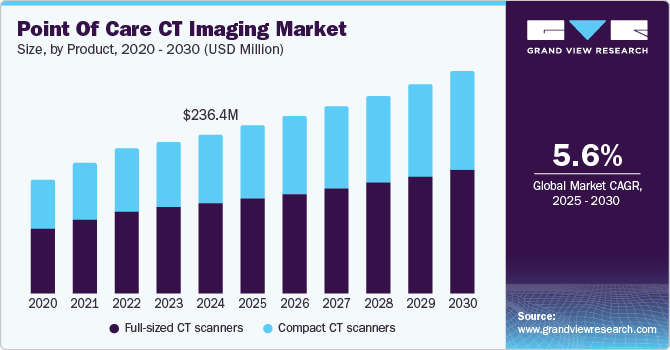

The global point of care CT imaging market size was estimated at USD 224.9 million in 2023 and is projected to grow at a CAGR of 5.59% from 2024 to 2030. Increasing prevalence of chronic disorders, technological advancements, growing emphasis on early diagnosis and treatment and the growing aging population are the major factors contributing to the market growth. For instance, according to data published by the Economic and Social Commission for Asia and the Pacific (ESCAP) in 2023, there are approximately 697 million older persons (aged 60 and over) living in Asia and the Pacific. This figure represents about 60 percent of the global elderly population.

Technological advancements are expected to have a significant impact on market growth, primarily through the development of portable and compact CT imaging devices. These innovations have made it possible to adopt CT imaging in various healthcare settings. For instance, in emergency rooms, these portable devices allow for immediate imaging of critical patients, facilitating rapid diagnosis and treatment decisions without the need to transfer patients to imaging department. In intensive care units, compact CT scanners enable continuous monitoring of patients with severe conditions, allowing for timely interventions. Furthermore, the portability of these devices is also beneficial in remote or rural locations, where access to advanced imaging facilities is often limited.

The growing initiatives undertaken by companies in the global market to secure a substantial market share are anticipated to further drive market growth. For instance, in 2022, Philips partnered with Roswell Park Comprehensive Cancer Center (Buffalo, New York, U.S.) to develop truck-based mobile CT lung cancer screening units.These units, equipped with Philips’ advanced Incisive CT scanners, are already supporting Roswell Park’s Project Eddy (Early Detection Driven to You) by facilitating increased lung cancer screenings within the community.

“For more than a decade, the incidence of lung cancer has been higher in the city of Buffalo than in the rest of the state of New York,”

-Dr. Mary Reid, Chief of Cancer Screening, Survivorship and Mentorship at Roswell Park Comprehensive Cancer Center (Buffalo, New York, USA).

“Since partnering with Project Eddy, we actually brought screening to our firehouses in Buffalo and caught cancers, and people are now healthy and able to return to work,”

-Chris Whelan, Trustee for Buffalo Professional Firefighters Local 282

Chronic diseases such as cardiovascular disease, cancer, diabetes, and respiratory disorders are on the rise globally, leading to an increased demand for diagnostic imaging to monitor and manage these conditions effectively. PoC CT imaging offers the advantage of immediate and accurate diagnostic capabilities at the patient’s location, enabling prompt decision-making and treatment. In addition, the aging population is expanding rapidly. Older adults are more prone to suffer from multiple chronic conditions that require frequent medical attention and medical imaging investigations. As the number of elderly individuals grows, so does the need for convenient, accessible, and rapid diagnostic solutions that can be provided without the need for transport to specialized facilities. PoC CT imaging meets this need by offering portable, high-quality imaging that can be utilized in various settings, including nursing homes, assisted living facilities, and at home.

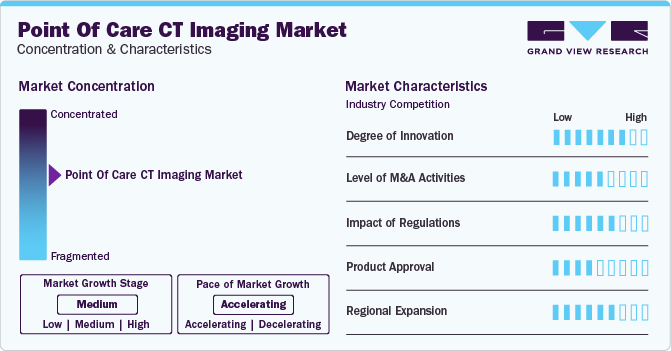

Market Concentration & Characteristics

The industry growth stage is moderate. The point of care (PoC) CT imaging industry has seen significant innovation, characterized by the development of advanced, portable CT imaging devices that can be easily transported and utilized in a variety of healthcare settings. These innovations include compact designs, and high-resolution scans. In addition, these devices are also equipped with enhanced connectivity features, enabling seamless integration with hospital information systems and electronic health records for efficient data sharing and patient management.

To expand their customer base and capture a larger industry share, major players in the industry are consistently improving their product offerings. This includes upgrading their current products with advanced technologies, pursuing strategic acquisitions to enhance their capabilities and presence, and securing necessary government approvals to ensure compliance and facilitate industry entry. For instance, in October 2022, NeuroLogica obtained CE marking for all Elite Mobile Computed Tomography Systems by complying with the new EU Medical Device Regulation (MDR 2017/745).

Point of care CT imaging has achieved a high degree of innovation due to remarkable technological advancements, such as the development of portable and high-resolution devices. These innovations have enabled immediate and accurate diagnostic capabilities in diverse healthcare settings, from emergency rooms to remote locations. For instance, in November 2023, Canon Medical Systems announced the integration of its Advanced intelligent Clear-IQ Engine (AiCE) Deep Learning Technology across all segments of its CT business, aiming to provide high-quality imaging at low doses for all patients.

Manufacturers of point of care CT imaging devices are undertaking partnership and collaboration activities. For instance, in January 2023, NeuroLogica Corp., a subsidiary of Samsung Electronics Co. Ltd., announced a collaboration with The University of Dundee in Scotland, United Kingdom, to conduct research using the OmniTom Elite with Photon Counting Detector (PCD) CT imaging technology.

“By utilizing the state-of-the-art equipment alongside the University of Dundee’s unique research and clinical expertise, together we can work to modernize the future of patient care.”

-Professor Grunwald, and executive member of SINAPSE

Regulations significantly impact point of care CT imaging by ensuring safety, efficacy, and quality standards. Compliance with regulatory requirements such as FDA approvals or CE marking is essential for industry entry and product usage. These regulations influence device design, manufacturing processes, and clinical practices, ultimately safeguarding patient well-being and increasing innovation in the field.

Industry participants are actively pursuing product approvals to maintain competitiveness. For instance, in November 2022, NeuroLogica Corp. announced that its comprehensive trauma imaging solution, the BodyTom 64 Point-of-Care Mobile Computed Tomography (CT) Scanner, received FDA clearance for commercial utilization in the U.S.

The geographical expansion of point of care CT imaging has been increasing moderately too significantly due to population growth, rising healthcare spending, and regulatory conditions.

Product Insights

The full-sized CT scanner segment led the largest market share with the largest revenue share of in 2023. Full-sized PoC CT scanners provide a wider range of imaging capabilities and high throughput, making them ideal for a variety of clinical applications. They are mostly preferred in larger healthcare facilities such as hospitals and imaging centers where there is a higher patient volume and the need for detailed diagnostic study. In addition, advancements in technology have led to improvements in full-sized PoC CT scanners, such as high imaging resolution, faster scan time, and reduced radiation dose, thus boosting the segment growth.

The compact CT scanner segment is expected to grow at a fastest CAGR from 2024 to 2030. This can be attributed to various factors, such as its portability, versatility, and convenience, allowing for their use in a wide range of clinical settings, including smaller healthcare facilities, outpatient clinics, and ambulatory care centers. In addition, the growing emphasis on point-of-care diagnostics and personalized medicine is driving the demand for compact CT scanners, as they enable immediate imaging and quick decision-making at the patient's bedside. Furthermore, the rising prevalence of chronic diseases and the aging population are fueling the need for accessible and efficient diagnostic solutions, further driving the adoption of compact CT scanners.

Application Insights

Based on application, the neurology segment led the market with the largest revenue share of 29.4% in 2023. The rising prevalence of neurological disorders, coupled with an aging population, has led to growing awareness for efficient diagnostic solutions in neurology. This device holds the ability to conduct immediate imaging at the patient's bedside or within neurocritical care units is crucial for facilitating timely diagnosis and treatment decisions, particularly in acute neurological emergencies such as strokes or traumatic brain injuries. Point-of-care CT scanners offer the advantage of rapid imaging acquisition, enabling healthcare providers to quickly assess patients' neurological status and determine the most appropriate course of action.

The respiratory segment is expected to grow at the fastest CAGR over the forecast period. The growing prevalence of respiratory disorders worldwide such as pneumonia, chronic obstructive pulmonary disease (COPD), and lung cancer, are major contributing factors to segment growth. For instance, according to the International Agency for Research on Cancer in 2022, Lung cancer cases ranked first among all other cancers, and about 2,480,675 lung cancer cases were reported worldwide.

Point-of-care CT scanners offer a crucial diagnostic tool for assessing respiratory health, enabling healthcare providers to promptly detect and evaluate pulmonary abnormalities, monitor disease progression, and guide treatment decisions. Furthermore, the increasing emphasis on early detection and management of respiratory diseases, is expected to boost the segment growth.

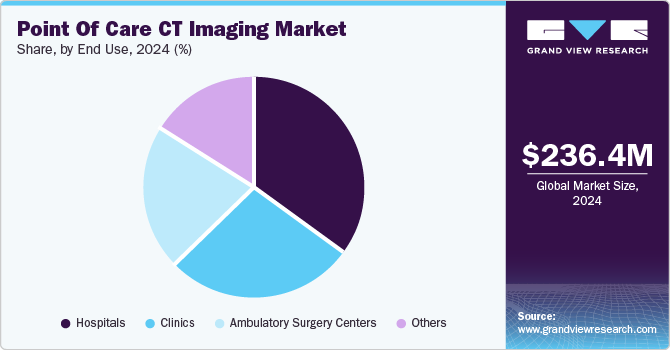

End-use Insights

Based on end-use, the hospital segment led the market with the largest revenue share of 35.1% in 2023 and are further expected to grow at the fastest CAGR over the forecast period. The growing adoption of this technology by hospitals is a major factor contributing to the segment growth. For instance, in May 2024, Surrey and Sussex Healthcare NHS Trust introduced a new mobile CT scanner at Crawley Hospital to enhance the capacity for outpatient diagnostic appointments for the local community. In addition, factors like high patient volume, availability of advanced medical devices, specialized staff, and the need for rapid on-site diagnostic imaging make hospitals a preferred choice for medical diagnosis.

“We are delighted to have this opportunity to start putting into practice the principles of Community Diagnostic Centres offering responsive high-quality diagnostics where patients can easily access them - reducing waiting times for all our patients and ensuring our hospital imaging facilities are able to respond to the needs of our most acutely unwell patients.”

- Dr Tony Newman-Sanders, consultant radiologist and chief of cancer and diagnostics at the Trust

The ambulatory surgery centers (ASCs) segment is expected to grow at the fastest CAGR during the forecast period. The growing development of compact point of care CT imaging devices to be incorporated in outpatient settings such as ASCs is expected to drive the segment. Moreover, patients opt for ASCs to avoid the extra cost associated with the hospital stay. This cost-efficiency, coupled with the convenience and shorter recovery times of outpatient care, contributes to the rising patient preference for ASCs. Thus, the aforementioned factors are expected to contribute to the market growth.

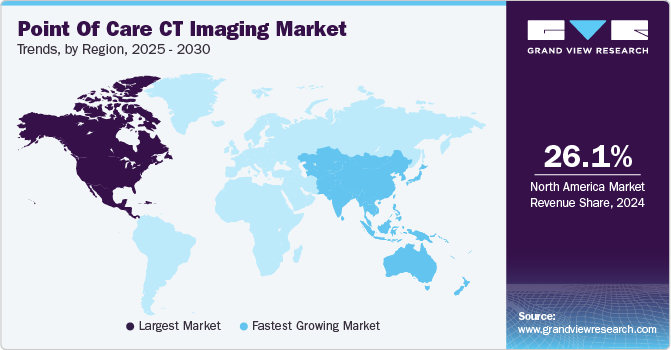

Regional Insights

North America dominated the point of care CT imaging market with the largest revenue share of 26.2%, in 2023. Several factors contribute to this trend, such as highly advanced healthcare infrastructure, presence of leading market players in this region, adoption of advanced imaging technologies and the growing prevalence of chronic disorders.

U.S. Point Of Care CT Imaging Market Trends

The point of care CT imaging market in U.S. held the largest market share in the North America region in 2023. The country has a high incidence of chronic diseases and a significant number of emergency and critical care situations that demand rapid and precise diagnostic tools, further boosting the demand for PoC CT imaging. For instance, according to data published by the American Hospital Association, 133 million Americans, nearly half the population, suffer from at least one chronic illness, such as hypertension, heart disease, or arthritis.

Europe Point Of Care CT Imaging Market Trends

The point of care CT imaging market in Europe held a significant market share in 2023. European countries have strong healthcare funding and reimbursement policies which support the acquisition and utilization of advanced imaging technologies. In addition, the increasing prevalence of chronic disorders, such as cancer, is expected to drive the adoption of these devices. For instance, according to the International Agency for Research on Cancer in 2022, about 4,471,422 new cancer cases were reported in this region.

The UK point of care CT imaging marketis expected to grow at the fastest CAGR over the forecast period, owing to the rising awareness and adoption of medical imaging coupled with increasing government initiatives in the country. For instance, in March 2024, Planning permission has been granted for the new Plymouth Community Diagnostic Centre (PCDC) to be constructed in the West End. Plymouth City Council has approved the plans for this new facility, which will offer over 91,600 imaging tests at its location in Colin Campbell Court. Patients will be able to visit the PCDC for various tests, including MRI, CT, X-ray, lung cancer screening, ultrasound, audiology, ECG, point of care testing, and blood tests.

The point of care CT imaging market in France is expected to grow at the substantial CAGR over the forecast period. In June 2021, the government announced the Health Innovation 2030 plan, with a budget of 7.5 billion euros. This initiative aims to increase innovation and advancements in the healthcare sector over the next decade.

The Germany point of care CT imaging market is expected to grow at the significant CAGR over the forecast period, due to the rapid aging of the population, leading to a higher incidence of chronic disorders. PoC CT imaging provides convenient and effective solutions for diagnosing and managing these conditions, offering precise results that facilitate timely treatment decisions.

Asia Pacific Point Of Care CT Imaging Market Trends

The point of care CT imaging market in Asia Pacificis estimated to witness at the fastest CAGR during the forecast period. This can be attributed to the growing adoption of this technology in this region. For instance, in December 2022, NeuroLogica Corp., announced the installation of its SmartMSU with OmniTom Elite for head imaging - in the Asia-Pacific region.

The China point of care CT imaging market is expected to grow at the substantial CAGR over the forecast period, this expansion is primarily driven by the presence of leading market players within the country, each employing various strategies to hold a prominent market share.

The point of care CT imaging market in Japanis expected to grow at the significant CAGR over the forecast period. This expansion is primarily attributed to the country's focus on technological innovation and the widespread adoption of advanced medical technology.

The India point of care CT imaging marketis expected to grow at a rapid CAGR over the forecast period. This expansion is primarily due to adoption of advanced imaging technology and the growing prevalence of chronic disorders in the country.

Latin America Point Of Care CT Imaging Market Trends

The point of care CT imaging in the Latin America market is anticipated to grow at a moderate CAGR throughout the forecast period. This growth is fueled by increasing demand for PoC CT imaging systems due to the increasing prevalence of chronic diseases and the necessity for effective diagnostic tools. In addition, the growth is also supported by government initiatives and investments in healthcare infrastructure in this region.

Middle East & Africa Point Of Care CT Imaging Market Trends

Thepoint of care CT imaging in Middle East & Africa is expected to grow at the fastest CAGR during the forecast period, owing to the robust economies and significant investments in healthcare infrastructure. Countries like the UAE and Saudi Arabia are leading the adoption of advanced medical technologies. Thus, there is a rising focus on integrating PoC CT imaging systems into their healthcare systems to address the need for efficient and rapid diagnostic solutions. Moreover, governmental support for expanding healthcare services in these countries is expected to contribute to the increasing demand for PoC CT imaging.

Key Point Of Care CT Imaging Company Insights

The major as well as emerging players in this industry are actively pursuing various initiatives to secure a significant share of the market. These initiatives involve different strategies aimed at strengthening their market position and competitiveness. Established companies use their existing resources, brand reputation, and market presence to grow their offerings. Whereas emerging players concentrate on specialized markets or innovative technologies to establish themselves in the industry. For instance, as a key technology partner in the Australian Stroke Alliance, Micro-X is in the process of developing a CT scanner that is lightweight and can be integrated into any ambulance.

Key Point Of Care CT Imaging Companies:

The following are the leading companies in the point of care CT imaging market. These companies collectively hold the largest market share and dictate industry trends.

- Xoran Technologies, LLC

- CurveBeam

- Planmed

- NeuroLogica Corp.

- Siemens Healthcare GmbH

Recent Developments

-

In January 2024, Varian, a Siemens Healthineers company, has entered into a 10-year, $175 million CAD (approximately $131 million USD) multi-disciplinary oncology partnership (MDOP) with Nova Scotia Health. This collaboration aims to enhance the patient journey across the Nova Scotia Health system, accelerating progress from screening to survivorship in oncology care

-

In December 2023, OU Health collaborates with Siemens Healthineers to enhance healthcare in Oklahoma, promote research, and innovation. The 10-year Value Partnership encompasses imaging and laboratory equipment

-

In September 2022, CurveBeam, LLC and StraxCorp Pty Ltd announced a merger agreement resulting in the establishment of CurveBeam AI Limited. This merger enables CurveBeam AI to broaden CurveBeam's economically sustainable point-of-care imaging solutions into the realm of bone health, while also serving as a platform for the development of artificial intelligence (AI) driven applications for weight-bearing CT (WBCT) imaging

Point of Care CT Imaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 236.4 million

Revenue forecast in 2030

USD 327.8 million

Growth rate

CAGR of 5.59% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Xoran Technologies, LLC; CurveBeam; Planmed; NeuroLogica Corp.; Siemens Healthcare GmbH

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point Of Care CT Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global point of care CT imaging market report on the basis of product, application, end-use and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Compact CT scanners

-

Full-sized CT scanners

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Neurology

-

Musculoskeletal

-

Respiratory

-

ENT

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgery Centers

-

Clinics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the point of care CT imaging market include Xoran Technologies, LLC, CurveBeam, Planmed, NeuroLogica Corp., and Siemens Healthcare GmbH.

b. The global point of care CT imaging market size was estimated at USD 224.9 million in 2023 and is expected to reach USD 236.4 million in 2024.

b. The global point of care CT imaging market is expected to grow at a compound annual growth rate of 5.59% from 2024 to 2030 to reach USD 327.8 million by 2030.

b. North America dominated the point of care CT imaging market with a share of 26.20% in 2023. This is attributable to the presence of major market players such as Xoran Technologies, and CURVEBEAM.

b. Key factors that are driving the point of care CT imaging market growth include the increasing prevalence of chronic disorders, technological advancements, growing emphasis on early diagnosis and treatment and the growing aging population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."