- Home

- »

- Clinical Diagnostics

- »

-

Point-Of-Care Glucose Testing Market Size Report, 2030GVR Report cover

![Point-of-Care Glucose Testing Market Size, Share & Trends Report]()

Point-of-Care Glucose Testing Market Size, Share & Trends Analysis Report By Product (Accu Check Aviva Meter, Onetouch Verio Flex, i-STAT), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-134-4

- Number of Report Pages: 145

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Market Size & Trends

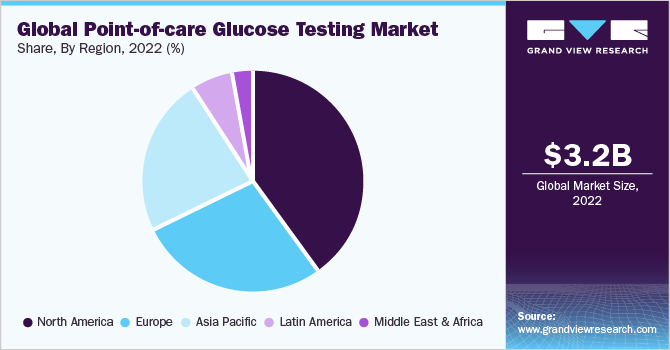

The global point-of-care glucose testing market size was valued at USD 3.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.1% from 2023 to 2030. The growing geriatric population, the ability of point-of-care (POC) diagnostic tests to deliver immediate results, thus providing improved patient care, and rising market penetration of electronic medical records (EMRs) are among the high-impact rendering drivers of this market. The shortage of skilled staff, especially in the field of diagnostics, is also expected to increase the market penetration of glucose POC diagnostic products.

Thus, diabetes management is one of the key priorities among healthcare professionals to limit the mortality rate. According to a survey by the Diabetes Research Foundation, diabetes increases the risk of a fatal outcome by 50% among COVID-19 patients. The growing awareness about diabetes management, poor healthcare access, scarcity of healthcare professionals, and the highest global prevalence recorded in Asian countries are likely to increase the adoption of PoC glucose testing solutions. This, in turn, creates an opportunity to reduce the healthcare burden by improving patient outcomes.

The introduction of favorable regulatory policies aimed at promoting PoC glucose diagnostics is expected to serve as a high impact rendering driver for the market. For example, in the U.S., the implementation of Clinical Laboratory Improvement Amendments (CLIA) is expected to boost usage rates during the forecast period. CLIA-waived tests are approved for use by healthcare providers operating in nontraditional laboratory sites, such as emergency rooms, physician offices, pharmacy clinics, health department clinics, and other healthcare facilities. The prevalence of diabetes is increasing worldwide, which is expanding the patient pool for the market.

Furthermore, the presence of unmet medical needs for diagnosis and management of diabetes and the increase in patient awareness are expected to boost the demand for POC diagnostics. According to the International Diabetes Federation, an estimated 537 million people had diabetes in 2021, and the number is projected to increase to 643 million by 2030 and 783 million by 2045. The healthcare industry is focusing on shorter hospital stays, better acute care, and the expansion of outlying surgical centers, which has consequently increased the demand for Short Turn-Around Testing (STAT). POC management solutions allow patients and healthcare providers to easily collect, share, and manage specimens to meet regulatory requirements.

In March 2023, Astellas Pharma Inc. announced a collaboration with Roche Diabetes Care Japan Co., Ltd. to develop and commercialize the world-renowned Accu-Chek Guide Me blood glucose monitoring system with advanced accuracy as a combined medical product with BlueStar. Welldoc, Inc. created BlueStar, an FDA-cleared digital health solution for diabetes patients that is being offered in the United States and Canada. BlueStar is being developed in Japan by Astellas and Welldoc. Astellas will seek regulatory clearance and reimbursement for a combined medical product in the future.

Product Insights

The others product segment accounted for the largest share of more than 54.6% of the global revenue in 2022 and will continue expanding at a steady CAGR during the forecast period. POC monitoring devices allow home-based self-monitoring of blood glucose levels and help patients perform routine activities with ease. These devices are also being used in inpatient settings as they are easy to use while offering quick results. Several glucose meters have been launched in the industry to suffice the significant need for diabetes monitoring technologies across hospitals, clinics, and other medical settings.

The Accu-Chek Inform II segment held the second-largest share in 2022. The FreeStyle Lite product segment is expected to witness the fastest growth rate over the forecast period. FreeStyle Lite is offered by Abbott and is available in discreet size with an in-built portlight and backlight, which makes it user-friendly for patients with a busy lifestyle. The product is used for measuring blood sugar from samples collected from fingers, forearm, hand, upper arm, and thigh. It is recommended to use the FreeStyle Lite meter only with the FreeStyle control solution and testing strips as the usage of other control solutions and test strips can yield inaccurate results.

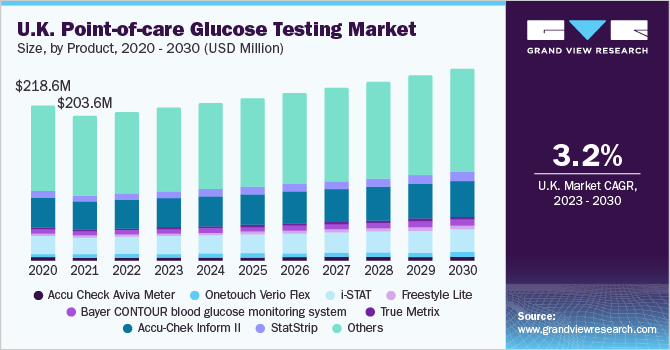

Regional Insights

North America dominated the global market in 2022. The regional market accounted for the largest share of over 40.3% of the overall revenue in the same year. It is expected to maintain its lead even during the forecast period. This region is home to several key market players, such as Abbott, Nova Biomedical, and Prodigy Diabetes Care, LLC. This has increased the availability of glucose testing products, thereby contributing to the revenue generation of the regional market. In addition, higher healthcare expenditure by governments on diabetes management is one of the factors responsible for the regional market growth.

The waiver of CLIA for certain POC glucose testing products is the most significant driver of this market. CLIA refers to regulatory standards imposed by the U.S. FDA on all clinical laboratory tests performed on humans except clinical trials and basic research. Asia Pacific is expected to be the most attractive POC diagnostics market owing to the presence of high unmet medical needs and constantly improving healthcare infrastructure in countries witnessing rapid economic development, including India and China.

The waiver of CLIA for certain POC glucose testing products is the most significant driver of this market. CLIA refers to regulatory standards imposed by the U.S. FDA on all clinical laboratory tests performed on humans except clinical trials and basic research. Asia Pacific is expected to be the most attractive POC diagnostics market owing to the presence of high unmet medical needs and constantly improving healthcare infrastructure in countries witnessing rapid economic development, including India and China.Furthermore, local manufacturers are continuously evolving in terms of technological advancements and are incorporating latest technologies, such as Picture Archiving and Communication Systems (PACS) and Electronic Medical Records (EMR), which is expected to drive the market growth during the forecast period. Research studies performed on analyzing glucose POC testing compliances offer useful insights for users.

Key Companies & Market Share Insights

The market is highly fragmented with the presence of many large-, small-, and medium-scale vendors. Key players are focusing on multiple growth strategies, such as new product launches, expansions, collaborations, partnerships, and acquisitions. In January 2022, Roche introduced the Cobas pulse, a point-of-care blood glucose monitor meant for hospital personnel, along with a companion gadget structured like a touchscreen smartphone that will run its own apps. The Cobas pulse will begin shipping to certain European countries with a CE mark. Some prominent players in the global point-of-care glucose testing market include:

-

F. Hoffmann-La Roche Ltd.

-

Abbott

-

Nipro

-

PlatInium Equity Advisors, LLC (Lifescan, Inc.)

-

Nova Biomedical

-

ACON Laboratories

-

Trividia Health, Inc.

-

Prodigy Diabetes Care, LLC

-

Bayer AG/Ascensia Diabetes Care Holdings AG

-

EKF Diagnostics

Point-of-Care Glucose Testing Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.40 billion

Revenue forecast in 2030

USD 4.51 billion

Growth rate

CAGR of 4.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2016 - 2021

Forecast period

2023 - 2030

Report updated

May 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

F. Hoffmann-La Roche Ltd.; Abbott; Nipro; PlatInium Equity Advisors, LLC (Lifescan, Inc.); Nova Biomedical; ACON Laboratories; Trividia Health, Inc.; Prodigy Diabetes Care, LLC; Bayer AG/Ascensia Diabetes Care Holdings AG; EKF Diagnostics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point-of-Care Glucose Testing Market Report Segmentation

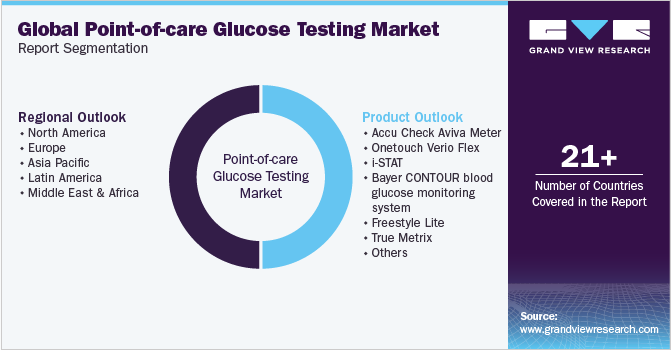

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2016 to 2030. For the purpose of this study, Grand View Research has segmented the global point-of-care glucose testing market report on the basis of product, and region:

-

Product Outlook (Revenue, USD Million, 2016 - 2030)

-

Accu Check Aviva Meter

-

Onetouch Verio Flex

-

i-STAT

-

Bayer CONTOUR Blood Glucose Monitoring System

-

Freestyle Lite

-

True Metrix

-

Accu-Chek Inform II

-

StatStrip

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2016 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global point-of-care glucose testing market size was estimated at USD 3.2 billion in 2022 and is expected to reach USD 3.4 billion in 2023.

b. The global point-of-care glucose testing market is expected to grow at a compound annual growth rate of 4.1% from 2023 to 2030 to reach USD 4.51 billion by 2030.

b. North America dominated the point-of-care glucose testing market with a share of 40.3% in 2022. This is attributable to the presence of key players such as Abbott, Nova Biomedical, and Prodigy Diabetes Care, LLC.

b. Some key players operating in the point-of-care glucose testing market include F. Hoffmann-La Roche Ltd., Abbott, Nipro, Nova Biomedical, ACON Laboratories, Inc., Trividia Health, Inc., Prodigy Diabetes Care, LLC, Bayer AG/Ascensia Diabetes Care Holdings AG, and EKF Diagnostics.

b. Key factors that are driving the point-of-care glucose testing market growth include the increasing diabetes population and technological population.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."