- Home

- »

- Clinical Diagnostics

- »

-

Point Of Care Infectious Disease Testing Market Report, 2030GVR Report cover

![Point Of Care Infectious Disease Testing Market Size, Share & Trends Report]()

Point Of Care Infectious Disease Testing Market Size, Share & Trends Analysis Report By Technology, By Disease (HIV POC, Clostridium Difficile POC), By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-569-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

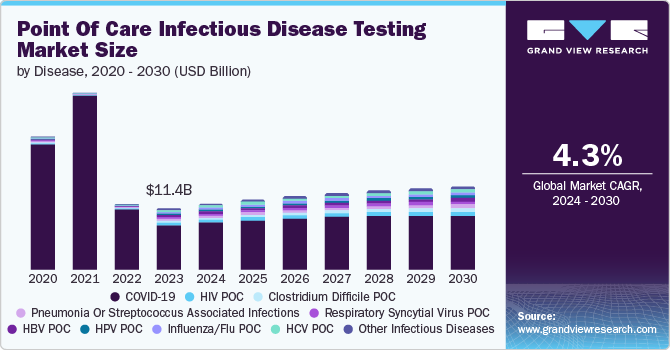

The global point of care infectious disease testing market size was valued at USD 11.40 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. The market is driven by the rising infectious diseases, demand for precise diagnostics tools and technological advancements such as molecular diagnostics & agglutination test. The rising contagious disease and increasing aging population along with the supportive government policies promoting the adoption of point of care (POC) testing are the factors likely to fuel the market growth during the forecast period.

The rising demand for diagnostic tools is increasing due to the increasing number of infectious diseases such as HIV, hepatitis, and tuberculosis. These point-of-care tests are becoming more common as many illnesses need to be found early to be treated as soon as possible. There is an increasing shift towards rising communicable diseases and rise in home healthcare preferred by many patients, especially the elderly and individuals with chronic conditions such as heart disease, diabetes and cancer. This shift contributes to POC diagnostics tools by allowing tests to be done outside typical medical places, even at home. This brings benefits like convenience, lower expenses, and more control for patients. Easy-to-use POC tests give accurate results, letting patients keep tabs on their health and require fewer doctor hospital visits.

Disease Insights

COVID-19 segment dominated the market and accounted for a share of 67% in 2023. This high percentage can be attributed to the rising number of infectious cases and need for fast and accessible diagnostics testing solutions. Point-of-care tests were crucial as they delivered results quickly, allowing for rapid identification and management of cases. These tests could be done outside traditional labs, like in clinics or even at home, making them highly convenient.

The pneumonia or streptococcus associated infections segment is anticipated to witness the fastest CAGR during the forecast period, owing to the rising cases of communicable disease and developments of new drugs in treatment of disease. Pneumococcal disease is caused by bacteria called Streptococcus pneumonia. Streptococcus bacteria are very common and can be spread easily through an infected person owing to rapid diagnosis importance to the disease. POC test provides faster results, allowing for faster treatments.

Technology Insights

Molecular diagnostics accounted for the largest market revenue share of 43.0% in 2023, owing to rising number of patients due to infectious disease and advancements in molecular testing. Molecular tests are highly accurate and capable of detecting genetic materials. Molecular diagnostics devices deliver faster and accurate results, which is essential for patient care and helpful for doctors for quicker treatment decisions.

Lateral flow immunoassay is expected to register the fastest CAGR of 5.7% during the forecast period. The growth can be attributed to increasing prevalence of infectious diseases such as respiratory disease and technological advancements in point of care diagnostics device. A lateral flow immunoassay is a diagnostic device that confirms the presence of substance from a sample. Lateral flow tests are portable and lightweight and are great for point of care settings such as homes, offices and remote regions with small healthcare facilities. The rise in consumer demand for lateral flow immunoassay devices is likely to drive the growth due to its several benefits.

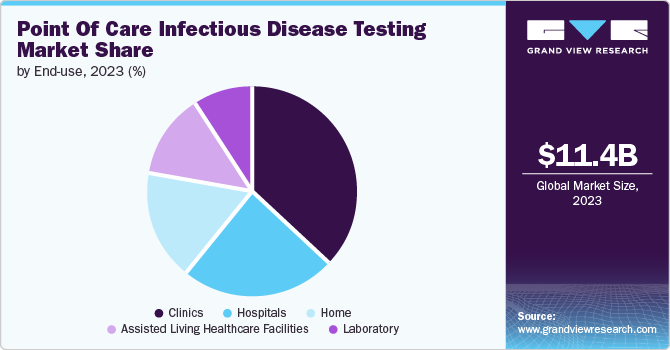

End Use Insights

The clinics segment dominated the market in 2023. The growth can be attributed to increasing establishments of point of care diagnostics laboratory centers and rising number of communicable diseases. Clinics play a crucial role serving as an important point of care center for treating and testing patients for various diseases such as TB, etc.

The home segment is projected to grow at the fastest CAGR of 5.5% over the forecast period, owing to increasing adoption of point of care testing among geriatric population and increasing emphasis on personalized and preventive home care facilities. Home care provides patients with convenience and accessibility. Easy-to-use tools for diagnosing infectious diseases at home allow patients to test themselves without requiring healthcare professionals. Moreover, convenience encourages people to manage their health better by getting tested quickly, which helps find and treat infectious diseases early.

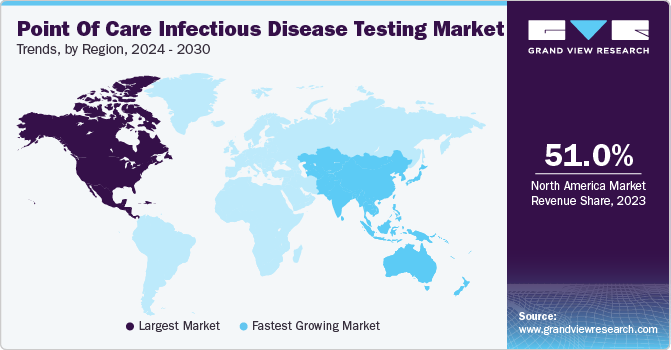

Regional Insights

North America point of care infectious disease testing market dominated the market with the revenue share of 51.0% in 2023 owing to the rising number of infectious and advancements in technology. The presence of advanced healthcare infrastructure, high adoption of point of care testing and home to some of largest companies operating in point of care infectious disease testing market are some of the factors propelling the market growth. Moreover, the rising healthcare expenditure and increasing geriatric population in countries such as U.S. Canada & Mexico is boosting the region growth.

U.S. Point Of Care Infectious Disease Testing Market Trends

The U.S. point of care infectious disease diagnostics dominated the North America market with a share of 82.6% in 2023 due to rising number of infectious in the nation. According to centers for disease control and prevention, there were more than 9,500 cases of TB registered in 2023, a 16% increase from 2022. Furthermore, the country has a robust infrastructure for research and development and a better advanced healthcare system.

Europe Point Of Care Infectious Disease Testing Market Trends

Europe point of care infectious disease testing market was identified as a lucrative region in 2023. The growth can be attributed to the increasing prevalence of infectious disease. Rising healthcare expenditure and growing awareness among people for point of care testing is driving the region’s growth. The private sector is playing a crucial role in development of new diagnostics devices which are easy to use and convenient.

The UK point of care infectious disease testing market is expected to grow rapidly in the coming years due to increasing number of communicable disease and public health initiatives. The UK government focuses strong emphasis on public health and preventing health issues, with support from organizations such as National Health Service. Furthermore, the health initiatives and research & development by the UK government is likely to contribute to the growth in the country.

The point of care infectious disease testing market in Germany held a substantial market share in 2023 owing to increasing geriatric population and rising prevalence of infectious disease. The country possesses robust healthcare infrastructure and ranks 3rd in healthcare innovation. Moreover, the government policy and initiatives for healthcare system such as mandatory health insurance for all residents is likely to propel the region’s growth.

Asia Pacific Point Of Care Infectious Disease Testing Market Trends

Asia Pacific market point of care infectious disease diagnostics is anticipated to witness the fastest CAGR of 5.0% during the forecast period. This growth is due to the significantly increasing population in the region and rising infectious diseases. Infectious diseases are more common compared to other places and infectious diseases spread easily due to large and rising geriatric population in countries like China, Japan and India. The rising demand for fast and easy ways to diagnose the disease is fueling the growth.

The China point of care infectious disease testing market held a substantial market share in 2023 driven by large population and rising cases of infectious diseases such as TB, and hepatitis. The adoption of advanced diagnostic medical devices such as molecular diagnostics and lateral flow immunoassay are fueling the country’s growth.

The point of care infectious disease testing market in India is expected to witness significant growth during the forecast period, owing to the increasing population, rise in prevalence of communicable disease in children under age of 3 and population over the age of 65.

Key Point Of Care Infectious Disease Testing Company Insights

Some of the key companies in the point of care infectious disease testing market include Abbott; Thermo Fisher Scientific Inc; F. Hoffmann-La Roche Ltd; Siemens Healthineers; Quest Diagnostics Incorporated. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

Key Point Of Care Infectious Disease Testing Companies:

The following are the leading companies in the point of care infectious disease testing market. These companies collectively hold the largest market share and dictate industry trends.

- Abbott

- Thermo Fisher Scientific Inc

- F. Hoffmann-La Roche Ltd

- Siemens Healthineers

- Becton, Dickinson & Company

- Chembio Diagnostics Inc.

- Trinity Biotech

- Cardinal Health

- Quest Diagnostics Incorporated

- Bio-Rad Laboratories Inc.

- bioMérieux SA

- Sight Diagnostics Ltd.

- Gene POC

- Trivitron Healthcare

- OJ-Bio Ltd.

- Ortho-Clinical Diagnostics.

Recent Developments

-

In January 2024, Roche acquired LumiraDx’s point of care technology. The LumiraDx’s platform includes a range of immunoassay and clinical chemical tests. The addition of LumiraDx’s to Roche may enable the company to transform testing at the point of care.

-

In February 2023, Thermo Fisher partnered with Mylab, announced to launch made-in-India RTPCR kits for infectious disease in India. Mylab in partnership with Thermo Fisher aims to access of the test to a greater portion of the population in India as well as the world.

Point Of Care Infectious Disease Testing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.2 billion

Revenue forecast in 2030

USD 15.76 billion

Growth rate

CAGR of 4.3% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, disease, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy,, Spain, Denmark, Sweden, Norway, Japan, China, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE and Kuwait

Key companies profiled

Abbott; Thermo Fisher Scientific Inc; F. Hoffmann-La Roche Ltd; Siemens Healthineers; Becton, Dickinson & Company; Chembio Diagnostics Inc.; Trinity Biotech; Cardinal Health; Quest Diagnostics Incorporated; Bio-Rad Laboratories Inc.; bioMérieux SA; Sight Diagnostics Ltd.; Gene POC; Trivitron Healthcare; OJ-Bio Ltd.; Ortho-Clinical Diagnostics.;

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point Of Care Infectious Disease Testing Market Report Segmentation

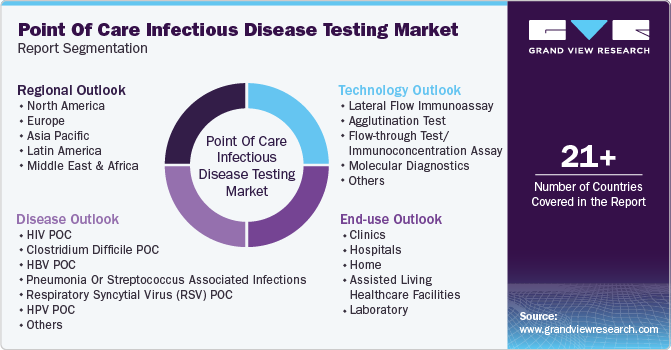

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global point of care infectious disease testing market report based on technology, disease, end use, and region:

-

Technology Outlook (Revenue, USD Billion, 2018 - 2030)

-

Lateral Flow Immunoassay

-

Agglutination Test

-

Flow-through test/Immunoconcentration Assay

-

Molecular Diagnostics

-

Others

-

-

Disease Outlook (Revenue, USD Billion, 2018 - 2030)

-

HIV POC

-

Clostridium Difficile POC

-

HBV POC

-

Pneumonia Or Streptococcus Associated Infections

-

Respiratory Syncytial Virus (RSV) POC

-

HPV POC

-

Influenza/Flu POC

-

HCV POC

-

MRSA POC

-

TB & Drug-resistant TB POC

-

HSV POC

-

COVID-19

-

Other Infectious Diseases

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinics

-

Hospitals

-

Home

-

Assisted Living Healthcare Facilities

-

Laboratory

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."