- Home

- »

- Electronic Devices

- »

-

Point-of-Sale Terminal Market Size & Share Report, 2030GVR Report cover

![Point-of-Sale Terminal Market Size, Share & Trends Report]()

Point-of-Sale Terminal Market Size, Share & Trends Analysis Report By Product (Fixed, Mobile), By Component (Hardware, Software, Services), By Deployment (Cloud, On-premise), By End-use (Healthcare, Retail), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-263-1

- Number of Report Pages: 189

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Point-of-Sale Terminal Market Size & Trends

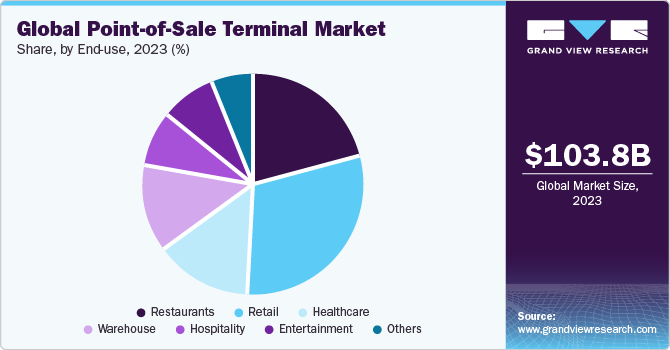

The global point-of-sale terminal market size was valued at USD 103.83 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 8.3% from 2023 to 2030. The Point-of-Sale (POS) terminal is an electronic appliance utilized to procedure card payments to locations, such as hospitals, pharmacies, resorts, restaurants, hotels, gas stations, and retail stores. The growth in demand for reasonable wireless communication technologies has grown the demand for the market. POS systems use wireless devices to facilitate payments for products and services. The utilization of wireless technology streamlines various processes, from rental cabs to restaurants. Businesses in the retail and hospitality sectors use POS terminals for remittance and additional operational tasks, such as accounting, sales tracking, and inventory management.

For instance, restaurants, bars, and food service providers depend on POS technology to inventory, products, operations, and track sales, operations, products, and inventory. With the help of cash registers, barcode scanners, and computers, the market concept involves devices and displays to engage in online transactions. Furthermore, the increasing adoption of POS terminals, which are mobile-based, development in payment technologies, the use of Europay, Marstercard, and Visa (EMV) cards, and the increasing adoption of the market in the e-commerce and retail sector are driving the industry growth.

In addition, the market has been captivated by security and privacy concerns linked to data breaches. The rise of the modern drive-thru is the factor promoting the growth of the POS terminals market. Various companies started adopting POS systems to link their drive-thru line, kitchen, and back-office operations for a smooth delivery and order process. For instance, fast-casual businesses, such as Chipotle, Starbucks, Panera have added drive-thru components to some of their drive-thru locations. The growing prominence of mobile POS terminals has indued avenues for market growth.

The facility of better return on investment (ROI) offered by these systems positively impacted the market. In addition, the rising need for customer and employee management, inventory tracking, and in-store & online sale unification through tablets has increased product adoption. Furthermore, the increasing trend of contactless and penetration of near field communication (NFC) devices in many industry verticals boost the demand. Remittance companies are introducing new solutions for certain industrial purposes to gain profitability. The market allows retailers to manage their business operations and store inventory, which results in industry growth.

Benefits offered by modern drive-thrus, such as increased convenience, have resulted in an improved customer experience. This, in turn, is also expected to provide lucrative growth opportunities for the market. However, privacy issues and security concerns related to misuse of information and data leakage on the cards are constraints to the growth of the market. In addition, the lack of awareness among the audience restraints the growth of the market. The market is challenging to secure due to its role and exposed location over the network. These systems hold critical information and are essential to be managed from rural areas.

A substantial impact of POS breaches is the possibility of identity threats. These victims encounter damaged financial loss, credit standing, and fraudulent purchases. Hence, compensating controls to handle the data flow are anticipated to improve POS security. For instance, VeriFone’s VeriShield is a provisional power for transmitting data between different parts of the POS systems. During the COVID-19 pandemic, the growth of the industry was impacted due to social lockdown and distance restrictions. As a result, many end-use verticals suffered losses, which hindered the demand for new fixed POS terminals.

Nevertheless, as the severity of the pandemic has mellowed due to a dip in positive cases and vaccination drives, countries across the globe have eased out restrictions and have started operating as usual. Moreover, COVID-19 triggered a shift in consumer habits, resulting in a surge in demand for Artificial Intelligence (AI), digital menu boards, and the expansion of drive-thrus into dual lanes for increased convenience. Owing to this, the restaurant, hospitality, and entertainment sectors are expected to witness substantial growth over the forecast period.

Market Concentration & Characteristics

The growth of the Point-of-Sale Terminal Market is medium, and the growth’s pace is accelerating. The POS system has become a vital tool for many businesses. Initially, POS terminal were majorly used to carry out payment transactions. However, now the POS system have become one of the most multifaceted systems owing to its diverse features required by different businesses or end-user such as retail, hospitality, restaurant, healthcare, and other industries.

The market is also witnessing a high level of merger and acquisition (M&A) activity by key players. Furthermore, market players are heavily investing in R&D to develop innovative CX BPO services to attract targeted audiences and increase their revenue streams.

Various international and local regulatory bodies have drafted regulations to protect consumer data from unauthorized users and prevent any potential misuse of it. Market players must abide by various regulations and acts, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), related to personal data protection.

There are no direct substitutes for point of sale terminal system. However, there is internal threat of substitute between, mPOS, and fixed POS terminal system. mPOS is increasingly gaining acceptance In various application segments. Innovation and expansion in wireless technology is a major threat to traditional POS terminals. Retailers have been providing extended value added services and new acceptance capabilities, while improving in-store mobility levels. However, fixed POS terminals are being preferred by high-volume retailers in order to keep track of the front-end checkout

Buyers in the POS terminal market are many prominent companies from several industries such as, retail, and hospitality. Seamless usage of consumer-grade tablets, and mobiles alleviates buyer power as these devices are easily available across the market. Additionally, the availability of open platform and specialized applications adds flexibility for end-users.

Product Insights

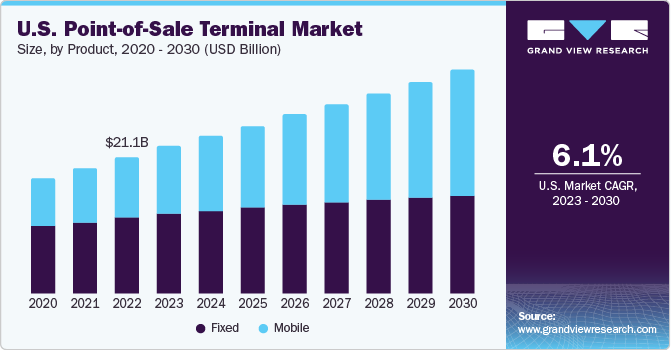

The fixed product segment led the industry in 2022 and accounted for the maximum share of more than 60% of the global revenue. The fixed POS segment is divided into kiosks and others. The large-scale vendors choose fixed POS terminals due to high procurement and installation costs, which currently supported the growth of the segment. Furthermore, end-users that are aware of cloud data storage install fixed POS terminals for data storage with the on-premises server. These systems have applications, such as printing bills, Customer Relationship Management (CRM), inventory management, and supporting payments devices.

The mobile POS segment is expected to register the fastest CAGR from 2023 to 2030. This growth is attributed to the rising adoption of in-store mobile payments among customers across the globe. Mobile POS terminals help carry out payments from any part of the store. Many end-users, such as restaurants, have started adopting mPOS as it helps ease payments during busy hours and avoids loss of sales due to delays, thereby improving customer satisfaction. For instance, Quick-Service Restaurants (QSRs) in China have started using systems, such as digital kiosks and tablets, to display menus and place orders. This helps the restaurants to enhance operational efficiency & customer experience, which, in turn, is likely to drive the industry.

Component Insights

The hardware segment dominated the global industry in 2022 and accounted for the largest share of more than 63% of the overall revenue. The segment is estimated to expand further at a steady CAGR from 2023 to 2030. Hardware components include interfaces or devices to register transaction details, such as EFT-POS machines, network devices, barcode scanners, cash drawers, receipt printers, tablets, and monitors. The fixed POS terminal comprises most of the hardware components to complete the system and facilitates the experience of managing daily activity using the system.

Furthermore, the software segment is estimated to register the highest CAGR from 2023 to 2030. This growth can be attributed to data support functionality, multifunctional features, and sales analysis ease. There is specialized software for different applications. For instance, retail POS software offers functions such as accounting, transaction alerts, inventory management, etc. The systematic software integration functionalities of screen terminals and barcode scanners across these systems provide backup features and data restoration, supporting segment growth.

Deployment Insights

Based on deployment, the global industry has been further segmented into cloud and on-premises. The cloud segment is expected to register the fastest growth rate of 10.9% from 2023 to 2030. This growth is attributed to the increasing adoption of SaaS technology and software integration. In the SaaS model, rather than paying for all the software, hardware, and support services in advance, customers pay a minimum monthly fee on a subscription basis. This helps restaurants and other end-users to reduce their up-front expenses.

On-premises deployment incorporates manual installation at the client’s premise. The installation includes cabling permits and cabling, hardware and software installation, and electrical work. Many companies have started adopting cloud POS due to its various benefits over on-premises deployment. For instance, In January 2022, Xenial, Inc. launched a development for Xenial Cloud POS, named 3.6 Xenial Ordering. This cloud POS offers seamless process workflow, user experience, and infrastructure updates and improvements for this developed version of Xenial Ordering UI and API.

End-use Insights

The retail segment accounted for the largest revenue share of more than 30% of the overall revenue. Several retailers are moving towards the simple mode of transactions to avoid long waiting queues and delays in transactions. As a result, retailers are now integrating the POS system with inventory, merchandising, marketing, and Customer Relationship Management (CRM) data to offer personalized, interactive, and unique customer experience. Furthermore, the retail segment is bifurcated into supermarkets/hypermarkets, convenience stores, grocery stores, specialty stores, and gas stations.

The supermarkets/hypermarkets segment is expected to grow at the highest CAGR over the forecasting period. The exposure of mobile wallet technology is forecasted to increase the penetration of retail-based products over the forecast period. The healthcare segment is estimated to exhibit a greater CAGR over the forecasting period. This growth is attributed to a broad product application scope in managing patient information, facilitating quick payment processes, and tracking employee statistics. The rising need to organize the payment process, and manage vaccination drives and COVID-19 patient records is expected to boost market growth.

Regional Insights

Asia Pacific Point-of-Sale Terminal Market Trends

The point-of-sale market in the Asia Pacificremained the largest market in the POS market in 2022, accounting for more than 33% of the total revenue share. Moreover, Asia Pacific is anticipated to register the fastest CAGR of 9.6% from 2023 to 2030. Government initiatives that support a cashless economy are growing the demand for POS terminals in the region.

China Point-of-Sale Terminal Market Trends

The point-of-sale market in China is projected to grow at a CAGR nearly of 10% from 2023 to 2030. China, one of the manufacturing hubs for POS terminal hardware components, recouped early compared to other countriesA rise in digital payment technologies in the country has lucrative opportunities for mPOS system.

Japan Point-of-Sale Terminal Market Trends

The point-of-sale market in Japan is projected to grow at a CAGR of 9.4% from 2023 to 2030. The demand for fixed POS terminals from large enterprises to protect their business details and ensure the processing of high amounts of data of their customers is supporting the growth of the Japan point-of-sale terminal market.

India Point-of-Sale Terminal Market Trends

The point-of-sale terminal market in India is projected to grow at a CAGR of 13.3%% from 2023 to 2030. Enterprises across the country are increasingly implementing measures to revive their business, which is expected to increase the POS terminal demand in the forecasted period.

North America Point-of-Sale Terminal Market Trends

The point-of-sale terminal market in the North Americais projected to grow at a CAGR of 6.2% from 2024 to 2030. Several demanding payment technologies, such as contactless payments and NFC have been driving the product demand in the region. Moreover, the U.S. has many large retail brand outlets, such as Wal-Mart, Costco Wholesale Corp., Target, The Kroger Co, and The Home Depot, which need POS terminals to manage billing, payment, employee duty, and inventory daily.

Europe Point-of-Sale Terminal Market Trends

The point-of-sale terminal market in Europe is growing significantly at a CAGR of 7.8% from 2023 to 2030. Due to consumers' increasing demand for cashless and contactless transactions, the POS terminal market is growing significantly. The region's payment terminal market has expanded as a result of increased digitalization, the usage of e-payment platforms, and increased regulatory action on secure payments brought on by several instances of financial fraud.

U.K. Point-of-Sale Terminal Market Trends

The point-of-sale terminal market in U.K. is growing significantly at a CAGR of 8.5% from 2023 to 2030. A POS system has become a vital tool for many businesses in the U.K. to manage long queues and provide quick payment facilities. Initially, POS terminals with compatibly integrated software facilitated cashless payment transactions. However, upgrades in POS software offer multiple functions such as employee management, loyalty and gift card management, inventory management, everyday sales tracking, and insights on popular products and sales trends. Therefore, driving the growth of the U.K. point-of-sale terminal market.

Germany Point-of-Sale Terminal Market Trends

The point-of-sale terminal market in Germany is growing significantly at a CAGR of 8.3% from 2023 to 2030. The increasing use of online shopping and contactless payment methods are increasingly contributing to the growth of the point-of-sale terminal market in the Germany.

France Point-of-Sale Terminal Market Trends

The point-of-sale terminal market in Franceis growing significantly at a CAGR of the 7.9% from 2023 to 2030. The market for point-of-sale terminals is primarily driven by the increasing use of EMV (Euroy, Mastercard, and Visa) cards, the growing acceptance of mobile-based POS terminals, and the expanding use of POS terminals in the e-commerce and retail industries.

Middle East & Africa Point-of-Sale Terminal Market Trends

Middle East & Africa point-of-sale terminal market is anticipated to witness significant growth from 2023 to 2030 at a CAGR of 8.5%. Wholesalers and customers are opting for contactless payment methods in order to reduce the chance of data thefts as the security of processing cash transactions continue to grow.

Saudi Arabia Point-of-Sale Terminal Market Trends

Saudi Arabia point-of-sale terminal market is anticipated to witness significant growth in the forecasted period. Large enterprises across the country have begun to invest in POS terminals in an effort to enhance customer satisfaction, which has created enormous growth potential for the point-of-sale terminal industry.

Key Point-of-Sale Terminal Company Insights

Some of the key players operating in the market includeNCR Corporation, and Oracle Corporation.

-

NCR Corporation provides mobile and electronic payment solutions to the hospitality and retail sectors. The company specializes in offering POS software applications, store and restaurant management applications, and back-office inventory management solutions to the restaurant and hotel chains.

-

Oracle Corporation is engaged in delivering Point-of-Sale (POS) solutions to retail and hospitality industries globally. The company provides a range of solutions to businesses, including inventory management, reporting and analysis, loss prevention, gift and loyalty, and table reservations.

Qu, Inc., ResultsCX; Firstsource; and ibex Limited are some of the emerging market participants in the Point-of-Sale Terminal Market.

-

Qu, Inc. specializes in digital-first solutions for quick-service and fast casual restaurant chains. Using its single menu management platform and API-first architecture, Qu has simplified enterprise omnichannel ordering solutions. The company operates through ordering, kitchen, and platforms categories. The ordering category includes POS, drive thru, kiosk, online order, and third-party ordering. The kitchen category includes kitchen display system, ghost kitchens, and third-party marketplaces. The platform category offers enterprise management, single menu management, reporting & notify, unified data, and commerce cloud.

-

Quail Digital is a global brand manufacturing high-quality wireless headset systems for healthcare, retail, community, and quick-service. It provides products with quality, technical innovation, and design excellence. These market-leading products are developed with high-quality materials and innovative design to meet the needs of a diverse customer community.

Key Point-of-Sale Terminal Companies:

The following are the leading companies in the point-of-sale terminal market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these POS terminal companies are analyzed to map the supply network.

Recent Developments

- Acumera, Inc.

- Acrelec

- AURES Group

- HM Electronics

- Hewlett Packard Development LP

- NCR Corporation

- Oracle Corporation

- Payabl

- POSaBIT Systems Corporation

- Presto Group

- Qu, Inc.

- Quail Digital

- Revel Systems

- Toast, Inc.

- Toshiba Corp.

- TouchBistro

- Xenial, Inc.

Recent Developments

-

In January 2024, Acumera, Inc., would demonstrate Acumera Reliant Platform in the National Retail Federation's (NRF) 2024 Annual Convention and Expo.The Acumera Reliant Platform is designed for retailers. Retailers can have continuous access to vital applications so they can stay competitive in the rapidly evolving retail market.

-

In September 2023, POSaBIT Systems Corporation, point-of-sale system provider, launched POSaBIT POS 2.0. POSaBIT POS 2.0 is a scalable, agile, and user-friendly solutions that can adapt to changing market conditions.

-

In June2023, payabl., a FinTech company, launched, a new point of sale (POS) solution that enables businesses to take payments for both online and offline sales utilizing a single terminal, improving their omnichannel payment services for in-person purchases at retailers.

Point-of-Sale Terminal Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 103.83 billion

Revenue forecast in 2030

USD 181.47 billion

Growth rate

CAGR of 8.3% from 2023 to 2030

Actual data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company share, competitive landscape, growth factors, and trends

Segments covered

Product, component, deployment, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; Italy; Spain; China; Japan; India; South Korea; Australia; Brazil; Mexico; Saudi Arabia; UAE; South Africa

Key companies profiled

Acumera, Inc; Acrelec; AURES Group; HM Electronics; Hewlett Packard Development LP; NCR Corporation; Oracle Corporation; Payabl; POSaBIT Systems Corporation; Presto Group; Qu, Inc.; Quail Digital; Revel Systems; Toast, Inc.; Toshiba Corp.; TouchBistro; Xenial, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Point-of-Sale Terminal Market Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global Point-of-Sale Terminal Market report based on product, component, deployment, end-use, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed

-

Kiosks

-

Others

-

-

Mobile

-

Tablet

-

Others

-

-

-

Component Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Restaurants

-

FSR

-

Fine Dine

-

Casual Dine

-

-

QSR

-

Drive-Thru

-

Others

-

-

Institutional

-

Fast Casual

-

Drive-Thru

-

Others

-

-

Others

-

-

Retail

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Specialty Stores

-

Gas Stations

-

Others

-

-

Hospitality

-

Spas

-

Hotels

-

Resorts

-

-

Healthcare

-

Pharmacies

-

Others

-

-

Warehouse

-

Entertainment

-

Cruise Lines/Ships

-

Cinema

-

Casinos

-

Golf Clubs

-

Stadiums

-

Amusement Parks

-

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global point-of-sale terminal market size was estimated at USD 94.40 billion in 2022 and is expected to reach USD 103.83 billion in 2023.

b. The global point-of-sale terminal market is expected to grow at a compound annual growth rate of 8.3% from 2023 to 2030 to reach USD 181.5 billion by 2030.

b. The Fixed segment dominated the POS terminals market and accounted for more than 60% of the global revenue share in 2022. Fixed terminals are preferred mainly by large-scale vendors due to high procurement and installation costs, which have currently contributed to market growth.

b. The hardware product segment emerged as the largest segment in 2022 in the POS terminals market, accounting for a revenue share of more than 63%. Hardware components comprise interfaces or devices to register transaction details, such as tablets, monitors, cash drawers, receipt printers, barcode scanners, EFT-POS machines, and network devices.

b. On-premise deployment emerged as the largest segment in 2022 in the point-of-sale terminal market and accounted for over 70% of the global revenue share. On-premise deployment comprises manual installation at the customer’s premise.

b. The retail segment generated the highest revenue share of over 30% in 2022 in the POS terminals market and is expected to grow further at a significant rate over the forecast period.

Table of Contents

Chapter 1. Methodology and Scope

1.1. Market Segmentation and Scope

1.2. Market Definitions

1.3. Research Methodology

1.3.1. Information Procurement

1.3.2. Information or Data Analysis

1.3.3. Market Formulation & Data Visualization

1.3.4. Data Validation & Publishing

1.4. Research Scope and Assumptions

1.4.1. List of Data Sources

Chapter 2. Executive Summary

2.1. Market Outlook

2.2. Segment Outlook

2.3. Competitive Insights

Chapter 3. Point-of-Sale Terminal Market Variables, Trends, & Scope

3.1. Market Introduction/Lineage Outlook

3.2. Market Size and Growth Prospects (USD Billion)

3.3. Industry Value Chain Analysis

3.4. Market Dynamics

3.4.1. Market Drivers Analysis

3.4.2. Market Restraints Analysis

3.4.3. Market Opportunity Analysis

3.5. Point-of-Sale Terminal Market Analysis Tools

3.5.1. Porter’s Analysis

3.5.1.1. Bargaining power of the suppliers

3.5.1.2. Bargaining power of the buyers

3.5.1.3. Threats of substitution

3.5.1.4. Threats from new entrants

3.5.1.5. Competitive rivalry

3.5.2. PESTEL Analysis

3.5.2.1. Political landscape

3.5.2.2. Economic and Social landscape

3.5.2.3. Technological landscape

3.5.2.4. Environmental landscape

3.5.2.5. Legal landscape

Chapter 4. Point-of-Sale Terminal Market: Product Estimates & Trend Analysis

4.1. Segment Dashboard

4.2. Point-of-Sale Terminal Market: Product Movement Analysis, USD Billion, 2023 & 2030

4.3. Fixed

4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.3.2. Kiosks

4.3.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.3.3. Others

4.3.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4. Mobile

4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.2. Tablet

4.4.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

4.4.3. Others

4.4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 5. Point-of-Sale Terminal Market: Component Estimates & Trend Analysis

5.1. Segment Dashboard

5.2. Point-of-Sale Terminal Market: Component Movement Analysis, USD Billion, 2023 & 2030

5.3. Hardware

5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.4. Software

5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

5.5. Services

5.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 6. Point-of-Sale Terminal Market: Deployment Estimates & Trend Analysis

6.1. Segment Dashboard

6.2. Point-of-Sale Terminal Market: Deployment Movement Analysis, USD Billion, 2023 & 2030

6.3. Cloud

6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

6.4. On-premise

6.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 7. Point-of-Sale Terminal Market: End-use Estimates & Trend Analysis

7.1. Segment Dashboard

7.2. Point-of-Sale Terminal Market: End-use Movement Analysis, USD Billion, 2023 & 2030

7.3. Restaurants

7.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.2. FSR

7.3.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.2.2. Fine Dine

7.3.2.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.2.3. Casual Dine

7.3.2.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.3. QSR

7.3.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.3.2. Drive-Thru

7.3.3.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.3.3. Others

7.3.3.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.4. Institutional

7.3.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.5. Fast Casual

7.3.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.5.2. Drive-Thru

7.3.5.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.3.5.3. Others

7.3.5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4. Retail

7.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.2. Supermarkets/Hypermarkets

7.4.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.3. Convenience Stores

7.4.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.4. Grocery Stores

7.4.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.5. Specialty Stores

7.4.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.6. Gas Stations

7.4.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.4.7. Others

7.4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5. Hospitality

7.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5.2. Spas

7.5.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5.3. Hotels

7.5.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.5.4. Resorts

7.5.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6. Healthcare

7.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6.2. Pharmacies

7.6.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.6.3. Others

7.6.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.7. Warehouse

7.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8. Entertainment

7.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8.2. Cruise Lines/Ships

7.8.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8.3. Cinemas

7.8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8.4. Casinos

7.8.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8.5. Golf Clubs

7.8.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8.6. Stadiums

7.8.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.8.7. Amusement Parks

7.8.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

7.9. Others

7.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

Chapter 8. Point-of-Sale Terminal Market: Regional Estimates & Trend Analysis

8.1. Point-of-Sale Terminal Market Share by Region, 2023 & 2030 (USD Billion)

8.2. North America

8.2.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.2.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.2.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.2.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.2.6. U.S.

8.2.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.6.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.2.6.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.2.6.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.2.6.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.2.7. Canada

8.2.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.2.7.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.2.7.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.2.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.2.7.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.3. Europe

8.3.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.3.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.3.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.3.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.3.6. U.K.

8.3.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.6.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.3.6.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.3.6.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD

8.3.6.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.3.7. Germany

8.3.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.7.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.3.7.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.3.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.3.7.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.3.8. France

8.3.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.8.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.3.8.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.3.8.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.3.8.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.3.9. Italy

8.3.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.9.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.3.9.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.3.9.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.3.9.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.3.10. Spain

8.3.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.3.10.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.3.10.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.3.10.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.3.10.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.4. Asia Pacific

8.4.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.4.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.4.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.4.6. China

8.4.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.6.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.4.6.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.4.6.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.6.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.4.7. India

8.4.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.7.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.4.7.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.4.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.7.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.4.8. Japan

8.4.8.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.8.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.4.8.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.4.8.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.8.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.4.9. Australia

8.4.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.9.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.4.9.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.4.9.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.9.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.4.10. South Korea

8.4.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.4.10.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.4.10.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.4.10.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.4.10.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.5. Latin America

8.5.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.5.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.5.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.5.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.5.6. Brazil

8.5.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5.6.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.5.6.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.5.6.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.5.6.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.5.7. Mexico

8.5.7.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.5.7.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.5.7.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.5.7.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.5.7.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.6. Middle East & Africa

8.6.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.6.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.6.4. Market Size Estimates and Forecasts by Services, 2018 - 2030 (USD Billion)

8.6.5. Market Size Estimates and Forecasts by Testing Type, 2018 - 2030 (USD Billion)

8.6.6. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.6.7. Market Size Estimates and Forecasts by Enterprise Size, 2018 - 2030 (USD Billion)

8.6.8. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.6.9. UAE

8.6.9.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.9.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.6.9.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.6.9.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.6.9.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.6.10. Saudi Arabia

8.6.10.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.10.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.6.10.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.6.10.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.6.10.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

8.6.11. South Africa

8.6.11.1. Market Size Estimates and Forecasts, 2018 - 2030 (USD Billion)

8.6.11.2. Market Size Estimates and Forecasts by Product, 2018 - 2030 (USD Billion)

8.6.11.3. Market Size Estimates and Forecasts by Component, 2018 - 2030 (USD Billion)

8.6.11.4. Market Size Estimates and Forecasts by Deployment, 2018 - 2030 (USD Billion)

8.6.11.5. Market Size Estimates and Forecasts by End Use, 2018 - 2030 (USD Billion)

Chapter 9. Competitive Landscape

9.1. Recent Developments & Impact Analysis by Key Market Participants

9.2. Company Categorization

9.3. Company Market Positioning

9.4. Company Market Share Analysis

9.5. Company Heat Map Analysis

9.6. Strategy Mapping

9.6.1. Expansion

9.6.2. Mergers & Acquisition

9.6.3. Partnerships & Collaborations

9.6.4. New Product Launches

9.6.5. Research And Development

9.7. Company Profiles

9.7.1. Acumera, Inc.

9.7.1.1. Participant’s Overview

9.7.1.2. Financial Performance

9.7.1.3. Product Benchmarking

9.7.1.4. Recent Developments

9.7.2. Acrelec

9.7.2.1. Participant’s Overview

9.7.2.2. Financial Performance

9.7.2.3. Product Benchmarking

9.7.2.4. Recent Developments

9.7.3. AURES Group

9.7.3.1. Participant’s Overview

9.7.3.2. Financial Performance

9.7.3.3. Product Benchmarking

9.7.3.4. Recent Developments

9.7.4. HM Electronics

9.7.4.1. Participant’s Overview

9.7.4.2. Financial Performance

9.7.4.3. Product Benchmarking

9.7.4.4. Recent Developments

9.7.5. Hewlett Packard Development LP

9.7.5.1. Participant’s Overview

9.7.5.2. Financial Performance

9.7.5.3. Product Benchmarking

9.7.5.4. Recent Developments

9.7.6. NCR Corporation

9.7.6.1. Participant’s Overview

9.7.6.2. Financial Performance

9.7.6.3. Product Benchmarking

9.7.6.4. Recent Developments

9.7.7. Oracle Corporation

9.7.7.1. Participant’s Overview

9.7.7.2. Financial Performance

9.7.7.3. Product Benchmarking

9.7.7.4. Recent Developments

9.7.8. Payabl

9.7.8.1. Participant’s Overview

9.7.8.2. Financial Performance

9.7.8.3. Product Benchmarking

9.7.8.4. Recent Developments

9.7.9. POSaBIT Systems Corporation

9.7.9.1. Participant’s Overview

9.7.9.2. Financial Performance

9.7.9.3. Product Benchmarking

9.7.9.4. Recent Developments

9.7.10. Presto Group

9.7.10.1. Participant’s Overview

9.7.10.2. Financial Performance

9.7.10.3. Product Benchmarking

9.7.10.4. Recent Developments

9.7.11. Qu, Inc.

9.7.11.1. Participant’s Overview

9.7.11.2. Financial Performance

9.7.11.3. Product Benchmarking

9.7.11.4. Recent Developments

9.7.12. Quail Digital

9.7.12.1. Participant’s Overview

9.7.12.2. Financial Performance

9.7.12.3. Product Benchmarking

9.7.12.4. Recent Developments

9.7.13. Revel Systems

9.7.13.1. Participant’s Overview

9.7.13.2. Financial Performance

9.7.13.3. Product Benchmarking

9.7.13.4. Recent Developments

9.7.14. Toast, Inc.

9.7.14.1. Participant’s Overview

9.7.14.2. Financial Performance

9.7.14.3. Product Benchmarking

9.7.14.4. Recent Developments

9.7.15. Toshiba Corp.

9.7.15.1. Participant’s Overview

9.7.15.2. Financial Performance

9.7.15.3. Product Benchmarking

9.7.15.4. Recent Developments

9.7.16. TouchBistro

9.7.16.1. Participant’s Overview

9.7.16.2. Financial Performance

9.7.16.3. Product Benchmarking

9.7.16.4. Recent Developments

9.7.17. Xenial, Inc.

9.7.17.1. Participant’s Overview

9.7.17.2. Financial Performance

9.7.17.3. Product Benchmarking

9.7.17.4. Recent Developments

List of Tables

Table 1 Point-of-Sale Terminal market 2018 - 2030 (USD Billion)

Table 2 Global point-of-sale terminal market estimates and forecasts by region 2018 - 2030 (USD Billion)

Table 3 Global point-of-sale terminal market estimates and forecasts by product 2018 - 2030 (USD Billion)

Table 4 Global point-of-sale terminal market estimates and forecasts by Fixed 2018 - 2030 (USD Billion)

Table 5 Global point-of-sale terminal market estimates and forecasts by Mobile 2018 - 2030 (USD Billion)

Table 6 Global point-of-sale terminal market estimates and forecasts by component 2018 - 2030 (USD Billion)

Table 7 Global point-of-sale terminal market estimates and forecasts by deployment 2018 - 2030 (USD Billion)

Table 8 Global point-of-sale terminal market estimates and forecasts by end use 2018 - 2030 (USD Billion)

Table 9 Global point-of-sale terminal market estimates and forecasts by restaurant 2018 - 2030 (USD Billion)

Table 10 Global point-of-sale terminal market estimates and forecasts by FSR 2018 - 2030 (USD Billion)

Table 11 Global point-of-sale terminal market estimates and forecasts by QSR 2018 - 2030 (USD Billion)

Table 12 Global point-of-sale terminal market estimates and forecasts by fast casual 2018 - 2030 (USD Billion)

Table 13 Global point-of-sale terminal market estimates and forecasts by retail 2018 - 2030 (USD Billion)

Table 14 Global point-of-sale terminal market estimates and forecasts by hospitality 2018 - 2030 (USD Billion)

Table 15 Global point-of-sale terminal market estimates and forecasts by healthcare 2018 - 2030 (USD Billion)

Table 16 Global point-of-sale terminal market estimates and forecasts by entertainment 2018 - 2030 (USD Billion)

Table 17 Product market by region, 2018 - 2030 (USD Billion)

Table 18 Fixed market by region, 2018 - 2030 (USD Billion)

Table 19 Kiosks market by region, 2018 - 2030 (USD Billion)

Table 20 Others market by region, 2018 - 2030 (USD Billion)

Table 21 Mobile market by region, 2018 - 2030 (USD Billion)

Table 22 Tablet market by region, 2018 - 2030 (USD Billion)

Table 23 Others market by region, 2018 - 2030 (USD Billion)

Table 24 Component market by region, 2018 - 2030 (USD Billion)

Table 25 Hardware market by region, 2018 - 2030 (USD Billion)

Table 26 Software market by region, 2018 - 2030 (USD Billion)

Table 27 Services market by region, 2018 - 2030 (USD Billion)

Table 28 Deployment market by region, 2018 - 2030 (USD Billion)

Table 29 Cloud market by region, 2018 - 2030 (USD Billion)

Table 30 On premise market by region, 2018 - 2030 (USD Billion)

Table 31 End-use market by region, 2018 - 2030 (USD Billion)

Table 32 Restaurants by region, 2018 - 2030 (USD Billion)

Table 33 FSR market by region, 2018 - 2030 (USD Billion)

Table 34 Fine dine market by region, 2018 - 2030 (USD Billion)

Table 35 Casual dine market by region, 2018 - 2030 (USD Billion)

Table 36 QSR market by region, 2018 - 2030 (USD Billion)

Table 37 Drive-Thru market by region, 2018 - 2030 (USD Billion)

Table 38 Others market by region, 2018 - 2030 (USD Billion)

Table 39 Institutional market by region, 2018 - 2030 (USD Billion)

Table 40 Fast casual market by region, 2018 - 2030 (USD Billion)

Table 41 Drive-Thru market by region, 2018 - 2030 (USD Billion)

Table 42 Others market by region, 2018 - 2030 (USD Billion)

Table 43 Others market by region, 2018 - 2030 (USD Billion)

Table 44 Retail market by region, 2018 - 2030 (USD Billion)

Table 45 Supermarkets/Hypermarkets market by region, 2018 - 2030 (USD Billion)

Table 46 Cconvenience stores market by region, 2018 - 2030 (USD Billion)

Table 47 Grocery stores market by region, 2018 - 2030 (USD Billion)

Table 48 Specialty stores market by region, 2018 - 2030 (USD Billion)

Table 49 Gas stations market by region, 2018 - 2030 (USD Billion)

Table 50 Others market by region, 2018 - 2030 (USD Billion)

Table 51 Hospitality market by region, 2018 - 2030 (USD Billion)

Table 52 Spas market by region, 2018 - 2030 (USD Billion)

Table 53 Hotels market by region, 2018 - 2030 (USD Billion)

Table 54 Resorts market by region, 2018 - 2030 (USD Billion)

Table 55 Healthcare market by region, 2018 - 2030 (USD Billion)

Table 56 Pharmacies market by region, 2018 - 2030 (USD Billion)

Table 57 Others market by region, 2018 - 2030 (USD Billion)

Table 58 Warehouse market by region, 2018 - 2030 (USD Billion)

Table 59 Entertainment market by region, 2018 - 2030 (USD Billion)

Table 60 Cruise lines/Ships market by region, 2018 - 2030 (USD Billion)

Table 61 Cinemas market by region, 2018 - 2030 (USD Billion)

Table 62 Casinos market by region, 2018 - 2030 (USD Billion)

Table 63 Golf clubs market by region, 2018 - 2030 (USD Billion)

Table 64 Stadiums market by region, 2018 - 2030 (USD Billion)

Table 65 Amusement parks market by region, 2018 - 2030 (USD Billion)

Table 66 Others market by region, 2018 - 2030 (USD Billion)

Table 67 North America point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 68 North America point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 69 North America point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 70 North America point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 71 North America point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 72 North America point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 73 North America point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 74 North America point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 75 North America point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 76 North America point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 77 North America point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 78 North America point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 79 North America point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 80 U.S. point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 81 U.S. point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 82 U.S. point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 83 U.S. point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 84 U.S. point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 85 U.S. point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 86 U.S. point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 87 U.S. point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 88 U.S. point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 89 U.S. point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 90 U.S. point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 91 U.S. point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 92 U.S. point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 93 Canada point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 94 Canada point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 95 Canada point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 96 Canada point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 97 Canada point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 98 Canada point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 99 Canada point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 100 Canada point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 101 Canada point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 102 Canada point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 103 Canada point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 104 Canada point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 105 Canada point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 106 Europe point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 107 Europe point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 108 Europe point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 109 Europe point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 110 Europe point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 111 Europe point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 112 Europe point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 113 Europe point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 114 Europe point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 115 Europe point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 116 Europe point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 117 Europe point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 118 Europe point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 119 U.K. point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 120 U.K. point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 121 U.K. point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 122 U.K. point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 123 U.K. point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 124 U.K. point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 125 U.K. point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 126 U.K. point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 127 U.K. point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 128 U.K. point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 129 U.K. point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 130 U.K. point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 131 U.K. point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 132 Germany point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 133 Germany point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 134 Germany point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 135 Germany point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 136 Germany point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 137 Germany point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 138 Germany point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 139 Germany point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 140 Germany point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 141 Germany point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 142 Germany point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 143 Germany point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 144 Germany point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 145 France point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 146 France point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 147 France point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 148 France point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 149 France point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 150 France point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 151 France point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 152 France point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 153 France point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 154 France point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 155 France point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 156 France point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 157 France point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 158 Italy point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 159 Italy point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 160 Italy point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 161 Italy point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 162 Italy point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 163 Italy point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 164 Italy point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 165 Italy point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 166 Italy point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 167 Italy point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 168 Italy point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 169 Italy point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 170 Italy point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 171 Spain point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 172 Spain point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 173 Spain point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 174 Spain point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 175 Spain point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 176 Spain point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 177 Spain point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 178 Spain point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 179 Spain point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 180 Spain point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 181 Spain point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 182 Spain point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 183 Spain point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 184 Asia Pacific point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 185 Asia Pacific point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 186 Asia Pacific point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 187 Asia Pacific point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 188 Asia Pacific point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 189 Asia Pacific point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 190 Asia Pacific point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 191 Asia Pacific point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 192 Asia Pacific point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 193 Asia Pacific point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 194 Asia Pacific point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 195 Asia Pacific point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 196 Asia Pacific point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 197 China point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 198 China point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 199 China point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 200 China point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 201 China point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 202 China point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 203 China point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 204 China point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 205 China point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 206 China point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 207 China point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 208 China point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 209 China point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 210 India point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 211 India point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 212 India point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 213 India point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 214 India point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 215 India point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 216 India point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 217 India point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 218 India point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 219 India point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 220 India point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 221 India point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 222 India point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 223 Japan point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 224 Japan point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 225 Japan point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 226 Japan point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 227 Japan point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 228 Japan point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 229 Japan point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 230 Japan point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 231 Japan point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 232 Japan point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 233 Japan point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 234 Japan point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 235 Japan point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 236 South Korea point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 237 South Korea point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 238 South Korea point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 239 South Korea point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 240 South Korea point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 241 South Korea point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 242 South Korea point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 243 South Korea point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 244 South Korea point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 245 South Korea point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 246 South Korea point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 247 South Korea point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 248 South Korea point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 249 Australia point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 250 Australia point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 251 Australia point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 252 Australia point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 253 Australia point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 254 Australia point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 255 Australia point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 256 Australia point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 257 Australia point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 258 Australia point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 259 Australia point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 260 Australia point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 261 Australia point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 262 Latin America point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 263 Latin America point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 264 Latin America point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 265 Latin America point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 266 Latin America point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 267 Latin America point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 268 Latin America point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 269 Latin America point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 270 Latin America point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 271 Latin America point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 272 Latin America point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 273 Latin America point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 274 Latin America point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 275 Brazil point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 276 Brazil point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 277 Brazil point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 278 Brazil point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 279 Brazil point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 280 Brazil point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 281 Brazil point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 282 Brazil point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 283 Brazil point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 284 Brazil point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 285 Brazil point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 286 Brazil point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 287 Brazil point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 288 Mexico point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 289 Mexico point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 290 Mexico point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 291 Mexico point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 292 Mexico point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 293 Mexico point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 294 Mexico point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 295 Mexico point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 296 Mexico point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 297 Mexico point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 298 Mexico point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 299 Mexico point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 300 Mexico point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 301 Middle East & Africa point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 302 Middle East & Africa point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 303 Middle East & Africa point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 304 Middle East & Africa point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 305 Middle East & Africa point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 306 Middle East & Africa point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 307 Middle East & Africa point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 308 Middle East & Africa point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 309 Middle East & Africa point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 310 Middle East & Africa point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 311 Middle East & Africa point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 312 Middle East & Africa point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 313 Middle East & Africa point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 314 UAE point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 315 UAE point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 316 UAE point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 317 UAE point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 318 UAE point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 319 UAE point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 320 UAE point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 321 UAE point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 322 UAE point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)

Table 323 UAE point-of-sale terminal market, by retail, 2018 - 2030 (Revenue, USD Billion)

Table 324 UAE point-of-sale terminal market, by hospitality, 2018 - 2030 (Revenue, USD Billion)

Table 325 UAE point-of-sale terminal market, by healthcare, 2018 - 2030 (Revenue, USD Billion)

Table 326 UAE point-of-sale terminal market, by entertainment, 2018 - 2030 (Revenue, USD Billion)

Table 327 Saudi Arabia point-of-sale terminal market, by product, 2018 - 2030 (Revenue, USD Billion)

Table 328 Saudi Arabia point-of-sale terminal market, by fixed, 2018 - 2030 (Revenue, USD Billion)

Table 329 Saudi Arabia point-of-sale terminal market, by mobile, 2018 - 2030 (Revenue, USD Billion)

Table 330 Saudi Arabia point-of-sale terminal market, by component, 2018 - 2030 (Revenue, USD Billion)

Table 331 Saudi Arabia point-of-sale terminal market, by deployment, 2018 - 2030 (Revenue, USD Billion)

Table 332 Saudi Arabia point-of-sale terminal market, by end use, 2018 - 2030 (Revenue, USD Billion)

Table 333 Saudi Arabia point-of-sale terminal market, by FSR, 2018 - 2030 (Revenue, USD Billion)

Table 334 Saudi Arabia point-of-sale terminal market, by QSR, 2018 - 2030 (Revenue, USD Billion)

Table 335 Saudi Arabia point-of-sale terminal market, by fast casual, 2018 - 2030 (Revenue, USD Billion)