- Home

- »

- Medical Devices

- »

-

Poly-L-Lactic Acid Filler Market Size, Industry Report, 2030GVR Report cover

![Poly-L-Lactic Acid Filler Market Size, Share & Trends Report]()

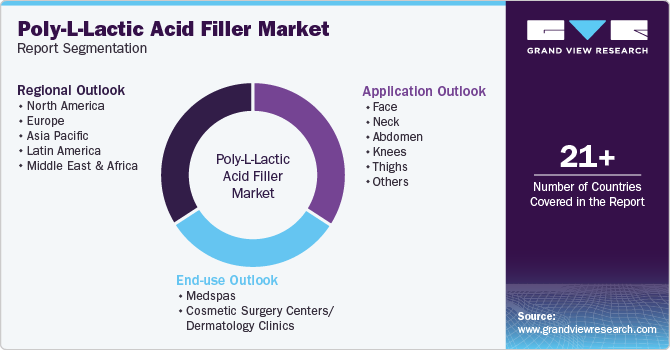

Poly-L-Lactic Acid Filler Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Face, Neck, Abdomen, Knees, Thighs), By End-use (Medspas, Cosmetic Surgery Centers), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-364-7

- Number of Report Pages: 140

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Poly-L-Lactic Acid Filler Market Summary

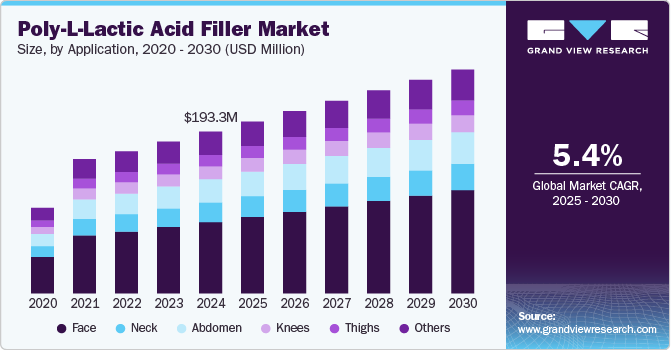

The global poly-l-lactic acid filler market size was estimated at USD 193.3 million in 2024 and is projected to reach USD 267.4 million by 2030, growing at a CAGR of 5.4% from 2025 to 2030. Increasing demand for minimally invasive cosmetic procedures is a major factor boosting poly-l-lactic acid (PLLA) filler market growth.

Key Market Trends & Insights

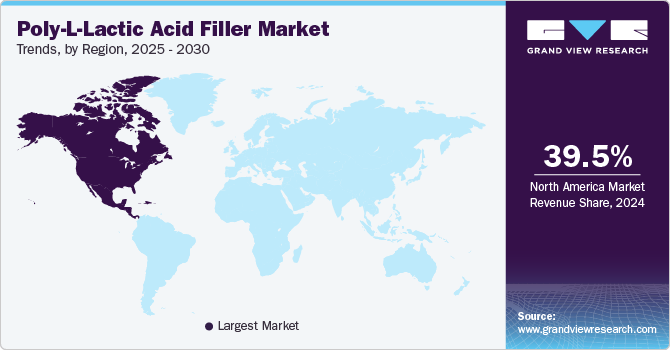

- North America poly-l-lactic acid filler market dominated with the largest revenue share of 39.47% in 2024.

- The poly-l-lactic acid (PLLA) filler market in the U.S. accounted for the largest market share in North America in 2024.

- The Asia Pacific region is expected to grow at the fastest CAGR during the forecast period.

- Based on application, the abdomen segment is expected to grow at a significant CAGR during the forecast period.

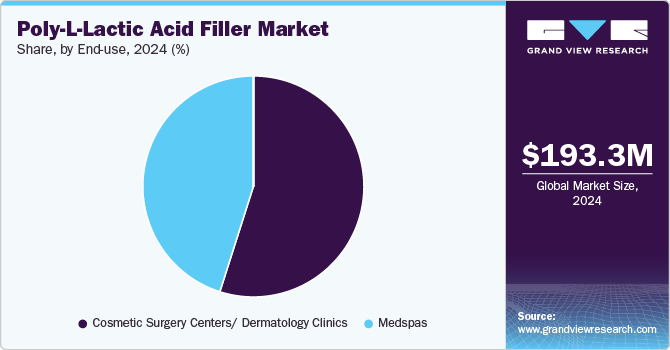

- On the basis of end use, the cosmetic surgery centers segment led the market with the largest revenue share of 54.9% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 193.3 Million

- 2030 Projected Market Size: USD 267.4 Million

- CAGR (2025-2030): 5.4%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

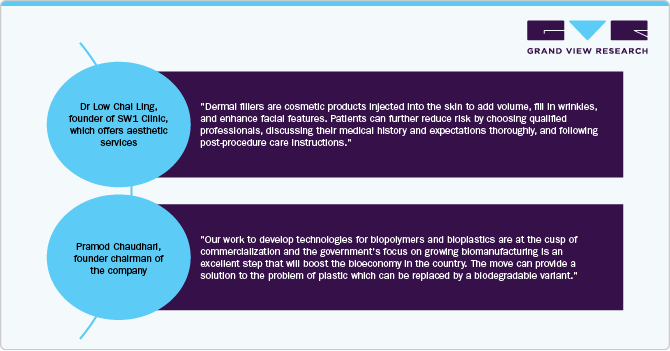

According to the American Society of Plastic Surgeons (ASPS) report published in 2023, in America, 25,442,640 minimally invasive cosmetic procedures were performed freshly. Among these procedures, non-HA fillers such as, Radiesse, Sculptra, Bellafill accounted for 924,549 treatments. This data highlights the significant use of poly-lactic acid (PLLA) filler in aesthetic treatments to restore facial volume and reduce wrinkles.Aging population, rising focus on anti-aging solutions, technological advancements, product innovations, and the growing awareness and acceptance of cosmetic enhancements are the drivers boosting the market's growth over the forecast period.

Aging population and rising focus on anti-aging solutions is boosting the market's growth. According to United Nations Fund for Population Activities (UNFPA), the global proportion of individuals aged 65 and older is increasing more rapidly than the younger population. This demographic is expected to grow from 5.5% in 1974 to 10.3% in 2024. According to United Nations projections, this figure is expected to double again, reaching 20.7% by 2074. In addition, the number of people aged 80 and above is set to more than triple over the same period, highlighting the growing demand for aesthetic solutions like Poly-L-lactic Acid (PLLA) fillers to address age-related volume loss and skin rejuvenation. In 2023, ASPS surgeons performed 369,614 cosmetic procedures using non-hyaluronic acid fillers on individuals aged 55 to 69, the highest number among all age groups. This reflects a widespread acknowledgment of PLLA fillers' effectiveness in anti-aging treatments, meeting the demands of aging populations globally.

Technological advancements and product innovations drive the market growth as companies continue to explore innovative treatment approaches. On January 14, 2025, Galderma announced promising initial results from a groundbreaking clinical trial assessing the combined use of Restylane Lyft or Contour with Sculptra in patients experiencing medication-induced weight loss and facial volume depletion. The three-month interim data from this first-of-its-kind study demonstrated significant improvements in facial aesthetics, along with high patient satisfaction. These findings, set to be presented at the 43rd Annual J.P. Morgan Healthcare Conference, highlight the growing potential of PLLA-based fillers in advanced aesthetic treatments.

Growing awareness and acceptance of cosmetic enhancements are among the major factors driving the poly-l-lactic acid (PLLA) filler industry. According to NCBI article published in March 2024, several clinical trials and studies have confirmed the safety and efficacy of PLLA in skin rejuvenation. PLLA treatments have been shown to notably increase skin thickness and improve texture, particularly in refining static wrinkles. For instance, a study involving 54 patients in the U.S. demonstrated a 54.9% increase in skin thickness after 12 months of PLLA treatment. Other research has indicated that repeated PLLA treatments can effectively address contour defects and enhance overall skin quality.

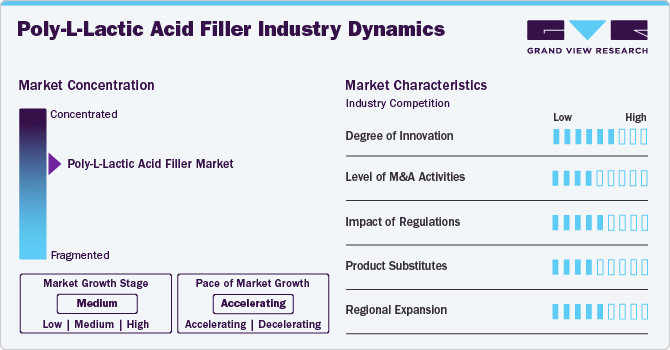

Market Concentration & Characteristics

The market is witnessing a high degree of innovation through advanced formulations that enhance biocompatibility and longevity, ensuring safer and more effective treatments. PLLA's unique ability to stimulate natural collagen production results in long-lasting, natural-looking outcomes.

Several market players, such as Galderma, GANA R&D, and Sinclair Pharma, are involved in mergers and acquisitions. Through M&A activity, these companies employ key strategies such as application innovation, strategic collaborations, and geographical expansion to enhance their presence and address the growing demand for minimally invasive interventions.

Regulations in the market have a significant impact, ensuring product safety and efficacy through stringent approvals. Regulatory compliance boosts consumer confidence and market acceptance. However, the lengthy approval processes can delay market entry and increase development costs for manufacturers.

Potential product substitutes in the industry include hyaluronic acid (HA) fillers, calcium hydroxylapatite (CaHA) fillers, polymethyl methacrylate (PMMA) fillers, and autologous fat grafting. These alternatives offer different mechanisms of action, longevity, and application techniques for soft tissue augmentation and wrinkle reduction.

Market players are expanding their presence regionally by entering untapped geographical markets, forging strategic partnerships with local distributors, and modifying product applications to accommodate to specific healthcare demands within each region.

Application Insights

Based on application, the face segment led the market with the largest revenue share of 44.14% in 2024, owing to the rising popularity of facial rejuvenation procedures, technological advancements in fillers, and the expanding middle-aged and elderly population. For instance, in May 2024,recent advancements in PLLA filler technology aimed to develop more refined formulations. For example, Devolux Injectable Filler employs advanced granular technology to produce ultra-fine particle sizes (3-5µm), enabling faster dissolution and dispersion within five minutes. This improvement minimizes the risk of post-treatment issues like nodules and papules, resulting in a smoother and safer treatment experience. These advancements contribute to the growing popularity and trust in PLLA treatments for facial applications. There has been a 60% rise in facelifts and partial facelifts in 2023 compared to 2017. With a rising number of younger patients (ages 35-55) opting for facial procedures, the need for non-surgical alternatives like PLLA fillers is expanding.

The abdomen segment is expected to grow at a significant CAGR during the forecast period, driven by the increasing demand for non-invasive skin rejuvenation and tightening solutions. Abdominal skin laxity commonly occurs due to aging, pregnancy, and significant weight loss, leading many individuals to seek aesthetic treatments to restore skin firmness and elasticity. Individuals with mild-to-moderate skin laxity or those unwilling to undergo surgery turn to PLLA-based stimulatory collagen activators as a safer and more convenient alternative. Research supports the effectiveness of PLLA-SCA in improving sagging, wrinkling, dimpling, and cellulite, with long-lasting results and minimal side effects. The introduction of advanced formulations, such as Lanluma, has further expanded the application of PLLA fillers beyond traditional facial treatments, positioning them as a versatile solution for abdominal rejuvenation. As consumer awareness grows and technology advances, the market for PLLA fillers in abdominal treatments is expected to experience significant expansion, catering to the rising demand for minimally invasive body contouring solutions.

End-use Insights

Based on end use, the cosmetic surgery centers segment led the market with the largest revenue share of 54.9% in 2024, due to an increasing patient base seeking minimally invasive alternatives to traditional surgical procedures. Cosmetic surgery centers are well-equipped with advanced technologies and skilled professionals who can effectively administer PLLA fillers.Moreover, the integration of PLLA fillers into the treatment protocols at cosmetic surgery centers is supported by continuous advancements in product formulations and injection techniques. These innovations improve the safety, efficacy, and patient satisfaction of PLLA filler treatments, making them a reliable option for practitioners and patients.In addition, the growing strategic initiatives adopted by key players are anticipated to fuel segment growth over the forecast period.

For instance, in January 2024, The Waldorf Center for Plastic Surgery partnered with Forefront Dermatology Group, a well-established dermatology organization. Such collaborations underscore the growing integration of cosmetic surgery and dermatology services. In February 2023, Athenix, a leading plastic surgery practice in the U.S., acquired Marina Plastic Surgery and Medspa, a renowned cosmetic surgery center in California, the U.S. By this acquisition, Athenix would operate from six locations in the U.S. Similarly, in June 2023, Kortesis Bharti Management Group, LLC acquired Lowcountry Plastic Surgery Center. Post acquisition, the latter company’s name will be H/K/B Mount Pleasant.

The medspas segment is expected to show at a lucrative CAGR during the forecast period, due to its several factors increasing consumer confidence in the safety and efficacy of non-invasive treatments offered in these settings, supported by stringent regulatory oversight and advancements in injection techniques. Moreover, medspas are strategically positioned to offer consumers who value personalized care and a complete approach to beauty and wellness. Medspas, which combines medical expertise with a spa-like environment, offers a range of non-surgical cosmetic procedures that appeal to a broad demographic seeking rejuvenation and enhancement without the downtime associated with surgical options.In 2024, the American Med Spa Association reported that over 10,488 Medspas were operational in the U.S., which has increased by 15.2% since 2022. According to the American Med Spa Association’s 2024 Medical Spa State of the Industry Report, an average medical spa generates more than USD 1.4 million annually.

Regional Insights

North America poly-l-lactic acid filler market dominated with the largest revenue share of 39.47% in 2024, owing to advanced healthcare infrastructure, increasing adoption of aesthetic procedures, huge research and development activities, continuous technological advancements in cosmetic treatments, growing geriatric population and a strong presence of key market players.The growing geriatric population in the U.S., susceptible to skin imperfections or diseases, is expected to increase the demand for cosmetic procedures, thereby significantly contributing to the market growth over the forecast period. Moreover, according to a U.S. Census Bureau article published in May 2023, the geriatric population in the region is about 1 in 6 people above 65. Furthermore, the country has the most plastic surgeons, fueling market growth. Furthermore, the country has the highest number of plastic surgeons, which is expected to boost market growth. For instance, the ISAPS 2023 report estimates that nearly 7,750 plastic surgeons are practicing in the country.

U.S. Poly-L-Lactic Acid Filler Market Trends

The poly-l-lactic acid (PLLA) filler market in U.S. accounted for the largest market share in North America in 2024. This market dominance can be attributed to several key factors, including highly developed healthcare infrastructure and the advanced cosmetic industry, which facilitate widespread availability and adoption of PLLA fillers among consumers and healthcare providers. Moreover, the economy and high disposable incomes enable greater affordability and accessibility to aesthetic treatments like PLLA fillers, and technological advancements boost the market's growth.According to the American Society of Plastic Surgeons (ASPS) article, in 2023 there was a significant increase of 5% in cosmetic surgeries and procedures in the U.S. as compared to 2022, totaling 1.5 million. This indicates that more people are now open to and choosing aesthetic enhancements. The article also revealed a nearly 7% increase in minimally invasive cosmetic procedures from 2023 to 2022.

Europe Poly-L-Lactic Acid Filler Market Trends

The poly-l-lactic acid (PLLA) filler market in Europe held a significant share during 2024,due to the presence of skilled professionals and the rise in the geriatric population. Rising demand for advanced treatment tools in Europe is a major factor anticipated to propel the market growth.

The Germany poly-l-lactic acid (PLLA) filler market dominated with the largest revenue share of 24.7% in 2024. Various factors, such as an increase in the popularity of cosmetic procedures, an aging population, technological advancements, and a rise in beauty consciousness, are driving the market.The aging population's interest in maintaining a youthful appearance drives market growth as individuals seek nonsurgical solutions like dermal fillers, emphasizing the relevance & potential growth within the market in Germany. According to AARP, the prevalence of individuals aged 65 and above is expected to increase by 41%, reaching 24 million by 2050, which will make up nearly one-third of the total population, is a significant growth driver for the poly-l-lactic acid (PLLA) filler industry.

The poly-l-lactic acid (PLLA) filler market in the UK held the second largest market share in 2024. The country's growing number of nonsurgical procedures is expected to boost the market over the forecast period. According to the ISAPS 2023 report, nearly 63,130 nonsurgical procedures were performed nationwide. Moreover, it was estimated that nearly 717 surgeons were registered in the country.Moreover, the country is rapidly changing its regulations for poly-l-lactic acid (PLLA) filler due to practitioner malpractices. For instance, in September 2023, a government consultation program was launched to improve the clinical practices related to dermal fillers and Botox procedures.

The France poly-l-lactic acid (PLLA) filler market is anticipated to witness at a significant CAGR of 5.5% during the forecast period. Increased awareness among customers about the potential benefits of aesthetic procedures and the growing adoption of minimally invasive procedures are boosting the market in France. Furthermore, rising purchasing power, growing involvement of international players, increasing spending on cosmetics and personal care, & rising number of beauty clinics are among the factors fueling the market growth in France.

Asia Pacific Poly-L-Lactic Acid Filler Market Trends

The poly-l-lactic acid (PLLA) filler market in Asia Pacific region is expected to grow at the fastest CAGR during the forecast period. This can be attributed to the rising medical tourism industry, especially in Southeast Asia. According to the ISAPS 2023 report, 25.4% of patients who underwent aesthetic treatments in Thailand were foreign nationals, while in India, the figure was 10.2%. The growing preference among foreign nationals to undergo treatments in Thailand can be attributed to the availability of advanced techniques and cost-effective treatment options.

The China poly-l-lactic acid (PLLA) filler market accounted for the largest market share in Asia Pacific in 2024, due to increasing demand for antiaging procedures. According to WHO, 28% of the country’s population is projected to be above 65 by 2040, which in turn is expected to boost the adoption of noninvasive aesthetic treatments. Moreover, according to the ISAPS in 2023, China has a surgical workforce of 3,000 surgeons, constituting 5.4% of the total number of surgeons.

The poly-l-lactic acid (PLLA) filler market in Japan held the second largest market share in the Asia Pacific in 2024. Japan is one of the most rapidly aging countries in the world. The National Institute of Population and Social Security Research projects that by 2040, individuals aged 65 & older will make up 34.8% of Japan's total population. The rapidly aging population in the country is also anticipated to boost the market demand, as the geriatric population is more susceptible to fine lines, wrinkles, saggy skin, and other signs of aging.

The India poly-l-lactic acid (PLLA) filler market is experiencing significant growth, driven by several key factors, increasing affordability of aesthetic procedures along with growing disposable income & awareness about these procedures.Moreover, lower treatment costs in the country are expected to contribute to the growing medical tourism. According to the Times of India article published in May 2023, India witnesses an annual arrival of around 800,000 to 1 million cosmetic procedure patients, 10% of whom come from foreign countries. This positions India as the sixth most favored global destination for medical tourism in cosmetic procedures.

Latin America Poly-L-Lactic Acid Filler Market Trends

The poly-L-lactic acid (PLLA) filler market in Latin America is growing due to several factors. These countries are preferred for medical tourism due to the availability of treatments at lower cost (30% to 70% discount) compared to North American and European countries. In addition, a stronger emphasis on physical beauty coupled with extensive acceptance of facial surgeries has led to the high demand for poly-l-lactic acid filler in Brazil.

The Brazil poly-l-lactic acid filler market is expanding due to several distinct growth drivers. Brazil has a strong culture of beauty & aesthetics, emphasizing youthful appearances and physical attractiveness. This cultural focus on beauty has contributed to the widespread acceptance and use of poly-l-lactic acid filler to enhance or maintain one's appearance. According to the ISAPS report, in 2023, 2,185,038 surgical procedures were conducted in Brazil, alongside 1,196,513 nonsurgical procedures.

MEA Poly-L-Lactic Acid Filler Market Trends

The poly-l-lactic acid (PLLA) filler market in MEA is expected to grow at the lucrative CAGR during the forecast period. The MEA region is witnessing a rising preference among consumers for non-surgical cosmetic treatments, driven by increasing disposable incomes and a growing awareness of aesthetic procedures. Moreover, MEA countries invest in healthcare infrastructure and adopt advanced aesthetic technologies, facilitating greater accessibility to cosmetic procedures, including PLLA fillers.

The South Africa poly-l-lactic acid (PLLA) filler market accounted for significant share in 2024. The growing demand for hyaluronic acid-based dermal fillers from the geriatric population is expected to boost market growth. According to the UNFPA Statistics, in 2024, nearly 6% of the total country’s population was aged over 65.

Key Poly-L-Lactic Acid Filler Company Insights

Some of the key players operating in the industry include Galderma, GANA R&D and Sinclair Pharma. Company’s key strategies include understanding the strengths and weaknesses of major market participants, anticipating future market trends, opportunities, and challenges, and making proactive decisions based on insights into emerging technologies and changing consumer preferences. For instance, PRP Science and EPRUI Biotech are some of the emerging players in the poly-l-lactic acid (PLLA) filler. These industry players continuously focused on leveraging specialized technologies to differentiate themselves.

Key Poly-L-Lactic Acid Filler Companies:

The following are the leading companies in the Poly-L-Lactic acid filler market. These companies collectively hold the significant market share and dictate industry trends.

- Galderma

- Sinclair Pharma

- GANA RND

- PRP Life Science Co., Ltd

- Laboratories Hyamed SA

- Dermax Co., Ltd

- Rimless Industry Co., Ltd.

- Hangzhou Singclean Medical Products Co.,Ltd

- LINKUS GLOBAL Co., Ltd.

Recent Developments

-

In January 2025, Alpha Aesthetics Partners announced its strategic collaboration with Flawless Medspa & Wellness, a reputed aesthetic-care center in Mexico and abroad. This partnership would expand the business in bodu contouring, dermal fillers and other aesthetic treatments by combining expertise from both the companies.

-

In February 2024, Praj Industries revealed that its polylactic acid (PLA) pilot plant was nearing completion and would convert to operation by April 2024. The facility, designed to manufacture bioplastics, was part of the company’s R&D push to develop renewable chemicals like biodegradable polymers using feedstocks.

-

In April 2023, Galderma revealed that the U.S. FDA has launched Sculptra (injectable poly-L-lactic acid) for treating fine lines and wrinkles in the cheek area. Sculptra, the first FDA-launched PLLA collagen stimulator, enhances collagen production to smooth wrinkles and improve skin firmness and glow, with effects lasting up to 2 years.

Poly-L-Lactic Acid (PLLA) Filler Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 205.4 million

Revenue forecast in 2030

USD 267.4 million

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait.

Key companies profiled

Galderma; GANA R&D; Sinclair Pharma; PRP Science; ELASTEM; EPRUI Biotech; and Hyamax

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Poly-L-Lactic Acid Filler Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global poly-l-lactic acid (PLLA) filler market report based on the application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Face

-

Neck

-

Abdomen

-

Knees

-

Thighs

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Medspas

-

Cosmetic Surgery Centers/Dermatology Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

- Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global poly-l-lactic acid filler market size was estimated at USD 429.4 million in 2024 and is expected to reach USD 469.3 million in 2025.

b. The global poly-l-lactic acid filler market is expected to grow at a compound annual growth rate of 10.3% from 2025 to 2030 to reach USD 764.8 million by 2030.

b. North America dominated the poly-lactic acid (PLLA) filler market with a share of 36.5% in 2024, owing to advanced healthcare infrastructure, increasing adoption of aesthetic procedures, huge research and development activities, and continuous technological advancements in cosmetic treatments.

b. Some key players operating in the poly-l-lactic acid filler market include Galderma, GANA R&D, Sinclair Pharma, PRP Science, EPRUI Biotech, and Hyamax,

b. The primary factors driving the market are the rising demand for minimally invasive cosmetic procedures, the growing aging population, and technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.