- Home

- »

- Biotechnology

- »

-

Polyclonal Antibodies Market Size & Share Report, 2030GVR Report cover

![Polyclonal Antibodies Market Size, Share & Trends Report]()

Polyclonal Antibodies Market (2023 - 2030) Size, Share & Trends Analysis Report By Product (Primary, Secondary), By Application (Biomedical Research, Diagnostics), By Source (Rabbit, Goats), By End-user, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-071-6

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global polyclonal antibodies market size was valued at USD 1.48 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.01% from 2023 to 2030. This is mainly attributed to the growing prevalence of infectious and chronic diseases such as cancer across the globe, increasing technological advancements in antibody-based drugs, and the rising R&D activities in the biopharmaceutical industry. Moreover, as compared to monoclonal antibodies, the manufacturing cost of polyclonal antibodies is less. Polyclonal antibodies (pAbs) are widely used in qualitative and quantitative biological analysis and various diagnostic testing. The COVID-19 pandemic significantly impacted the polyclonal antibody market. Various firms are working towards establishing pAbs-based in-house products that are used for treating individuals suffering from COVID-19. The rising acceptance of standard laboratory tests, such as western blot analysis, microarray assays, cell imaging, and immunohistochemical, is projected to propel polyclonal antibody market growth. For instance, GenScript, a U.S.-based biotechnology company, offers tailored pAbs that are appropriate for several assays type, such as CHiP, sandwich ELISA, Immunoprecipitation, Western Blot, IHC, IF, and Flow Cytometry. Additionally, according to an article published in April 2021, a human-derived antibody, SAB-185 developed by SAB Biotherapeutics, Inc., has been tested in a Phase 2/3 trial that is enrolled in non-hospitalized individuals with mild or moderate COVID-19 infections. Hence, these initiatives showcased the rise of demand for the pAbs during the pandemic period.

According to a report published by WHO in February 2022, approximately 10 million deaths were reported in the year 2020, among which, the most common cancers include lung, breast, rectum & colon, and prostate cancer. Furthermore, as per the article released by the American Cancer Society in January 2023, nearly 59,610 fresh leukemia cases (of all kinds) and 23,710 deaths caused due to leukemia (of all kinds) in the U.S. Polyclonal antibody treatment is widely used to treat various cancers including lymphoma, leukemia, solid tumor, and many more. For instance, in August 2021, the Cancer Prevention & Research Institute of Texas was funded with USD 250,000, for Antibody like Therapeutics which would Target Polyclonal T Cells to CMV-Positive Glioblastomas. Thus, the increasing prevalence of cancer is expected to create huge opportunities to propel the upsurge of the market.

According to an article published by the National Library of Medicine in May 2018, the rabbit model was adopted initially to study polyclonal antibody reactions and supported the immunogenicity associated with DNA immunization as an innovative immunization technique. Additionally, the rabbit model has been used significantly in the development of the HIV vaccine. Rabbits have a number of benefits over other small animals, such as mouse or rat, including, ease in inducing high-titer, high-affinity epitope-specific Abs that respond to nearly all kinds of antigens and minimal non-specific responses.

Additionally, government organizations around the world are increasingly recognizing the potential of the pAbs, and are taking initiatives to support its growth. These initiatives are aimed at promoting research and development, improving healthcare infrastructure, and providing funding for the development of new and innovative products. In September 2021, Regeneron Pharmaceuticals, Inc. announced their collaboration with the U.S. government, i.e., the Department of Defense (DOD) and the Department of Health and Human Services (HHS) for buying doses of REGEN-COV (casirivimab and imdevimab) antibody cocktail that is used in treating COVID infected patients in various hospitals.

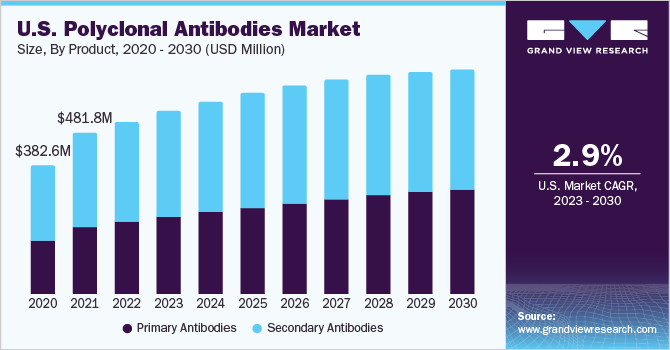

Product Insights

In 2022, the secondary antibodies segment dominated the market with a market share of 56.14%. Secondary Abs bind to primary Abs that are raised against the target antigen and amplify the signal through various detection methods including ELISA, Western blotting, and Immunohistochemistry. In addition, secondary Abs are typically produced by immunizing host animals, such as rabbits, goats, or mice along with the immunoglobulin (Ig) of the same species as the primary antibody. Thus, this leads to the production of polyclonal secondary Abs that can recognize multiple epitopes on primary Abs, henceforth increasing the sensitivity and specificity of the assay.

The primary antibodies segment is expected to grow at the fastest CAGR of 6.44% during the forecast period. The increasing adoption of primary antibodies based (pAb-based) assays in clinical diagnostics, and rising demand for high-quality & diverse primary Abs are the factors contributing to the growth of the segment. Primary Abs are essential reagents for various clinical assays, including Western Blotting, ELISA, and Immunohistochemistry for the identification of disease biomarkers. Thus, as the demand for personalized medicine and biomarker-based diagnostics continues to grow, the primary antibody segment in the pAbs market is expected to grow further.

Application Insights

The diagnostics segment dominates the market for polyclonal antibodies with a share of 59.81% in 2022 and the same is anticipated to have the highest CAGR rate of 5.63% from 2023-2030. pAbs are considered to be an ideal reagent in hemagglutination reactions and diagnostics assay due to their capability to identify the epitopes of targeted molecules. Moreover, pAbs are relatively inexpensive to produce as compared to mAbs, as they can be produced by immunizing animals such as rabbits, goats, or mice, with the target antigen that would stimulate a polyclonal antibody response. In addition, the polyclonal antibody used in applications such as ELISA, Western Blot, and many others, are less likely to produce false negatives due to their ability to recognize multiple epitopes on the targeted antigen.

Biomedical research is projected to show significant growth during 2023-2030. This growth is due to their versatile nature, easy producibility, diverse range of binding specificities, and the ability to detect a wide range of biomolecules. In addition, as per the article published in January 2023 by ScienceDaily, scientists have developed a machine learning approach using AI technology to accelerate the production of new highly specific antibody drugs against diseases such as cancer, rheumatoid arthritis, and COVID-19. Additionally, in June 2021, Rapid Novor designed the first-of-its-kind sequencing technology, namely, REpAb, used for identifying sequences in pAbs utilized during drug discovery processes. Such technological advancements are expected to increase the demand for biomedical research during the forecast period.

Source Insights

The rabbit segment dominated the market in 2022 with a market share of 50.69% due to rapid immune response against small molecules, haptens, and post-translational modifications. Moreover, rabbit Abs have better affinity and specificity as compared to other animals. Rabbit-sourced antibodies (Abs) are highly specific Abs with a binding capability to various proteins in the picomolar range. Abs sourced from rabbits are highly particular, and showcase an improved immunologic response, thus facilitating better recognition of diseases during diagnosis. For instance, in February 2023, Roche announced the launch of two novel Abs (i.e., Rabbit Monoclonal Primary Antibody and the ATRX Rabbit Polyclonal Antibody) that would be used to identify the mutated gene in patients with brain cancer.

Mouse is expected to grow with the fastest CAGR of 8.01% during 2023-2030. Mice are widely available in research laboratories compared to other animals for the production of Abs that are manufactured using immunization protocols. Moreover, the growth factors for mouse-derived pAbs, include their high degree of homology with human proteins. Mice share a high degree of genetic and protein sequences similar to humans, making them one of the ideal hosts for generating pAbs that cross-react with human proteins.

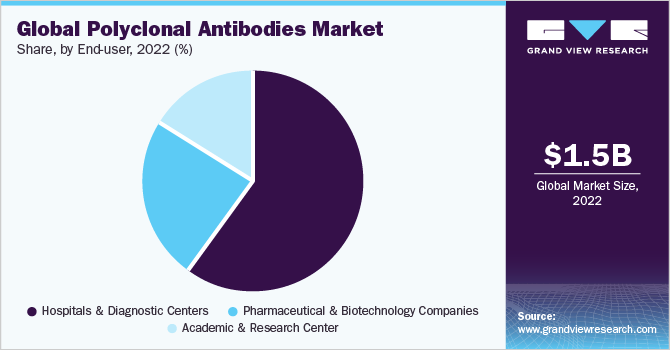

End-User Insights

In 2022, the hospitals & diagnostic centers segment dominated with a market share of 59.81%, and the same is anticipated to have the highest CAGR rate of 5.63% during 2023-2030. Due to the rising prevalence of chronic & infectious diseases, growing cases of cancer, and increasing demand for pAbs-based assays in diagnostic centers the demand for hospitals & diagnostic centers are anticipated to increase during the forecast period. Furthermore, growing investments in hospitals & diagnostic centers are expected to boost the growth of the segment.For instance, in April 2020, the University of Arizona Health Sciences associated with the State of Arizona accompanied an antibody blood examination for the COVID-19 pandemic. To the university, the State offered financial assistance of USD 3.5 million. Hence, increasing demand for antibody-based tests is further expected to grow the demand for pAbs.

The pharmaceutical & biotechnology companies’ segment is projected to show significant growth over the forecast period owing to the increasing demand for pAbs in drug discovery & development, and growing investment in biologics. For instance, in January 2023, SAB Biotherapeutics, a clinical-stage biopharmaceutical firm announced results from a project in collaboration with global biotechnology leader CSL, approving that SAB’s DiversitAb platform can produce efficient fully-human anti-idiotype pAbs that can efficiently target and nullify autoantibodies related with autoimmune ailments.

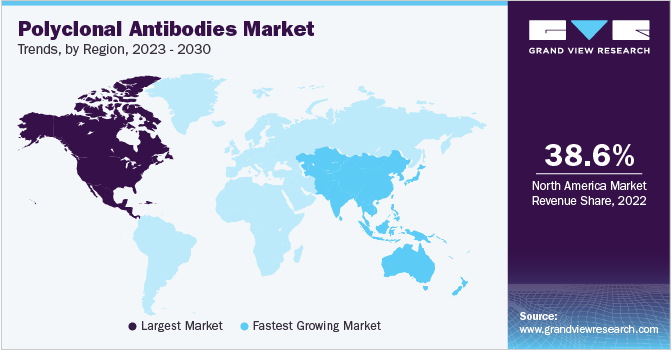

Regional Insights

In 2022, North America dominated the industry with a market share of 38.62% in terms of revenue. This large market share is attributed due to several factors, including, the presence of a large number of biotechnology and pharmaceutical companies, advanced technology and infrastructure, a strong focus on innovation, a stringent regulatory environment, and a well-developed healthcare system. In July 2022, GigaGen, headquartered in California, U.S., published a study showcasing the First-Ever Clinical GMP Manufacturing and IND-Enabling Studies for the organization’s novel class of recombinant pAbs drug, an approach to treat infectious and chronic diseases, by targeting numerous viral epitopes.

Asia Pacific is anticipated to register the highest CAGR of 9.67% during 2023-2030. The pAbs market is driven by several factors, including the increasing prevalence of chronic diseases, rising demand for personalized medicine, growing investments in research and development, and advancements in healthcare infrastructure in countries like India, China, and South Korea. As a result, the pAbs market in the Asia Pacific region is expected to continue to grow rapidly in the coming years. For instance, in May 2020, China-based biotechnology company Junshi Biosciences, collaborated with Eli Lilly and Company to jointly create therapeutic antibodies to prevent and treat illness caused due to the COVID-19 pandemic.

Key Companies & Market Share Insights

Companies in the polyclonal antibodies market are leveling on manufacturing novel medical products, developments, and advancements in technology. In addition, M&As and collaborations for novel product development constitute some of the initiatives implemented by major players. For instance, in February 2023, Thermo Fisher Scientific announced its contract manufacturing agreement with Elektrofi, a U.S.-based biotechnology firm, in order to improve production facilities for upcoming clinical trials in biologic-based therapies. This collaboration will assist early clinical activities across multiple pipeline programs, enabling a quick scaling up for late-stage along with commercial advancement. Additionally, in March 2020, Takeda Pharmaceutical Company, a Japan-based biotechnology company initiated the development of Anti-SARS-CoV-2 polyclonal hyperimmune globulin (H-IG), a plasma-derived therapy for treating infection in individuals caused due to COVID-19. Thus, these initiatives and collaborations are anticipated to propel market growth. Some of the key players operating in the global polyclonal antibodies market include:

-

Thermo Fisher Scientific Inc.

-

Merck KGaA

-

Abcam plc.

-

ProteoGenix

-

Proteintech Group, Inc.

-

Bio-Rad Laboratories Inc.

-

BPS Bioscience, Inc.

-

R&D Systems, Inc.

-

Agilent Technologies, Inc.

-

Atlas Antibodies

-

CUSABIO TECHNOLOGY LLC

-

ROCKLAND IMMUNOCHEMICALS, INC.

Recent Development

- In December 2021, Atlas Antibodies announced the release of 1,200 new Triple-A Polyclonals™, highly validated antibodies for cell and tissue analysis. These new solutions cover research areas such as cancer, cell biology, immunology, metabolism, neuroscience, transcriptional regulation, and stem cells & developmental biology.

Polyclonal Antibodies Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 1.57 billion

Revenue forecast in 2030

USD 2.21 billion

Growth rate

CAGR of 5.01% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, source, end-user, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Thermo Fisher Scientific Inc.; Merck KgaA; Abcam plc.; ProteoGenix; Proteintech Group, Inc.; Bio-Rad Laboratories Inc.; BPS Bioscience, Inc.; R&D Systems, Inc.; Agilent Technologies, Inc.; Atlas Antibodies; CUSABIO TECHNOLOGY LLC; ROCKLAND IMMUNOCHEMICALS, INC.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact researchneeds. Explore purchase options

Global Polyclonal Antibodies Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyclonal antibodies (pAbs) market based on product, application, source, end-user, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Primary Antibodies

-

Secondary Antibodies

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Biomedical Research

-

Diagnostics

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Rabbits

-

Goats

-

Sheep

-

Mouse

-

Others

-

-

End-User Outlook (Revenue, USD Million; 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Hospitals & Diagnostic Centers

-

Academic & Research Center

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The rabbit segment dominated in terms of the revenue share in 2022. Abs from rabbits have a high level of specificity and can bind to a variety of proteins at picomolar concentrations. Hence, the demand for rabbit-based Abs is expected to increase in the future.

b. Some of the key players operating in the industry include Thermo Fisher Scientific Inc., Merck KGaA, Abcam plc., ProteoGenix, Proteintech Group, Inc., Bio-Rad Laboratories Inc., BPS Bioscience, Inc., R&D Systems, Inc., Agilent Technologies, Inc., Atlas Antibodies, CUSABIO TECHNOLOGY LLC, ROCKLAND IMMUNOCHEMICALS, INC.

b. The increasing technological advancements in the production of antibodies-based drugs, the growing prevalence of infectious & chronic diseases such as cancer across the globe, and the rising biopharmaceutical research and development activities are the main drivers of the industry.

b. The global polyclonal antibodies market size was estimated at USD 1.48 billion in 2022 and is expected to reach USD 1.57 billion in 2023.

b. The global polyclonal antibodies market is expected to grow at a compound annual growth rate of 5.01% from 2023 to 2030 to reach USD 2.21 billion by 2030.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.