- Home

- »

- Petrochemicals

- »

-

Polyester Polyol Market Size & Share, Industry Report, 2033GVR Report cover

![Polyester Polyol Market Size, Share & Trends Report]()

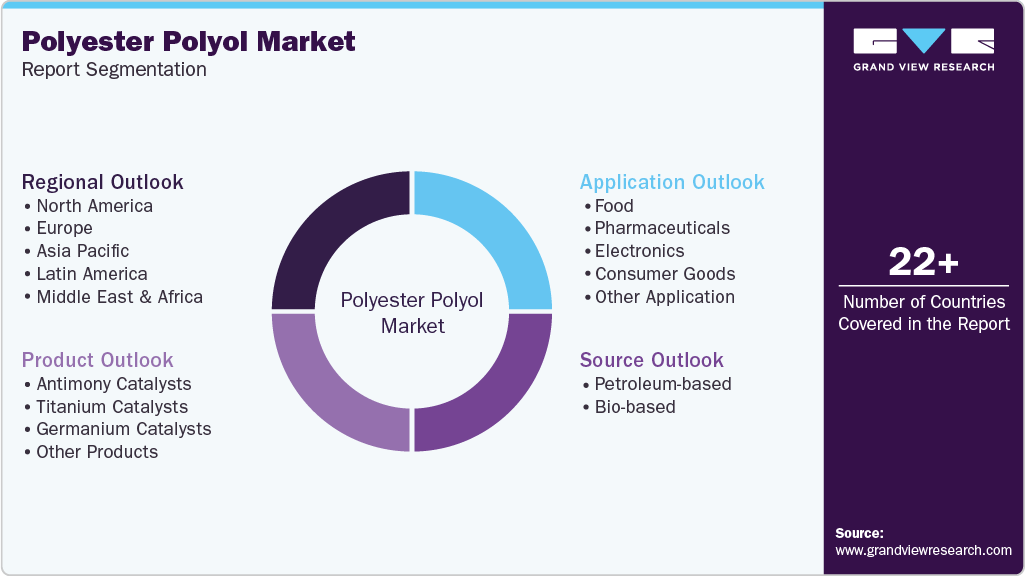

Polyester Polyol Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Antimony Catalysts, Titanium Catalysts, Germanium Catalysts ), By Source (Petroleum-based, Bio-based), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-699-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyester Polyol Market Summary

The global polyester polyol market size was estimated at USD 9,654.2 million in 2024 and is projected to reach USD 15,033.3 million by 2033, at a CAGR of 5.1% from 2025 to 2033. The market is primarily driven by the growing demand for high-performance polyurethane-based products across industries such as construction, automotive, and consumer goods.

Key Market Trends & Insights

- Asia Pacific dominated the polyester polyol market with the largest revenue share of 43.7% in 2024.

- The market in China is expected to grow at the highest CAGR of 5.2% from 2025 to 2033 in terms of revenue.

- By product, the titanium catalysts segment is expected to grow at the highest CAGR of 5.7% from 2025 to 2033 in terms of revenue.

- By source, the petroleum-based segment held the largest revenue share of 85.7% in 2024 in terms of value.

- By application, the food segment held the largest revenue share of 61.4% in 2024 in terms of value.

Market Size & Forecast

- 2024 Market Size: USD 9,654.2 Million

- 2033 Projected Market Size: USD 15,033.3 Million

- CAGR (2025-2033): 5.1%

- Asia Pacific: Largest market in 2024

- North America: Fastest growing market

Rising consumption of flexible and rigid foams for insulation, cushioning, and structural applications is fueling market expansion. The increased regulatory focus on energy efficiency and sustainable building materials is propelling the adoption of advanced polyester polyol formulations. Opportunities lie in the rising shift toward bio-based polyester polyols, supported by sustainability goals and regulatory frameworks promoting green chemistry. Advancements in catalyst technologies, particularly titanium and other non-toxic alternatives, open doors for applications in food-grade and pharmaceutical products. Furthermore, emerging economies in Asia Pacific and Latin America offer untapped potential due to increasing industrialization, urban development, and demand for eco-friendly consumer products.

Key challenges include fluctuating raw material prices, particularly those derived from petroleum sources, which impact production cost stability. In addition, environmental concerns associated with traditional catalysts such as antimony, along with stringent regulatory scrutiny, are putting pressure on manufacturers to innovate cleaner alternatives. High production costs and limited scalability of bio-based polyols also pose barriers to widespread adoption, especially in price-sensitive markets.

Market Concentration & Characteristics

The market is moderately fragmented, with a few global players, such as Alfa Chemicals, Arkema, and Arpadis, are some of the prominent companies that dominate the competitive landscape. These companies benefit from their scale of operations, competitive pricing, and diversified product offerings. They are actively investing in research and development, expanding production capacities, and focusing on sustainable practices to strengthen their positions in the competitive market.

Leading players in the global polyester polyol market are adopting a combination of strategic initiatives to strengthen their market position and address evolving industry demands. These include expanding their bio-based product portfolios to align with sustainability trends and regulatory mandates, as well as investing in R&D for advanced catalyst technologies that offer improved performance with reduced environmental impact. Companies are also pursuing strategic partnerships and joint ventures to enhance regional presence, especially in high-growth markets such as Asia Pacific. Moreover, capacity expansions and vertical integration are being leveraged to optimize supply chains, ensure raw material security, and improve cost efficiencies across operations.

Product Insights

Antimony catalysts held the largest revenue share of 61.7% in 2024 owing to their proven efficiency, widespread commercial availability, and cost-effectiveness in polyester polyol production, particularly for PET and polyurethane applications. Their strong catalytic activity ensures high polymer yield and consistent product quality. It makes them the preferred choice for large-scale manufacturers across industries such as packaging, consumer goods, and construction. Despite increasing regulatory scrutiny over antimony’s environmental and health impact, its long-standing dominance and process familiarity continue to support its large market share, especially in cost-sensitive regions and mature manufacturing setups.

However, the market is gradually witnessing a shift toward alternative catalyst systems due to sustainability concerns and tightening global regulations. Titanium catalysts are gaining traction as they offer comparable performance with significantly lower toxicity, making them attractive for applications requiring food-grade and pharmaceutical compliance. Germanium catalysts, while more expensive, are favored in niche applications such as electronics and optical-grade packaging due to their ability to produce high-clarity, color-stable polyols. The “Others” category, including zinc, manganese, and cobalt-based catalysts, represents a growing segment driven by innovation in low-toxicity and eco-friendly chemistry, particularly as regulatory frameworks around heavy metals become stricter globally.

Source Insights

The petroleum-based segment held the largest revenue share of 85.7% in 2024 due to its well-established production infrastructure, lower cost, and superior performance attributes. These polyols offer high compatibility with a wide range of applications such as foams, adhesives, coatings, and elastomers, making them the go-to choice for large-scale industrial applications. Their consistent quality, process stability, and global supply availability further reinforce their dominance, especially in sectors such as automotive, construction, and consumer goods, where performance and cost-efficiency are prioritized over sustainability.

Despite their dominance, the bio-based polyester polyols segment is witnessing accelerated growth driven by increasing environmental regulations, growing consumer demand for sustainable products, and rising corporate ESG commitments. Derived from renewable feedstocks such as vegetable oils and recycled PET, bio-based polyols offer reduced carbon footprint and potential biodegradability, making them ideal for green building materials, packaging, and personal care applications. Although current production costs are relatively higher, ongoing R&D, policy incentives, and advancements in scalable technologies are expected to narrow the cost gap, positioning bio-based polyols as a strategic growth segment in the coming years.

Application Insights

The food segment held the largest revenue share of 61.4% in 2024 owing to the extensive use of polyester polyols in food packaging materials, particularly in flexible films, laminates, and coatings that require superior barrier properties and chemical resistance. These polyols contribute to enhanced shelf life, structural integrity, and heat resistance of food packaging, aligning with the industry's stringent safety and quality standards. The rise in processed and packaged food consumption, especially in emerging markets, further fueled demand. Additionally, regulatory compliance and increased emphasis on safe, food-grade catalyst systems such as titanium and bio-based options are supporting the segment’s dominance.

Beyond food, the market sees growing traction across pharmaceutical, electronics, and consumer goods applications. In pharmaceuticals, polyester polyols are used for capsule coatings and controlled drug delivery systems due to their biocompatibility and stability. The electronics segment utilizes these materials in encapsulants and conformal coatings for protection against moisture and electrical interference. Meanwhile, consumer goods, including textiles, footwear, and furnishings, leverage polyester polyols for their durability, flexibility, and lightweight properties. The others category, including automotive, industrial, and construction uses, is steadily expanding as sustainability initiatives and performance needs drive the development of advanced polyol formulations tailored for demanding environments.

Regional Insights

Asia Pacific dominated the global polyester polyol market with a 43.7% revenue share in 2024, driven by rapid industrialization, urbanization, and growing demand across construction, automotive, and consumer goods sectors. The region benefits from cost-effective manufacturing, favorable government initiatives, and a strong presence of local and international manufacturers. Rising investments in infrastructure and smart city development, coupled with increased consumption of flexible polyurethane foams, are reinforcing market growth. In addition, the region is witnessing a shift toward bio-based alternatives, particularly in Japan and South Korea, aligned with sustainability goals.

China Polyester Polyol Market Trends

China stood as the key growth engine within Asia Pacific, supported by its large-scale polyester and polyurethane production ecosystem. Strong demand from food packaging, automotive interiors, and construction insulation segments continues to drive market expansion. The government's push for energy-efficient buildings and green materials is also prompting investments in advanced polyol technologies. Moreover, China is increasingly adopting bio-based polyester polyols as part of its carbon neutrality roadmap, supported by both policy incentives and corporate sustainability commitments.

North America Polyester Polyol Market Trends

North America accounted for 27.3% of the global market revenue in 2024, underpinned by the region’s mature polyurethane industry and consistent demand from food packaging, pharmaceuticals, and electronics applications. Technological innovation, strong R&D capabilities, and early adoption of bio-based and non-toxic catalyst systems are driving product development and differentiation. Regulatory frameworks such as FDA and EPA guidelines continue to shape material choices, pushing manufacturers to invest in sustainable and compliant polyester polyol solutions.

US Polyester Polyol Market Trends

The U.S. remained the largest contributor to the North American polyester polyol market, fueled by high consumption of rigid and flexible foams in construction, refrigeration, and automotive industries. Strong consumer demand for packaged and processed foods, along with stringent packaging safety standards, boosts demand for high-performance polyester polyols. In addition, domestic players are actively investing in bio-based product lines and forming strategic alliances to expand their global footprint while meeting evolving sustainability mandates.

Europe Polyester Polyol Market Trends

Europe held 21.8% of the global revenue share in 2024, supported by the region’s strong regulatory environment and a highly developed packaging and consumer goods industry. The European Green Deal and other sustainability-focused policies are accelerating the transition from petroleum-based to bio-based polyester polyols. Innovation in catalyst technologies and eco-friendly packaging solutions is being driven by both government regulations and consumer demand for safer, more sustainable products. Countries such as France, Italy, and Spain are also witnessing growth due to increased infrastructure renovation projects.

Germany led the European market with its advanced chemical manufacturing base, strong automotive sector, and focus on green innovation. The country's industrial strength supports large-scale production of polyester polyols for use in automotive coatings, electronics, and construction insulation materials. Furthermore, Germany is at the forefront of adopting sustainable catalyst systems and bio-based formulations, supported by public and private investments in circular economy initiatives and clean technologies.

Latin America Polyester Polyol Market Trends

Latin America accounted for a modest 4.1% of the global market in 2024, with growth driven primarily by Brazil and Mexico. Rising consumer demand for packaged food and expanding construction activities are supporting the use of polyester polyols, particularly in insulation and flexible foams. However, limited domestic production capabilities and dependence on imports constrain rapid growth. That said, increasing awareness of green building standards and government efforts to promote industrial development are expected to create long-term growth opportunities.

Middle East & Africa Polyester Polyol Market Trends

The Middle East & Africa region contributed 3.0% to the global market in 2024, driven by growing infrastructure projects, urban development, and industrial diversification efforts in countries such as the UAE, Saudi Arabia, and South Africa. Demand for polyester polyols is rising in construction and packaging applications, supported by increasing investments in manufacturing and logistics hubs. However, limited access to advanced technologies and raw materials, along with regulatory variability, continues to challenge broader market penetration across the region.

Key Polyester Polyol Company Insights

Key players, such as Alfa Chemicals, Arkema, Arpadis, BASF SE, are dominating the market.

-

Alfa Chemicals is a privately held UK and Ireland specialty chemical distributor founded in 1976 and headquartered in Binfield, Berkshire, with a dedicated subsidiary, Alfa Chemicals Nordic ApS, in Copenhagen. The company operates three specialist divisions, Industrial, Pharmaceutical, and Personal Care, each supported by regulatory‑trained chemists who provide deep technical advice tailored to specific sector needs. In its Industrial division, Alfa acts as a regional partner of global polymer and specialty chemical producers, stocking and distributing key raw materials and additives, including STEPANPOL polyester polyols for coatings, adhesives, sealants, and elastomers, in the UK, Ireland, and Nordic markets. Alfa also offers proprietary and environmentally aware solvent systems under its ALFAREs and RESIN KLEEN brands for industrial cleaning and polymer processing applications. Committed to compliance with REACH, CLP, ISO 9001:2015 quality standards, and industry best practices, Alfa Chemicals positions itself as a trusted and technically informed supply chain partner.

Key Polyester Polyol Companies:

The following are the leading companies in the polyester polyol market. These companies collectively hold the largest market share and dictate industry trends.

- Alfa Chemicals

- Arkema

- Arpadis

- BASF SE

- DIC CORPORATION

- Dow

- Evonik

- Huntsman Corporation

- Oleon NV

- PCC SE

- Purinova Sp. z o.o.

- Stepan Company

- TER HELL & Co. GmbH

- Townsend Chemicals P/L

Recent Developments

-

In May 2025, Huntsman announced the expansion of its Conroe, Texas facility with a new E‑GRADE purification and packaging unit, targeting semiconductor‑grade amines. While centered on specialty amines, this investment highlights Huntsman’s strategic push into electronics‑grade materials and high‑purity chemistries, complementary to polyester polyol innovation in electronics segment applications.

-

In August 2024, BASF initiated a strategic alliance with Renewable Energy Group (REG) to co-develop bio‑based feedstocks. The objective is to replace up to 20% of fossil-based inputs in polyester polyol production by 2025, supporting BASF’s sustainability strategy and accelerating the decarbonization of its polyurethane platforms.

-

In December 2023, UPM Biochemicals began commercial operations at its Leuna, Germany biorefinery, supplying wood-based glycols (Bio‑MEG, Bio‑MPG) at full scale by 2024. Dow formally integrated these wood-derived glycols into its polyester polyol production, mitigating raw material scarcity and enhancing renewable feedstock adoption in industrial applications.

Polyester Polyol Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 10,061.1 million

Revenue forecast in 2033

USD 15,033.3 million

Growth rate

CAGR of 5.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, application, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; Australia; South Korea; Saudi Arabia; South Africa; Brazil; Argentina

Key companies profiled

CarbPure Technologies; Alfa Chemicals; Arkema; Arpadis; BASF SE; DIC CORPORATION; Dow; Evonik; Huntsman Corporation; Oleon NV; PCC SE; Purinova Sp. z o.o.; Stepan Company; TER HELL & Co. GmbH; Townsend Chemicals P/L.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyester Polyol Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global polyester polyol market report based on product, source, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Antimony Catalysts

-

Titanium Catalysts

-

Germanium Catalysts

-

Other Products

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Petroleum-based

-

Bio-based

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

Food

-

Pharmaceuticals

-

Electronics

-

Consumer Goods

-

Other Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Latin America

-

Brazil

-

Argentina

-

-

Frequently Asked Questions About This Report

b. The global polyester polyol market size was estimated at USD 9,654.2 million in 2024 and is expected to reach USD 10,061.1 million in 2025.

b. The global polyester polyol market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 15,033.3 million by 2033.

b. The petroleum-based segment held the largest revenue share in 2024 due to its well-established supply chain, cost-effectiveness, and widespread applicability across industrial sectors. Its consistent performance characteristics and scalability continue to drive preference over emerging bio-based alternatives, especially in price-sensitive markets.

b. Some of the key players operating in the polyester polyol market include CarbPure Technologies, Alfa Chemicals, Arkema, Arpadis, BASF SE, DIC CORPORATION Dow, Evonik, Huntsman Corporation, Oleon NV, PCC SE, Purinova Sp. z o.o., Stepan Company, TER HELL & Co. GmbH, and Townsend Chemicals P/L.

b. The growth of the global polyester polyol market is primarily driven by rising demand for polyurethane-based products across industries such as construction, automotive, and electronics. The advancements in catalyst technologies and increasing interest in sustainable polyol solutions are further propelling market expansion.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.