- Home

- »

- Micro Molding & Microspheres

- »

-

Polymer Microinjection Molding Market Size Report, 2030GVR Report cover

![Polymer Microinjection Molding Market Size, Share & Trends Report]()

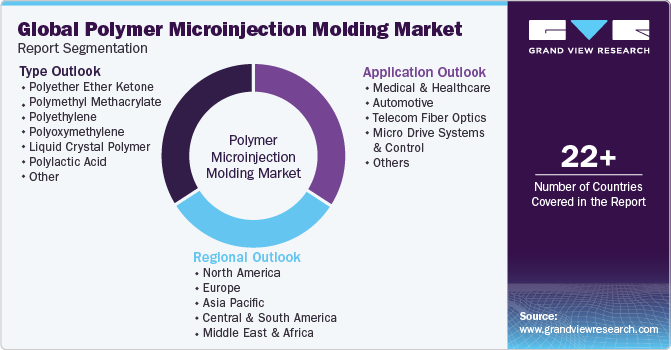

Polymer Microinjection Molding Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Polyethylene, Polyoxymethylene), By Application (Medical & Healthcare, Automotive), By Region, And Segment Forecasts

- Report ID: 978-1-68038-062-0

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global polymer microinjection molding market size was estimated at USD 1,264.7 million in 2023 and is projected to grow at a CAGR of 10.5% from 2024 to 2030. Increasing demand for miniature materials is expected to be a key factor driving the overall market for polymer microinjection molding for various applications spread across widespread end-use industries, including medical, electronics, automotive, and telecom.

Moreover, the growing adoption of polymer microinjection polymers applications that helps usually the ultra-fine molding resolution in the manufacturing of small sized products is expected to positively influence the market growth.

The U.S. market is expected to grow significantly. This sector encompasses the production of small and intricate polymer components using advanced microinjection molding techniques. Such components find applications across various industries, including medical devices, automotive, electronics, consumer goods, and aerospace, among others. Factors driving the market growth include increasing demand for miniaturized and high-precision components, advancements in microinjection molding technology, growing adoption of polymers in manufacturing, and rising applications in sectors like healthcare and electronics.

Moreover, the rise in demand for miniature materials for various applications such as medical & healthcare, automotive is the root cause fueling up the market growth rate. Further, rising industrialization, surging demand for small sized components and growth of various end user verticals such as automotive, medical & healthcare industry especially in the U.S. will also positively impact the market growth. For instance, the presence of a large number of medical device manufacturers and the easy availability of technically advanced equipment in the U.S. are anticipated to fuel the demand for medical devices in the country over the forecast period.

The key driving factor for the market is the increasing demand for small-sized components, mainly from the medical industry. The adoption of micro molding within the medical sector has been driven by a notable shift in the trend away from phthalate-containing polymers, such as PVC, towards thermoplastics. This transition is further fueled by a surge in demand for micro materials. For the manufacture of ear implants, micro filters, precision blades, bearing caps, and certain other devices requiring precise features and geometries, micro molded parts are largely used. According to AdvaMed, the U.S. is the largest medical device market. As per the 2023 Report from the U.S. Centers for Medicare & Medicaid Services, healthcare expenditure in the United States saw a 4.1% increase in 2022, reaching a total of USD 4.5 trillion, translating to USD 13,493 per capita. In addition, healthcare spending represented 17.3% of the nation's Gross Domestic Product (GDP) during this timeframe. It is anticipated that this rise will have an impact on the growth of the polymer microinjection moldings market.

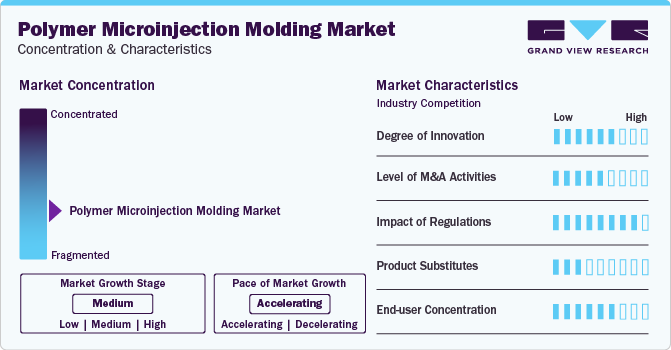

Market Concentration & Characteristics

Market growth stage is medium and the pace is accelerating. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Regulatory frameworks, such as quality standards, safety guidelines, and environmental regulations, govern various aspects of polymer microinjection molding, ensuring product safety, reliability, and compliance with industry standards. These regulations often dictate material selection, manufacturing processes, waste management practices, and product labeling requirements, impacting the entire supply chain from raw material suppliers to end-users. In addition, evolving regulations concerning healthcare, automotive, electronics, and other industries drive the demand for specialized polymer components, stimulating innovation and technological advancements in microinjection molding techniques.

The degree of innovation in the market is substantial and continuously evolving. This market segment is characterized by ongoing advancements in materials, technologies, processes, and product design. One key area of innovation lies in materials development, with manufacturers continually exploring new polymer formulations that offer enhanced properties such as strength, flexibility, heat resistance, and biocompatibility. Additionally, advancements in microinjection molding machinery, including precision control systems, automation, and multi-cavity molds, enable manufacturers to produce complex and highly detailed components with greater efficiency and accuracy.

The end-user concentration in the market varies depending on the specific applications and industries served. In some sectors, such as medical devices, automotive components, and consumer electronics, there may be a relatively moderate to high concentration of large end-users who require specialized polymer microinjection molded parts. These end-users often have stringent quality standards, precise specifications, and large volume demands, leading to long-term partnerships and contracts with key suppliers in the microinjection molding industry.

In the global market, there are several potential substitutes depending on the specific application requirements. One substitute is traditional injection molding, which is suitable for larger parts or components that do not require the extreme precision and small-scale production capabilities offered by microinjection molding. Another substitute could be additive manufacturing technologies, such as 3D printing, which allow for rapid prototyping and production of complex geometries without the need for molds. However, 3D printing may not always offer the same level of material properties or surface finish as microinjection molding.

Type Insights

Based on type, the polyether ether ketone segment held the market with the largest revenue share in 2023. Factors driving the growth of the polyether ether ketone type segment include increasing demand for lightweight and high-performance materials, growing applications in critical industries where reliability and durability are paramount, and advancements in microinjection molding technology that enable the production of complex geometries with tight tolerances using PEEK material.

Polymethyl methacrylate microinjection molded components find extensive use in automotive applications such as headlight lenses, tail light lenses, and dashboard displays, owing to their exceptional optical clarity, impact resistance, and weatherability. In addition, polymethyl methacrylate is utilized in electronic devices like LED light guides and display panels due to its transparency and resistance to discoloration. In the medical sector, polymethyl methacrylate is employed in surgical instruments, medical implants, and diagnostic devices due to its biocompatibility and sterilizability. Such growing applications of polymethyl methacrylate is expected to fuel the segment growth over the forecast period.

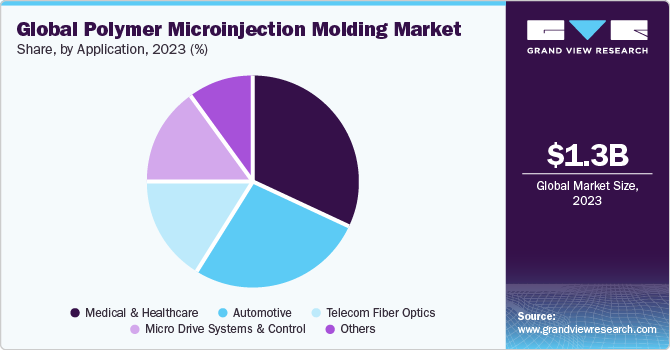

Application Insights

Based on application, the medical & healthcare segment held the market with the largest revenues share of 32.0% in 2023. Polymer microinjection molding is extensively used to manufacture various medical devices such as surgical instruments, catheters, syringes, and drug delivery systems. These components require precise dimensions, biocompatibility, and sterilizability, all of which can be achieved through microinjection molding processes.

The automotive segment anticipated to grow at the lucrative CAGR from 2024 to 2030. Microinjection molding is widely used to produce automotive lighting components such as headlight lenses, taillight lenses, and turn signal indicators. These components require high optical clarity, impact resistance, and weatherability, all of which can be achieved through microinjection molding processes.

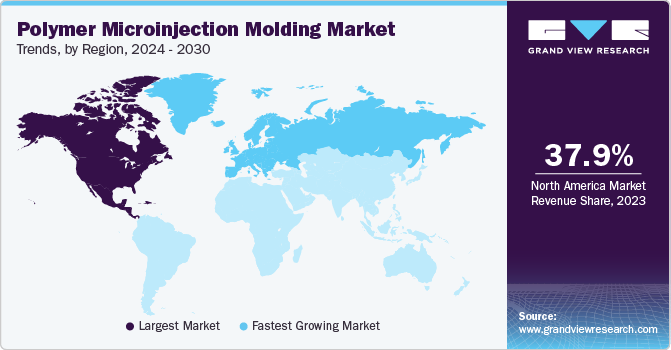

Regional Insights

North America dominated the polymer microinjection molding market with the revenue share of 37.9% in 2023. The region has emerged as a dominant force in the increasing consumption of small-sized products across various end-use sectors including medical, automotive, and telecom. Both device manufacturers and end-use industries in the region have embraced the concept of micro-molding. Particularly, the medical and automotive industries have emerged as major consumers of micro-molded parts. Manufacturers of components are now directing their efforts towards the development of polymer micro-molded products to capitalize on the cost advantages offered by this process. Furthermore, the availability of biodegradable polymers has led to an expansion in the demand for polymer devices from the medical industry in recent years.

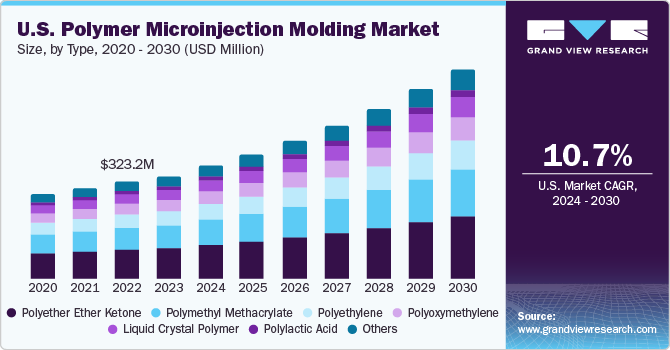

U.S. Polymer Microinjection Molding Market Trends

The polymer microinjection molding market in U.S. is anticipated to grow at the fastest CAGR of 10.5% from 2024 to 2030. Owing to the rising automotive production, growing preferences for the electric vehicles, and government initiatives and funding for research & development in microinjection molding technologies.

Asia Pacific Polymer Microinjection Molding Market Trends

The polymer microinjection molding market in Asia Pacific was the second-largest regional market in 2023 and it accounted with the revenue share of around 28.0%. As per Invest India, the medical device sector is projected to become a USD 65 billion industry by 2024, with India's anticipated medical device exports reaching around USD 10 billion by 2025. This anticipated expansion is poised to have a significant impact on the market growth.

The India polymer microinjection molding market is estimated to grow at a significant CAGR over the forecast period. The country's rapid industrialization and expanding automotive, medical & healthcare have led to a significant adoption of polymer microinjection molding to manufacture catheters, syringes, headlight lenses, among others.

Europe Polymer Microinjection Molding Market Trends

The polymer microinjection molding market in Europe is anticipated to witness at the significant CAGR from 2024 to 2030, owing to the strict environmental and medical device regulations in Europe incentivize high-precision and clean manufacturing methods, favoring microinjection molding. Further, European manufacturers, known for their cost-consciousness, increasingly recognize microinjection's potential for cost savings compared to traditional molding methods.

The Germany polymer microinjection molding market is expected to grow at the significant CAGR of around 10% during the forecast period. The country's thriving automotive industry, in particular, drives significant demand for polymer microinjection molded components, such as precision-engineered parts for vehicle interiors, lighting systems, and functional components.

The polymer microinjection molding market in UK accounted with the revenue share of over 15% in the European market. The UK is home to a diverse range of industries, including automotive, aerospace, healthcare, electronics, and consumer goods, all of which require precision-engineered components produced through microinjection molding processes. The country's strong manufacturing base, skilled workforce, and innovative capabilities contribute to its competitiveness in the market.

Central & South America Polymer Microinjection Molding Market Trends

The polymer microinjection molding market in Central & South America is estimated to grow at the fastest CAGR over the forecast period, owing to the region's diverse industrial landscape, including automotive, electronics, medical devices, and consumer goods, presents significant opportunities for microinjection molding applications.

The Brazil polymer microinjection molding market accounted with the largest revenue share of around 30% in the Central & South American market, due to the country’s focus on sustainability and environmental responsibility is driving the adoption of bio-based and recycled materials for microinjection molding applications.

Middle East & Africa Polymer Microinjection Molding Market Trends

The polymer microinjection molding market in Middle East & Africa is growing due to the emerging applications in electronics, medical devices, and consumer goods within the region create demand for miniaturized components, potentially met by microinjection molding.

The Saudi Arabia polymer microinjection molding market accounted with the revenue share of around 20% in the Middle East & African market. The healthcare sector in Saudi Arabia relies on microinjection molding for the manufacturing of medical devices, diagnostic equipment, and surgical instruments. The ability to produce biocompatible, sterilizable, and precision-engineered components makes microinjection molding an ideal choice for the healthcare industry.

Key Polymer Microinjection Molding Company Insights

The market is fragmented with various global and regional product manufacturers releasing innovative systems and technologies. Various industry participants strategies typically involve new product development, product upgrades, and expansions to boost market penetration and respond to the changing technical needs of the application industries. The major players form technical partnerships to innovate and develop novel product lines, therefore expanding their consumer base. In addition, evolving consumer preferences along with quality requirements, as well as energy efficiency, are projected to offer new opportunities for key participants in the coming years.

In September 2023, Accumold pioneered an innovative method for micro injection molding of thin-wall cannulas at exceptionally high production rates. These delicate and slender cannulas hold crucial importance across a spectrum of medical uses, notably in reducing patient discomfort and enhancing medical procedures. Furthermore, with ongoing advancements in medical technology favoring miniaturization and minimally invasive approaches, the demand for small and thin-walled cannulas has become indispensable for cutting-edge medical devices.

Key Polymer Microinjection Molding Companies:

The following are the leading companies in the polymer microinjection molding market. These companies collectively hold the largest market share and dictate industry trends.

- Accu-Mold LLC

- Precipart

- Makuta Technics

- Micromolding Solution Inc.

- Precimold Incorporation

- Rapidwerks Inc.

- Stack Plastics Inc.

- Stamm AG

- Sovrin Plastics

- Likuta Technics Inc.

- Norco Injection Molding

- OMNI Mold Systems

- ALC Precision

- American Precision Products

- WestFall

Recent Developments

-

In January 2023, Accumold made a strategic investment in its micro additive manufacturing (AM) capability with the acquisition of the Fabrica 2.0 machine from Nano Dimension. This move signifies Accumold's ongoing commitment to enhancing its portfolio of precision micro AM technologies. This investment is particularly significant as it complements the company's existing micro molding services, which Accumold has been pioneering for over three decades

Polymer Microinjection Molding Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1,390.75 million

Revenue forecast in 2030

USD 2.53 billion

Growth rate

CAGR of 10.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Region scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Accu-Mold LLC; Precipart; Makuta Technics; Micromolding Solution Inc.; Precimold Incorporation; Rapidwerks Inc.; Stack Plastics Inc.; Stamm AG; Sovrin Plastics; Likuta Technics Inc.; Norco Injection Molding; OMNI Mold Systems; ALC Precision; American Precision Products; Sovrin Plastics

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polymer Microinjection Molding Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the polymer microinjection molding market report based on type, application, and region:

-

Type Outlook Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyether Ether Ketone

-

Polymethyl Methacrylate

-

Polyethylene

-

Polyoxymethylene

-

Liquid Crystal Polymer (LCP)

-

Polylactic Acid (PLA)

-

Other

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Medical & Healthcare

-

Automotive

-

Telecom Fiber Optics

-

Micro Drive Systems & Control

-

Others

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Argentina

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polymer microinjection molding market size was estimated at USD 1,264.7 million in 2023 and is expected to reach USD 1,390.75 million in 2024.

b. The polymer microinjection molding market, in terms of revenue, is expected to grow at a compound annual growth rate of 10.5% from 2024 to 2030 to reach USD 2.53 billion by 2030.

b. North America dominated the global polymer microinjection molding market and accounted for a 37.9% share, in terms of revenue, in 2023. The region has emerged as a dominant force in the increasing consumption of small-sized products across various end-use sectors including medical, automotive, and telecom.

b. Some of the key players operating in the polymer microinjection molding market include Accu-Mold LLC, Precipart, Makuta Technics, Micromolding Solution Inc., Precimold Incorporation, Rapidwerks Inc., Stack Plastics Inc., Stamm AG, Sovrin Plastics, Likuta Technics Inc., among others.

b. The key factors that are driving the polymer microinjection molding market include the increasing demand for miniature materials is expected to be a key factor driving the overall market for polymer microinjection molding for various applications spread across widespread end-use industries, including medical, electronics, automotive, and telecom.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.