- Home

- »

- Plastics, Polymers & Resins

- »

-

Polymethacrylimide Foam Market Size, Industry Report, 2030GVR Report cover

![Polymethacrylimide Foam Market Size, Share & Trends Report]()

Polymethacrylimide Foam Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Wind Energy, Aerospace & Defense, Sports Goods, Automotive & Transportation, Others), By Region, And Segment Forecasts

- Report ID: 978-1-68038-409-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polymethacrylimide Foam Market Trends

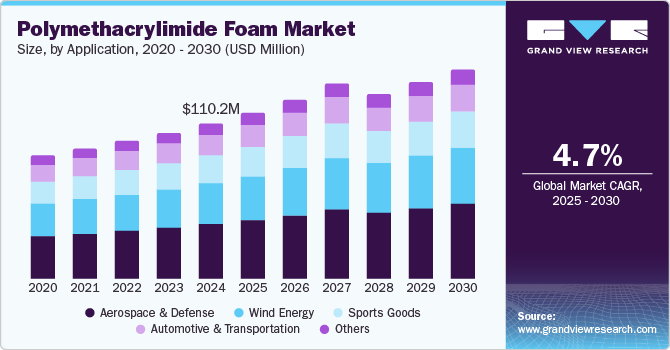

The global polymethacrylimide foam market size was valued at USD 110.2 million in 2024 and is projected to grow at a CAGR of 4.7% from 2025 to 2030. Polymethacrylimide (PMI) foam is known for its lightweight, strength, thermal insulation, and impact resistance properties, making it a preferred choice in many high-performance applications despite its expensiveness. PMI foam has a very low density, making it an ideal material for applications where weight reduction is important. This characteristic contributes significantly to its use in aerospace and other transportation segments. Constant innovations in material development are expected to maintain steady growth of the polymethacrylimide foam industry in the coming years.

PMI foam possesses a high strength-to-weight ratio, allowing it to maintain good mechanical strength while being much lighter than many other materials, such as metals or denser foams. Moreover, it also offers good thermal insulation, enhancing its usability in environments where temperature control or insulation is crucial. The automotive & transportation industry extensively uses these features during manufacturing processes, enabling market expansion. PMI foam is utilized in automotive components to achieve weight savings. This is crucial for improving fuel efficiency and overall vehicle performance, as lighter vehicles require less energy to operate. The foam serves as a base material in sandwich structures, which combine layers of materials such as composites or metals with PMI foam to enhance strength while minimizing weight. This is particularly beneficial for components such as body panels and chassis parts. As automakers continue to seek ways to improve vehicle performance while meeting regulatory standards, the adoption of PMI foam is expected to grow significantly.

The fast-growing construction sector and increasing focus on energy-efficient projects and promoting sustainability present another avenue for market expansion. PMI foam provides excellent thermal insulation properties, making it useful in construction applications where energy efficiency and temperature control are essential. Its utilization in walls, roofs, and insulation panels contributes to sustainability and energy savings. The product is used in sandwich panels, prefabricated structures, and other lightweight building elements, particularly in green buildings and sustainable construction.

Another area that is witnessing a steady demand for PMI foam is the sporting goods industry. There has been a noticeable growth in the number of people seeking both casual and active participation in sports activities, leading to a rising demand for technically advanced gear or equipment. Companies in this sector are thus leveraging novel components such as PMI foam to develop performance-efficient products. These factors have helped sustain the growth of the global polymethacrylimide foam industry.

Application Insights

The aerospace & defense segment accounted for the largest revenue share of 35.3% in the global polymethacrylimide foam industry in 2024. The product demand has been driven substantially by its unique properties, such as high strength-to-weight ratio, excellent thermal and acoustic insulation, durability, and resistance to environmental factors, including moisture and heat. PMI foam has become a vital material in aircraft interior parts, structural components, and insulation, where minimizing weight is essential to enhance performance and energy efficiency. Similarly, in the defense segment, the ability of this foam to provide thermal insulation, vibration dampening, and soundproofing highlights its importance as a component in aircraft interiors, avionics housings, and fuel tanks. PMI foam is also used in the thermal protection of missiles, warheads, and munitions, providing insulation during flight or re-entry into the atmosphere.

The wind energy segment is expected to grow at a substantial CAGR from 2025 to 2030. The continued shift towards renewable energy production and rising focus on establishing wind and solar farms has enabled a significant demand for polymethacrylimide foam. Companies developing components to generate wind energy use this foam to enhance wind turbines' performance, efficiency, and sustainability. With a continued increase in the size of wind turbine blades, the need for lightweight and strong materials becomes more critical. PMI foam is used as a core material in sandwich structures for turbine blades, helping to reduce the overall weight of the blades without sacrificing their strength or performance. The solution helps improve aerodynamics and wind energy capture efficiency and thus increases their energy output. Lighter and more durable blades can also withstand harsher environmental conditions, leading to longer operational lifespans and lower maintenance costs.

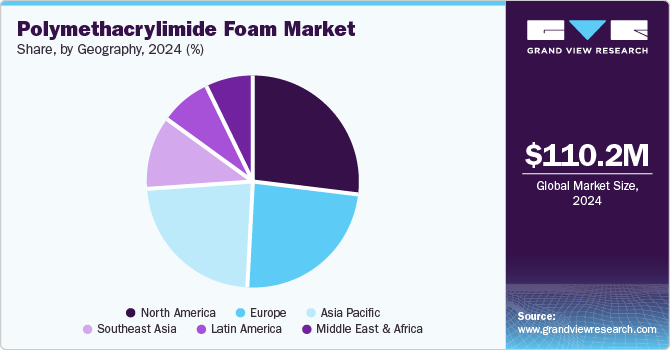

Regional Insights

The North America polymethacrylimide foam market accounted for a leading revenue share of 27.1% globally in 2024. The rapid pace of development of the aerospace and defense sectors in the U.S. and Canada has resulted in the increased incorporation of products such as PMI foams in high-performance components. Moreover, with the growing shift towards electric vehicles (EVs) in these economies, this type of foam has become a popular solution for developing lightweight structural components. Reducing vehicle weight directly contributes to improved battery efficiency, longer driving ranges, and better overall performance in these vehicles. Additionally, increasing investments in the wind power segment due to positive initiatives regarding renewable energy are expected to create further growth opportunities in this market.

U.S. Polymethacrylimide Foam Market Trends

The U.S. polymethacrylimide foam market accounted for a dominant revenue share in the North American market in 2024. The economy is one of the highest spenders on defense and aerospace technologies, which has led to increased awareness regarding the use of solutions such as PMI foams in military aircraft, drones, and defense structures. PMI foam has witnessed a steady demand due to its recyclability and low environmental footprint as part of a broader shift toward sustainable materials. The U.S. government’s policies promoting sustainable construction and energy efficiency drive the deployment of materials in manufacturing processes that can contribute to these goals. U.S.-based manufacturers increasingly seek tailored solutions to optimize the material for specific applications, enabling industry expansion.

Asia Pacific Polymethacrylimide Foam Market Trends

The polymethacrylimide foam industry in the Asia Pacific is expected to advance at the fastest CAGR during the forecast period. The market growth is being influenced by a range of factors, including the region’s rapid industrialization, growth in technology-driven sectors, and increasing focus on sustainability and energy efficiency. Economies such as China, India, and Japan invest heavily in commercial aviation and defense industries. PMI foam’s properties, such as its lightweight nature and high strength-to-weight ratio, make it an ideal material for reducing aircraft weight, improving fuel efficiency, and meeting environmental regulations. The presence of organizations such as the Commercial Aircraft Corporation of China, Ltd. (Comac) in China and Hindustan Aeronautics Limited (HAL) in India has further heightened the need to create strong and reliable aviation structures, aiding regional market growth.

China polymethacrylimide foam market accounted for the largest revenue share in the regional market in 2024. The economy’s aerospace sector is expanding significantly due to the presence of domestic aircraft manufacturers such as COMAC and a growing number of suppliers to Boeing and Airbus. Moreover, the marine and shipbuilding industry has also witnessed strong expansion, where PMI foam finds extensive usage. The product is used in marine insulation and composite structures for vessels and offshore platforms. It is valued for its resistance to water absorption, corrosion resistance, and lightweight nature, which help improve marine vessels’ overall performance and efficiency. The market is further expanding owing to notable developments in the electronics and telecommunications space of the country, where this foam plays a vital role in thermal management.

Europe Polymethacrylimide Foam Market Trends

Europe is expected to grow at a substantial CAGR in the market during the forecast period. The fast pace of growth of the automotive industry and the need to introduce energy-efficient vehicles due to increasing customer demand have created a substantial appeal for PMI foams in regional economies. Additionally, the development of green buildings and the incorporation of high-efficiency materials are expected to sustain industry expansion. PMI foam’s fire resistance makes it a preferred option for insulation and composite materials used in building façades, roofs, and walls, enabling builders to comply with the region’s fire safety regulations. Europe’s focus on establishing a circular economy and waste reduction also supports market demand, as PMI foam is a recyclable material with a lower environmental impact than traditional foam options.

Key Polymethacrylimide Foam Company Insights

Some major companies involved in the global polymethacrylimide foam industry include Evonik, Cashem Advanced Materials Hi-tech, and Sky Composites, among others.

-

Evonik Industries AG is a multinational specialty chemicals provider that operates through 5 major divisions - Nutrition & Care, Smart Materials, Specialty Additives, Performance Materials, and Technology & Infrastructure. The company has been involved in the development and manufacturing of ROHACELL, which is a polymethacrylimide (PMI) foam that is extensively used in the sports goods sector. The ROHACELL foam is known for its high strength-to-weight ratio, while it can also withstand high temperatures and offers great thermal insulation properties.

-

Cashem Advanced Materials Hi-tech Co., Ltd is a specialized manufacturer based in Zhejiang, China, focusing on producing PMI foam under the brand CASCELL. Notable products include CASCELL WH, CASCELL RS, CASCELL HF, and CASCELL FR, among others, along with custom composite solutions. The company’s PMI foam offerings cater to several major application areas, including aerospace, automotive, sports equipment, radome & antenna, wind power, and medical apparatus, and others.

Key Polymethacrylimide Foam Companies:

The following are the leading companies in the polymethacrylimide foam market. These companies collectively hold the largest market share and dictate industry trends.

- Evonik Industries AG

- Cashem Advanced Materials Hi-tech Co., Ltd.

- Hunan Rifeng Composite Co., Ltd

- Sky Composites

- tasuns.com

- Baoding Meiwo Science and Technology Development Co., Ltd.

- NIPPI Corporation

- CEL Components s.r.l.

- TOPOLO New Materials

- Kraton Corporation

- ERG Aerospace

Recent Developments

-

In September 2024, Evonik announced that it had shifted to using electricity solely from renewable energy sources for its ROHACELL PMI foam production facility in Darmstadt, Germany. The strategy is expected to ensure that the company’s High Performance Polymers division can reduce 3,400 metric tons of carbon dioxide emissions from its operations each year. The supply of green electricity to this site has been validated by relevant certificates and special Power Purchase Agreements (PPAs).

Polymethacrylimide Foam Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 117.9 million

Revenue forecast in 2030

USD 148.0 million

Growth Rate

CAGR of 4.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2025 to 2030

Report coverage

Revenue and volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America, Europe, Asia Pacific, Southeast Asia, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, China, Japan, India, Malaysia, Indonesia, Thailand, Brazil, Saudi Arabia

Key companies profiled

Evonik Industries AG; Cashem Advanced Materials Hi-tech Co.,Ltd.; Hunan Rifeng Composite Co., Ltd; Sky Composites; tasuns.com; Baoding Meiwo Science and Technology Development Co., Ltd.; NIPPI Corporation; CEL Components s.r.l.; TOPOLO New Materials; Kraton Corporation; ERG Aerospace

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polymethacrylimide Foam Market Report Segmentation

This report forecasts revenue and volume growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polymethacrylimide foam market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Wind Energy

-

Aerospace & Defense

-

Automotive & Transportation

-

Sports Goods

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Southeast Asia

-

Malaysia

-

Indonesia

-

Thailand

-

-

Latin America

-

Brazil

-

-

MEA

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.