- Home

- »

- Catalysts & Enzymes

- »

-

Polyurethane Catalyst Market Size, Industry Report, 2030GVR Report cover

![Polyurethane Catalyst Market Size, Share & Trends Report]()

Polyurethane Catalyst Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Amine Catalysts, Metal Catalysts), By Application (Flexible Foam, Rigid Foam), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-597-7

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyurethane Catalyst Market Summary

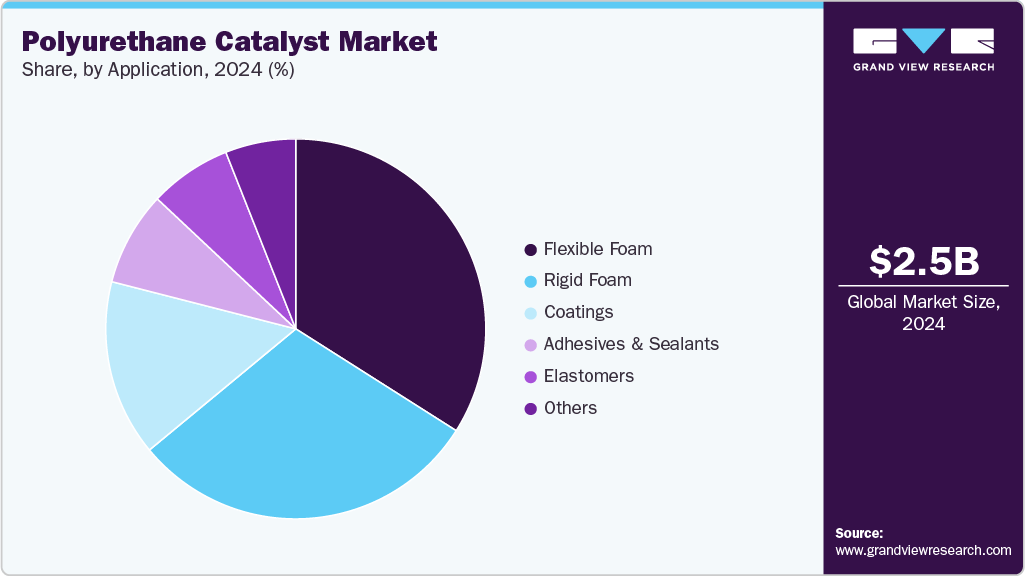

The global polyurethane catalyst market size was estimated at USD 2.46 billion in 2024 and is projected to reach USD 3.46 billion by 2030, growing at a CAGR of 5.9% from 2025 to 2030. The market is witnessing significant growth driven by the expanding usage of polyurethane across the automotive, construction, electronics, and furniture industries.

Key Market Trends & Insights

- Asia Pacific captured the largest revenue share of 40.07% in 2024.

- The polyurethane catalyst market in China is the largest contributor in Asia Pacific.

- In terms of product segment, the amine catalysts segment led the market with the largest revenue share of 28.6% in 2024.

- In terms of application segment, the flexible foam segment dominated the market with the largest revenue share of 33.69% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2.46 Billion

- 2030 Projected Market Size: USD 3.46 Billion

- CAGR (2025-2030): 5.9%

- Asia Pacific: Largest Market in 2024

Polyurethane catalysts are pivotal in accelerating the reaction between isocyanate and polyol during PU synthesis, directly impacting foam quality and curing time. Rapid industrialization in emerging economies and the growing demand for energy-efficient buildings and lightweight automotive components propel market expansion. Polyurethane catalysts are critical in controlling the speed and specificity of the chemical reactions that form polyurethane, ensuring optimal polymer structure and performance. They enable manufacturers to fine-tune reaction profiles for different end-use applications, such as achieving desired foam density, elasticity, or curing time. The PU formation process would be inefficient, inconsistent, and commercially unviable without catalysts.

The market faces challenges from stringent environmental regulations that restrict the use of toxic metal-based catalysts, such as those containing tin or mercury. Compliance with global safety standards while maintaining performance and cost-effectiveness poses a significant hurdle for manufacturers. Moreover, price volatility of raw materials adds to the complexity of managing production costs.

The shift toward sustainable, non-toxic, and bio-based catalyst alternatives presents lucrative growth opportunities for market players. Rising R&D investments in developing advanced, high-selective catalysts tailored to specific PU formulations further open new avenues for innovation. Growing awareness of green chemistry, especially in Europe and North America, supports the uptake of environmentally friendly catalyst solutions.

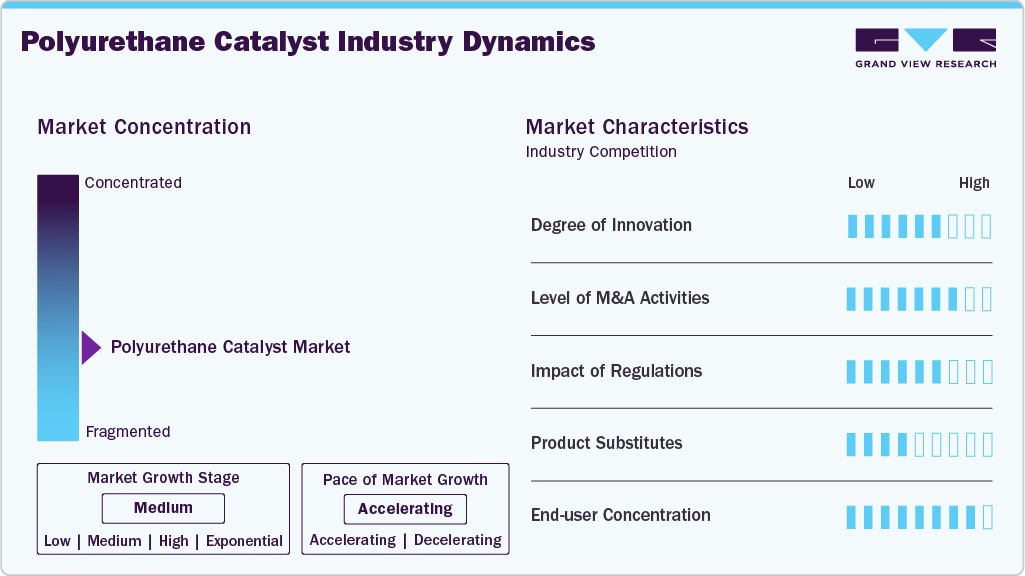

Market Concentration & Characteristics

The global polyurethane catalyst industry is moderately consolidated, with a few global players, such as Evonik Industries, Huntsman Corporation, and BASF SE, dominating the competitive landscape. These companies benefit from integrated value chains, robust R&D capabilities, and long-standing supply contracts with major PU manufacturers. However, regional and niche players are emerging, especially in the Asia Pacific, offering cost-effective alternatives and specialty formulations.

The market is highly application-driven, with catalyst selection varying based on the desired PU properties and end-use industry. It is also characterized by regulatory sensitivity, prompting continuous innovation toward safer and more sustainable formulations. Speed to market, formulation customization, and technical support are key competitive differentiators among manufacturers.

Product Insights

The amine catalysts segment led the market with the largest revenue share of 28.6% in 2024, as they are more reactive and versatile than metal, bismuth, and non-metal catalysts, especially in foam applications. Compared to metal and organometallic catalysts, amines offer faster reaction rates and better control over foam characteristics such as rising time and cell structure. They are also more cost-effective and easier to handle than bismuth and organometallic alternatives, making them the preferred choice in high-volume production of flexible and rigid foams. Their broad applicability across end-use industries gives them a clear edge in established and developing markets.

Moreover, amine catalysts are better suited for formulation customization than most non-metal and hybrid catalysts, enabling manufacturers to meet specific performance and regulatory requirements more efficiently. With the development of low-emission and low-odor variants, amine catalysts are more compliant with indoor air quality standards than traditional metal-based options. Their greater availability and integration also contribute to their dominance, especially compared to the relatively higher cost and limited adoption of bismuth and organometallic catalysts. This combination of technical superiority and economic feasibility makes amine catalysts the most competitive product in the market.

Application Insights

The flexible foam segment dominated the market with the largest revenue share of 33.69% in 2024 because it is more widely used than rigid foam, coatings, or elastomers, especially in high-demand sectors like bedding, furniture, and automotive seating. It offers greater production volumes and shorter product cycles, resulting in higher catalyst consumption compared to other applications. The need for finer control over reaction kinetics in flexible foam production makes catalyst performance more critical than in adhesives or sealants. Consequently, flexible foam applications rely more heavily on efficient catalysis, solidifying their lead.

Furthermore, flexible foam products are more adaptable and cost-effective than coatings or elastomers, which makes them more attractive for mass-industry applications. The demand for comfort, lightweight materials, and customizable features is stronger in this segment, particularly in the automotive and consumer goods industries. Growth in urbanization and consumer spending has a greater impact on flexible foam than on niche applications like elastomers. This broad, scalable demand ensures flexible foam remains the most commercially significant application for polyurethane catalysts.

Regional Insights

Asia Pacific captured the largest revenue share of 40.07% in 2024 due to its higher manufacturing output, rapid industrialization, and expanding construction and automotive sectors, especially in China, India, and Southeast Asia. The region offers lower production costs and strong domestic demand for polyurethane-based products, making it more favorable for catalyst consumption than North America or Europe. Moreover, increasing infrastructure and consumer goods investments have made Asia Pacific the fastest-growing and most catalyst-intensive regional market.

China Polyurethane Catalyst Market Trends

The polyurethane catalyst market in China is the largest contributor in Asia Pacific, driven by its robust manufacturing base, high demand for flexible and rigid foams, and strong presence of the automotive and construction industries. The country benefits from cost-effective production capabilities and is home to several key PU and catalyst manufacturers, making it a strategic hub for domestic consumption and export. Government support for infrastructure and industrial development further accelerates growth in China.

North America Polyurethane Catalyst Market Trends

The polyurethane catalyst market in North America held a significant revenue share of 26.96% in 2024, driven by its advanced manufacturing technologies and stringent environmental regulations that encourage the adoption of high-performance, low-emission catalysts. The region's strong automotive, construction, and furniture demand supports steady growth. In addition, continuous innovation and the presence of major industry players make North America a key market for premium and specialty catalyst solutions.

The U.S. polyurethane catalyst market plays a major role within North America, fueled by its large automotive and construction industries and increasing focus on sustainable manufacturing practices. Strict regulatory frameworks push manufacturers to adopt environmentally friendly and efficient catalyst technologies, driving innovation. The presence of leading chemical companies and strong R&D infrastructure makes the US a critical hub for advanced polyurethane catalyst development and commercialization.

Europe Polyurethane Catalyst Market Trends

The polyurethane catalyst market in Europe is a key market, characterized by stringent environmental regulations and a strong emphasis on sustainability and green chemistry. The region’s well-established automotive, construction, and furniture industries drive consistent demand for high-performance and eco-friendly catalysts. Europe’s focus on innovation and regulatory compliance also positions it as a leader in developing advanced, low-emission polyurethane catalyst solutions.

Germany polyurethane catalyst market is pivotal in Europe, backed by its world-class automotive and engineering sectors and commitment to sustainable manufacturing. The country has led the adoption of advanced, low-toxicity catalyst technologies driven by strict EU environmental standards. With a strong industrial base and continuous R&D investment, Germany is a key innovation and production hub for polyurethane catalysts in the region.

Latin America Polyurethane Catalyst Market Trends

The polyurethane catalyst market in Latin America is growing, supported by expanding construction, automotive, and furniture manufacturing sectors, particularly in Brazil and Mexico. While the region’s adoption rate is slower than that of Asia Pacific or Europe, increasing industrialization and infrastructure investment drive steady demand.

Middle East & Africa Polyurethane Catalyst Market Trends

The polyurethane catalyst market in the Middle East & Africa region is an emerging market, driven by infrastructure development, urbanization, and the growth of the construction and automotive sectors, particularly in the Gulf states and South Africa. Although the market is less mature than other regions, rising investments in housing, commercial projects, and industrial output create new opportunities for catalyst adoption.

Key Polyurethane Catalyst Company Insights

Some key players operating in the market include Evonik, BASF SE, and Huntsman International LLC.

-

Evonik is one of the prominent players operating in the market, renowned for its DABCO series of amine catalysts that serve a wide range of applications, including flexible foams, rigid foams, and CASE (coatings, adhesives, sealants, elastomers) products. With a strong focus on performance, consistency, and regulatory compliance, Evonik delivers advanced catalyst solutions that meet evolving industry demands, particularly in automotive, construction, and consumer goods. Its robust R&D capabilities, global manufacturing footprint, and emphasis on low-emission, sustainable formulations position the company as a key innovation driver and strategic partner for PU manufacturers worldwide.

King Industries, Inc., Tosoh Asia Pte. Ltd., and Guangzhou Yourun Synthetic Product Co., Ltd. are some of the emerging market participants in the polyurethane catalyst industry.

-

King Industries, Inc. is an emerging market specialist, known for its high-performance additive and catalyst technologies tailored to advanced polyurethane systems. The company emphasizes low-emission, low-VOC solutions, aligning with tightening global environmental regulations, particularly in the automotive, coatings, and flexible foam segments. With a strong focus on formulation customization, technical support, and innovation, King Industries is steadily expanding its global presence and positioning itself as a value-driven partner for manufacturers seeking performance and regulatory compliance.

Key Polyurethane Catalyst Companies:

The following are the leading companies in the polyurethane catalyst market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- Evonik

- Huntsman International LLC

- Covestro AG

- Momentive

- Shepherd Chemical

- Umicore Cobalt & Specialty Materials (CSM)

- Tosoh Asia Pte. Ltd.

- Guangzhou Yourun Synthetic Material Co., Ltd.

- King Industries, Inc.

- Wanhua

- Air Products and Chemicals, Inc.

- LANXESS AG

- Dorf Ketal Chemicals India Private Limited

- KAO Corporation

- KPX Chemical Co., Ltd.

Polyurethane Catalyst Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.59 billion

Revenue forecast in 2030

USD 3.46 billion

Growth Rate

CAGR of 5.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

US; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

BASF; Evonik; Huntsman International LLC; Covestro AG; Momentive; Shepherd Chemical; Umicore Cobalt & Specialty Materials (CSM); Tosoh Asia Pte. Ltd.; Guangzhou Yourun Synthetic Material Co., Ltd.; King Industries, Inc.; Wanhua; Air Products and Chemicals, Inc.; LANXESS AG; Dorf Ketal Chemicals India Private Limited; KAO Corporation; KPX Chemical Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyurethane Catalyst Market Report Segmentation

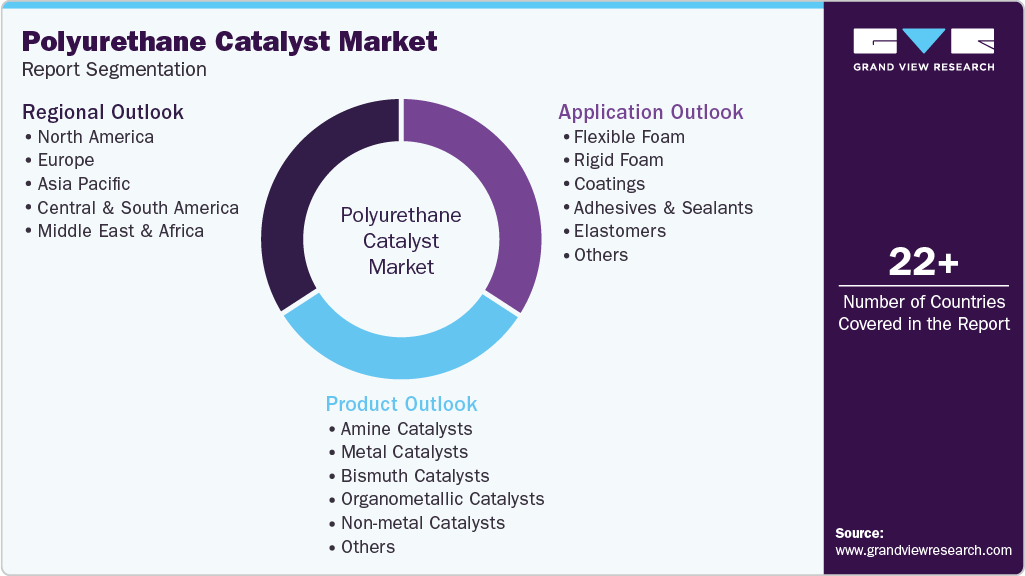

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyurethane catalyst market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Amine catalysts

-

Metal catalysts

-

Bismuth catalysts

-

Organometallic catalysts

-

Non-metal catalysts

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Flexible foam

-

Rigid foam

-

Coatings

-

Adhesives & sealants

-

Elastomers

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global polyurethane catalyst market size was estimated at USD 2.46 billion in 2024 and is expected to reach USD 2.59 billion in 2025.

b. The global polyurethane catalyst market is expected to grow at a compound annual growth rate of 5.9% from 2025 to 2030 to reach USD 3.46 billion by 2030.

b. Amine catalysts held the largest revenue share of 28.6% in 2024 due to their higher reactivity, broader applicability, and greater cost-efficiency compared to metal, bismuth, and organometallic catalysts.

b. Some of the key players operating in the polyurethane catalyst market include BASF, Evonik, Huntsman International LLC, Covestro AG, Momentive, Shepherd Chemical, Umicore Cobalt & Specialty Materials (CSM), Tosoh Asia Pte. Ltd., Guangzhou Yourun Synthetic Material Co., Ltd., King Industries, Inc., Wanhua.

b. The market is driven by the rising demand for polyurethane-based products in automotive, construction, and furniture industries, along with the shift toward energy-efficient and low-VOC catalyst technologies.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.