- Home

- »

- Plastics, Polymers & Resins

- »

-

Polyurethane Microspheres Market Size, Share Report, 2030GVR Report cover

![Polyurethane Microspheres Market Size, Share & Trends Report]()

Polyurethane Microspheres Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Encapsulation, Paints & Coatings, Adhesive Films, Cosmetics), By Region, And Segment Forecasts

- Report ID: 978-1-68038-880-0

- Number of Report Pages: 70

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Polyurethane Microspheres Market Trends

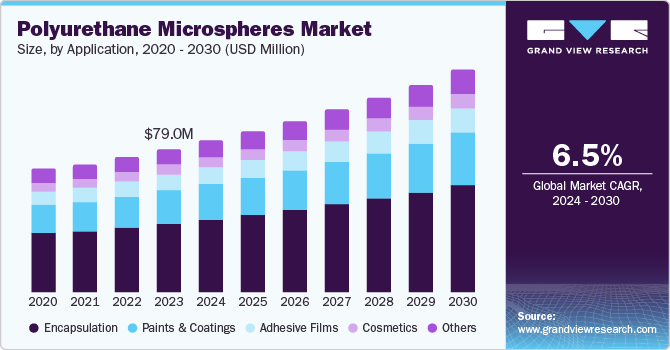

The global polyurethane microspheres market size was valued at USD 79.0 million in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. This growth is attributed to the expansion in the usage to increase the effectiveness of the capsules as an encapsulating agent in different sectors, including pharmaceuticals, paints & coats, and agrochemicals. In addition, the growing emphasis on sustainable and eco-friendly materials is driving demand, as polyurethane PU microspheres are recyclable and biodegradable. Furthermore, technological advancements and increased research investments further support market growth by improving product performance and expanding applications.

PU microspheres, also known as polyurethane, are spherical with sizes in the micrometer range and are drafted from polyurethane polymers. These microspheres have certain features including being lightweight, highly flexible, and very resilient, and they can be used in many industries. PU microspheres can be produced in a pre-specified size, density, and chemical composition, making them suitable for use in various industrial processes.

Furthermore, the extensive supply chain of upstream participants, including MDI, TDI, and Polyols, as well as downstream participants, namely vendors, PU microsphere applications such as encapsulation, coatings, adhesives, cosmetics, and government bodies. There is industry cooperation between the key players to develop the market and receive more government attention in the research of this industry field, as well as to improve the entire business process. This is also a major driving force to expect the growth of the market significantly in the upcoming years.

Applications Insights

The encapsulation applications segment dominated the market and accounted for the largest revenue share of 48.1% in 2023attributed to its massive consumption across a number of end-use industries today, including pharmaceuticals, paints & coatings, and agrochemicals. Since most of the major players in this industry are backward integrated, some 70% of the demand is met by companies that produce PU microspheres in-house. These factors are putting pressure on producers to produce microspheres on their own. These factors are increasing the demand for the products in these applications thus expected to grow the market in this segment significantly.

The paint and coatings applications segment is anticipated to grow at a CAGR of 6.9% over the forecast period driven by increasing sustainability and environmental concerns, where these microspheres offer solutions such as reducing VOCs. In addition, technological advancements in these sectors have enhanced new products with specific properties such as shape, size, surface chemistry, and others, thus offering enhanced performance and durability, which has led to a surge in demand for the product in this application.

Regional Insights

The polyurethane microspheres market in North America is expected to grow significantly over the forecast years. The factors for the growth are attributed to the growing economy in the region, which has increased the number of construction and automotive industries, thus increasing the demand for the product, increasing investment in R&D by the industry players to improve the existing products, and increasing their market share, shifting consumer preferences towards the products which offer better characteristics such as flexibility, resistance to wear and tear, improved adhesion, and others characteristics.

U.S. Polyurethane Microspheres Market Trends

The U.S. Polyurethane Microspheres market dominated the North American market in 2023 owing to growing demand for the product in multiple end use industries such as cosmetics, agrochemicals pharmaceuticals, paint & coatings, and other industries, increasing focus on sustainable products where there is increasing demand for these products due to its bio-based material properties that assist on minimizing environmental impacts, and growing population of elderly people which increase the demand for medications thus increasing the demand for the product in the region.

Asia Pacific Polyurethane Microspheres Market Trends

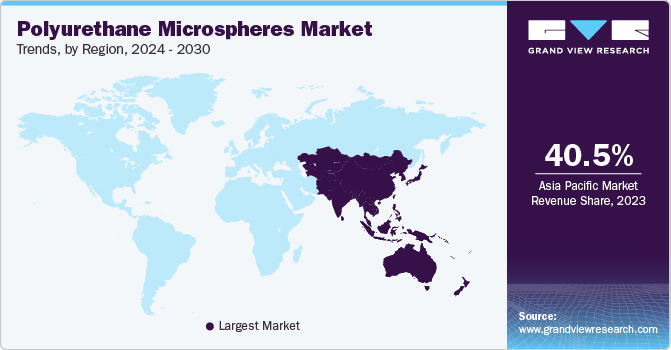

Asia Pacific polyurethane microspheres market dominated the global market and accounted for the largest revenue share of 40.5% in 2023. This growth is attributed to the rapid urbanization and infrastructure development in the region, leading to increased investment in the construction and automotive sector, which increased the demand for PU microspheres, innovations in drug delivery technologies where PU microspheres play a crucial role as encapsulating agents, and increasing agricultural sector which is increasing the demand for the products thus growing the market in the region significantly.

The polyurethane microspheres market in China led the Asia Pacific market and accounted for the largest revenue share in 2023 attributed to the growing competition among local manufacturers, leading to innovations and cost-effective products. Emerging applications of the products in various industries such as cosmetics and personal care, and rising disposable income among consumers are increasing investments in the product to gain high-quality benefits, thus growing the market in the country significantly.

India polyurethane microspheres market is anticipated to grow fastest in the Asia-Pacific region, with a CAGR of 7.3% over the forecast years. This growth is driven by the increasing demand in pharmaceutical applications as the PU microsphere plays a vital role as an encapsulating agent. In addition, the growing paint & coating sector, which has been one of the largest consumers of PU microspheres in the country due to increasing demand for high-quality finishes, and expanding agrochemicals applications of PU microspheres such as encapsulation of pesticides and biocides is contributing to the growth of the market in the country.

Europe Polyurethane Microspheres Market Trends

The polyurethane microspheres market in Europeis expected to grow at the fastest CAGR of 7.2% over the forecast period. This growth is driven by increasing demand for lightweight and high-performance materials in industries such as automotive, construction, and cosmetics is a significant contributor. The emphasis on sustainable and eco-friendly products further enhances market potential, as PU microspheres are recyclable and biodegradable. Furthermore, advancements in technology and manufacturing processes are improving product efficiency and expanding applications. Regulatory compliance with stringent EU standards also supports market growth by ensuring quality and safety in various applications, including pharmaceuticals and agrochemicals.

The UK polyurethane microspheres market is expected to grow rapidly over the forecast years owing to the increasing demand for lightweight and durable materials in industries such as automotive, construction, and cosmetics, which is driving this trend. In addition, the focus on sustainability and eco-friendly products enhances the appeal of PU microspheres, as they are recyclable and biodegradable. Furthermore, advancements in manufacturing technologies are improving product performance and expanding applications. Regulatory compliance with stringent environmental standards also supports market growth by ensuring safety and quality across various sectors.

Key Polyurethane Microspheres Company Insights

Some of the key companies in the polyurethane (PU) microspheres market include Microchem, Covestro AG, Chase Corp, EPRUI Biotech Co., Ltd, and others. Organizations are focusing on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Chase Corp offers a diversified portfolio of products ranging in different densities and sizes with features such as weight reduction, enhanced physical properties, cost-effectiveness, and other features. The company’s products are used in various industries, especially in the automobile sector, due to their duality microsphere applications that enhance the coating application and control expansion.

Key Polyurethane Microspheres Companies:

The following are the leading companies in the polyurethane microspheres market. These companies collectively hold the largest market share and dictate industry trends.

- Covestro AG

- Microchem

- Cospheric LLC

- Chase Corp

- SANYO CHEMICAL INDUSTRIES, LTD.

- Kolon Industries, Inc.

- EPRUI Biotech Co.,Ltd.

- Advanced Polymer

- Ellsworth Adhesives

Recent Developments

-

In April 2024, Covestro showcased its commitment to sustainability and the circular economy at UTECH Europe 2024 in Maastricht, Netherlands, held from April 23 to 25. The company presented innovative polyurethane solutions to reduce carbon emissions and enhance recycling processes. Covestro targeted climate neutrality by 2050 and planned to cut Scope 3 emissions by 30% by 2035. Their booth featured advancements in alternative raw materials, recycling technologies, and high-performance products, emphasizing the importance of collaboration across industries to achieve full circularity in manufacturing.

-

In November 2023, Covestro, a leading polymer materials company, is set to introduce sustainable polyurethane dispersions (PUDs) in the Asia Pacific market, starting in the first quarter of 2024. These PUDs, produced at Covestro Integrated Site Shanghai, incorporate up to 80% alternative raw materials and are designed for applications such as automotive adhesives and consumer electronics coatings. The mass balance approach allows a seamless transition from fossil-based to sustainable solutions without altering production processes. Covestro aims to support the shift towards a circular economy while meeting the rising demand for sustainable materials in the region.

Polyurethane Microspheres Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 83.8 million

Revenue forecast in 2030

USD 122.5 million

Growth rate

CAGR of 6.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Denmark; Sweden; Norway; Russia; China; Japan; India; South Korea; Australia; Indonesia; Vietnam; Brazil; Argentina; Saudi Arabia; UAE; Kuwait; South Africa

Key companies profiled

Covestro AG; Microchem; Cospheric LLC; Polysciences, Inc.; Polysciences, Inc.; Chase Corp; SANYO CHEMICAL INDUSTRIES, LTD.; Kolon Industries, Inc.; EPRUI Biotech Co.,Ltd.; Advanced Polymer; Ellsworth Adhesives

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Polyurethane Microspheres Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global polyurethane microspheres market report based on application and region.

-

Application Outlook (Volume, kilotons; Revenue, USD Million, 2018 - 2030)

-

Encapsulation

-

Paints & Coatings

-

Adhesive Films

-

Cosmetics

-

Others

-

-

Regional Outlook (Volume, kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.