- Home

- »

- HVAC & Construction

- »

-

Portable Oil-Free Air Compressor Market Size Report, 2022GVR Report cover

![Portable Oil-Free Air Compressor Market Report]()

Portable Oil-Free Air Compressor Market (Manufacturing) And Segment Forecasts To 2022) Analysis By Technology (Reciprocating, Rotary, Centrifugal), By Application (Semiconductors & Electronics, Food & Beverage, Healthcare, Home Appliances, Energy, Oil & Gas

- Report ID: GVR-4-68039-912-9

- Number of Report Pages: 163

- Format: PDF

- Historical Data: 2010-2012

- Forecast Period: 2016 - 2022

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

The global portable oil-free air compressor market exceeded USD 6.0 billion in 2014. Growing awareness for energy efficient low maintenance devices and increasing industrialization are anticipated to drive demand. These products are witnessing a significant surge in demand from the pharmaceutical and food & beverages industry. Companies operating in medical and fast-moving consumer goods (FMCG) sectors use clean and dry air for product quality enhancement.

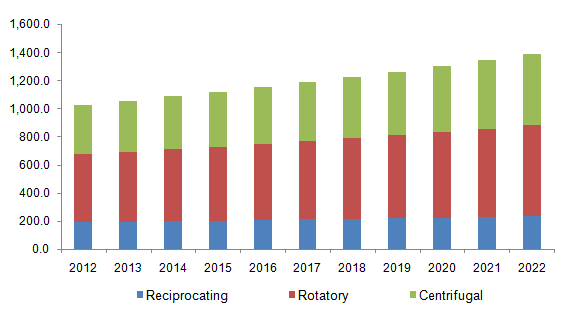

U.S. Portable oil-free air compressor market share by technology, 2012 - 2022 (USD Million)

Growing demand for maintenance and replacement activities is estimated to drive demand over the forecast period. Increasing trends such as clean air technology and new-age devices including portable and noise-free compressors are expected to offer lucrative opportunities for producers of innovative equipment.

Eco-friendly features, efficient operations at lower costs, and retrofitting of existing systems are also expected to drive demand. Rising cost of raw materials, high competition, and noisy operation can hamper the portable oil-free air compressor market. However, technological advancements, stringent government regulations, and environmental protection can reduce the impact over the next few years.

Technology Insights

The industry can be categorized by technology into reciprocating, rotary, and centrifugal segment. Reciprocating and rotary air compressor are termed as positive displacement compressors whereas centrifugal fall under the dynamic category or negative displacement products. Rotary air compressor market accounted for over 45% of the overall demand in 2014, followed by centrifugal and reciprocating.

Positive displacement equipment works by decreasing the volume of a chamber filled with air whereas negative or dynamic types utilize centrifugal force by spinning impeller for further increase and decrease the amount of air resulting in compressed air. The Centrifugal compressor market is expected to grow at a CAGR of over 4.0% over the forecast period.

Application Insights

Application sectors analyzed in the study include semiconductors & electronics, healthcare, food & beverage, energy, home appliances, oil & gas, and manufacturing. There exist high demand and product penetration in manufacturing applications; for instance, oil-free air is directly used in various locations in plants as power for manufacturing machines.

In the healthcare sector, these devices are used to clean the air required for dentistry and are also used in minimizing the contamination in the air. In the food & beverage sector, oil-free compressors reduce contamination risk for food & beverage manufacturers and also deliver air without the need for filtration and separation. They are used in the process of product transportation and storage, packaging, filling & capping for improving the product quality and avoiding potential health hazards.

Regional Insights

Europe portable oil-free air compressor industry led global revenue in 2014, accounting for over 30% of the overall demand owing to increasing applications in the exploration, production, refining, and processing of crude oil & gas products. Further investments in Eastern Europe are expected to provide significant opportunities for manufacturers.

Asia Pacific portable oil-free air compressor market is expected to witness substantial growth at a CAGR of over 4% owing to increasing establishment of petrochemical plants and oil refineries.

North America is anticipated to have moderate growth over the forecast period owing to saturation in the overall industry. Latin America and the Middle East & Africa are expected to grow at a considerable growth owing to increasing awareness for eco-friendly portable products.

Key Companies & Market Share Insights

Companies dominating portable oil-free air compressor market share include AireTex, Atlas Copco, Bauer Group, Frank Technologies, Ingersoll Rand, Oasis Manufacturing, and Cook Compression. Acquisitions, product launch, and expansion are among the major strategies adopted by these companies.

Several leading players such as Ingersoll Rand, Atlas Copco, Mitsubishi Heavy Industries Suzlar Ltd. have re-launched their products incorporating new features. These products are reliable, silent, compact and oil-free, and have therefore witnessed increased adoption among end-users.

Portable Oil-Free Air Compressor Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 7.9 billion

Revenue forecast in 2022

USD 8.5 billion

Growth Rate

CAGR of 3.5% from 2015 to 2022

Base year for estimation

2015

Historical data

2013 - 2015

Forecast period

2015 - 2022

Quantitative units

Revenue in USD million/billion and CAGR from 2015 to 2022

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; China; India; Japan; Brazil; Mexico

Key companies profiled

AireTex; Atlas Copco; Bauer Group; Frank Technologies; Ingersoll Rand; Oasis Manufacturing; Cook Compression

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Frequently Asked Questions About This Report

b. The global portable oil-free air compressor market size was estimated at USD 7.6 billion in 2019 and is expected to reach USD 7.9 billion in 2020.

b. The global portable oil-free air compressor market is expected to grow at a compound annual growth rate of 3.5% from 2015 to 2022 to reach USD 8.5 billion by 2022.

b. Asia Pacific dominated the portable oil-free air compressor market with a share of 31.5% in 2019. This is attributable to the increasing applications in the exploration, production, refining, and processing of crude oil & gas products.

b. Some key players operating in the portable oil-free air compressor market include AireTex, Atlas Copco, Bauer Group, Frank Technologies, Ingersoll Rand, Oasis Manufacturing, and Cook Compression.

b. Key factors that are driving the market growth include increasing need for energy-efficient compressors and low-cost portable compressors.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.