- Home

- »

- Pharmaceuticals

- »

-

Post-traumatic Stress Disorder Treatment Market Report 2030GVR Report cover

![Post-traumatic Stress Disorder Treatment Market Size, Share & Trends Report]()

Post-traumatic Stress Disorder Treatment Market (2025 - 2030) Size, Share & Trends Analysis Report By Drug Class (Antidepressants, Anti-anxiety, Antipsychotics), By Demographics, By Distribution Channel (Retail Pharmacies, Hospital Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-997-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Post-traumatic Stress Disorder Treatment Market Summary

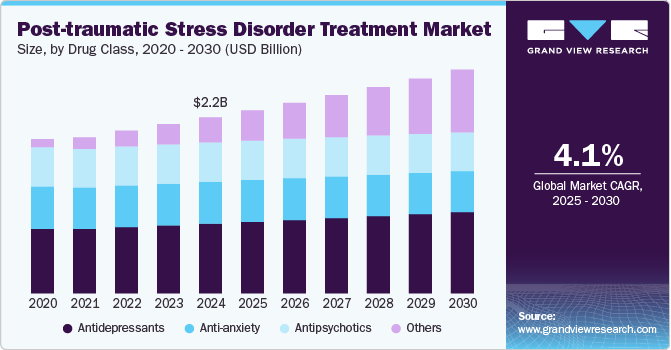

The global post-traumatic stress disorder treatment market size was estimated at USD 2,244.8 million in 2024 and is projected to reach USD 2,852.4 million by 2030, growing at a CAGR of 4.1% from 2025 to 2030. The increasing prevalence of PTSD, driven by traumatic events like natural disasters, terrorist attacks, and armed conflicts, is significantly contributing to the market’s growth.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, antidepressants accounted for a revenue of USD 912.9 million in 2024.

- Antidepressants is the most lucrative drug class segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 2,244.8 Million

- 2030 Projected Market Size: USD 2,852.4 Million

- CAGR (2025-2030): 4.1%

- North America: Largest market in 2024

Greater awareness about the importance of addressing mental health concerns, including PTSD, is encouraging more individuals to seek help and support. In addition, advancements in innovative therapies and technologies, such as virtual reality therapy, are bolstering market growth. These emerging treatments provide alternative and effective options for individuals dealing with disorders.

The World Health Organization (WHO) highlights that approximately 70% of individuals worldwide are likely to encounter a potentially traumatic event in their lifetime. However, only a small percentage, around 5.6%, develop post-traumatic stress disorder. Research estimates that 3.9% of the global population has experienced PTSD at some stage in their lives. The probability of developing PTSD is significantly influenced by the nature of the trauma. For instance, exposure to violent conflict or war increases the risk, with PTSD prevalence rising to about 15.3% in such cases—over three times the general rate. Incidents of sexual violence are associated with particularly high disorder rates. Thus, growing number these incidents is expected to boost the prevalence of disorder across worldwide and drive industry growth during the forecast period.

Furthermore, according to Anxiety & Depression Association of America (ADAA), post-traumatic stress disorder impacts approximately 7.7 million adults in the U.S. in 2022, representing about 3.6% of the population. Notably, women are disproportionately affected, with their risk being five times higher than that of men. Certain experiences, such as sexual violence, are especially potent in triggering post-traumatic stress. For instance, 65% of men and 45.9% of women who experience rape are likely to develop the disorder. In addition, childhood sexual abuse is a significant factor that strongly predicts the lifetime risk of post-traumatic stress. These disease patterns highlight the critical role of gender and specific trauma types in shaping disease prevalence and prioritizing gender-sensitive approaches and early interventions for survivors of sexual violence and childhood abuse to mitigate long-term mental health impacts.

Moreover, increased awareness about mental health and the significance of seeking treatment is contributing to the rising demand for PTSD therapies. As individuals become more informed about the benefits of addressing mental health issues, including PTSD, the willingness to pursue professional support has grown. For instance, Community Health of Central Washington recognizes June as National Post-Traumatic Stress Disorder Awareness Month. This initiative aims to enhance public understanding of disorder, address the stigma surrounding the condition, and promote access to appropriate treatment for those affected, including individuals dealing with the psychological impact of war and other traumas. Such awareness campaigns are crucial in fostering a supportive environment for mental health initiatives and driver demand for treatment over the forecast period.

Drug Class Insights

The antidepressants segment dominated the market and accounted for 39.65% of the global revenue in 2024. This can be attributed to high prescription rate owing to wide availability and easy accessibility to approved antidepressants drug worldwide for treatment of PTSD. Selective serotonin reuptake inhibitors (SSRIs) belong to the Antidepressants drug class. Selective serotonin reuptake inhibitors (SSRIs), such as sertraline, paroxetine, and fluoxetine, along with the selective serotonin-norepinephrine reuptake inhibitor (SNRI) venlafaxine, demonstrate the most robust clinical support in post-traumatic stress treatment.

However, among these, only sertraline (Zoloft) and paroxetine (Paxil) have received approval from the U.S. Food and Drug Administration (FDA) for post-traumatic stress disorder treatment. All other medications used for treatment are considered "off-label" from the FDA's perspective. This regulatory distinction emphasizes the need for further research and development in pharmacotherapy to expand FDA-approved options and boost market growth.

The other drug class segment is expected to witness lucrative growth from 2025 to 2030. In addition to antidepressants, anti-anxiety, and antipsychotics, several other drug classes are commonly used for disease management. These include Alpha-1 adrenergic receptor blockers, Mood Stabilizers/Anticonvulsants, and Glutamatergic Agents. The rising demand for these drugs is anticipated to boost market growth.

Demographics Insights

Adult segment dominated the market with a revenue share of 75.86% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This dominance is attributed to rising adult population with the PTSD. According to the American Psychiatric Association (APA), about 3.5% of U.S. adults experience PTSD annually. In adolescents aged 13 to 18, the lifetime prevalence of PTSD is 8%. In addition, certain ethnic groups, including U.S. Latinos, African Americans, and Native Americans/Alaska Natives are more likely to develop PTSD, with these populations experiencing higher rates compared to non-Latino whites. As the demand for tailored treatments grows, providers are focusing on culturally sensitive care and personalized therapeutic approaches to address the unique needs of these groups.

The geriatric segment is projected to experience lucrative growth from 2025 to 2030. The global population of individuals aged 65 and above is growing rapidly. According to the United Nations, this demographic is projected to double by 2050. According to the World Social Report 2023 of United Nations, the number of people aged 65 years or older worldwide is projected to more than double, rising from 761 million in 2021 to 1.6 billion by 2050. The population aged 80 years or older is growing even faster, representing a critical subgroup that often faces higher vulnerability to PTSD due to compounded life stressors, chronic illnesses, and reduced psychological resilience. In addition, trauma experienced in earlier life stages often resurfaces or worsens in later years, increasing the demand for PTSD diagnosis and treatment in this population.

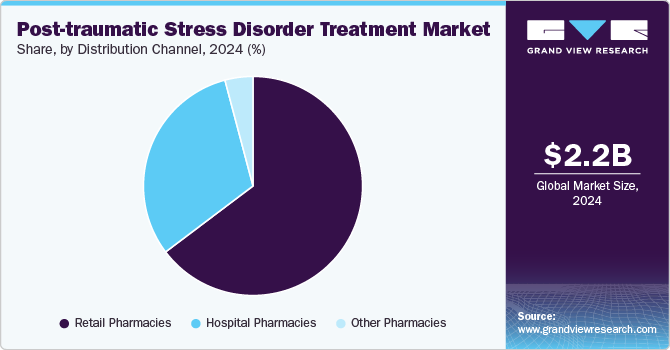

Distribution Channel Insights

The retail pharmacies segment dominated the market with a revenue share of 64.71% in 2024 and is expected to grow at the fastest CAGR over the forecast period. This dominance is attributed to widespread availability and easy access to medications. Major retail pharmacies, such as CVS Health, Walgreens Boots Alliance, Inc., and Rite Aid Corp., are key providers of these drugs. Currently, the FDA has approved only two medications specifically for the treatment of PTSD.

However, other drugs, such as Fluoxetine (Prozac) and Venlafaxine (Effexor), are commonly prescribed off-label to patients with PTSD. This limited number of FDA-approved drugs for treatment presents both challenges and opportunities for the retail pharmacy segment. On one hand, the reliance on off-label prescriptions for post-traumatic stress medications increases the demand for a broader range of pharmaceutical options, driving sales in the retail pharmacy industry.

The hospital pharmacies segment is projected to witness a lucrative growth from 2025 to 2030.The hospital segment plays a critical role in the market, driven by increasing demand for advanced psychiatric care and the integration of multidisciplinary treatment approaches. Hospitals are often the first point of contact for patients experiencing severe PTSD symptoms, including acute stress reactions and comorbidities such as depression and substance abuse. Rising awareness about mental health, government initiatives promoting mental healthcare access, and advancements in diagnostic tools such as functional MRI and biomarkers drive the growth of this segment.

Regional Insights

The North America post-traumatic stress disorder treatment market is experiencing steady growth, primarily driven by increasing awareness of PTSD's impact on mental health and rising demand for post-traumatic stress disorder options. Antidepressants dominate the market, with Selective Serotonin Reuptake Inhibitors (SSRIs) and Non-Selective Antidepressants being the most prescribed. Antipsychotics and Anti-anxiety medications are frequently used as adjuncts to antidepressants to address the severity of PTSD symptoms, particularly in cases of acute stress and insomnia. Alternative drug classes, including anticonvulsants and alpha-1 adrenergic receptor blockers, are also gaining traction for managing hyperarousal and mood stabilization. The market faces barriers, such as high healthcare costs and inconsistent insurance coverage, particularly for geriatric and uninsured populations who need ongoing support for chronic PTSD.

U.S. Post-traumatic Stress Disorder Treatment Market Trends

The post-traumatic stress disorder treatment market in the U.S. remains the largest market in North America, seeing a marked shift toward personalized post-traumatic stress disorder treatments. Antidepressants, especially SSRIs like Sertraline and Paroxetine, are widely prescribed for adult patients. The use of Antipsychotics, such as Quetiapine, and Anti-anxiety medications like Benzodiazepines, continues to grow in response to comorbid anxiety symptoms. Geriatric populations also increasingly receive tailored therapies, especially as the prevalence of PTSD from aging veterans and trauma survivors rises. New drug classes, including Glutamatergic Agents like Ketamine, are gaining traction as treatment for treatment-resistant PTSD. Despite healthcare advancements, out-of-pocket costs and limited access for underinsured populations remain significant challenges.

Europe Post-traumatic Stress Disorder Treatment Market Trends

The European market for post-traumatic stress disorder treatments is expanding as countries emphasize the importance of early intervention and post-traumatic stress disorder therapies. Antidepressants remain the most common treatment, particularly SSRIs and SNRIs, for managing symptoms like intrusive memories, hyperarousal, and mood disturbances. Antipsychotics and Anti-anxiety medications are often added for severe cases or when PTSD symptoms are comorbid with other mental health disorders. Treatment options for geriatric patients, such as anticonvulsants for mood stabilization and alpha-1 adrenergic blockers for hyperarousal, are also becoming more common. Despite advances in PTSD care, the cost of these treatments and the availability of comprehensive healthcare insurance present barriers to wider market growth.

The post-traumatic stress disorder treatment market in the UK is seeing increased emphasis on multi-modal therapy approaches. Antidepressants such as Fluoxetine and Escitalopram are widely prescribed for adults with PTSD, particularly for those experiencing depression and intrusive thoughts. In addition, Antipsychotics are used more frequently in cases of severe PTSD, while Anti-anxiety medications are used in the management of acute anxiety symptoms. In addition to traditional therapies, there is rising interest in incorporating Mood Stabilizers/Anticonvulsants, such as Lamotrigine, for patients dealing with co-occurring conditions. Efforts to enhance digital health tools have improved patient access to PTSD treatments, providing greater support for both outpatient care and mental health services.

Germany post-traumatic stress disorder treatment market is experiencing growth with an increasing focus on Antidepressants as the first line of therapy for both adults and geriatric patients. SSRIs are the most commonly prescribed, along with Antipsychotics for patients with more complex PTSD symptoms, such as severe anxiety and aggression. Anti-anxiety medications like Clonazepam are used in combination with other treatments to alleviate acute anxiety. Additionally, the use of Alpha-1 adrenergic receptor blockers for managing sleep disturbances, including nightmares, has gained momentum. Patient education on medication adherence and access to mental health resources is key to furthering the market's growth in Germany, as insurance coverage remains an important factor in treatment access.

In post-traumatic stress disorder treatment market in France, there is a growing shift towards treating PTSD with a combination of Antidepressants and Antipsychotics, particularly in adult patients. SSRIs are commonly prescribed for managing depressive symptoms and mood disturbances, while Antipsychotics are becoming more prevalent for treating severe post-traumatic stress disorder cases. Anti-anxiety medications are used to help manage acute panic attacks and excessive worry. Mood Stabilizers such as Valproate are gaining attention for complex PTSD cases with co-occurring mood disorders. The French healthcare system is working to improve access to these treatments through both hospital and retail pharmacies, aiming to reduce the reliance on more restrictive therapies.

Asia Pacific Post-traumatic Stress Disorder Treatment Market Trends

The Asia-Pacific post-traumatic stress disorder treatment market is witnessing rapid growth, driven by increasing healthcare investments and a rise in mental health awareness. Antidepressants are the dominant drug class for treating PTSD, with SSRIs and SNRIs being the most prescribed in countries like Japan, China, and India. Antipsychotics and Anti-anxiety medications are frequently used for managing the anxiety and aggression associated with PTSD. In addition, the use of Alpha-1 adrenergic receptor blockers like Prazosin is gaining popularity in regions with high PTSD prevalence, particularly for managing sleep disturbances. As healthcare systems in China and Japan invest in expanding mental health resources, access to treatments is expected to improve, although costs can be a barrier in some areas.

The post-traumatic stress disorder treatment market in China is experiencing a rise in demand for post-traumatic stress disorder treatment market, particularly among adults and the geriatric population. Antidepressants are the most prescribed drug class for treating PTSD, with SSRIs such as Fluoxetine being widely used. Antipsychotics and Anti-anxiety medications like Alprazolam are gaining traction in the management of more severe post-traumatic stress disorder cases, especially among older adults. There is also growing interest in Glutamatergic agents and Mood Stabilizers, which are increasingly being explored for complex PTSD cases with comorbid conditions. The Chinese government is working to expand access to mental health treatments through both public and private healthcare systems.

Japan post-traumatic stress disorder treatment market is growing, driven by the country’s aging population and the increased recognition of PTSD as a significant mental health issue. Antidepressants are commonly prescribed to manage symptoms, with SSRIs and SNRIs leading the way. Antipsychotics are increasingly used for patients with more severe PTSD symptoms, while Anti-anxiety medications are prescribed for managing anxiety and hypervigilance. The growing focus on geriatric care is contributing to the rise in PTSD treatment in older adults, with Mood Stabilizers/Anticonvulsants like Topiramate being explored for co-occurring conditions. Japan's healthcare system continues to improve access to PTSD treatments, particularly through integrated healthcare solutions and digital health initiatives.

Latin America Post-traumatic Stress Disorder Treatment Market Trends

The post-traumatic stress disorder treatment market in Latin America is expanding, fueled by rising healthcare investments and greater awareness of mental health issues. Antidepressants are the most used treatments, with SSRIs leading the way in countries like Brazil, Mexico, and Argentina. Antipsychotics are prescribed for patients with severe PTSD symptoms, while Anti-anxiety medications such as Diazepam are commonly used in acute cases. The region is also seeing an increase in the use of Mood Stabilizers for more complex PTSD cases. Brazil is a leader in the adoption of Antidepressants for post-traumatic stress disorder, with a growing focus on improving healthcare access in both urban and rural areas.

Brazil post-traumatic stress disorder treatment market is at the forefront in Latin America, with Antidepressants like Fluoxetine and Sertraline being widely prescribed for managing PTSD symptoms in adults and children. Antipsychotics and Anti-anxiety medications are also becoming more common, especially for patients with severe PTSD. The country is increasingly focusing on expanding access to Mood Stabilizers/Anticonvulsants for complex cases. Efforts to improve healthcare infrastructure and increase awareness about PTSD are contributing to a greater adoption of non-habit-forming treatments, making Brazil a key player in the Latin American post-traumatic stress disorder treatment landscape.

Middle East And Africa Post-traumatic Stress Disorder Treatment Market Trends

The post-traumatic stress disorder treatment market in the Middle East and Africa (MEA) region is beginning to experience notable growth, driven by increased healthcare investments and improved access to mental health care. Antidepressants are the most prescribed treatments, particularly for adults with PTSD. Antipsychotics and Anti-anxiety medications are also widely used, with a focus on managing anxiety and aggression associated with PTSD. The adoption of Mood Stabilizers and Anti-anxiety medications for complex cases is increasing. Countries such as Saudi Arabia and the UAE are focusing on enhancing healthcare access, which is expected to support the market's growth.

Saudi Arabia post-traumatic stress disorder treatment market is poised for growth, driven by increased healthcare investments and rising awareness of mental health issues. Antidepressants such as Sertraline are commonly prescribed for managing PTSD symptoms, along with Antipsychotics and Anti-anxiety medications for more severe cases. The healthcare system's focus on improving patient access to both prescription and over-the-counter treatments is expected to drive the adoption of non-habit-forming therapies for PTSD in both adult and geriatric.

Key Post-traumatic Stress Disorder Treatment Company Insights

Key industry players include Lupin, AstraZeneca, Pfizer Inc., and Otsuka Holdings Co., Ltd. These leading pharmaceutical companies are at the forefront of developing and manufacturing antidepressants, anti-anxiety medications, and other alternative therapies for PTSD. With their extensive product portfolios and global market reach, they are well-positioned to address the growing demand for safer and more effective PTSD treatments. By expanding access to affordable options and fostering innovation in drug development, these companies are playing a crucial role in enhancing patient care and improving treatment outcomes in the PTSD management landscape.

Key Post-traumatic Stress Disorder Treatment Companies:

The following are the leading companies in the post-traumatic stress disorder treatment market. These companies collectively hold the largest market share and dictate industry trends.

- AstraZeneca

- GSK plc.

- Pfizer Inc.

- Otsuka Holdings Co., Ltd

- Aurobindo Pharma

- Merck KGaA

- Jazz Pharmaceuticals, Inc.

- Bionomics

- Eli Lilly and Company

- Viatris Inc.

Recent Developments

-

In June 2024, Otsuka Pharmaceutical Co., Ltd. and H. Lundbeck A/S announced that the U.S. Food and Drug Administration (FDA) had determined the supplemental New Drug Application (sNDA) for brexpiprazole, in combination with sertraline, to be sufficiently complete for a substantive review. This submission is supported by data from three randomized clinical trials that evaluated the safety and efficacy of brexpiprazole in combination with sertraline for the treatment of adults with post-traumatic stress disorder.

-

In May 2022, Madrigal Mental Care unveiled its innovative nanotechnology for the treatment and prevention of post-traumatic stress disorder at Biomed Israel 2022. This technology enables precise and rapid delivery of psychoactive substances, using biodegradable nanoparticles. The approach offers significant advantages over traditional methods, particularly in terms of stability and dosing accuracy.

-

In February 2024, Lykos Therapeutics announced that the U.S. Food and Drug Administration (FDA) had accepted its new drug application (NDA) for midomafetamine capsules (MDMA). This treatment, when used in combination with psychological interventions such as psychotherapy and other supportive services provided by qualified healthcare providers, is intended for individuals with post-traumatic stress disorder.

Post-traumatic Stress Disorder Treatment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.33 billion

Revenue forecast in 2030

USD 2.85 billion

Growth rate

CAGR of 4.08% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug class, demographics, distribution channels, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

AstraZeneca; GSK plc.; Pfizer Inc.; Otsuka Holdings Co., Ltd; Aurobindo Pharma; Merck KGaA; Jazz Pharmaceuticals, Inc.; Bionomics; Eli Lilly and Company; Viatris Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Post-traumatic Stress Disorder Treatment Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global post-traumatic stress disorder treatment market report based on drug class, Demographics, distribution channels, and region.

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Antidepressants

-

Anti-anxiety

-

Antipsychotics

-

Other Drug Class

-

-

Demographics Outlook (Revenue, USD Million, 2018 - 2030)

-

Adult

-

Children

-

Geriatric

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Other Pharmacies

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

Kuwait

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global post-traumatic stress disorder treatment market size was estimated at USD 2.24 billion in 2024 and is expected to reach USD 2.33 billion in 2025

b. The global post-traumatic stress disorder treatment market is expected to grow at a compound annual growth rate of 4.08% from 2025 to 2030 to reach USD 2.85 billion by 2030.

b. North America dominated the market for post-traumatic stress disorder treatment in 2024, due to high awareness regarding PTSD and the availability of treatment options.

b. Some key players operating in the post-traumatic stress disorder treatment market include GlaxoSmithKline plc.; Otsuka Pharmaceutical Development; Jazz Pharmaceuticals; Bionomics; Aptinyx; AstraZeneca

b. Key factors that are driving the post-traumatic stress disorder treatment market growth include robust product pipeline, rising prevalence of PTSD, and increasing awareness about mental health.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.