- Home

- »

- Next Generation Technologies

- »

-

Postal Automation System Market Size & Share Report, 2030GVR Report cover

![Postal Automation System Market Size, Share & Trends Report]()

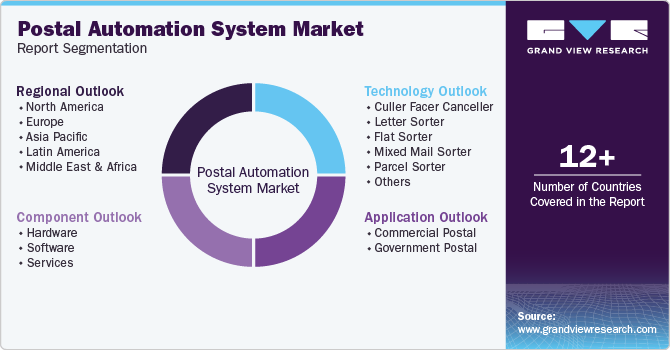

Postal Automation System Market (2025 - 2030) Size, Share & Trends Analysis Report By Technology (Letter Sorter, Parcel Sorter), By Component (Hardware, Software), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68039-979-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Postal Automation System Market Trends

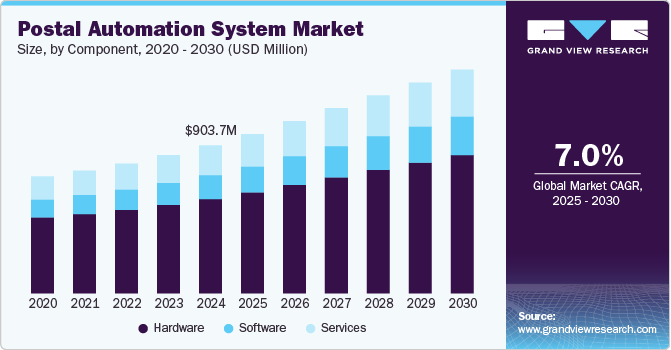

The global postal automation system market size was estimated at USD 903.7 million in 2024 and is projected to grow at a CAGR of 7.0% from 2025 to 2030. The growing e-commerce sector is one of the primary drivers of market growth, as retailers and logistics providers seek faster and more efficient methods to manage increasing parcel volumes. Automation is crucial to meet consumer expectations for quick deliveries, with systems designed to handle larger parcel volumes and a variety of package types. Companies are investing in high-speed sorting systems, robotics, and AI to streamline operations and reduce human intervention.

Automation helps reduce operational costs and enhances the speed of service, key factors in competing in the fast-paced e-commerce environment. As parcel delivery demands continue to rise, automation solutions are becoming a necessity to ensure timely, cost-effective deliveries.

Artificial intelligence (AI) and machine learning are playing a critical role in transforming postal automation systems by improving the accuracy and speed of sorting processes. AI-driven systems can optimize routing, track parcels in real time, and predict demand, enhancing operational efficiency. Machine learning algorithms are being used to detect errors and improve sorting accuracy, leading to fewer mistakes and faster processing. The integration of AI also enables postal services to better handle varying parcel volumes and complex delivery requirements. As technology matures, AI’s role in postal automation will expand to more sophisticated predictive analytics, further streamlining operations.

Sustainability is becoming a critical focus in the market as operators seek to reduce their environmental impact. Many postal facilities are transitioning to energy-efficient equipment, such as low-energy conveyor systems and sorting machines, to decrease electricity consumption. The use of renewable energy sources, like solar panels, is also gaining traction within the industry. Automation systems are being designed to not only improve efficiency but also minimize the carbon footprint of postal operations. This trend is in response to growing environmental awareness and regulatory pressures to adopt greener technologies in the logistics and postal industries.

The trend towards modular and scalable automation systems is growing as postal operators seek solutions that can easily adapt to fluctuating parcel volumes. These systems allow for flexibility, enabling postal operators to add or remove components as needed to meet changing demand levels. Scalable solutions reduce initial investment costs, as operators can expand their systems gradually without significant upfront capital expenditures. As parcel volumes fluctuate throughout the year, particularly during peak seasons like holidays, having adaptable systems ensures postal services can maintain high efficiency. Modular systems are also easier to maintain and upgrade, providing long-term operational flexibility.

Robotics is increasingly being integrated into postal automation systems to enhance parcel handling, sorting, and last-mile delivery. Automated guided vehicles (AGVs) and robots are used to carry parcels across sorting centers, reducing human labor and increasing operational efficiency. Robotics can handle a variety of parcel types and sizes, allowing for a more streamlined and flexible workflow. Autonomous delivery vehicles are also being explored for last-mile delivery, offering potential cost savings and increased delivery speed. The growth of robotics and autonomous vehicles in postal services is expected to continue, with these technologies playing a central role in the future of automated logistics.

Technology Insights

The parcel sorter led the market in 2024, accounting for over 28% of the global revenue. The parcel sorter segment is expanding rapidly due to the increasing demand for faster parcel processing driven by the e-commerce boom. Innovations in automation, such as robotic arms and AI-driven systems, are improving sorting speed and accuracy for parcels of various sizes. Companies are adopting modular and scalable parcel sorting solutions to manage fluctuating parcel volumes effectively. Sustainability is a growing trend, with eco-friendly features like energy-efficient operations and the use of recyclable materials being integrated into new parcel sorter systems.

The letter sorter segment is predicted to foresee significant growth in the coming years. The letter sorter segment is evolving to handle higher volumes and greater diversity in mail types, fueled by the demand for quicker, more efficient processing. AI and machine learning are being incorporated into letter sorters to enhance sorting accuracy and adapt to different mail formats. The integration of high-speed, multi-function sorting systems that can handle both letters and small parcels is becoming more common. In addition, there is an emphasis on energy efficiency and sustainability, with modern letter sorters designed to reduce environmental impact through energy-saving features and recyclable components.

Component Insights

The hardware segment accounted for the largest market revenue share in 2024. The rising demand for efficient parcel processing is driving growth in the hardware segment. Innovations in sorting machines, conveyor belts, scanners, and robotics are enhancing the speed and accuracy of postal operations. There is a growing focus on developing hardware that can handle larger volumes of parcels, with advancements in modular and scalable solutions that can be easily adapted to meet changing demand. In addition, the integration of AI-driven sensors and machine vision technology into sorting hardware is improving sorting accuracy and reducing errors. Sustainability is also a key consideration, with hardware solutions now designed to be energy-efficient and capable of supporting eco-friendly practices, such as electric-powered conveyors and recyclable materials.

The software segment is predicted to foresee the largest growth in the coming years. The growing demand for real-time tracking and operational optimization is fueling growth in the software segment. Software solutions are increasingly leveraging artificial intelligence, machine learning, and data analytics to improve sorting accuracy, streamline logistics, and enhance decision-making capabilities. Cloud-based platforms are becoming more prevalent, enabling postal services to manage operations remotely and access real-time data from various touchpoints across the supply chain. Software also plays a critical role in optimizing last-mile delivery, with advanced route planning and predictive analytics systems that enhance delivery efficiency. In addition, there is a significant shift towards integrating sustainability-focused software tools that help track and reduce carbon footprints, enhancing overall environmental performance.

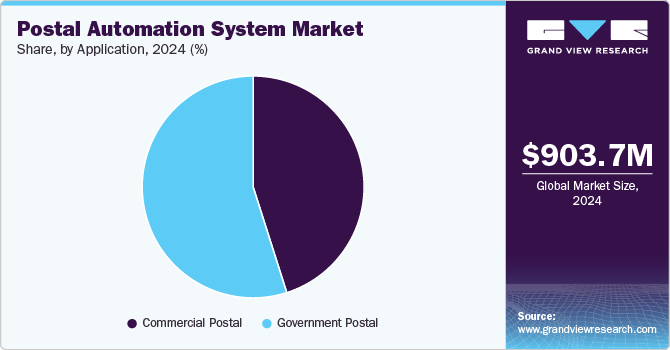

Application Insights

The government postal segment accounted for the largest market revenue share in 2024.In the government postal segment, automation is being adopted to improve service efficiency and reduce operational costs, particularly in response to the growing volume of parcels. Many government postal agencies are investing in AI-powered sorting systems that improve accuracy and speed, allowing for better management of parcel flows. Digitalization is another key trend, with government postal services incorporating online tracking, automated customer service systems, and data analytics to enhance customer experience. Sustainability initiatives are becoming more prominent, with government-run postal services focusing on energy-efficient infrastructure and eco-friendly solutions such as electric delivery vehicles. In addition, governments are working to modernize their postal systems to meet the evolving needs of consumers while ensuring compliance with regulatory standards and public service obligations.

The commercial postal segment is projected to exhibit the fastest CAGR over the forecast period. The rising demand for faster deliveries and efficient parcel handling is driving the adoption of automation in the commercial postal segment. Businesses are investing in advanced automation systems to enhance sorting accuracy, speed, and overall efficiency to meet customer expectations in a highly competitive market. Commercial postal operators are focusing on integrating AI and machine learning to optimize sorting processes and improve operational cost efficiency. Sustainability is also a growing concern, with commercial postal services incorporating eco-friendly solutions, such as energy-efficient systems and electric delivery vehicles, to reduce carbon footprints. As e-commerce continues to grow, the demand for automated solutions that can handle high volumes of parcels with minimal human intervention is expected to further drive innovation in the commercial postal sector.

Regional Insights

North America postal automation systems market dominated globally with a revenue share of over 41% in 2024. The market in North America benefits from strong technological infrastructure and high demand from the booming e-commerce sector. The U.S. leads in adopting automated sorting, AI-based parcel tracking, and robotic solutions to maintain operational efficiency. Regional focus on reducing labor costs and improving service speed is accelerating investments in advanced automation technologies across postal facilities.

U.S. Postal Automation System Market Trends

The U.S. postal automation systems market is expected to grow at a lucrative CAGR from 2025 to 2030. The U.S. has a robust market, largely driven by the need to manage high mail and package volumes efficiently. With the surge in online shopping, USPS and private operators are adopting AI-driven sorting and automation to meet rising demands. U.S. postal services are also prioritizing sustainability, incorporating energy-efficient technologies in automation systems to align with environmental goals.

Europe Postal Automation System Market Trends

The postal automation systems market in the Europe region is expected to witness significant growth over the forecast period. Europe’s market is marked by the rising adoption of green technologies and automation to meet environmental regulations and consumer expectations for faster deliveries. Key countries such as Germany, the UK, and France are heavily investing in sustainable automation solutions, like energy-efficient sorting systems and digital tracking tools. Europe also faces a labor shortage, prompting postal operators to further streamline operations with automation.

Asia Pacific Postal Automation System Market Trends

The postal automation systems market in the Asia Pacific region is anticipated to register the fastest CAGR over the forecast period. Asia Pacific is experiencing rapid growth in postal automation, fueled by high e-commerce demand and expanding urban populations, especially in China, Japan, and India. Investment in automation systems is increasing as operators seek to scale up capacities and reduce human intervention. Regional governments support the adoption of automation to boost logistics efficiency, further accelerating market expansion in this area.

Key Postal Automation System Company Insights

Key players in the market for postal automation systems, including Toshiba Infrastructure Systems & Solutions Corporation, SOLYSTIC, Pitney Bowes Inc., Vanderlande Industries B.V., BEUMER GROUP, and Fluence Automation, LLC, are actively pursuing growth strategies to strengthen their competitive edge and expand their customer reach. These companies are engaging in partnerships, mergers, acquisitions, and product innovation to enhance their market presence and respond to changing industry demands. By focusing on technological advancements and collaborative ventures, they aim to drive innovation and improve operational efficiency. This strategic focus supports their goal to meet evolving security and automation needs within the postal and logistics sectors.

-

Toshiba Infrastructure Systems & Solutions Corporation focuses on providing innovative automation solutions for postal and logistics sectors worldwide. Their postal automation systems streamline mail sorting and parcel handling, integrating advanced robotics and AI-driven software for high efficiency and accuracy. Toshiba’s solutions are known for enhancing processing speed and scalability, enabling postal operators to meet growing demands in e-commerce and logistics. The company’s global presence and expertise in infrastructure solutions position it as a key player in modernizing postal services.

-

SOLYSTIC specializes in comprehensive automation systems for postal and logistics industries, delivering cutting-edge sorting and parcel handling technologies. With a strong emphasis on automation and data analytics, SOLYSTIC’s solutions are designed to improve operational efficiency and productivity in mail and parcel sorting facilities. The company provides modular systems that can be adapted to client-specific needs, accommodating high volumes and diverse mail formats. SOLYSTIC’s reputation for reliability and innovative technology makes it a preferred choice for postal organizations globally seeking optimized and future-ready processing solutions.

Key Postal Automation System Companies:

The following are the leading companies in the postal automation system market. These companies collectively hold the largest market share and dictate industry trends.

- Toshiba Infrastructure Systems & Solutions Corporation

- Körber AG

- NEC Philippines, INC.

- SOLYSTIC

- Pitney Bowes Inc.

- Vanderlande Industries B.V.

- Fives Group

- Leonardo S.p.A.

- Lockheed Martin Corporation

- BEUMER GROUP

- Interroll Group

- Dematic

- Eurosort

- Fluence Automation LLC.

Recent Developments

-

In August 2024, DHL Express inaugurated a new, fully renewable energy-powered service center near Cambridge, UK, featuring an advanced automation system valued at £2 million. The facility can handle up to 4,000 parcels per hour, with a projected weekly volume of over 50,000 items. Designed with sustainability in mind, the center includes solar panels, energy-efficient heating, and charging infrastructure for electric vehicles. This new hub highlights DHL’s commitment to both operational efficiency and environmental responsibility.

-

In March 2024 Wayzim Technology’s Vision Singulator and Fast Scanner automation products earned CE certification, marking compliance with EU safety standards. Certified by SGS, these products underwent rigorous testing, demonstrating their adherence to essential safety criteria for innovative automation technologies. These certifications represent a significant milestone for Wayzim’s advanced image processing and deep learning-based technology. Wayzim’s general manager expressed great pride in achieving this recognition, underscoring the company’s dedication to high-quality, compliant products.

Postal Automation Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 973.1 million

Revenue forecast in 2030

USD 1,365.9 million

Growth Rate

CAGR of 7.0% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; Australia; South Korea; Brazil; UAE; South Africa; KSA

Key companies profiled

Toshiba Infrastructure Systems & Solutions Corporation, Körber AG, NEC Philippines, INC., SOLYSTIC, Pitney Bowes Inc., Vanderlande Industries B.V., Fives Group, Leonardo S.p.A., Lockheed Martin Corporation, BEUMER GROUP, Interroll Group, Dematic, Eurosort, Fluence Automation, LLC.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Postal Automation Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global postal automation systems market report based on technology, component, application, and region.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Culler Facer Canceller

-

Letter Sorter

-

Flat Sorter

-

Mixed Mail Sorter

-

Parcel Sorter

-

Others

-

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Hardware

-

Software

-

Services

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial Postal

-

Government Postal

-

-

Regional Outlook (Revenue, USD Million, 2018-2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

South Africa

-

KSA

-

-

Frequently Asked Questions About This Report

b. The global postal automation systems market size was estimated at USD 903.7 million in 2024 and is expected to reach USD 973.1 million in 2025

b. The global postal automation systems market is expected to grow at a compound annual growth rate of 7.0% from 2025 to 2030 to reach USD 1,365.9 million by 2030

b. North America dominated the postal automation systems market with a share of over 40% in 2024. This is attributable to increased online shopping and processing of a considerable number of orders in the region.

b. Some key players operating in the postal automation systems market include Toshiba Infrastructure Systems & Solutions Corporation; Körber AG; NEC Philippines, INC.; SOLYSTIC; Pitney Bowes Inc.; Vanderlande Industries B.V.; Fives Group; Leonardo S.p.A.; Lockheed Martin Corporation; BEUMER GROUP; Interroll Group; Dematic; Eurosort; Fluence Automation, LLC

b. Key factors that are driving the market growth include the growing demand for faster delivery while saving labor costs from numerous industries and the increasing need for automation in delivery and sorting processes

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.