- Home

- »

- Pharmaceuticals

- »

-

Postpartum Health Supplements Market Size Report, 2030GVR Report cover

![Postpartum Health Supplements Market Size, Share & Trends Report]()

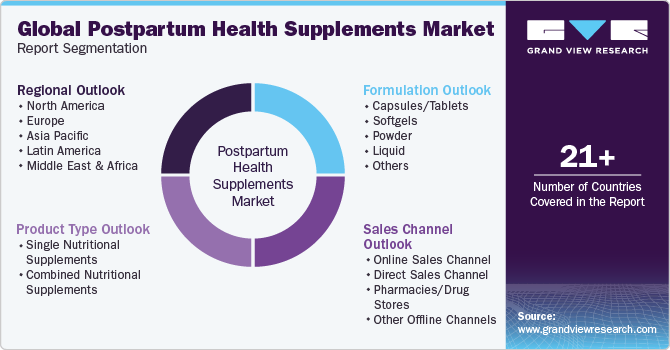

Postpartum Health Supplements Market Size, Share & Trends Analysis Report By Product Type (Single Nutritional Supplements, Combined Nutritional Supplements), By Formulation, By Sales Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-981-8

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

The global postpartum health supplements market size was estimated at USD 1.24 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8.01% from 2024 to 2030. The introduction of innovative products by the key players and the increasing prevalence of postnatal depression are some of the key factors expected to drive the market's growth during the forecast period. Increasing awareness about postnatal problems globally is anticipated to drive demand for postnatal health supplements. The American College of Obstetricians and Gynecologists recommended that postnatal care be an ongoing process and that women should visit doctors within 12 weeks of pregnancy. Such initiatives are expected to influence the postnatal health supplements market positively.

Postnatal health problems are more common in women with chronic disease conditions such as cardiac diseases, high blood pressure, and obesity, which is expected to contribute to the revenue of the market during the forecast period. According to the article published by Postpartum Depression in July 2023, about one in 10 women may undergo postpartum depression (PPD) following childbirth, and certain studies indicate a prevalence of one in seven women. The duration of postpartum depression typically spans 3 to 6 months, though this varies depending on various factors. An estimated 50% of mothers experiencing PPD do not receive a diagnosis from a healthcare professional. However, around 80% of women with PPD can attain full recovery with the help of proper care and nutrition. These statistics are expected to aid the demand for postpartum health supplements, boosting market growth.

Several initiatives have been undertaken by public and private institutions across the world to combat postnatal depression. This is anticipated to increase awareness among women, positively impacting the market growth during the forecast period. For instance, the American College of Obstetricians and Gynecologists provides information to new parents about the treatment options available for postnatal depression. Furthermore, in August 2023, the WHO updated its article emphasizing the importance of Vitamin A in postpartum women.

Increased healthcare spending due to the rising disposable income is expected to increase the expenditure on such supplements, which is anticipated to positively impact the demand for the supplements, during the forecast period. Hesitation toward disclosure of postnatal depression among new mothers due to the social stigma and isolation are some of the factors which are anticipated to hamper the market growth, during the forecast period.

Market Concentration & Characteristics

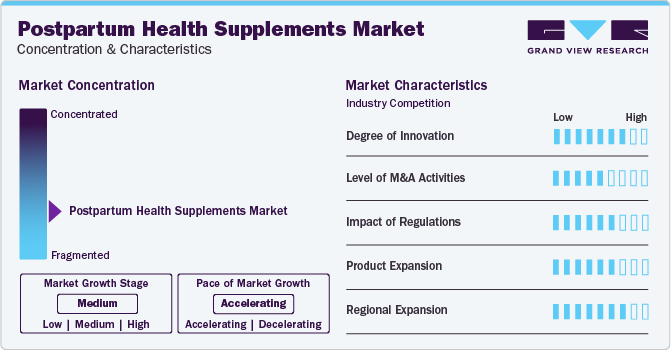

The market growth stage is medium, and the market growth is accelerating. The global market is characterized by a high degree of innovation due to rapid advancements and innovations in the pharmaceutical industry. It utilizes advanced drug delivery techniques to deliver various types of postpartum supplements.

The market is further characterized by a moderate level of merger and acquisition (M&A) activity by the leading players. This is due to several factors, including the desire to gain access to new drug development formulations & facilities, increase their capabilities, expand product portfolios, and improve competencies.

The market is also subject to substantial regulatory scrutiny. Manufacturers and suppliers of postpartum supplements must comply with various regulations, such as drug development and clinical trials. If the companies fail to adhere to the regulations, the regulatory bodies might issue a warning against the companies.

The market has a moderate level of product/service expansion. This expansion involves introducing various types of supplement types and formulations.The product expansion enables companies to expand their postpartum supplement portfolio.

Regional expansion is a significant factor with moderate to high growth in the market. Since a huge number of end-users drive demand for postpartum health supplements, the market players are investing in regional expansion to increase manufacturing capacity. Furthermore, regional expansion enables players to capture the untapped customer base, thereby strengthening their position in the market.

Product Type Insights

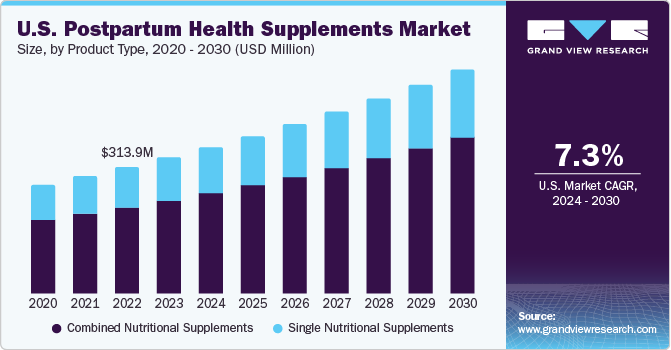

Based on the product, the combined nutritional supplements segment led the market with the largest revenue share of 68.10% in 2023. This segment is driven by players focusing on launching combined nutritional supplements for postpartum health. For instance, in November 2022, Vegan Life Nutrition, a part of the GHT Companies, a nutraceutical manufacturer, introduced a new line of postnatal vitamins for post pregnancy support. This line includes a capsule combining vitamin D, Thiamin, Riboflavin, Niacin, Folate, and Choline for postnatal care.

The single nutritional supplements segment is anticipated to grow considerably at a CAGR of 7.17% during the forecast period. This segment comprises individual doses of vitamins, minerals, herbal supplements, proteins, omega-3, probiotics, and other supplements. They help replenish nutrient deficiencies caused during lactation or after birth. According to an article published in March 2023 by Thriva, a nutritional supplement provider, vitamin B12 requirements increase while breastfeeding, as the deficiency of vitamin B12 among mothers affects their milk quality. Thus, the demand for single nutritional supplements like Vitamin B12 and Vitamin D is expected to increase in the coming years, thereby boosting the segment growth over the forecast period.

Formulation Insights

Based on formulations, the capsules/tablets segment held the largest revenue share of 38.3% in 2023. Factors such as ease of consumption, faster relief, and breakdown than other formulation types are anticipated to support the segment's growth during the forecast period. Moreover, the key players offering their products in capsule/tablet form further contributed to the segment's revenue. For instance, Megafood, a supplement provider, offers Baby & Me 2 Postnatal Multi supplement in tablet formulation, and Ritual offers its Postnatal Multivitamin in capsule formulations.

The softgels segment is anticipated to witness a significant CAGR during the forecast period. Factors such as easy swallowing & digestion, increased bioavailability, convenience, and resistance to light and UV rays are anticipated to boost the segment's growth. Also, the availability of a range of products in this segment is a key factor anticipated to drive the segment growth during the forecast period. For instance, Nestle and Theralogix offer postpartum health supplements in soft gel formulations.

Sales Channel Insights

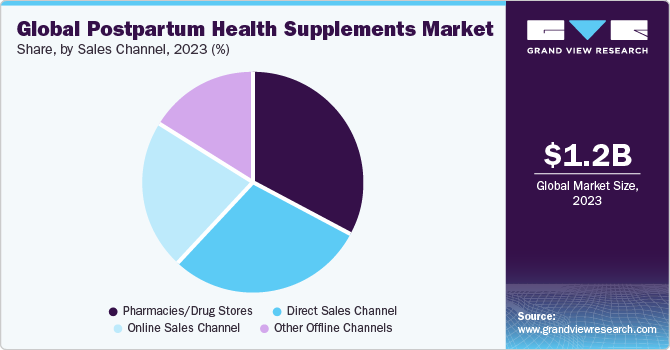

Based on sales channel, the pharmacies/drug stores segment led the market with largest revenue share of 32.8% in 2023. These stores generally sell all types of postpartum supplements and are not limited to products of a specific company or category. It allows buyers to choose from different products and compare pricing. Moreover, local pharmacies offer benefits, such as easy access and a wide variety of products, which appeal to consumers. Thus, due to the easy accessibility & availability of numerous products, pharmacies are estimated to generate considerable revenue by selling postpartum health supplements. Furthermore, numerous pharmacy and drug store chains like Walgreens, CVS Pharmacy, and Rite Aid offer postnatal supplements through their stores.

The online sales channel segment is projected to witness the fastest CAGR over the forecast period. Growth in the segment can be primarily attributed to the increased internet penetration and availability of a wide range of products on the online channel. The key players actively enter this segment by listing their products on e-commerce platforms. For instance, industry participants like Nestle, Pinkstork, Centrum, Thorne, and Vitabiotics offer supplements for breastfeeding or lactating women through e-commerce platforms like Amazon. Thus, the availability of top brands of postpartum health supplements through online sales channels is expected to fuel the segment over the forecast period.

Regional Insights

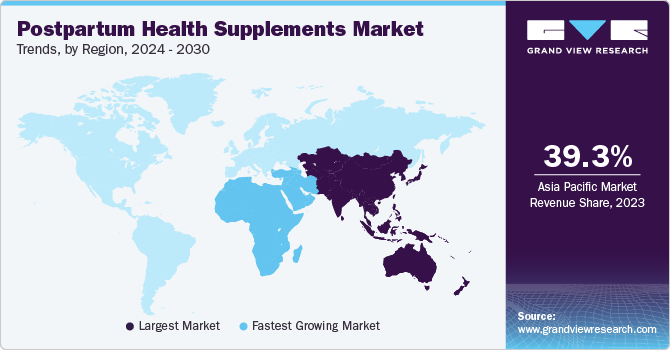

Asia Pacific dominated the market with the revenue share of 39.3% in 2023. The growth is attributed to countries such as India and China with maximum population. Furthermore, according to UNICEF, around 25 million births occur annually in India, constituting around 20% of births occurring annually across the globe. Moreover, according to the Indian Journal of Obstetrics and Gynecology Research published in May 2023, the National Guidelines for "Calcium Supplementation During Pregnancy and Lactation" suggest that pregnant women should consume supplements containing vitamin D (250 IU as cholecalciferol) and elemental calcium (500mg as calcium carbonate) in the form of two tablets taken twice daily after a meal until six months of postpartum. Hence, these factors collectively are expected to drive the regional market.

The market for postpartum health supplements in India is expected to grow at a rapid pace in the forecast period. India is home to several supplement manufacturers and the country is witnessing an increase in consumer spending power. Furthermore, India has a large and growing population which is expected to boost the adoption of postpartum health supplements in near future.

The MEA region is expected to grow at the fastest CAGR for the forecast period. The factors, such as increasing disposable income of the population and growing cases of postnatal depression among women in countries such as Saudi Arabia, UAE, and South Africa, among others, are expected to drive the market growth. For instance, according to a study published by the National Library of Medicine in March 2023, the prevalence of maternal depressive symptoms is significant in the UAE. Out of 457 women considered in the study, 35% showed depressive symptoms within the first six months postpartum. Thus, the need for postpartum health supplements that can help reduce depression symptoms or support maternal mood is anticipated to increase in the forecast period.

Key Postpartum Health Supplements Company Insights

The market leaders are DSM, Mommy’s Bliss, Inc., Nordic Naturals, and New Chapter, Inc. These companies are actively involved in product launches, acquisitions, and mergers to strengthen the postpartum health supplements portfolio.

However, companies such as Pink Stork, The Honest Company, Inc., and Anya, among others, are emerging players in the market. The players undertake business initiatives, such as product launches and expansion, to strengthen their market position.

Key Postpartum Health Supplements Companies:

The following are the leading companies in the postpartum health supplements market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these postpartum health supplements companies are analyzed to map the supply network.

- New Chapter, Inc.

- Mama's Select

- ACTIF USA

- Nutraceutical Wellness Inc.

- Anya

- DSM

- Pink Stork

- Mommy’s Bliss, Inc.

- The Honest Company, Inc.

- Nordic Naturals

Recent Developments

-

In October 2023, LaVie Mom announced the launch of two prenatal and postpartum supplements, Ginger Prenatal Vitamin and a Prebiotic Fiber Postpartum Gummy

-

In August 2023, the U.S. FDA announced the approval of Zurzuvae (zuranolone), an oral medication to treat PPD in adults

-

In May 2023, DSM announced the completion of its merger with Firmenich to form a new company, DSM-Firmenich. The company comprises four business units: health nutrition & care, animal nutrition & health, perfumery & beauty, and taste texture & health created for food & beverage products

-

In April 2023, Ritual, a health and wellness provider, announced its retail presence across Target stores. This is anticipated to boost the distribution of the company products

-

In April 2023, Tabu Group, Inc., a health and wellness company, announced its products will be available on Sephora.com. This is expected to increase the company’s distribution network and strengthen its presence

Postpartum Health Supplements Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.34 billion

Revenue forecast in 2030

USD 2.13 billion

Growth rate

CAGR of 8.01% from 2024 to 2030

Base year for estimation

2023

Historic period

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, formulation, sales channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; France; Spain; Italy; Denmark; Sweden; Norway; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Mexico; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

New Chapter, Inc.; Mama's Select; ACTIF USA; Nutraceutical Wellness Inc.; Anya; DSM; Pink Stork; Mommy’s Bliss, Inc.; The Honest Company, Inc.; Nordic Naturals

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Postpartum Health Supplements Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global postpartum health supplements market report based on product type, formulation, sales channel, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Nutritional Supplements

-

Vitamins

-

Minerals

-

Herbal Supplements

-

Proteins

-

Omega-3

-

Probiotics

-

Others

-

-

Combined Nutritional Supplements

-

-

Formulation Outlook (Revenue, USD Million, 2018 - 2030)

-

Capsules/Tablets

-

Softgels

-

Powder

-

Liquid

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online Sales Channel

-

Direct Sales Channel

-

Pharmacies/Drug Stores

-

Other Offline Channels

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global postpartum health supplements market was estimated at USD 1.24 billion in 2023 and is expected to reach USD 1.34 billion in 2024.

b. The global postpartum health supplements market is expected to grow at a compound annual growth rate of 8.01% from 2024 to 2030 to reach USD 2.13 billion by 2030.

b. Asia Pacific dominated the global postpartum health supplements market with a share of 39.21% in 2023. This is attributable to the rising birth rate in the region and increasing awareness about postpartum health supplements among women.

b. Some key players operating in the postpartum health supplements market are New Chapter, Inc., Mama's Select, ACTIF USA, Nutraceutical Wellness Inc., Anya, DSM, Pink Stork, Mommy’s Bliss, Inc., The Honest Company, Inc., Nordic Naturals

b. Key factors that are driving the market growth include the increasing prevalence of postpartum depression, rising awareness for postpartum health supplements, and several initiatives undertaken to combat postpartum depression.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."