- Home

- »

- Paints, Coatings & Printing Inks

- »

-

Powder Coating Equipment Market Size & Share Report, 2030GVR Report cover

![Powder Coating Equipment Market Size, Share & Trends Report]()

Powder Coating Equipment Market Size, Share & Trends Analysis Report By Product (Ovens & Booths), By Application (Consumer Goods), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-295-2

- Number of Report Pages: 137

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Report Overview

The global powder coating equipment market size was estimated at USD 2,929.9 million in 2022 and is anticipated to grow at a compounded annual growth rate (CAGR) of 5.0% from 2023 to 2030. Growing requirements for powder coatings with the simplicity of use, greater flexibility, high quality, and storage performance, as well as the rising need for energy-saving devices because of the depletion of non-renewable resources, are key factors boosting market revenue growth.

The COVID-19 pandemic slowed market development due to forced production shutdowns, decreased consumer spending, and global supply chain disruption. The pandemic had a significant effect on the automotive industry, which led to a decline in orders for powder coating machinery in 2020.

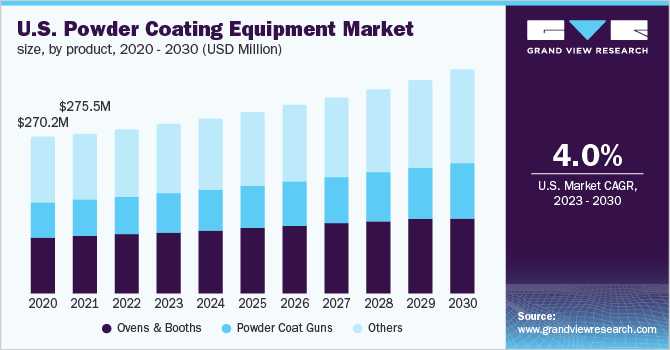

The need for powder coat guns is anticipated to increase as domestic production and nearshoring increase in the U.S. Additionally, it is seen that demand for powder coating equipment would increase due to the U.S. government's focus on coatings that don't emit volatile organic compounds. Additionally, rising private company investments in the paint and coatings sectors in this region are anticipated to fuel market revenue growth.

The use of coatings that emit volatile organic compounds has been reduced with the help of the U.S. and Europe (VOC). To stop VOC emissions, the Environmental Protection Agency (EPA) and the European Commission (EU) have established rules and directives. For instance, China also established VOC emission standards in December 2020, which increased the use of powder coatings and raised the need for machinery.

The development of innovations in auxiliary equipment for powder coating has significantly improved operating efficiency and reduced costs. Additionally, it is anticipated that over the projected period, demand for powder coating equipment will increase due to functional powder coatings adaptability in tougher environments. This, in turn, is anticipated to boost the demand for powder coating equipment over the projected period.

In addition, expanding government programs that support the use of energy-efficient appliances in industrial settings also supports market expansion for powder coating equipment. Additionally, manufacturers are making significant investments in creating energy-efficient appliances to encourage sustainability, which is also boosting market revenue growth throughout the anticipated time.

Product Insights

Ovens & booths product segment led the market and accounted for 39.3% of the global revenue share in 2022. Ovens and booths are mainly used in the automotive industry because they give the vast amount of coating space that is needed. Additionally, the introduction of electric vehicles in the automotive sector is anticipated to positively affect the expansion of the powder coating equipment market.

Powder coat guns product accounted for 24.1% of the global revenue share in 2022. The DIY powder coating market for home restoration and improvement has grown owing to orders from stay-at-home customers. The DIY industry is expanding as a result of people in the U.S. and other European nations taking a similar tack, which will increase the sales of powder coat guns throughout the projection period.

Manufacturers of powder coating equipment are especially working to provide ancillary equipment that can boost productivity and maximize energy savings. The developed markets of the U.S., Germany, and Japan are introducing various types of controllers, modules, pumps, and gauges. Therefore, these factors are likely to fuel the market demand.

Other powder coating equipment comprises a variety of auxiliary items such as controllers, gauges, pumps, filters, hoses, and tubing. As powder coating businesses seek to modernize their processes to improve productivity and efficiency, the demand for this equipment is anticipated to expand significantly.

Application Insights

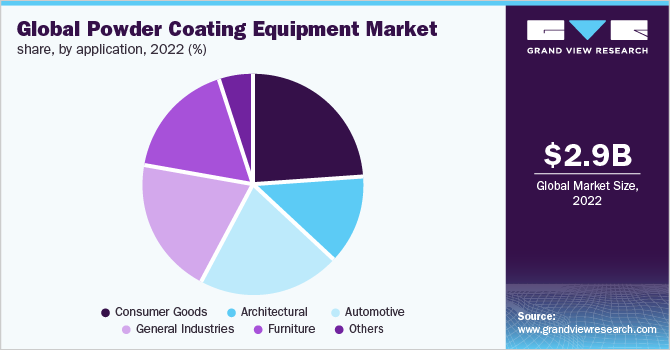

Consumer application segment holds the largest market and accounted for more than 23.6% of the global revenue share in 2022 since powder coatings are being used more frequently on workout equipment and white goods. Due to the improved finishing and more flexibility of powder coatings, coatings producers like PPG, Jotun, and Akzo Nobel, are concentrating especially on their powder coatings portfolio for consumer goods, which is driving up demand for powder coating equipment.

The demand for powder coatings is likely to grow as the sports industry expands as a result of the commercialization of sports like cricket, soccer, and golf as well as upcoming competitions like the South-East Asian Games, Arafura Games, FIFA Club World Cup, ICC Cricket World Cup, and Olympic competitions. To boost production in coating recreational equipment and support expansion, businesses have started implementing smart control systems.

Powder coating equipment demand in automotive applications is estimated to witness growth at a CAGR of 5.6% due to the expanding Electric Vehicle (EV) market and growing use of coatings in automobile reconditioning. Additionally, powder coatings can provide the thermal management, fire resistance, and low dielectric currents that batteries require, which are some of the factors which will further assist in segment growth.

The need for powder coatings in architectural applications is anticipated to increase with the expansion of the residential construction sector. Aluminum extrusions with powder coating are anticipated to be the main market driver because of the advantages of aluminum, which is also the chosen sustainable material, as well as the advantages of powder coating, such as low VOC and durability.

Regional Insights

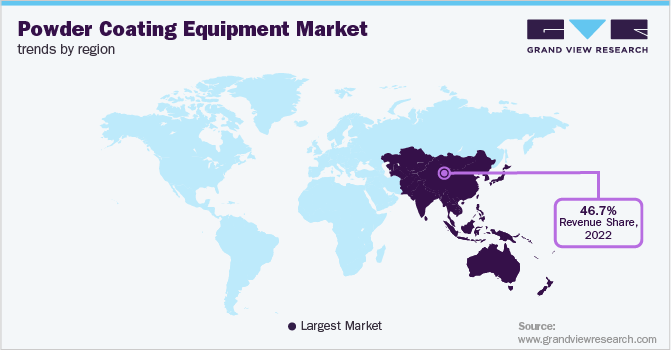

Asia Pacific led the market and accounted for 46.7% of the global revenue share in 2022. This is due to the growing presence of important market players in this area, like Anest Iwata Corporation and Hangzhou Color Powder Coating Equipment Co., Ltd. In nations like China, Japan, India, and South Korea, the development of this coating equipment is anticipated to continue, helping the vehicle sector to expand. Additionally, changing lifestyles, increased disposable incomes, and a rising population all support the market's revenue expansion. Strong investment policies will generate new growth prospects for the construction sector in developing nations like China, Japan, and India.

Owing to the growing presence of major automakers like General Motors, Cadillac, and Ford Motors, the North American market is anticipated to see a very high rate of revenue growth throughout the forecast period. The need for powder coat guns in this area is anticipated to increase as domestic production and nearshoring increase in the U.S. Additionally, it is anticipated that demand for powder coating equipment would increase due to the U.S. government's focus on coatings that don't emit volatile organic compounds. Additionally, rising private company investments in the paint and coatings sectors in this region are anticipated to fuel market revenue growth.

European market is likely to grow at a CAGR of 3.9% over the forecast period. Market expansion is being driven by the region's quick industrialization and urbanization, as well as improvements in the public transportation system and rising consumer spending. In addition, the need for powder coating equipment used for painting has increased as major automakers like Volkswagen, Mercedes-Benz AG, Audi, and BMW are becoming more prevalent.

Central & South America market is likely to grow at a CAGR of 5.5% over the forecast period. In order to meet the demand for powder coating equipment from the expanding population, governments of different countries in Central and South America are concentrating on the construction of sustainable infrastructures related to railways, urban mass transits, energy and oil & gas production, renewable energy generation, etc. In turn, this increases the need for powder-coating machinery in the area for use in construction applications.

The growing acceptance of powder coating equipment across a wide range of end-user industries, including electrical appliances, automotive, architectural, healthcare, and consumer products, is what is driving the need for it in the Middle East and Africa. This should lead to several prospects for growth.

Key Companies & Market Share Insights

Most manufacturers adopt strategies such as joint ventures, mergers & acquisitions, product launches, and geographical expansions to enhance market penetration and cater to the changing technological requirements. For instance, Gema Switzerland GmbH introduced OptiFlex Pro manual units with power boost technology on January 27, 2022, to improve manual powder coating performance. At the stroke of a button, this power boost feature provides 110 kV and 110A of high-voltage power. Due to this substantial boost in force, even tricky-to-apply powders may be used swiftly and safely. The OptiFlex Pro units are created for ergonomic operation and optimal industrial adaptability. Some prominent players in the global powder coating equipment market include:

-

Nordson Corporation

-

Gema Switzerland GmbH

-

WAGNER

-

ANEST IWATA Corporation

-

Carlisle

-

Hangzhou Color Powder Coating Equipment Co., Ltd.

-

Mitsuba Systems Pvt. Ltd.

-

Statfield Equipment Pvt. Ltd.

-

SAMES KREMLIN

-

Eastwood Company

-

Parker Ionics

-

Red Line Industries Ltd

-

Reliant Finishing Systems

-

Pittsburgh Spray Equipment Co.

-

Oven Empire Manufacturing

Powder Coating Equipment Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3,053.7 million

Revenue forecast in 2030

USD 4,329.0 million

Growth Rate

CAGR of 5.0% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country Scope

U.S.; Canada; Mexico; France; Germany; Italy; U.K.; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia

Key companies profiled

Nordson Corporation; Gema Switzerland GmbH; WAGNER; ANEST IWATA Corporation; Carlisle; Hangzhou Color Powder Coating Equipment Co., Ltd.; Mitsuba Systems Pvt. Ltd.; Statfield Equipment Pvt. Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Powder Coating Equipment Market Segmentation

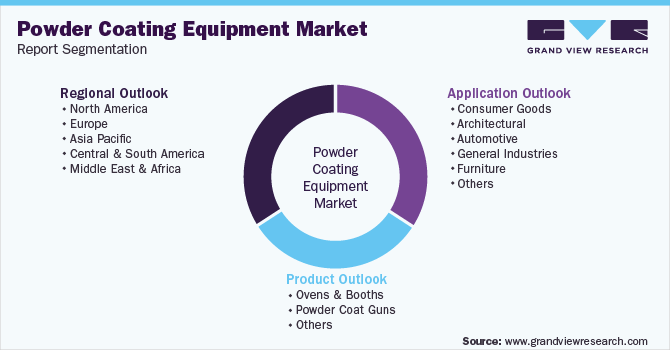

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global powder coating equipment market on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million; 2018 - 2030)

-

Ovens & Booths

-

Powder coat guns

-

Others l

-

-

Application Outlook (Revenue, USD Million; 2018 - 2030)

-

Consumer Goods

-

Architectural

-

Automotive

-

General Industries

-

Furniture

-

Others

-

-

Regional Outlook (Revenue, USD Million; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. Asia Pacific dominated the powder coating equipment market with a revenue share of 36.1% in 2022. Asia Pacific powder coating equipment market is expected to exhibit the highest growth rate on account of the robust automotive industry in addition increasing demand for electric and hybrid cars is expected to further benefit the demand for powder coating equipment.

b. Some of the key players operating in the powder coating equipment market include Nordson Corporation, Gema Switzerland GmbH, WAGNER, ANEST IWATA Corporation, Carlisle, Hangzhou Color Powder Coating Equipment Co., Ltd., among others

b. The key factors that are driving the powder coating equipment market include the growing demand for powder coating equipment across applications such as consumer goods, architectural, automotive, general industries, furniture, and others.

b. The global powder coating equipment market size was estimated at USD 2,929.9 million in 2022 and is expected to reach USD 3,053.7 million in 2023

b. The powder coating equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.0% from 2023 to 2030 to reach USD 4,329.0 million by 2030

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."