- Home

- »

- Power Generation & Storage

- »

-

Power Plant Boiler Market Size, Share, Industry Report, 2030GVR Report cover

![Power Plant Boiler Market Size, Share & Trends Report]()

Power Plant Boiler Market (2024 - 2030) Size, Share & Trends Analysis Report By Process (Pulverized Fuel Combustion, Fluidized Bed Combustion), By Technology, By Fuel Type, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-852-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Plant Boiler Market Size & Trends

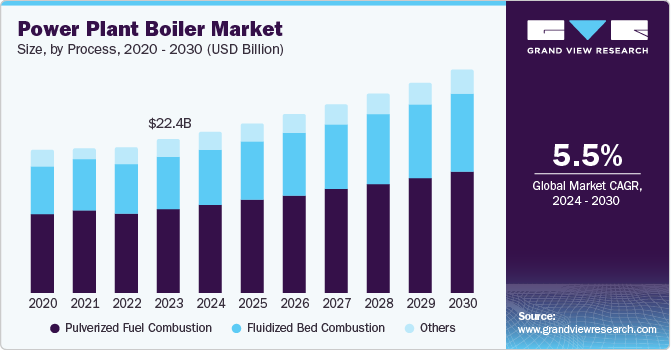

The global power plant boiler market size was valued at USD 22.38 billion in 2023 and is projected to grow at a CAGR of 5.5% from 2024 to 2030. Market growth is driven by technological advancements in efficiency and adaptability, regulatory demands for reduced emissions, increasing energy demand, and the development of sustainable infrastructure to address environmental concerns and promote carbon-reducing measures.

The growing need for electricity globally, driven by urbanization, industrialization, and population growth, is creating a surge in demand for power generation technologies. In particular, the Asia-Pacific region is experiencing rapid growth, driven by industrial development and urbanization in countries such as China and India. Accordingly, industry growth worldwide is driven by several key factors, including increasing energy demand, technological advancements, and regulatory and environmental pressures.

Technological innovations are also playing a crucial role in driving the market. Advances in boiler design and materials are enabling more efficient and environmentally friendly operations, making them more attractive to power producers. The adoption of digital technologies and automation systems is also improving operational efficiency and reducing maintenance costs. Moreover, the shift towards cleaner energy sources, such as biomass and natural gas, is supported by government policies aimed at reducing greenhouse gas emissions.

Regulatory pressures are also driving the market, with governments implementing stricter environmental laws and emission standards, such as the Clean Air Act in the U.S. The need to replace aging infrastructure is another critical driver, with many existing power plants equipped with outdated boiler systems that require upgrades or replacements to meet current efficiency and environmental standards. The market is expected to see significant growth in the coming years as power plant operators invest in modern boiler systems that comply with these standards.

Process Insights

Pulverized fuel combustion process led the market with a revenue share of 54.8% in 2023. The pulverized fuel combustion technology enables higher heat rates, increasing the surface area burned and reducing unburned carbon emissions. This versatile technology accommodates various solid fuels, including coal, biomass, and waste-derived fuels, offering a sustainable and efficient power generation solution for the industry.

The fluidized bed combustion (FBC) process is expected to register the fastest CAGR of 6.1% in the forecast period. FBC systems operate at lower temperatures, minimizing thermal NOx emissions and enhancing combustion efficiency. FBC’s flexibility in fuel types, including low-grade coal, biomass, and waste, allows power plants to adapt fuel consumption to availability and price, making it an attractive option for energy producers seeking cost-effective and sustainable solutions.

Technology Insights

Subcritical technology segment dominated the market with 73.9% of the total revenue in 2023. Subcritical boilers operate at pressures below 22.1 MPa (3200 psi), yielding thermal efficiencies of 30%-40%. With lower capital costs compared to supercritical and ultra-supercritical boilers, subcritical boilers are a cost-effective option for utilities seeking to replace existing facilities or build new ones, offering a reliable and efficient solution for energy generation.

The ultra-critical technology segment is expected to register the fastest CAGR of 13.3% in the forecast period. Ultra-critical boilers operate at pressures above 27.2 MPa, offering enhanced thermodynamic efficiency and thermal efficiencies exceeding 45%. In contrast, subcritical boilers achieve 33%-38% efficiency. Ultra-critical boilers’ improved efficiency translates to reduced fuel consumption and operational costs, making them a compelling choice for utilities seeking to optimize energy production and minimize expenses.

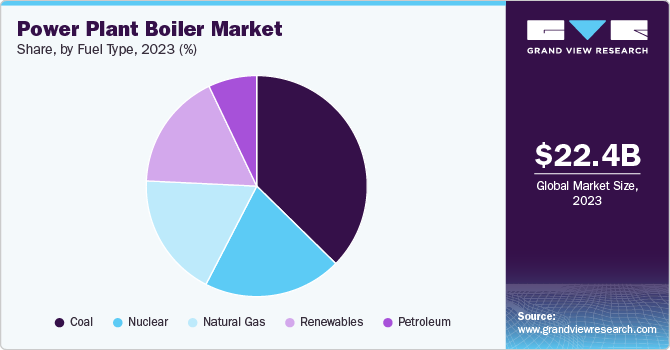

Fuel Insights

Coal held the largest market share of 37.2% in 2023, as it remains a dominant global fossil fuel resource, with significant reserves in countries such as China, India, the US, and Australia. Coal’s accessibility makes it an attractive option for countries with limited alternative energy sources, particularly due to low extraction and transportation costs. This factors into its widespread use for power generation.

The renewables segment is expected to register the fastest CAGR of 7.1% over the forecast period. The global push for reduced carbon emissions has significantly impacted the energy sector. Renewable sources such as biomass, solar, thermal, and geothermal energy are gaining prominence. Advances in boiler technology have streamlined the integration of renewables, enabling efficient and low-emission combustion. Examples include improved biomass combustion technologies, enhancing sustainability and reducing environmental impact.

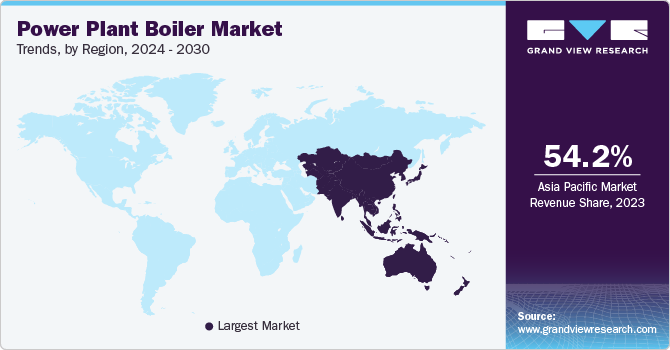

Regional Insights

Asia Pacific power plant boiler market dominated the global power plant boiler market with a revenue share of 54.2% in 2023. The Asia-Pacific region, comprising countries such as China and India, is characterized by rapid economic growth and industrialization, driving high energy demand. In response, countries have implemented large-scale infrastructure development programs to ensure energy security and reliability. These initiatives aim to enhance the region’s energy landscape, supporting sustained economic growth.

China Power Plant Boiler Market Trends

The power plant boiler market in China dominated the Asia Pacific power plant boiler market with a revenue share of 66.8% in 2023. The country’s adoption of supercritical boiler technology is driving power generation capacity, fostering growth opportunities. Urbanization, industrialization, and a growing transportation sector are contributing to market growth. The government’s promotion of electric vehicles is expected to increase demand for power, further propelling the need for efficient and reliable energy solutions.

Latin America Power Plant Boiler Market Trends

Latin America power plant boiler market is expected to register the fastest CAGR of 5.0% during the forecast period. Latin America boasts significant natural resources, including fossil fuels such as natural gas and coal, which are used to meet domestic demand and export requirements. In addition, the region has made notable strides in renewable energy investments, including hydropower, wind, and solar energy, demonstrating a commitment to diversifying its energy mix.

The power plant boiler market in Brazil is expected to grow significantly over /the forecast period. Brazil has abundant energy sources with biomass and hydropower being dominant forms of energy. It has vast tracts of forests that supply biomass fuel which is gradually being demanded in the production of energy. In addition, Brazil has some of the biggest hydroelectric power stations of the world such as the Itaipú Dam.

North America Power Plant Boiler Market Trends

North America power plant boiler market has a substantial market share in 2023. Market growth in the region has been driven by the introduction of innovative solutions and technologies, fueled by significant investments in R&D to enhance efficiency, reduce emissions, and increase productivity. Regulatory volatility has also played a crucial role.

The power plant boiler market in the U.S. held significant market share in 2023. The U.S. boasts a wealth of natural resources, including coal, natural gas, and biomass, which have been leveraged for steam generation in power plant boilers, driving market growth. Although renewable energy adoption is increasing, the existing infrastructure for fossil fuel-based energy generation remains substantial, maintaining a significant market presence.

Europe Power Plant Boiler Market Trends

Europe power plant boiler market is expected to grow in the forecast period. European manufacturers have invested heavily in research and development, driving advancements in material science, combustion technology, and exhaust emission technology. As a result, they have developed efficient boilers that meet stringent EU environmental standards, solidifying their position in the market.

The power plant boiler market in UK held substantial market share in 2023. Rising population and increased electrification of transportation in the UK are likely to drive demand for electricity, necessitating investment in new boiler capacity to ensure energy security and grid stability. This will support the reliable supply of power to meet growing demand.

Key Power Plant Boiler Company Insights

Some key companies in the power plant boiler market include General Electric Company; Babcock & Wilcox Enterprises, Inc.; and MITSUBISHI HEAVY INDUSTRIES, LTD.; among others. Owing to increasing competition, market participants have been implementing tactics and strategies such as new product launches, enhanced distribution, new product launches, geographical expansion and more.

-

General Electric Company is a provider of advanced boiler technologies and services, with its boilers comprising 30% of global installations. GE’s comprehensive portfolio includes pulverized coal, circulating fluidized bed, and ultra-supercritical boilers, renowned for their efficiency, flexibility, and ability to handle challenging fuels. The company offers extensive services, including optimization, maintenance, and upgrades for both utility and industrial boilers.

-

Babcock &Wilcox Enterprises, Inc. is a provider of power generation and environmental equipment, with a significant presence in the boiler market. The company offers a broad range of boiler technologies, leveraging its 150-year history in design and manufacturing. It also owns a 100% stake in TBWES, a joint venture a joint venture between Babcock & Wilcox India Holdings Inc., and Thermax.

Key Power Plant Boiler Companies:

The following are the leading companies in the power plant boiler market. These companies collectively hold the largest market share and dictate industry trends.

- General Electric Company

- Babcock & Wilcox Enterprises, Inc.

- MITSUBISHI HEAVY INDUSTRIES, LTD.

- Siemens

- Doosan Corporation.

- Dongfang Electric Corporation

- IHI Corporation

- John Wood Group PLC

- Bharat Heavy Electricals Limited

- Thermax Limited.

- ANDRITZ

- Sumitomo Heavy Industries, Ltd.

Recent Developments

-

In August 2024, Bharat Heavy Electricals Limited secured a prestigious order, which included establishing a 2x800 MW supercritical thermal power project for Damodar Valley Corporation (DVC) on an EPC basis.

-

In August 2024, Babcock & Wilcox Enterprises, Inc. had awarded a USD 25 million contract to upgrade boilers, replace pressure parts, and provide outage and maintenance services at a US thermal power plant.

-

In July 2024, Thermax Group secured an order of approximately USD 67 million from a leading conglomerate to establish a 600 MW Botswana energy project.

-

In May 2024, MITSUBISHI HEAVY INDUSTRIES, LTD. and CONSAG Engenharia signed an agreement with Portocem and New Fortress Energy in May 2024 for the EPC of Portocem Thermoelectric Power Plant in Brazil.

-

In April 2024, DEC appointed Zhang Yanjun as President in April 2024, following board approval. Zhang, a seasoned executive, brought expertise in power engineering and thermophysics.

Power Plant Boiler Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.54 billion

Revenue forecast in 2030

USD 32.48 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Process, technology, fuel type, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, China, India, Japan, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

General Electric Company; Babcock & Wilcox Enterprises, Inc.; MITSUBISHI HEAVY INDUSTRIES, LTD.; Siemens AG; Doosan Corporation.; DEC; IHI Corporation; John Wood Group PLC; Bharat Heavy Electricals Limited; Thermax Limited; ANDRITZ; Sumitomo Heavy Industries, Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

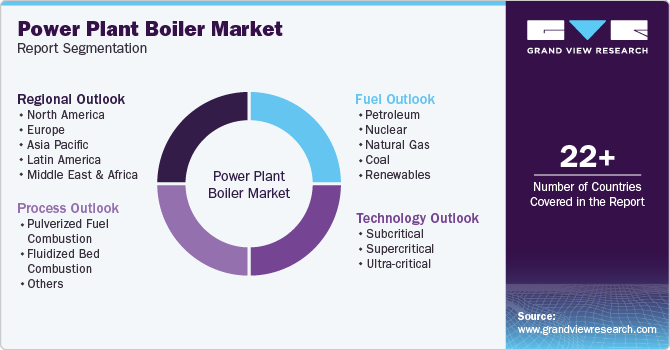

Global Power Plant Boiler Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global power plant boiler market report based on process, technology, fuel type, and region:

-

Process Outlook (Revenue, USD Million, 2018 - 2030)

-

Pulverized fuel combustion

-

Fluidized bed combustion

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Subcritical

-

Supercritical

-

Ultra-critical

-

-

Fuel Outlook (Revenue, USD Million, 2018 - 2030)

-

Petroleum

-

Nuclear

-

Natural gas

-

Coal

-

Renewables

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.