- Home

- »

- Distribution & Utilities

- »

-

Power Rental Market Size & Share, Industry Report, 2033GVR Report cover

![Power Rental Market Size, Share & Trends Report]()

Power Rental Market (2026 - 2033) Size, Share & Trends Analysis Report By Fuel Type (Diesel, Natural Gas), By Equipment (Generators, Transformers, Load Banks), By End User (Mining, Construction), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-465-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Power Rental Market Summary

The global power rental market size was estimated at USD 11.76 billion in 2025 and is projected to reach USD 19.10 billion by 2033, growing at a CAGR of 6.3% from 2026 to 2033. Large construction projects, mining operations, remote industrial sites, and temporary worksites require reliable power that is often needed before permanent grid connections are available.

Key Market Trends & Insights

- Asia Pacific power rental market held the largest share of over 35% of the global market in 2025.

- Based on fuel type, diesel segment held the highest market share in 2025.

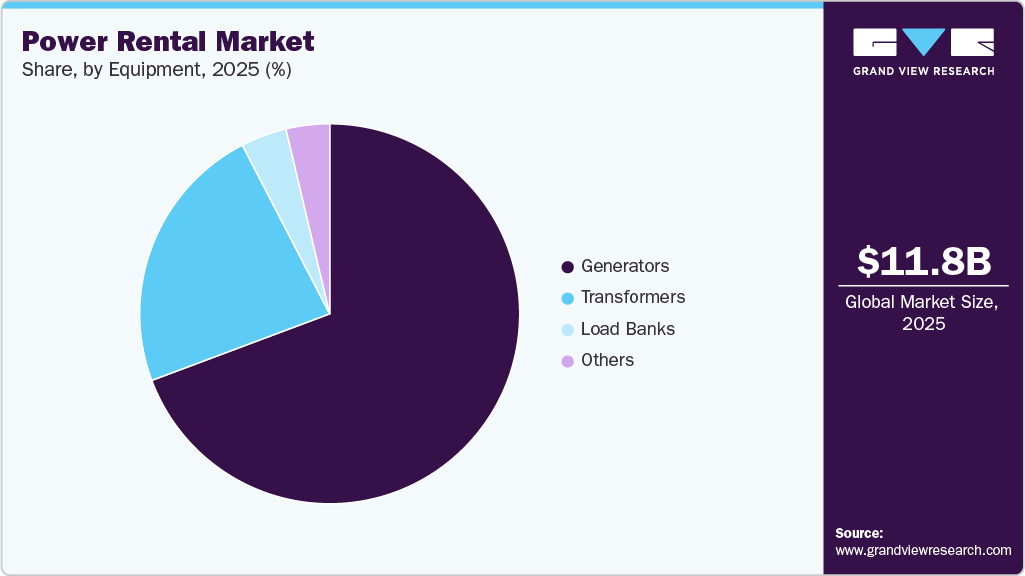

- Based on equipment, generators segment held the highest market share in 2025.

- Based on end user, construction segment held the highest market share of over 23% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 11.76 Billion

- 2033 Projected Market Size: USD 19.10 Billion

- CAGR (2026-2033): 6.3%

- Asia Pacific: Largest market in 2025

- Latin America: Fastest growing market

Power rental provides a fast turnkey solution that matches project timelines, scales with demand, and reduces the risks and delays associated with building new power plants. Increasing penetration of renewable energy creates a parallel demand for flexible backup and balancing capacity. Solar and wind generation are variable, and grids or large consumers frequently rely on rental gensets or hybrid rental systems to smooth intermittency, handle ramp events, and provide black start capability. This trend drives demand for short-term and seasonal rentals as well as for integrated solutions that combine storage, generators, and control systems.Climate-related extreme weather events and growing focus on resilience are pushing public sector agencies and private firms to maintain access to temporary power. Governments, utilities, hospitals, data centers, events, and disaster relief organizations use rental power for emergency restoration, planned maintenance, and surge events. The ability to quickly deploy modular power increases preparedness and reduces downtime costs, which makes rental an attractive risk management tool.

Financial considerations and shifting buyer preferences favor rental over capital purchase. Many end users prefer operating expenditure models to preserve balance sheet flexibility and avoid large upfront investments in equipment that may be needed only intermittently. Rental companies also offer turnkey services, including fuel management, maintenance, and remote monitoring, turning power into a predictable service and lowering the total cost and complexity for customers.

Technology improvements and fleet modernization are strengthening the value proposition of rental providers. Newer gensets are more fuel-efficient and lower in emissions. Telematics and remote controls permit proactive servicing, real-time performance optimization, and remote load management. Integration with battery storage and digital load forecasting allows rental fleets to deliver higher reliability and lower operating cost, which expands the addressable market to more sophisticated commercial and industrial users.

Drivers, Opportunities & Restraints

The power rental market is driven by rising demand for reliable and flexible electricity across construction, industrial, utilities, and events sectors. Rapid urbanization, infrastructure development, and industrial expansion increase the need for temporary power where grid access is limited or timelines are tight. Grid instability, maintenance outages, and climate-related disruptions further push organizations to secure fast-deployable backup power. Preference for operational expenditure models over capital investment strengthens adoption, as customers seek scalable solutions with minimal upfront cost and bundled services such as installation, fuel management, and maintenance.

Growing renewable energy integration opens new opportunities for power rental as grids and large consumers require balancing and backup capacity to manage intermittency. Hybrid rental systems combining generators, battery storage, and digital controls are gaining traction, especially for utilities, data centers, and remote operations. Expansion in emerging economies, disaster preparedness initiatives, and temporary power needs for large-scale events create additional demand. Stricter environmental norms also encourage fleet modernization, creating opportunities for providers offering low-emission, fuel-efficient, and hybrid rental solutions.

High fuel costs and fuel supply volatility can pressure operating margins for rental providers and increase costs for end users. Environmental regulations on emissions and noise may restrict the use of conventional diesel generators in urban or sensitive locations, requiring higher investment in cleaner technologies.

Fuel Type Insights

The diesel segment dominates the fuel type landscape of the power rental market due to its proven reliability, rapid deployment capability, and high power density across a wide range of applications. Diesel powered rental generators are extensively used in construction sites, mining operations, utilities, and industrial facilities where grid access is limited or unreliable. Their ability to deliver consistent output under fluctuating load conditions makes them suitable for both prime and standby power requirements.

The natural gas segment within the fuel type landscape of the power rental market is gaining traction due to its lower emission profile and cost efficiency compared to conventional liquid fuels. Natural gas based rental generators are increasingly adopted in urban construction projects, utilities, and industrial facilities where pipeline connectivity or access to compressed or liquefied natural gas is available. These systems offer stable and continuous power output, making them suitable for longer duration rental requirements such as planned maintenance outages, grid support, and temporary capacity augmentation.

Equipment Insights

The generators segment represents the core of the equipment landscape in the power rental market, driven by its critical role in delivering reliable and scalable temporary power across diverse end use industries. Rental generators are widely deployed across construction, oil and gas, mining, utilities, manufacturing, and events where uninterrupted electricity is essential. Their modular design and broad power rating availability enable users to match capacity precisely with project requirements, supporting applications ranging from small scale backup power to large industrial and grid support operations.

The transformers segment plays a vital supporting role within the equipment landscape of the power rental market by enabling safe voltage conversion and efficient power distribution across temporary installations. Rental transformers are widely used in construction sites, utilities, industrial plants, and large scale events where power needs to be stepped up or stepped down to match equipment and grid requirements. Their deployment is critical in projects involving grid connections, load balancing, and temporary substations, especially during maintenance activities, infrastructure upgrades, or emergency power restoration.

End User Insights

The construction segment represents a major end user of the power rental market, driven by the growing need for reliable temporary power across infrastructure, residential, and commercial building projects. Construction sites often operate in areas with limited or no access to grid electricity, making rental power solutions essential for running heavy machinery, lighting systems, concrete batching plants, and on site offices. Power rental systems support uninterrupted operations across different project phases, from site preparation and structural work to finishing activities, helping contractors maintain productivity and adhere to strict project timelines.

The mining segment is a significant end user within the power rental market, driven by the high dependence of mining operations on reliable and continuous power in remote and off-grid locations. Mining sites require substantial electricity to support drilling, excavation, crushing, material handling, ventilation, and worker accommodation facilities. In many cases, permanent grid infrastructure is either unavailable or economically unviable, making rental power solutions essential for both short-term exploration activities and long-term extraction projects. Power rental systems enable mining operators to maintain operational continuity while minimizing upfront capital investment in permanent power assets.

Regional Insights

Asia Pacific Power Rental Market Trends

The Asia Pacific market is witnessing strong growth due to rapid industrialization, urban expansion, and large scale infrastructure development across emerging economies. Countries such as India, Indonesia, Vietnam, and the Philippines are investing heavily in transportation networks, commercial construction, mining projects, and manufacturing facilities that require immediate and reliable power during project execution. Power rental solutions help bridge the gap where grid connectivity is delayed or insufficient, enabling uninterrupted operations without long term capital investment.

North America Power Rental Market Trends

In the North America market is expanding as businesses and utilities seek flexible and cost effective solutions for temporary and peak power needs while permanent infrastructure is upgraded. Growth is fueled by large scale construction projects, industrial expansions, and major events that require reliable temporary power systems. Developers of data centers, hospitals, and commercial facilities increasingly turn to rental power to maintain operations during grid connection delays and planned outages.

U.S. Power Rental Market Trends

In the U.S. market is growing as businesses, utilities, and event organizers increasingly require flexible solutions to manage temporary and transitional power needs. Large scale construction projects, industrial expansions, and infrastructure upgrades often face delays in permanent grid connection or planned shutdowns, prompting users to rely on rental generators and modular power systems to ensure continuity. Demand is particularly strong in sectors such as data centers, healthcare facilities, and manufacturing plants where power reliability directly affects operations and safety.

Europe Power Rental Market Trends

In Europe, the market is expanding as utilities, industries, and event operators seek flexible solutions to support temporary and transitional power requirements while permanent capacity is installed or refurbished. Growth is being driven by large infrastructure modernization programs, construction of commercial facilities, and industrial projects where grid access can be constrained or phased. Sectors such as data centers, manufacturing sites, ports, and rail networks increasingly use rental power to maintain seamless operations during planned outages, peak demand periods, and connectivity delays.

Middle East & Africa Power Rental Market Trends

In the Middle East & Africa, the market is expanding as governments and private developers accelerate infrastructure development and industrial growth across the region. Major construction projects such as airports, commercial zones, manufacturing facilities and mining operations often require immediate power solutions while permanent grid connections are built or upgraded.

Key Power Rental Company Insights

Some of the key players operating in the global Power rental market include Aggreko, APR Energy, Atlas Copco, Caterpillar Inc., Cummins Inc., FG Wilson, Global Power Supply, among others. These companies are actively engaged in expanding their market footprint through product innovation, strategic acquisitions, and collaborations aimed at enhancing their global distribution networks and technology capabilities.

Key Power Rental Companies:

The following key companies have been profiled for this study on the power rental market.

- Aggreko

- APR Energy

- Atlas Copco

- Caterpillar Inc.

- Cummins Inc.

- FG Wilson

- Global Power Supply

- Jassim Transport & Stevedoring Co. K.S.C.C.

- Kohler-SDMO

- Modern Hiring Service

Recent Developments

-

In August 2025, Caterpillar Inc. launched the new Cat D1500 diesel generator set, delivering 1.5 MW of standby power from a compact 32.1-liter Cat C32B engine, occupying up to 13% less floor space and weighing up to 32% less than its predecessor for space-constrained applications with reduced shipping, installation, and structural costs.

Power Rental Market Report Scope

Report Attribute

Details

Market Definition

The power rental market size represents the global revenue generated from renting temporary power equipment and related services, including generators, load banks, transformers, and fuel/support services for industrial, commercial, utility, and event applications.

Market size value in 2026

USD 12.47 billion

Revenue forecast in 2033

USD 19.10 billion

Growth rate

CAGR of 6.3% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Fuel type, equipment, end user, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

Aggreko; APR Energy; Atlas Copco; Caterpillar Inc.; Cummins Inc.; FG Wilson; Global Power Supply; Jassim Transport & Stevedoring Co. K.S.C.C.; Kohler-SDMO; Modern Hiring Service

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Power Rental Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global power rental market report on the basis of fuel type, equipment, end user and region.

-

Fuel Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Diesel

-

Natural Gas

-

Others

-

-

Equipment Outlook (Revenue, USD Million, 2021 - 2033)

-

Generators

-

Transformers

-

Load Banks

-

Others

-

-

End User Outlook (Revenue, USD Million, 2021 - 2033)

-

Mining

-

Construction

-

Manufacturing

-

Utility

-

Events

-

Oil & Gas

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global power rental market size was estimated at USD 11.76 billion in 2025 and is expected to reach USD 12.47 billion in 2026.

b. The global power rental market is expected to grow at a compound annual growth rate of 6.3% from 2026 to 2033 to reach USD 19.10 billion by 2033.

b. Based on the end user segment, construction held the largest revenue share of over 23.0% in the power rental market in 2025.

b. Some of the prominent players in the market include Aggreko, APR Energy, Atlas Copco, Caterpillar Inc., Cummins Inc., FG Wilson, Global Power Supply, Jassim Transport & Stevedoring Co. K.S.C.C., Kohler-SDMO, Modern Hiring Service, and others.

b. The key factors driving the power rental market due to rising demand for reliable temporary electricity supply across construction sites, oil and gas operations, mining activities, large scale events, and emergency power backup during grid outages and natural disasters.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.