- Home

- »

- Advanced Interior Materials

- »

-

Precious Metal Plating Market Size & Share Report 2028GVR Report cover

![Precious Metal Plating Market Size, Share & Trends Report]()

Precious Metal Plating Market (2021 - 2028) Size, Share & Trends Analysis Report By Product (Gold, PGM), By Application (Jewelry, Fashion Accessories), By Region (APAC, North America), And Segment Forecasts

- Report ID: GVR-4-68039-677-3

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

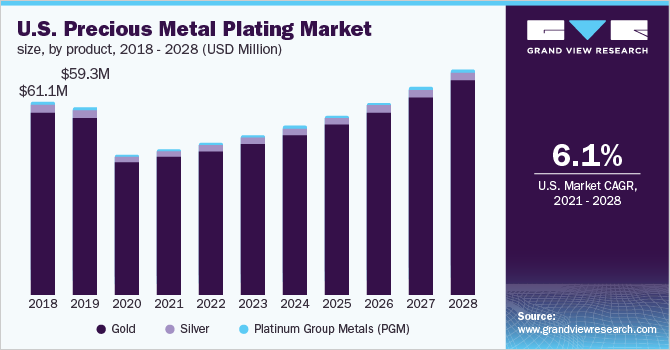

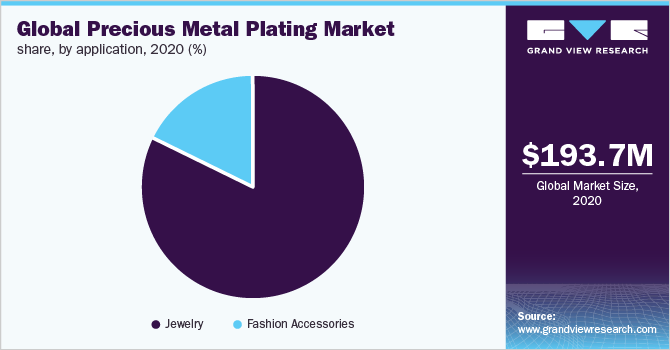

The global precious metal plating market size was valued at USD 193.73 million in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 6.1% from 2021 to 2028. A rise in disposable income levels coupled with the growing popularity of plated jewelry and their growing sale through e-commerce portals make the market lucrative. A rise in disposable income boosts consumers’ buying power, which, in turn, drives the plated jewelry market. In addition, the online platform is one of the most suitable portals for the sales of jewelry and fashion accessories, which has gained importance during the pandemic. Major luxurious brands and even the small ones today have attractive and professional webshops and e-boutiques.

Leading jewelry manufacturers are adopting advanced technology and opting for digital marketing for successful online sales. Thus, significant adoption of the online portal is expected to drive the market during the forecast period. The growing trend of trading of metal & mining products among countries has increased the demand for precious metals. For instance, as per the U.S. Census Bureau, in the mid of 2020, the import of precious metals witnessed an abrupt increase, which holds a strong potential for market growth over the projected period.

The increase in trading activities of precious metals is a positive sign for market growth over the forecast period. An increase in the number of marriages where jewelry is predominantly used coupled with the growing adoption of plated jewelry from the young population drives the market. For instance, as per the data released by Statistics Korea in March 2021, the youth of South Korea had emerged as a leading segment for the sales of luxury goods, which increased by seven times between 2017 and 2019. The COVID-19 has impacted the economic activities as the consumer buying power is shrinking, which compels the buyers to invest money more sensibly on essential items.

Conscious buying pattern among consumers is expected to highly reshape the fashion and luxury market owing to a substantial decline in precious metal prices. For example, in February 2020 the palladium prices were USD 2,610.58 per ounce, which further declined by almost 50% of its prices dipping to USD 1,534.53 per ounce by the mid of March 2020. Thus, declining product prices owing to the pandemic have negatively influenced the market.

Product Insights

Gold was the largest segment in 2020 that accounted for a revenue share of over 90%. Gold plating is done in jewelry applications as the plated surface remains bright and attractive for a long time. Gold is alloyed with various metals to obtain different color shades and improve the aesthetics of products. For instance, gold and silver alloys are widely used in the plated jewelry industry to form intermediate coatings, which provide good corrosion resistance.

The rise in the price of pure gold and other precious metal fluctuates the demand and supply of gold. In addition, plated jewelry and related items are not expensive compared to pure gold jewelry, hence the rise in consumer preference to purchase plated jewelry being a cost-efficient solution is anticipated to drive the market during the projected timeline.

Fashion accessories or jewelry are largely preferred by the young population. These accessories are priced at affordable rates and can also be changed as per the latest trends. The changing outlook of the population toward fashion accessories as a daily wear commodity has boosted the demand for such products. Television shows, movies, fashion bloggers, etc. are influencing the choice of fashion accessories among youth.

Application Insights

The jewelry segment accounted for over 82% of the global revenue in 2020. An increase in disposable income coupled with a growth in the young population in countries, such as India and the U.S., is expected to accelerate the demand for jewelry over the forecast period. For instance, the consumer disposable income in the U.S. increased at a significant rate from USD 16.54 trillion in the last quarter of 2019 to USD 17.26 trillion in the last quarter of 2020.

The rise in virtual meetings owing to the pandemic has given a push to the “above-the-keyboard-dressing” trend among working women along with the growing acceptance of jewelry among men. Such emerging trends are driving the segment, thus benefitting the overall market growth. The skyrocketing prices of traditional jewelry, whether gold, silver, or platinum, are one of the factors driving the demand for plated jewelry. The use of gold chains and necklaces is no longer limited to weddings and functions, as both men and women wear rings, plain gold chains, anklets, etc. as a fashion statement. This trend in consumer behavior is expected to have a positive effect on market growth.

Regional Insights

The demand comes majorly from the North America region, which accounted for the largest revenue share of more than 34% in 2020. Growth in trading activities also influences the market. For instance, in 2019, Italy exported precious metals worth USD 436.5 million to the U.S. and USD 648.8 million in 2020, recording a growth of 48.6% over the previous year. This is expected to favor the growth of the market during the projected period.

The regional landscape of the market is segmented into North America, Europe, Asia Pacific, Central & South America, and Middle East & Africa. Asia Pacific is projected to be the fastest-growing regional market over the forecast period. The demand for luxurious products and fashion accessories among the young population is increasing in the region, owing to the growing adoption of plated jewelry by men, such as signet rings, chunky bands, watches, bracelets, necklace chains, and cufflinks. This is anticipated to benefit the market growth over the forecast period.

The growing sales of jewelry owing to a rise in the number of weddings in the year 2021 followed by the increasing preference of young women for casual daily-wear jewelry supported the market growth. For instance, in April 2020, in a survey conducted by LendingTree in the U.S., 63% of marriages were postponed, whereas research by The Knot Worldwide in India says, in July 2020, 80% of marriages were postponed. Thus, it holds a promising growth opportunity for jewelry makers, which drives the overall market.

Key Companies & Market Share Insights

The prominent companies, such as Umicore, MacDermid, Inc., and DuPont, primarily focus on the development in plating solutions for various applications. For instance, in April 2020, Umicore developed a unique product in its electroplating portfolio, the RHODUNA PT ONE, which is designed for small-scale applications and is cost-efficient than a pure rhodium electrolyte.

Companies are aiming for survivability and resilience to hold financial stability in the post-COVID-19 scenario by focusing on sales from e-commerce platforms. In the wake of the COVID-19 crisis, the demand for gold-plated jewelry and fashion accessories has slumped significantly owing to a decline in the spending capacity of consumers. Moreover, the whole supply chain got disrupted, which has hampered the market dynamics. Hence, in 2021, companies are looking forward to revised business models and strategies to cater to the growing demand. Some of the prominent players in the global precious metal plating market include:

-

Umicore

-

Bluclad S.p.A.

-

Atotech

-

MacDermid, Inc.

-

METALOR Technologies SA

-

Coventya International

-

Italfimet

-

Valmet Plating SRL

-

Krohn Industries, Inc.

-

Gold Plating Services

-

DuPont

Precious Metal Plating Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 201.21 million

Revenue forecast in 2028

USD 312.01 million

Growth rate

CAGR of 6.1% from 2021 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2021 - 2028

Quantitative units

Revenue in USD million, volume in tons, and CAGR from 2021 to 2028

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, and region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; France; U.K.; Italy; Spain; Turkey; Russia; Poland; Austria; Czech Republic; China; India; Japan; South Korea; Indonesia; Vietnam; Thailand; Brazil; Chile; Colombia; Saudi Arabia; UAE; Egypt; Israel; Morocco

Key companies profiled

Umicore; Bluclad S.p.A.; Atotech; MacDermid, Inc.; METALOR Technologies SA; COVENTYA International; Italfimet; Valmet Plating SRL; Krohn Industries, Inc.; Gold Plating Services; DuPont

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global precious metal plating market report on the basis of product, application, and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Gold

-

Silver

-

Platinum Group Metal (PGM)

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Jewelry

-

Fashion Accessories

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Italy

-

Spain

-

Turkey

-

Russia

-

Poland

-

Austria

-

Czech Republic

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Indonesia

-

Vietnam

-

Thailand

-

-

Central & South America

-

Brazil

-

Chile

-

Colombia

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

Egypt

-

Israel

-

Morocco

-

-

Frequently Asked Questions About This Report

b. The precious metal plating market size was estimated at USD 193.73 million in 2020 and USD 201.21 million in 2021.

b. The precious metal plating market is expected to grow at a compound annual growth rate of 6.1% from 2021 to 2028 to reach USD 312.01 million by 2028.

b. Gold segment dominated the precious metal plating market with a volume share of over 67% in 2020, owing to increasing demand for gold-plated jewelry among various groups of population.

b. Some of the key players operating in the precious metal plating market includes Umicore, Bluclad S.p.A., Atotech, MacDermid, Inc., METALOR Technologies SA, COVENTYA International, Italfimet, Valmet Plating srl, Krohn Industries, Inc., Gold Plating Services, and DuPont.

b. The key factors that are driving the precious metal plating market are growing demand for precious metal jewelry through e-commerce platforms and increasing adoption of plated jewelry among youth population.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.