- Home

- »

- Electronic Devices

- »

-

Precision Engineering Machines Market Size Report, 2030GVR Report cover

![Precision Engineering Machines Market Size, Share & Trends Report]()

Precision Engineering Machines Market (2023 - 2030) Size, Share & Trends Analysis Report By End-use (Automotive, Non-Automotive), By Region (North America, Europe, Asia Pacific, Latin America, Middle East and Africa), And Segment Forecasts

- Report ID: GVR-4-68039-810-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Precision Engineering Machines Market Summary

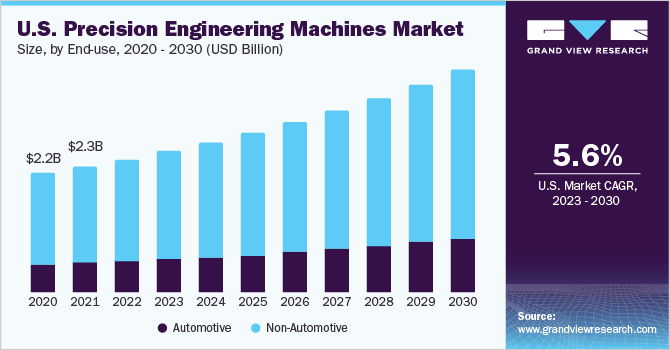

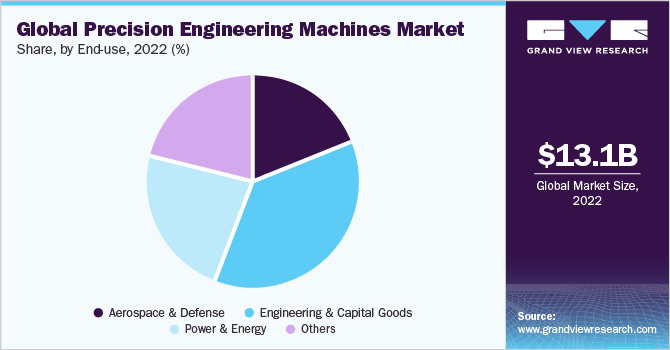

The global precision engineering machines market size was valued at USD 13.07 billion in 2022 and is projected to reach USD 22.05 billion by 2030, growing at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. The rising demand for advanced precision machining solutions and the emphasis on lowering downtime to boost production efficiency, boost accuracy, and optimize machining procedures are the main factors for the expansion of the market.

Key Market Trends & Insights

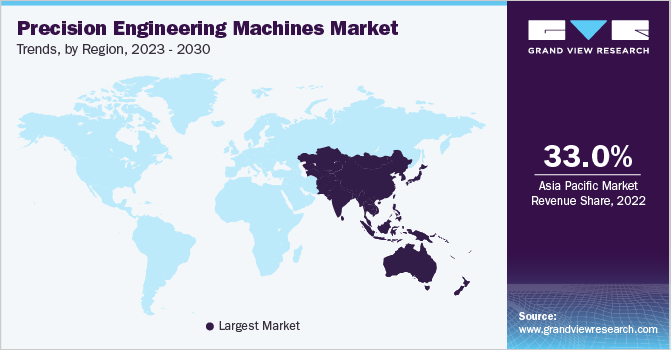

- Asia Pacific dominated the precision engineering machines market in terms of market share in 2022 at over 33.0%.

- In terms of market share, Europe is anticipated to grow at a significant CAGR over the forecast period.

- Based on end-use, the non-automotive segment held the largest market share of nearly 78.0% in 2022.

- Based on end-use, the automotive segment is expected to register the highest CAGR over the forecast period.

Market Size & Forecast

- 2022 Market Size: USD 13.07 Billion

- 2030 Projected Market Size: USD 22.05 Billion

- CAGR (2023-2030): 6.8%

- Asia Pacific: Largest market in 2022

By reducing machining time, advanced machining techniques help to reduce the cost of materials, setup, and custom machining. Because of this, manufacturing companies commonly employ precision engineering machinery in their manufacturing spaces.

The COVID-19 outbreak has had a detrimental effect on the market by stifling innovation, lowering profitability, reducing cash flow, and creating an unbalanced economy. The COVID-19 pandemic also caused the cancellation of several events in 2020, which made it harder for businesses to market new products and technological advancements. Lockdowns all around the world led to the closure of businesses, including offices and retail outlets, as well as limitations on manufacturing, distribution, and travel, all of which influenced the market. The negative effects of supply chain and trade interruptions on overall operations have had a direct impact on revenue streams. Due to efforts undertaken to cut non-critical and CAPEX investments, plans to upgrade technology are likely to be delayed. On the other hand, inexperienced workers may find it difficult to handle precise engineering equipment, which could lead to machine damage and jeopardize the manufacturing unit's investments. As a result, a dearth of seasoned operators is a key obstacle to the precision engineering machine industry progress.

Precision engineering includes the development of precise machine tools and the evaluation of machine design, construction, precision valuation and procedure, research and development, and the manufacturing and very accurate measurement of goods and parts. Precision engineering tools can be used to meet the demands of both mass production and exceedingly fine detail. The most modern and sophisticated precision engineering machines give suppliers greater quality control power with less labor input, allowing them to raise their profit margins. The fact that the most recent precision engineering equipment are modular and smaller in size than previous ones help to explain why their demand is rising.

The accuracy that computerized machining systems provide greatly reduces repeated work and machining time, increasing the effectiveness of industrial operations. Additionally, technological developments have led to the creation of software and end-uses that enable managers to follow machine activities on the shop floor in real time and make wise judgments. As manufacturers work to meet the needs of the expanding urban population, the demand quickly and efficiently for precision, engineering machines is rising along with the urban population increase and the expansion of the commercial and residential sectors.

Sales are growing due to the rising demand for sophisticated machining solutions and the emphasis on decreasing downtime to enhance production efficiency, boost precision, and optimize machining processes. In addition, industry 4.0 encourages the integration of manufacturing facilities with other processes to construct holistic and adaptable automation system designs utilizing precision engineering machinery for production and manufacture. Therefore, the market has several potentials with the arrival of Industry 4.0 in the upcoming years.

Several prominent market participants are introducing technologically improved precision engineering machines. However, the inadequate number of experienced operators is emerging as a major hindrance to market expansion. Untrained operators may find it challenging to control precision engineering machines and may cause damage to the machinery, subjecting the production unit's investments to risk. Another market barrier is the considerable costs involved in training existing operators in smoothly running modern precision machinery.

End-use Insights

The non-automotive segment held the largest market share of nearly 78.0%in 2022. This segment includes aerospace and defense, engineering and capital goods, power and energy, and others. The aerospace industry has observed increased demand for advanced materials such as nickel alloys and titanium alloys in recent years, leading to the increased use of machine tools and cutting tools. In Germany, the demand can be attributed to the fact that precision engineering machines produce components with higher accuracy and better finish in non-automotive industries. In the capital goods industry, heavy equipment and shipbuilding are expected to experience high demand for precision engineering machinery due to the growing production of heavy equipment in APAC countries such as Japan and China.

However, the automotive sector is expected to register the highest CAGR over the forecast period. Investment in industrial and heavy machinery is expected to grow over the forecast period, thereby accelerating the demand for precision engineering machines in Israel, Saudi Arabia, and other Middle Eastern countries. Furthermore, the rising trend of integrating advanced technologies in products to increase the productivity of machinery at drilling locations with newer depths and pressure requirements is expected to have a positive impact on the European and MEA markets.

Regional Insights

Asia Pacific dominated the precision engineering machines market in terms of market share in 2022 at over 33.0%. Precision engineering equipment is rapidly gaining importance in China's manufacturing sector. China is seeing profitable growth prospects in products and services, including CNC manufacturing systems and optimized manufacturing service centers in order to meet the growing demand for advanced manufacturing and CNC machining services. Japan is also home to almost 200 machine tool makers, making it one of the leading nations for precision engineering tools. Countries like India and South Korea are also experiencing a growth in demand for precision engineering machinery in end-use industries like the automotive and power & energy industries.

In terms of market share, Europe is anticipated to grow at a significant CAGR over the forecast period. The region's manufacturers are utilizing technological developments and incorporating the most advanced automation technologies into their machinery. Europe is followed by North America, where advances in robotics, design, and manufacturing processes have led to a significant rise in automation for overall vehicle design and performance enhancement. The importance of CNC machining in the modernization of numerous sectors is growing.

Key Companies & Market Share Insights

Strategic mergers and acquisitions and partnerships are estimated to be the most effective ways for market players to gain quick access to emerging markets. In February 2021, DMG Mori Co., Ltd. acquired GLOphotonics SAS, a manufacturer of femtosecond laser delivery technology. This acquisition is expected to expand the end-use of femtosecond to create additional surface quality and process large components. Similarly, in October 2021, for its mid-range lineup, Amada introduced the Amada HRB-ATC, an avant-garde ATC technology. The company wanted to meet the demand for a product of this nature through this launch by using unique Amada tools. Additionally, product improvements and distinctiveness are predicted to open up opportunities for market expansion for businesses. In June 2021, a compact, high-speed machining center with five-axis options and mild automation was introduced by DMG MORI as the DMP 35. The company wanted to provide a product through this introduction that includes a tool magazine with 15 slots for tools up to 150 mm long, direct absolute path measuring devices in all axes, and an inline spindle with 15,000 rpm.Some prominent players in the global precision engineering machines market include:

-

Amada Machine Tools Co., Ltd.

-

Amera-Seiki

-

DATRON AG

-

Dalian Machine Tool Group (DMTG) Corporation

-

DMG Mori Co., Ltd.

-

FANUC Corporation

-

Haas Automation, Inc.

-

Hurco Companies, Inc.

-

Okuma Corporation

-

Shenyang Machine Tool Co., Ltd.

-

Yamazaki Mazak Corporation

Precision Engineering Machines Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 13.90 billion

Revenue forecast in 2030

USD 22.05 billion

Growth rate

CAGR of 6.8% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

June 2023

Quantitative units

Revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; China; India; Japan; Australia; South Korea; Brazil; Mexico; Argentina; U.A.E.; Saudi Arabia; South Africa

Key companies profiled

Amada Machine Tools Co., Ltd.; Amera-Seiki; DATRON AG; Dalian Machine Tool Group (DMTG) Corporation; DMG Mori Co., Ltd.; FANUC Corporation; Haas Automation, Inc.; Hurco Companies, Inc.; Okuma Corporation; Shenyang Machine Tool Co., Ltd.; Yamazaki Mazak Corporation.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precision Engineering Machines Market Report Segmentation

The report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global precision engineering machines market report based on end-use and region.

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Non-Automotive

-

Aerospace & Defense

-

Engineering & Capital Goods

-

Power & Energy

-

Others

-

-

-

Region Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa (MEA)

-

U.A.E.

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global precision engineering machines market size was estimated at USD 13.07 billion in 2022 and is expected to reach USD 13.90 billion in 2023.

b. The global precision engineering machines market is expected to grow at a compound annual growth rate of 6.8% from 2023 to 2030 to reach USD 22.05 billion by 2030.

b. The Asia Pacific dominated the precision engineering machines market with a share of nearly 33.0% in 2022. CNC machining is quickly becoming a key production process for many industries in China. To fulfill the increased demand for sophisticated manufacturing and CNC machining services, China is witnessing lucrative growth opportunities in products and services such as CNC manufacturing systems and optimized manufacturing service centers.

b. Some key players operating in the precision engineering machines market include Amada Machine Tools Co., Ltd.; Amera-Seiki; DATRON AG; Dalian Machine Tool Group (DMTG) Corporation; DMG Mori Co., Ltd.; FANUC Corporation; Haas Automation, Inc.; Hurco Companies, Inc.; Okuma Corporation; Shenyang Machine Tool Co., Ltd.; Yamazaki Mazak Corporation.

b. The growth of the precision engineering machines market can be attributed to the rising demand for advanced machining solutions and emphasis on reducing downtime to increase production efficiency, boost accuracy, and optimize machining processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.