- Home

- »

- Advanced Interior Materials

- »

-

Aerospace And Defense Materials Market Size Report, 2030GVR Report cover

![Aerospace And Defense Materials Market Size, Share & Trends Report]()

Aerospace And Defense Materials Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Aluminum, Titanium), By Aircraft Parts (Aerostructure, Components), By Application, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-387-4

- Number of Report Pages: 106

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Aerospace And Defense Materials Market Summary

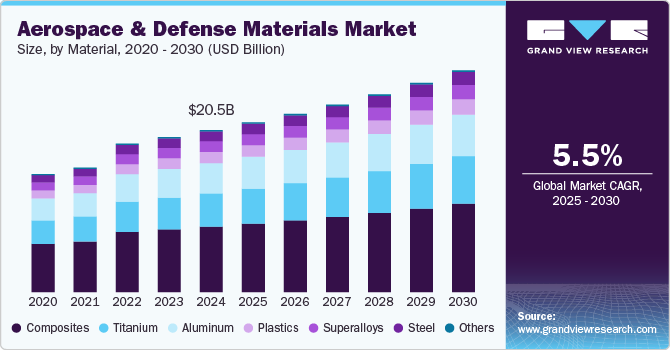

The global aerospace and defense materials market size was estimated at USD 20.45 billion in 2024 and is projected to reach USD 27.99 billion by 2030, growing at a CAGR of 5.5% from 2025 to 2030. As aircraft manufacturers strive to enhance fuel efficiency and reduce emissions, there is a significant shift towards materials that offer high strength-to-weight ratios.

Key Market Trends & Insights

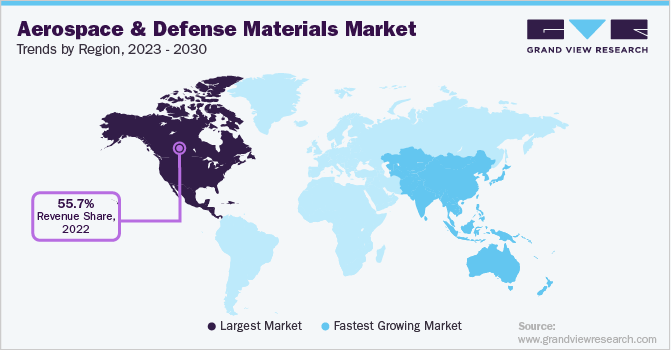

- The North America's aerospace and defense materials market is dominated, accounting for 55.3% of global revenue in 2024.

- The aerospace & defense materials market in the U.S. is experiencing significant growth.

- By material, the composites segment accounted for the largest market revenue share of 40.4% in 2024.

- By aircraft parts, the aerostructure segment accounted for the largest market revenue share of 51.5% in 2024.

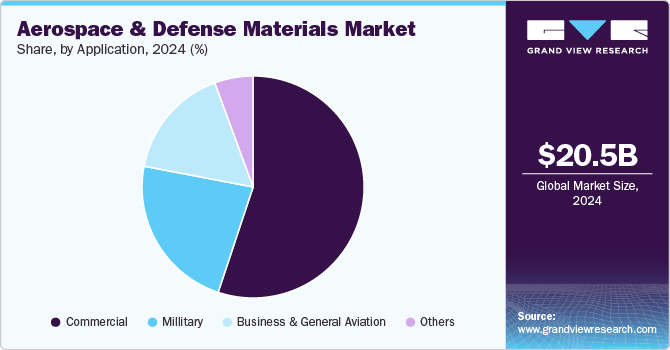

- By application, the commercial segment accounted for the largest market revenue share of 55.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 20.45 Billion

- 2030 Projected Market Size: USD 27.99 Billion

- CAGR (2025-2030): 5.5%

- North America: Largest market in 2024

Advanced composites, such as carbon fiber reinforced polymers (CFRP) and aluminum-lithium alloys, are increasingly utilized in commercial and military aircraft designs. These materials contribute to weight reduction and improve overall performance and durability, making them essential in meeting regulatory standards for environmental sustainability.Innovations such as additive manufacturing (3D printing) have revolutionized how aerospace components are designed and produced. This technology allows for complex geometries that were previously impossible with traditional manufacturing methods, leading to reduced waste and shorter production times. Furthermore, ongoing research into new alloys and composite materials continues to yield products that can withstand extreme conditions while maintaining structural integrity, enhancing aerospace systems' capabilities.

Countries increasingly invest in modernizing their defense systems to address emerging threats and geopolitical tensions. This has led to an uptick in demand for advanced materials used in military aircraft, naval vessels, and ground vehicles. The need for enhanced survivability, stealth features, and operational effectiveness has prompted defense contractors to seek innovative materials to meet these stringent requirements.

The expansion of the commercial aviation sector is also a vital factor contributing to the growth of aerospace materials. With increased air travel demand post-pandemic, airlines are looking to expand their fleets with more efficient aircraft that utilize advanced materials for better performance and lower operating costs. Additionally, new entrants into the aviation market are emerging, further driving competition among manufacturers to develop cutting-edge technologies that incorporate lightweight and durable materials.

Material Insights

The composites segment accounted for the largest market revenue share of 40.4% in 2024. Composites, renowned for their exceptional strength-to-weight ratio, empower manufacturers to fabricate lighter structures while upholding structural integrity. This weight reduction facilitates heightened fuel efficiency, reduced operational expenses, and augmented payload capacity, rendering composites an appealing option for commercial and military applications.

Titanium is anticipated to register the fastest growth with a CAGR of 6.2% worldwide during the forecast period. Titanium offers an exceptional strength-to-weight ratio, making it ideal for applications where reducing weight is crucial for performance and efficiency. This characteristic allows aerospace manufacturers to enhance fuel efficiency and payload capacity, which is particularly important in commercial aviation and military applications.

In variable grades, steel is combined with several other metals, including carbon, chromium, and nickel, offering enhanced hardness, yield strength, and corrosion resistance. Stainless steel provides ease of welding; aircraft manufacturers prefer it to produce fasteners and rivets, which aid in elevating air speed and reduce the chances of damage or accidents.

Aircraft Parts Insights

The aerostructure segment accounted for the largest market revenue share of 51.5% in 2024. According to the International Air Transport Association (IATA), passenger numbers are expected to double over the next two decades. This surge necessitates increased aircraft production rates, leading manufacturers to invest heavily in aerostructures. As airlines expand their fleets to accommodate growing passenger volumes, there is a corresponding need for new aircraft models incorporating advanced aerostructures designed for improved performance and fuel efficiency.

The components segment is anticipated to grow significantly with a CAGR of 5.4% over the forecast period. Airlines actively seek to reduce operational costs, and lightweight materials are critical in enhancing fuel efficiency. Advanced composites, aluminum alloys, and titanium are being increasingly adopted in manufacturing aircraft components, leading to improved performance and lower fuel consumption. This shift benefits the airlines economically and aligns global sustainability goals, propelling the growth of this segment.

Application Insights

The commercial segment accounted for the largest market revenue share of 55.1% in 2024. As global air travel expands, airlines increasingly focus on enhancing operational efficiency, reducing costs, and improving passenger experience. Rising disposable incomes, urbanization, and an increasing middle-class population in emerging economies influence this growth. Regulatory requirements for fuel efficiency and emissions reductions also spur the demand for new aircraft and upgrades to existing fleets.

The business & general aviation segment is anticipated to register the fastest CAGR of 6.4% over the forecast period. The business and general aviation segment represents a vital part of the aerospace and defense materials market, characterized by its focus on non-commercial aircraft operations. This segment includes private jets, helicopters, and other aircraft for personal or corporate purposes. Various factors, including increasing disposable incomes, globalization of businesses, and technological advancements, drive this sector's growth. As more individuals and corporations seek efficient travel solutions, the demand for business and general aviation continues to rise.

Regional Insights

The North America's aerospace and defense materials market is dominated, accounting for 55.3% of global revenue in 2024. The aerospace industry has progressively shifted towards advanced composites, aluminum alloys, and titanium materials to enhance fuel efficiency and overall performance. As airlines seek to reduce operating costs and improve sustainability, the drive for more efficient and durable materials is paramount, propelling investments in R&D for innovative material solutions in the region.

U.S. Aerospace & Defense Materials Market Trends

The aerospace & defense materials market in the U.S. is experiencing significant growth. In response to evolving geopolitical challenges and the need for advanced military capabilities, federal spending on defense has seen a marked increase. This growth translates to heightened procurement of cutting-edge aerospace and defense materials for new aircraft, drones, and military systems. The commitment to maintaining a technological edge in defense capabilities creates a steady demand for materials that offer superior performance under extreme conditions.

Asia Pacific Aerospace & Defense Materials Market Trends

The Asia Pacific aerospace & defense materials market is anticipated to register the fastest CAGR of 7.3% over the forecast period. As rising disposable incomes and a growing middle class in countries such as China and India fuel demand for air travel, airlines are investing heavily in fleet expansion and modernization. This surge in demand for new aircraft necessitates using advanced materials that enhance fuel efficiency, reduce weight, and improve overall performance, propelling the aerospace materials market forward.

The China aerospace & defense materials market is experiencing substantial growth. The country has made substantial investments in research and development, fostering innovation in additive manufacturing and advanced composite materials. These technologies enable the production of lighter, stronger components that can withstand the rigorous demands of aerospace applications. As Chinese manufacturers adopt these cutting-edge techniques, they improve their competitiveness and efficiency, vital in meeting the increasing demands of both the commercial and defense sectors.

Europe Aerospace & Defense Materials Market Trends

The aerospace & defense materials market in Europe is experiencing notable growth. European manufacturers, known for their engineering excellence, increasingly focus on developing lightweight, high-strength materials such as carbon fiber composites and titanium alloys. These materials are essential for enhancing fuel efficiency, reducing emissions, and improving the aircraft's overall performance. As airlines and aerospace companies strive for sustainability and operational cost reductions, the demand for these advanced materials continues to rise.

Key Aerospace & Defense Materials Company Insights

Some of the key players operating in the market include Huntsman International LLC, Toray Composites America, Inc., and thyssenkrupp Aerospace:

-

Huntsman International LLC is a global manufacturer and provider of a diverse range of advanced materials with a strong focus on innovation and sustainability. The company operates in various sectors, including aerospace and defense. The company offers a comprehensive portfolio of high-performance materials, such as epoxy resins, polyurethanes, and advanced composite systems in these fields. These products enhance aerospace components' durability, strength, and performance, providing solutions for aircraft structures, interior parts, and protective coatings while ensuring compliance with stringent industry standards and regulations.

-

Toray Composites America, Inc. is a manufacturer of advanced composite materials, specializing in high-performance solutions for various industries, including aerospace and defense. The company focuses on producing carbon fiber, prepregs, and other composite materials known for their exceptional strength-to-weight ratio and resistance to environmental degradation. These materials are integral to manufacturing lightweight and durable components used in aircraft structures, missile systems, and other defense applications.

Key Aerospace & Defense Materials Companies:

The following are the leading companies in the aerospace & defense Materials market. These companies collectively hold the largest market share and dictate industry trends.

- Huntsman International LLC

- Toray Composites America, Inc.

- VSMPO-AVISMA

- Arconic Inc.

- Kobe Steel, Ltd

- Allegheny Technologies

- Cytec Solvay Group

- Hexcel Corporation

- Novelis

- Constellium N.V

- SGL Carbon

- thyssenkrupp Aerospace

- Formosa Plastics Corporation, U.S.A

- Strata Manufacturing PJSC

- Teijin Limited

Aerospace & Defense Materials Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 21.42 billion

Revenue forecast in 2030

USD 27.99 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Base year for estimation

2024

Actual estimates/Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Regional Scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Czech Republic; China; India; Japan; Australia; South Korea; Brazil; South Africa

Segments covered

Material, aircraft parts, application, region

Key companies profiled

Huntsman International LLC; Toray Composites America, Inc.; VSMPO-AVISMA; Arconic Inc.; Kobe Steel, Ltd.; Allegheny Technologies; Cytec Solvay Group; Hexcel Corporation; Novelis; Constellium N.V.; SGL Carbon; thyssenkrupp Aerospace; Formosa Plastics Corporation, U.S.A.; Strata Manufacturing PJSC; Teijin Limited

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Aerospace & Defense Materials Market Report Segmentation

This report forecasts volume & revenue growth at country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global aerospace & defense materials market report based on material, aircraft parts, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aluminum

-

Titanium

-

Composites

-

Superalloys

-

Steel

-

Plastic

-

Others

-

-

Aircraft Parts Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Aerostructure

-

Components

-

Cabin Interiors

-

Propulsion System

-

Equipment, System, & Support

-

Satellites

-

Construction & Insulation Components

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Business & General Aviation

-

Military

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Czech Republic

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global aerospace & defense materials market size was estimated at USD 20.45 billion in 2024 and is expected to reach USD 21.42 billion in 2025.

b. The aerospace & defense materials market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 27.99 billion by 2030.

b. The aluminum product segment dominated the market with a volume of 446.5 kilotons in 2024 and is further expected to grow at a CAGR of 4.8% over the forecast period on account of its superior characteristics such as lightweight, corrosion resistance, and heat resistance.

b. Some of the key players operating in the aerospace & defense materials market include Huntsman International LLC, Toray Composites America, Inc., VSMPO-AVISMA, Arconic Inc., Kobe Steel, Ltd, Allegheny Technologies, Cytec Solvay Group, Hexcel Corporation, Novelis, Constellium N.V, and SGL Carbon.

b. The key factors that are driving the aerospace & defense materials market include growing international passenger and freight traffic, resulting in increased demand for aircraft, which will consequently drive the market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.