- Home

- »

- Advanced Interior Materials

- »

-

Precision Hand Tools Market Size, Industry Report, 2033GVR Report cover

![Precision Hand Tools Market Size, Share & Trends Report]()

Precision Hand Tools Market (2025 - 2033) Size, Share & Trends Analysis Report By End Use (Automotive & Transportation, Aerospace & Defense), By Product, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-790-0

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Precision Hand Tools Market Summary

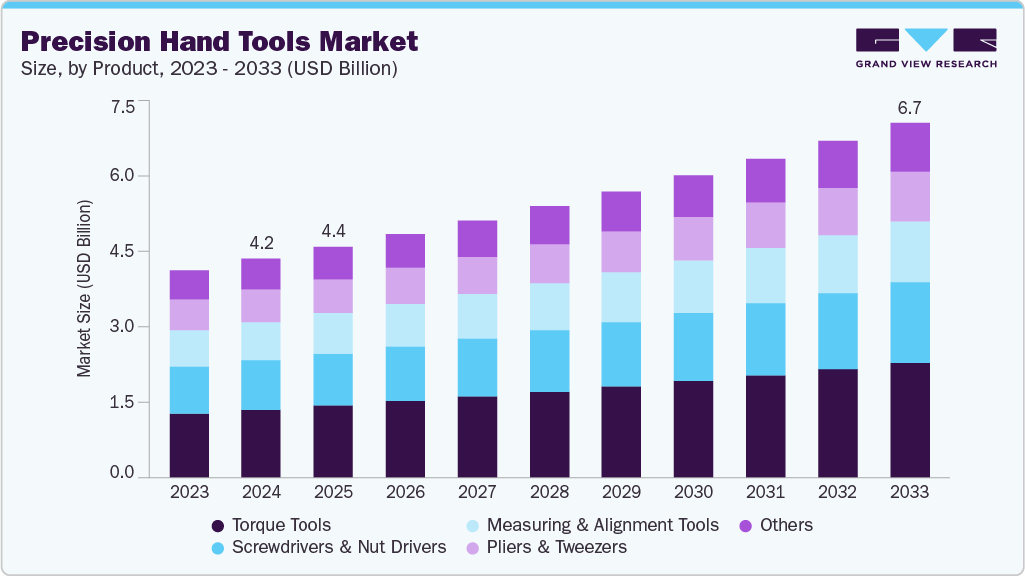

The global precision hand tools market size was estimated at USD 4.16 billion in 2024 and is projected to reach USD 6.74 billion by 2033, growing at a CAGR of 5.5% from 2025 to 2033. The industry outlook is driven by the growing demand from the electronics and electrical sectors, where high accuracy and fine workmanship are essential.

Key Market Trends & Insights

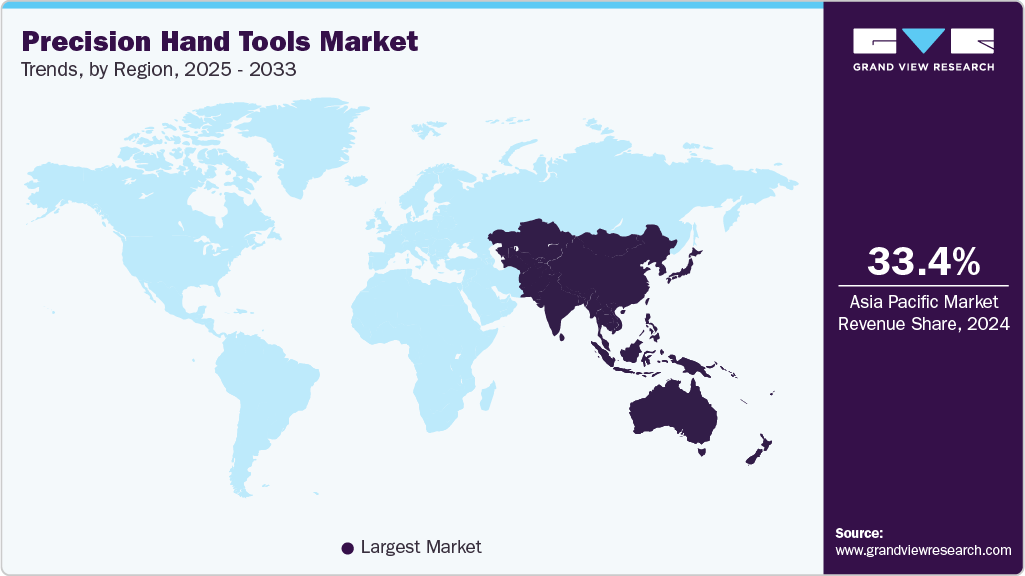

- Asia Pacific dominated the precision hand tools market with the largest revenue share of 33.4% in 2024.

- By product, the torque tools segment is expected to grow at the fastest CAGR of 5.9% over the forecast period.

- By end use, the automotive & transportation segment is expected to grow at fastest CAGR of 5.9% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 4.16 Billion

- 2033 Projected Market Size: USD 6.74 Billion

- CAGR (2025-2033): 5.5%

- Asia Pacific: Largest market in 2024

The increasing miniaturization of electronic components in consumer devices, automotive electronics, and medical instruments requires precise assembly and repair tools. Precision screwdrivers, pliers, and torque wrenches are vital for technicians working on circuit boards and micro-components. Moreover, the rising production of smartphones, tablets, and wearables in countries such as China, South Korea, and India continues to create significant opportunities for precision tool manufacturers globally.The growing emphasis on industrial maintenance and repair operations (MRO) is also fueling the growth of the precision hand tools market. Industries such as oil & gas, manufacturing, and construction rely on periodic maintenance to ensure operational efficiency and safety. The need for durable, ergonomic, and high-accuracy tools has led manufacturers to invest in product innovation and material enhancement. Companies are increasingly introducing lightweight alloys, corrosion-resistant coatings, and ergonomic designs to improve usability and reduce operator fatigue, thereby supporting consistent demand from industrial users.

Another key driver is the rapid expansion of the automotive and aerospace industries, which require precision hand tools for assembly, maintenance, and repair operations. The increasing integration of advanced electronic systems and lightweight materials in vehicles and aircraft demands tools with tighter tolerances and higher durability. Precision torque tools, ratchets, and micrometers are used to ensure exact fitting and torque control. Furthermore, the adoption of electric and hybrid vehicles has boosted demand for tools capable of handling sensitive electrical components safely and efficiently.

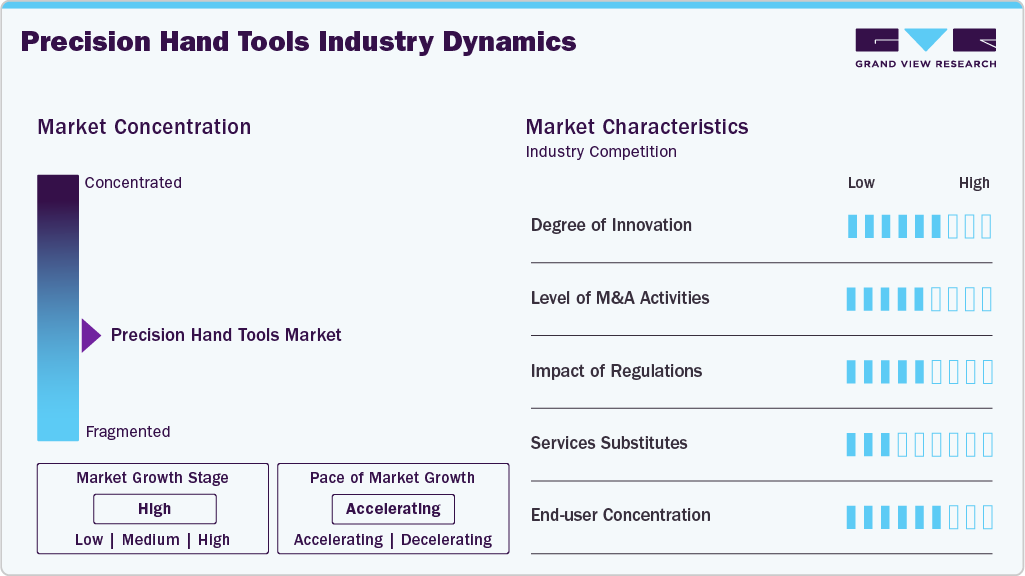

Market Concentration & Characteristics

The precision hand tools industry demonstrates a moderate to high degree of innovation, with manufacturers continuously enhancing product design, ergonomics, and material composition to meet evolving industrial and consumer needs. Advanced technologies such as precision machining, laser calibration, and smart torque measurement have improved tool accuracy and efficiency. The market has also witnessed a steady level of mergers and strategic collaborations, as leading players seek to expand product portfolios and strengthen distribution networks. Notable consolidation activities have allowed companies to achieve economies of scale, optimize supply chains, and increase their market reach in both developed and emerging economies.

Regulatory standards related to worker safety, product quality, and environmental compliance play a significant role in shaping the market dynamics. Compliance with ISO, ANSI, and OSHA standards ensures reliability and global acceptance of precision tools. Service substitutes, such as automated tightening and robotic assembly systems, are gradually emerging but have not significantly displaced manual precision tools due to their adaptability and cost-effectiveness in diverse applications. The end-user concentration remains relatively balanced, with steady demand from automotive, aerospace, electronics, and general manufacturing sectors. This diversified demand base helps stabilize market growth and reduces dependency on any single industry segment.

Product Insights

The torque tools segment led the market and accounted for the largest revenue share of 31.2% in 2024, driven by the growing need for precision and safety in assembly operations across automotive, aerospace, and industrial applications. The segment is also poised to exhibit the fastest CAGR of 5.9% over the forecast period. Accurate torque control ensures consistent fastening, preventing equipment damage and enhancing operational reliability. Increasing adoption of automated and robotic assembly lines further fuels the demand for high-performance torque tools. Manufacturers are investing in digital and electronic torque tools to improve accuracy and traceability. In addition, rising awareness of quality standards and regulatory compliance supports the expansion of this segment globally.

The screwdrivers & nut drivers segment is expected to depict a CAGR of 5.6% over the forecast period, driven by the demand for versatile, ergonomic, and durable hand tools in both professional and DIY applications. Growth in assembly-intensive industries, including electronics and manufacturing, has amplified the need for precision-driven fastening solutions. Innovations in handle design, material strength, and multi-functional capabilities enhance user efficiency and comfort. Increasing adoption of modular and portable tool kits for on-site and maintenance operations also supports market growth.

End Use Insights

The automotive & transportation segment dominated the market and accounted for the largest revenue share of 37.1% in 2024. Besides, the segment is expected to rise at the fastest CAGR of 5.9% over the forecast period, driven by the rapid expansion of vehicle manufacturing, coupled with stringent quality and safety standards. Precision hand tools are essential in engine assembly, chassis manufacturing, and maintenance operations, where accuracy and durability are critical. The rise of electric and hybrid vehicles has created new requirements for specialized tools that handle advanced components. Manufacturers are increasingly integrating ergonomic designs and digital torque monitoring to enhance efficiency.

The electronics & electrical segment is expected to grow significantly at a CAGR of 5.6% over the forecast period, driven by the increasing complexity and miniaturization of devices, which demand highly precise hand tools for assembly and maintenance. Screwdrivers, torque tools, and nut drivers are essential for ensuring secure and accurate fastening of delicate components in devices such as smartphones, computers, and industrial electronics. The surge in consumer electronics production and repair services further stimulates the market. Innovations in insulated and ESD-safe tools enhance safety and reliability during handling.

Regional Insights

The Asia Pacific precision hand tools industry held the largest revenue market share of 33.4% in 2024, experiencing strong growth driven by rapid industrialization and expanding manufacturing hubs in countries such as China, India, and Japan. The rise in small and medium-sized enterprises (SMEs) in automotive and electronics manufacturing has heightened demand for affordable yet precise tools. Increasing investments in infrastructure development and repair projects further stimulate tool usage across various sectors. Moreover, the growing workforce in skilled trades and industrial training programs enhances awareness of high-quality hand tools. Local manufacturers are also focusing on technological advancement and quality improvement to compete internationally. The region’s cost-effective production base strengthens its role as a global manufacturing center.

China Precision Hand Tools Market Trends

The precision hand tools industry in China is strengthened by the nation’s dominance in manufacturing and export-oriented industries. The government’s “Made in China 2025” initiative emphasizes high-end manufacturing, thereby boosting demand for precision tools that meet international standards. The rapid growth of the automotive, electronics, and construction sectors generates significant tool consumption. Moreover, Chinese manufacturers are increasingly investing in advanced production techniques to enhance product accuracy and performance. The expanding e-commerce ecosystem also facilitates easier access to both domestic and imported precision hand tools. Continuous improvements in product quality and export competitiveness position China as both a major producer and consumer in the global market.

North America Precision Hand Tools Market Trends

The North America precision hand tools industry is fueled by the robust presence of the automotive, aerospace, and electronics industries, which demand high-quality, durable, and accurate tools for assembly and maintenance operations. The region’s focus on manufacturing efficiency and precision engineering supports steady market expansion. Increasing adoption of advanced hand tools equipped with ergonomic designs and torque control features further boosts demand. Besides, the growth of DIY culture and home improvement projects has expanded consumer-level usage. Continuous technological innovation and the presence of major global tool manufacturers enhance competitiveness in the market. Government initiatives promoting skilled trade education also contribute to the region’s sustained tool demand.

The precision hand tools industry in the U.S. is propelled by the country’s well-established industrial base and continuous investment in high-precision manufacturing sectors. Rising automation and lean production techniques have increased the need for tools that deliver exact tolerances and high repeatability. The growing emphasis on workplace safety and ergonomic efficiency has encouraged manufacturers to design tools that reduce operator fatigue and improve productivity. Furthermore, the expansion of the aerospace and defense sectors provides a consistent demand for precision-grade tools. The U.S. market also benefits from strong distribution channels and retail presence, both online and offline, supporting widespread accessibility.

Europe Precision Hand Tools Market Trends

The precision hand tools industry in Europe is driven by the region’s commitment to quality manufacturing, engineering excellence, and sustainability. Stringent quality and safety standards encourage the use of precision-calibrated tools across industrial applications. Growth in renewable energy, automotive electrification, and aerospace maintenance sectors sustains steady market demand. European consumers also prioritize tools that combine performance with ergonomic comfort and environmental responsibility. Moreover, the adoption of Industry 4.0 principles promotes the integration of digital measurement and smart functionality in hand tools. Collaboration between manufacturers and research institutions fosters innovation and enhances the region’s technological leadership.

The Germany precision hand tools industry benefits from the country’s renowned engineering expertise and strong manufacturing traditions. The dominance of the automotive and machinery sectors generates continuous demand for high-precision and durable tools. German manufacturers focus heavily on research and development, incorporating advanced materials and designs to improve reliability and lifespan. Export-oriented production also drives adherence to global quality standards, enhancing competitiveness. Moreover, the presence of skilled labor and a strong focus on vocational training ensures sustained demand for professional-grade hand tools. Germany’s emphasis on sustainability and precision engineering further reinforces its market leadership within Europe.

Latin America Precision Hand Tools Market Trends

The Latin America precision hand tools industry is fueled by the expansion of manufacturing, automotive repair, and construction industries across countries like Brazil and Mexico. Industrial modernization and infrastructure development initiatives are boosting the adoption of durable and cost-effective hand tools. The growing aftermarket service sector in automotive and machinery industries also contributes to consistent tool demand. Additionally, the rise of small workshops and local production facilities encourages the use of precision tools for maintenance and repair. The increasing availability of international tool brands and e-commerce platforms enhances market accessibility. Gradual skill development and industrial training programs are also strengthening the market’s foundation.

Middle East & Africa Precision Hand Tools Market Trends

The precision hand tools industry in the Middle East & Africa is primarily driven by growth in construction, oil & gas, and industrial maintenance sectors. Expanding infrastructure development projects and diversification of economies beyond hydrocarbons create a favorable demand environment for precision tools. The region’s increasing focus on industrial safety and operational efficiency has prompted a shift toward high-quality, certified hand tools. Moreover, rising investments in manufacturing zones and industrial parks, particularly in the UAE and Saudi Arabia, are fostering greater adoption of precision instruments. The gradual rise in skilled labor and vocational training programs is also enhancing tool usage efficiency. The availability of global brands through authorized distributors supports steady market penetration.

Key Precision Hand Tools Company Insights

Some of the key players operating in market include Stanley Black & Decker, Inc., Snap-on Incorporated.

-

Stanley Black & Decker, Inc., based in the United States, is one of the leading global manufacturers of hand tools, power tools, and related accessories. The company’s precision hand tools are designed for professional and industrial use, offering products such as torque wrenches, pliers, precision screwdrivers, and micrometers.

-

Snap-on Incorporated is an American company recognized for producing premium tools and diagnostic equipment for professional technicians. The company offers a wide range of precision hand tools, including ratchets, torque wrenches, screwdrivers, and calibration instruments designed for automotive, aviation, and industrial maintenance.

Klein Tools, Inc., Hilti Corporation are some of the emerging industry participants.

-

Klein Tools, Inc., headquartered in Illinois, USA, specializes in manufacturing precision hand tools primarily for electrical and telecommunications applications. Its product range includes insulated pliers, wire cutters, precision screwdrivers, and crimping tools designed to meet the high standards of professional tradespeople.

-

Hilti Corporation, based in Liechtenstein, is a globally recognized manufacturer of high-performance tools, fastening systems, and industrial solutions. The company’s precision hand tools portfolio includes torque wrenches, measuring instruments, and fastening tools used in construction, energy, and infrastructure industries.

Key Precision Hand Tools Companies:

The following are the leading companies in the precision hand tools market. These companies collectively hold the largest market share and dictate industry trends.

- Stanley Black & Decker, Inc.

- Snap-on Incorporated

- Klein Tools, Inc.

- Hilti Corporation

- Wera Werkzeuge GmbH

- Wiha Werkzeuge GmbH

- Apex Tool Group, LLC

- Makita Corporation

- TONE Co., Ltd.

Recent Developments

-

In June 2025, UF-TOOLS expanded its global presence by launching innovative precision screwdriver sets and comprehensive repair tool kits. The new offerings are designed to enhance accuracy, durability, and versatility for both professional and DIY users. This expansion strengthens UF-TOOLS’ position in international markets while addressing the growing demand for high-quality precision hand tools.

Precision Hand Tools Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.39 billion

Revenue forecast in 2033

USD 6.74 billion

Growth Rate

CAGR of 5.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; India; Japan

Key companies profiled

Stanley Black & Decker, Inc.; Snap-on Incorporated; Klein Tools, Inc.; Hilti Corporation; Wera Werkzeuge GmbH; Wiha Werkzeuge GmbH; Apex Tool Group, LLC; Makita Corporation; TONE Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Precision Hand Tools Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global precision hand tools market report based on product, end use, and region:

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Automotive & Transportation

-

Aerospace & Defense

-

Electronics & Electrical

-

Industrial & Manufacturing

-

Others

-

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Torque Tools

-

Measuring & Alignment Tools

-

Screwdrivers & Nut Drivers

-

Pliers & Tweezers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global precision hand tools market size was estimated at USD 4.16 billion in 2024 and is expected to reach USD 4.39 billion in 2025.

b. The precision hand tools market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2033 to reach USD 6.74 billion by 2033.

b. Automotive & transportation segment dominated the market and accounted for the largest revenue share of 37.1% in 2024, driven by the rapid expansion of vehicle manufacturing, coupled with stringent quality and safety standards.

b. Some of key players in the precision hand tools market include Stanley Black & Decker, Inc., Snap-on Incorporated, Klein Tools, Inc., Hilti Corporation, Wera Werkzeuge GmbH, Wiha Werkzeuge GmbH, Apex Tool Group, LLC, Makita Corporation, and TONE Co., Ltd.

b. The key factors driving the precision hand tools market include increasing demand for high-accuracy tools in automotive, electronics, and industrial applications, rising adoption of automated assembly systems, advancements in ergonomic and digital tool designs, and growing emphasis on safety and quality compliance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.