- Home

- »

- Medical Devices

- »

-

Preclinical Imaging Market Size, Share, Industry Report 2033GVR Report cover

![Preclinical Imaging Market Size, Share & Trends Report]()

Preclinical Imaging Market (2026 - 2033) Size, Share & Trends Analysis Report By Type (Modality, Reagents and Service), By Application (Drug Discovery & Development, Basic & Translational Research), By End Use (Pharma and Biotech Companies), By Region, And Segment Forecasts

- Report ID: 978-1-68038-881-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Preclinical Imaging Market Summary

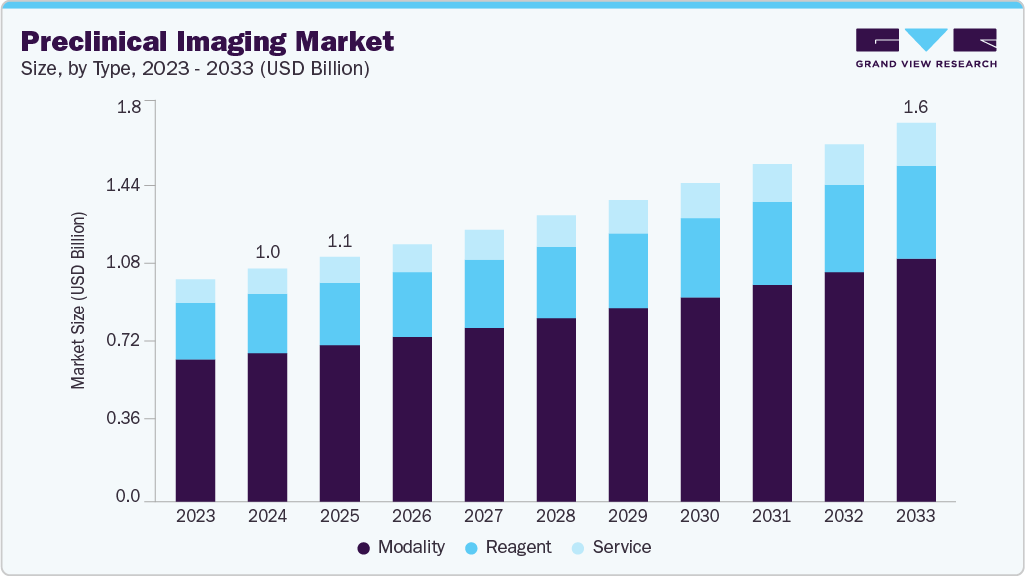

The global preclinical imaging market size was valued at USD 1.05 billion in 2025 and is expected to reach USD 1.63 billion by 2033, growing at a CAGR of 5.6% from 2026 to 2033. This growth is driven by the rising prevalence of chronic diseases, increasing investments in drug development, and growing demand for non-invasive imaging techniques.

Key Market Trends & Insights

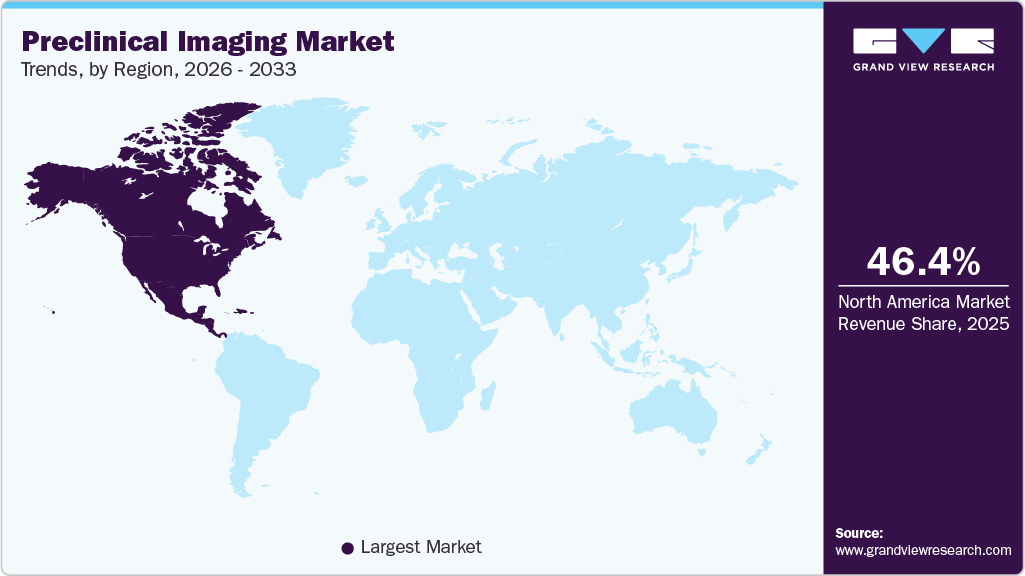

- The North America preclinical imaging market held the largest share of 46.42% of the global market in 2025.

- The preclinical imaging industry in the U.S. is expected to grow significantly over the forecast period.

- By type, the modality segment held the highest market share of 63.92% in 2025.

- Based on end use, the pharma & biotech companies segment held the highest market share in 2025.

Market Size & Forecast

- 2025 Market Size: USD 1.05 Billion

- 2033 Projected Market Size: USD 1.63 Billion

- CAGR (2026-2033): 5.6%

- North America: Largest market in 2025

The adoption of advanced imaging modalities for early-stage research, coupled with the expansion of translational research initiatives, further accelerates market expansion.Government initiatives, including grants and funding from organizations such as the National Institutes of Health (NIH) and similar agencies in Europe and Asia, are significantly enhancing preclinical research and bolstering the preclinical imaging market. For example, in September 2022, the NIH and the U.S. Department of Health and Human Services (DHHS) called for applications for milestone-driven preclinical vaccine development targeting Enterotoxigenic Escherichia coli (ETEC), Salmonella Paratyphi A, and Shigella species.

The program supported vaccine optimization, scale-up, safety, and efficacy testing, offering up to USD 750,000 annually over five years to help candidates reach clinical readiness. Eligible applicants included academic institutions, nonprofits, governments, and businesses. The National Institute of Allergy and Infectious Diseases (NIAID) planned to award USD 5.2 million across 4-6 projects to advance candidates toward FDA IND submission. This influx of funding allows researchers to invest in advanced platforms, develop new probes, and expand longitudinal studies, increasing demand in the preclinical in-vivo imaging market and supporting growth in segments like optical preclinical imaging.

Preclinical imaging modalities, such as magnetic resonance imaging (MRI), computed tomography (CT), positron emission tomography (PET), single-photon emission computed tomography (SPECT), and ultrasound, provide non-invasive methods for visualizing and quantifying biological processes at the cellular and molecular levels in animal models. For instance, a 2025 Nature Communications study on type I conventional dendritic cells (cDC1s) immunotherapy utilized PET imaging to noninvasively monitor immune responses and tumor dynamics in preclinical cancer models. Researchers used PET scans to track the enhanced infiltration and activation of tissue-resident memory T cells induced by cDC1 vaccination, correlating imaging signals with effective tumor control and prevention of relapse.

This imaging approach provided real-time insights into the spatial and temporal aspects of immune memory formation within tumors, validating the therapy’s efficacy beyond conventional assays. This capability is crucial for researchers to study disease progression, assess the impact of novel therapies, and optimize treatment strategies before clinical trials in humans.

Similarly, the high prevalence of these diseases in developed countries with well-established research infrastructures and investment in R&D significantly boosts the focus on preclinical imaging for treatment development, thereby contributing to the market growth. Additionally, chronic disease-specific animal models, such as genetically engineered mice, are being used extensively in combination with imaging systems, thereby increasing the need for platforms that support dynamic imaging protocols.

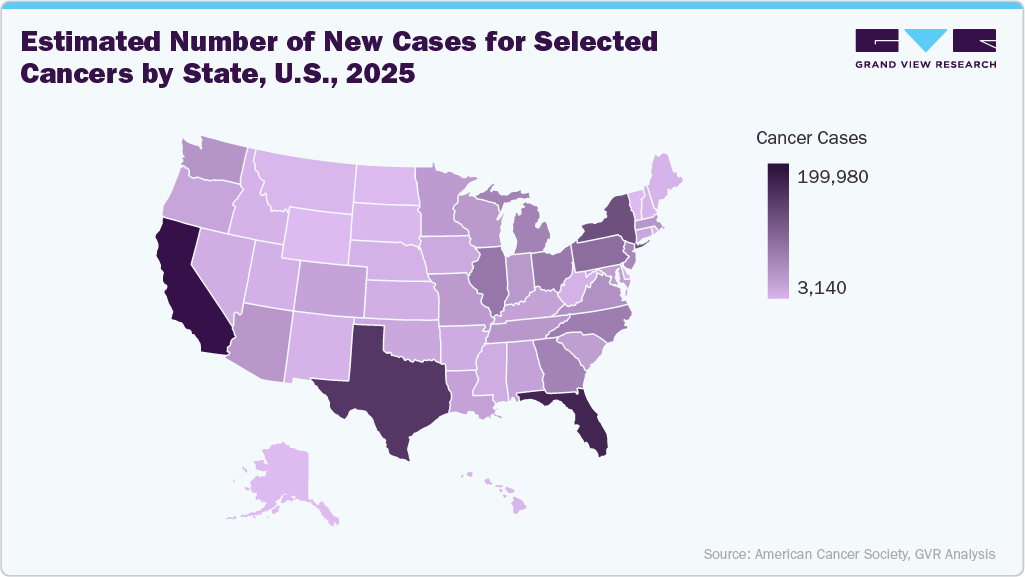

Neurodegenerative diseases such as Alzheimer’s and Parkinson’s are also key drivers for the adoption of preclinical imaging, particularly in CNS-focused drug discovery. For instance, according to the Alzheimer's Association, around 7.2 million Americans aged 65 years and above in the America have Alzheimer’s in 2025, with 74% among these being aged of age 75 years or above. Small-animal PET, SPECT, and MR imaging modalities are critical in tracking protein aggregation, neuroinflammation, and synaptic activity in murine models. The rising global burden of dementia and the lack of curative therapies have contributed to the surge in early-stage drug screening programs using advanced imaging techniques.

Preclinical imaging has seen considerable transformation and improvement with the use of Artificial Intelligence (AI). The enormous amount of imaging data generated is processed and analyzed using AI approaches, allowing researchers to get important insights and advance their work more quickly. For instance, in May 2023, Koninklijke Philips N.V. introduced a Philips CT 3500, an innovative high-throughput CT system that is aimed at meeting the demands of large quantities of screening initiatives and regular radiology. The Philips CT 3500 incorporates advanced image-reconstruction capabilities and workflow enhancements. These features deliver the reliability, speed, and high-quality imaging necessary for clinicians to confidently diagnose patients and optimize operational efficiency, even in demanding medical environments.

On the other hand, the restrictions placed on animal testing due to regulations enforced by organizations that protect animal rights are the major factors impeding the growth of the market. Therefore, the adoption of alternative methods, such as in-vitro tests, micro-dosing, computer-based models, virtual testing of new drugs, and the development of computerized databases for testing purposes, is rapidly increasing. However, modalities with non-invasive imaging techniques such as MRI and CT scans are making their way into the market.

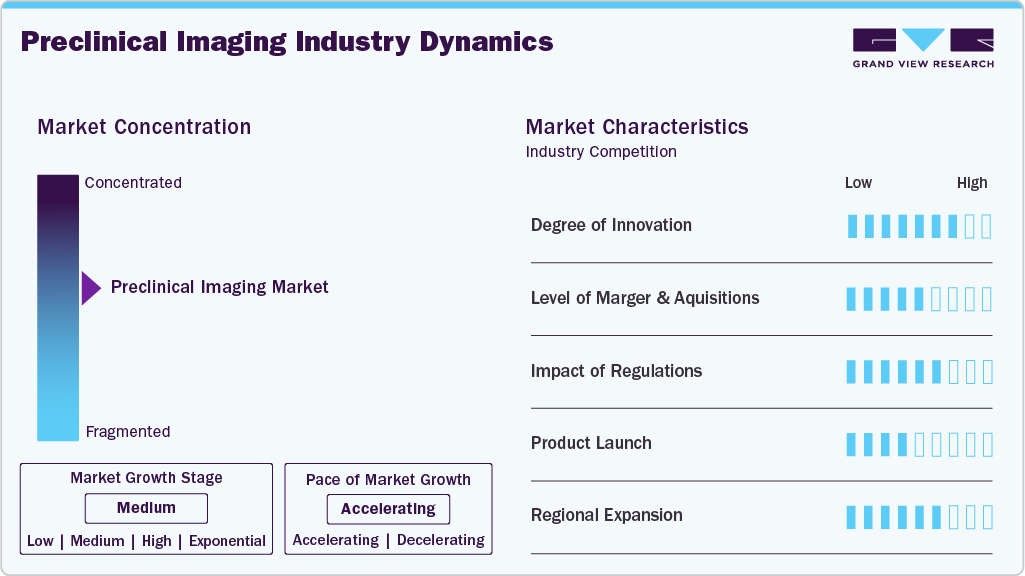

Market Concentration & Characteristics

The preclinical imaging market is accelerating at a moderate pace, supported by continuous innovation in preclinical imaging systems and imaging methodologies. Advances in high-resolution modalities such as micro-CT, PET, and MRI are enabling detailed visualization of biological processes at the molecular and cellular levels in animal models, improving translational relevance in early-stage research. In parallel, the integration of artificial intelligence (AI) and machine learning into preclinical imaging systems has enhanced image reconstruction, quantification, and automated analysis, resulting in faster and more accurate data interpretation. Market growth is further supported by rising research funding and increased collaboration among academic institutions, contract research organizations, and pharmaceutical companies, all focused on accelerating and de-risking drug discovery and preclinical development workflows.

Additionally, research institutes and academic centers are increasingly adopting advanced imaging systems and pursuing accreditation to improve the quality and reliability of their studies. These institutions are dedicated to meeting stringent standards and obtaining certifications that demonstrate their commitment to best practices in animal research. For instance, in November 2023, the Advanced Preclinical Imaging Center (APIC) received a perfect inspection score. This accomplishment followed a semi-annual inspection by the Institutional Animal Care and Use Committee (IACUC), which confirmed that APIC, part of the Lillehei Heart Institute, fully complied with all USDA requirements for safe and humane animal research.

The degree of innovation in preclinical imaging industry is marked by several advancements that are reshaping the landscape of biomedical research. For instance, in June 2025, FUJIFILM VisualSonics launched the Vevo F2 LAZR-X20, a multi-modal photoacoustic and ultra-high frequency ultrasound imaging platform for preclinical research. It features advanced laser technology with a 660-1320 nm wavelength range, enabling enhanced tissue characterization and real-time, high-resolution imaging of tissue types and contrast agents. This system non-invasively detects chromophores, lipids, and collagen, allowing visualization of tumor microenvironments and potential therapeutic quantification.

The level of mergers and acquisitions in the preclinical imaging industry has been notably high, reflecting a strategic consolidation trend among key industry players. For instance, in February 2024, Bruker Corporation announced its acquisition of Spectral Instruments Imaging LLC, a prominent provider of preclinical in-vivo optical imaging systems. This strategic move addresses a critical technology and product gap within Bruker BioSpin's Preclinical Imaging (PCI) division, significantly expanding its array of preclinical solutions tailored for disease research.

Regulations in the preclinical industry play a critical role in shaping research practices by ensuring safety, ethical compliance, and data integrity. Adherence to established frameworks such as Good Laboratory Practice (GLP) and animal welfare guidelines enhances the reliability of studies conducted using preclinical in-vivo imaging and supports smoother translation into clinical development. While stringent regulatory requirements can increase operational costs, extend study timelines, and necessitate comprehensive documentation, regulatory harmonization across agencies such as the FDA and EMA helps streamline multinational research efforts. These frameworks also promote transparency, risk mitigation, and the responsible adoption of advanced preclinical imaging solution platforms, alongside alternative approaches such as in vitro and computational models. Overall, regulatory oversight balances innovation with accountability, reinforcing confidence in preclinical research outcomes and imaging-derived data.

Manufacturers are actively involved in launching new products to meet evolving industry demands and technological advancements. For instance, in September 2023, Revvity launched several next-generation preclinical imaging technologies, including the IVIS Spectrum 2 and IVIS SpectrumCT 2 imaging systems, the QuantumTM GX3 microCT imaging solution, and the Vega preclinical ultrasound system. These innovations aim to enhance versatility, sensitivity, and throughput in preclinical research, facilitating discoveries in areas such as disease biology and therapeutic development.

The preclinical imaging industry is witnessing rapid regional expansion, driven by population growth, increased healthcare spending, and shifting regulatory frameworks. These factors are encouraging companies and research centers to widen operations and forge international collaborations. For example, in March 2023, Cyceron in Caen, France, installed a Momentum CT Magnetic Particle Imaging (MPI) system to advance preclinical studies on inflammatory diseases like Multiple Sclerosis and Crohn’s Disease. This cutting-edge MPI technology provides highly sensitive in vivo imaging of previously undetectable pathological processes, enabling rigorous testing of imaging protocols and cell therapies. Such advancements by research institutions significantly fuel demand for preclinical imaging systems.

Type Insights

In 2025, the modality segment dominated the preclinical imaging market, driven by advancements that are transforming disease modeling and drug discovery in small animals. Imaging modalities now span structural, functional, and molecular approaches, each adding unique value to research. Optical imaging, particularly bioluminescence and fluorescence, remains vital for the monitoring of molecular processes. Revvity’s IVIS Spectrum 2 and SpectrumCT 2 systems, launched in May 2023, highlight innovations in sensitivity and multimodal integration with CT. Structural imaging methods like CT and MRI provide detailed anatomical insights, with Revvity’s Quantum GX3 offering 5-micron resolution for bone and vascular studies. At the same time, MRI delivers superior soft tissue contrast for neurological and cardiovascular research. Functional modalities such as PET and SPECT quantitatively assess metabolic activity and are commonly integrated with CT or MRI. Ultrasound, exemplified by Revvity’s Vega system, provides automated, high-resolution imaging. Emerging photoacoustic imaging and hybrid multimodal systems further enhance translational research by combining complementary data streams.

The service segment is expected to register the fastest CAGR in the preclinical imaging market, driven by demand for advanced image acquisition, postprocessing, and AI-based analytics. These services enhance understanding of disease mechanisms and therapeutic responses in small animal models. Platforms like PerkinElmer’s IVIS with Living Image software and Bruker’s ParaVision enable real-time, non-invasive imaging of molecular and anatomical processes. Postprocessing tools, such as VivoQuant, optimize multimodal data interpretation, including PET, CT, and SPECT scans. AI-powered analytics further streamline complex image analysis, automating tissue segmentation and quantitative assessments. Collectively, these services accelerate drug discovery, improve accuracy, and deliver predictive, reliable research outcomes.

Application Insights

In 2025, the disease mechanism and pathophysiology studies segment held the largest market share, reflecting the growing role of preclinical imaging in understanding complex diseases across oncology, cardiology, neurology, immunology, and infectious diseases. Using MRI, PET, CT, SPECT, and optical imaging, researchers noninvasively track biological processes in real time, achieving high spatial and temporal resolution. These modalities reveal tumor growth, angiogenesis, metastasis, ischemic injuries, neurodegeneration, and immune responses. They also enable longitudinal studies to monitor disease progression, evaluate therapies, and reduce animal use. By visualizing cellular signaling, molecular interactions, and treatment outcomes, preclinical imaging supports more effective therapeutic discovery and development.

The drug discovery and development segment is projected to grow at the highest CAGR, driven by preclinical imaging’s ability to noninvasively visualize biological processes in real time. This accelerates drug development by enabling target validation, optimizing leads, and assessing safety and efficacy before clinical trials. Modalities like PET, MRI, and CT allow dynamic monitoring of drug distribution, pharmacodynamics, and toxicity. Lung imaging is increasingly vital for diseases like COPD and asthma, using MRI, micro-CT, and PET to detect early pathologies. In oncology, PET and multimodal imaging track tumor metabolism and therapeutic response, supporting precise, repeated, and cost-efficient longitudinal studies in small animal models.

End Use Insights

The pharma and biotech companies segment captured the largest market share in 2025. The demand for pre-clinical imaging in biotech companies has been steadily increasing in recent years and is expected to continue growing in the coming years. The growing market demand in pharma and biotech companies can be attributed to the spread of emerging & re-emerging infectious diseases and the need for preclinical imaging for a better understanding of pathogens, as well as to aid the development of new therapeutics & vaccines. Besides, constant experimentation on small animals and research activities in the laboratory have led to a rise in demand for PET and SPECT, fueling market growth.

The contract research organizations (CROs) segment is projected to grow at the fastest CAGR as pharmaceutical and biotechnology firms increasingly outsource preclinical imaging to streamline R&D costs and timelines. CROs offer advanced imaging technologies, expert analysis, and scalable infrastructure without requiring in-house facilities. For example, Crown Bioscience, a JSR Life Sciences company, launched its OrganoidXplore platform in November 2023, revolutionizing oncology drug discovery with large-scale organoid screening. Integrating assay-ready organoids with high-content imaging and analytics, it provides clinically relevant, reproducible data on patient-derived tumor models. OrganoidXplore shortens project timelines by two-thirds compared to traditional methods, enabling tailored studies across multiple cancer types with enhanced translational value.

Regional Insights

The North America preclinical imaging market held the largest share of 46.42% of the global market in 2025. This dominance is driven by the region’s robust R&D infrastructure, substantial investments from pharmaceutical companies, and government funding supporting advanced imaging technologies. The rising focus on personalized medicine and demand for non-invasive imaging methods further accelerate market growth. North America hosts one of the most advanced preclinical research ecosystems, featuring leading universities, national laboratories, CROs, and hospital-based research centers. Strong public-private investment continues to expand access to high-field imaging facilities and state-of-the-art modalities, enabling cutting-edge studies in disease mechanisms, drug development, and translational research across diverse therapeutic areas.

U.S. Preclinical Imaging Market Trends

The preclinical imaging market in the U.S. held the largest market share in 2025 in the North America region. This growth is fueled by rising investments in biomedical research across oncology, neurology, and cardiovascular diseases. Pharmaceutical firms and academic institutions increasingly use advanced imaging technologies like PET, SPECT, MRI, CT, and optical systems to accelerate drug discovery. Innovations, such as MH3D’s 2025 launch of a compact high-resolution SPECT/CT system with STFC’s hyperspectral HEXITEC detector, enhance accuracy and applications. The U.S. benefits from a supportive regulatory environment, extensive preclinical facilities, leading CROs, and established companies.

Europe Preclinical Imaging Market Trends

The preclinical imaging market in Europe held a significant market share in 2025. Rising investments in R&D by pharmaceutical and biotechnology companies are driving the adoption of advanced imaging technologies to speed drug discovery and development. Government funding and grants further support growth, while emphasis on personalized medicine and translational research strengthens demand. Technological advancements enable high-resolution, non-invasive imaging, improving efficiency and reducing costs. Strict regulations on animal research and welfare have also accelerated the shift to imaging methods that minimize animal use and invasiveness. Regulatory bodies like the EMA emphasize high-quality preclinical data, boosting the need for advanced imaging systems.

The preclinical imaging market in the UK is driven by the country’s developed research infrastructure, including leading universities, research institutions, and pharmaceutical companies, which fuels the demand for advanced imaging technologies. This strong foundation supports the adoption of advanced imaging modalities for drug discovery, disease modeling, and therapeutic development. For instance, in August 2024, the University of Edinburgh received a new 9.4T magnet, significantly boosting the capabilities of its Edinburgh Preclinical Imaging facility. This state-of-the-art high-field magnet enabled advanced magnetic resonance imaging (MRI) with enhanced resolution and sensitivity for preclinical research.

The preclinical imaging market in Germany is driven by the developed pharmaceutical and biotechnology sectors in the country, with a high demand for advanced imaging technologies to accelerate drug discovery and development processes. The presence of leading research institutions and universities further fuels market growth by enhancing innovation and driving the adoption of advanced imaging techniques.

The preclinical imaging market in France is experiencing steady growth, fueled by increasing investments in biomedical research and the development of innovative imaging technologies. The French government's commitment to fostering scientific advancements, coupled with the presence of numerous research institutions and pharmaceutical companies, creates a favorable environment for market expansion.

Asia Pacific Preclinical Imaging Market Trends

The Asia Pacific preclinical imaging market is driven by the increasing research and development (R&D) spending by pharmaceutical and biotechnology companies, coupled with government initiatives to promote scientific research. The rising prevalence of chronic diseases, such as cancer and cardiovascular diseases, necessitating advanced imaging technologies, coupled with the growing geriatric population, is also contributing to the market's growth. According to the United Nations Population Fund (UNFPA), by 2050, one in every four people in Asia and the Pacific is estimated to be over 60 years old. The population of older people (aged over 60) in the region is anticipated to triple between 2010 and 2050, reaching close to 1.3 billion people. The market is also benefiting from the increasing availability of funding for research and development activities, particularly in countries such as China and India.

The preclinical imaging market in Japan is driven by the nation's developed pharmaceutical and biotechnology sectors, coupled with a strong emphasis on research and development. Moreover, the aging population of the country is driving the advanced drug development activities, thereby fueling preclinical research initiatives in the country. For instance, according to the World Bank data, around 30% of Japan’s population was aged 65 years and above in 2024.

The preclinical imaging market in China is driven by the increasing investment in research and development (R&D) by both the government and private pharmaceutical companies, and the high prevalence of various diseases such as cancer, cardiovascular diseases, infectious diseases, and others. According to the International Agency for Research on Cancer (IARC), China witnessed around 4.82 million new cases of cancer in 2022, increasing the five-year cancer prevalence to 10.97 million. Such a high prevalence of diseases significantly increases the demand for effective drugs in the country, leading to a rise in preclinical research and fueling the market growth.

Latin America Preclinical Imaging Market Trends

The preclinical imaging market in Latin America is expected to grow owing to rising demand for advanced healthcare infrastructure and technologies across the region, driven by increasing healthcare expenditures and a growing focus on improving research capabilities. This demand is particularly pronounced in countries like Brazil and Argentina, which have significant pharmaceutical and biotechnology sectors.

Middle East & Africa Preclinical Imaging Market Trends

The preclinical imaging market in the MEA region is expected to grow due to the prevalence of infectious diseases, non-communicable diseases, and genetic disorders in the MEA region necessitate advanced research devices like preclinical imaging. These devices are crucial for understanding disease mechanisms, developing effective treatments, and conducting preclinical trials to evaluate new therapies.

The preclinical imaging market in Saudi Arabia is experiencing significant growth driven by the strategic investments in healthcare infrastructure, research and development, and a growing emphasis on personalized medicine, which are fueling demand for advanced imaging technologies. The Saudi Vision 2030 initiative, with its focus on diversifying the economy and fostering innovation, is also playing a significant role. This vision supports the development of an established healthcare sector, including advanced research capabilities, which directly benefits the preclinical imaging market.

Key Preclinical Imaging Company Insights

Market players are involved in implementing strategic initiatives to hold a prominent share in the market. One key area of focus is continuous innovation through product launches and upgrades. Companies regularly introduce new preclinical imaging systems and technologies that offer enhanced capabilities in imaging resolution, sensitivity, and data analysis. These innovations cater to the evolving needs of researchers and pharmaceutical developers, supporting advancements in drug discovery and disease research.

Key Preclinical Imaging Companies:

The following are the leading companies in the preclinical imaging market. These companies collectively hold the largest market share and dictate industry trends.

- Cubresa Inc.

- Bruker Corporation

- Revvity (PerkinElmer, Inc)

- FUJIFILM VisualSonics

- Mediso Ltd.

- Rigaku (MILabs B.V.)

- MR Solutions

- Aspect Imaging

- TriFoil Imaging

- Siemens Healthineers

Recent Developments

-

In February 2024, Bruker Corporation acquired Spectral Instruments Imaging (SII), one of the leading companies for preclinical in-vivo optical imaging systems. This acquisition expands Bruker's preclinical imaging portfolio, enhancing its capabilities in molecular imaging and expanding its offerings for life science research and drug development.

-

In May 2023, Revvity, formerly a part of PerkinElmer, launched as a standalone scientific solutions company. This separation allows Revvity to focus on its mission of driving innovation from discovery to cure, providing solutions for life sciences and diagnostics markets.

-

In August 2021, Rigaku acquired MILabs, a life science imaging equipment manufacturer. This strategic move aimed to expand Rigaku's portfolio in the life sciences sector, specifically in preclinical imaging. The acquisition integrates MILabs' advanced imaging technologies with Rigaku's offerings, potentially leading to new advancements in research and development.

Preclinical Imaging Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 1.11 billion

Revenue forecast in 2033

USD 1.63 billion

Growth rate

CAGR of 5.6% from 2026 to 2033

Actual period

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Revenue in USD million and CAGR from 2026 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, Application, End Use, and Region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Cubresa Inc.; Bruker Corporation; Revvity (PerkinElmer, Inc); FUJIFILM VisualSonics; Mediso Ltd.; Rigaku (MILabs B.V.); MR Solutions; Aspect Imaging; TriFoil Imaging; Siemens Healthineers

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Preclinical Imaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global preclinical imaging market based on type, application, end use and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Modality

-

Optical Imaging (BLI & F)

-

Magnetic Resonance Imaging (MRI)

-

Positron Emission Tomography (PET)

-

Single Photon Emission Computed Tomography (SPECT)

-

Computed Tomography (CT)

-

Ultrasound Imaging (US)

-

Photoacoustic Imaging (PAI)

-

Hybrid Imaging Systems

-

Bi-Modal

-

SPECT-CT

-

PET-CT

-

SPECT-PET

-

PET-MRI

-

Optical-CT

-

Others

-

-

Tri-Modal

-

PET-SPECT-CT

-

PET-SPECT-MRI

-

PET-CT-Optical

-

Others

-

-

-

Others

-

-

Reagent

-

Service

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Drug Discovery & Development

-

Toxicology & Pharmacokinetics Studies

-

Basic & Translational Research

-

Disease Mechanism & Pathophysiology Studies

-

Oncology

-

Cardiology

-

Neurology

-

Infectious Diseases

-

Immunology & Inflammation

-

Others

-

-

Biomarker & Imaging Agent Validation

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Pharma and Biotech Companies

-

Contract Research Organizations (CROs)

-

Academic and Research Institutes

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global preclinical imaging market size was estimated at USD 1.05 billion in 2025 and is expected to reach USD 1.11 billion in 2026.

b. The global preclinical imaging market is expected to grow at a compound annual growth rate of 5.6% from 2026 to 2033 to reach USD 1.63 billion by 2033.

b. The North America segment dominated the preclinical imaging market with a share of 46.42% in 2025. This is attributable to a well-developed research infrastructure, the availability of skilled professionals, a large number of preclinical projects, and higher adoption rates of technically advanced devices in the region.

b. Some key players operating in the preclinical imaging market include Cubresa Inc., Bruker Corporation, Revvity (PerkinElmer, Inc), FUJIFILM VisualSonics, Mediso Ltd., Rigaku (MILabs B.V.), MR Solutions, Aspect Imaging, TriFoil Imaging, Siemens Healthineers

b. Key factors that are driving the preclinical imaging market growth include the rising number of investments in research and development coupled with the constant pace of technological advancements.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.