- Home

- »

- Medical Devices

- »

-

Preclinical Medical Device Testing Services Market Report, 2030GVR Report cover

![Preclinical Medical Device Testing Services Market Size, Share & Trends Report]()

Preclinical Medical Device Testing Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Service (Biocompatibility Tests, Chemistry Test, Microbiology & Sterility Testing, Package Validation), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-943-4

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

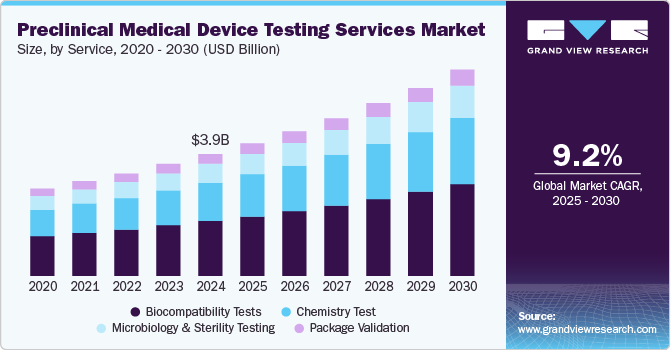

The global preclinical medical device testing services market size was valued at USD 3.87 billion in 2024 and is projected to grow at a CAGR of 9.20% from 2025 to 2030. Medical device manufacturers increasingly emphasize developing new medical devices based on the high prevalence of diseases. Therefore, the demand for preclinical medical device testing services is likely to rise due to the high complexity of medical device design and the prevalence of chronic diseases. Furthermore, most medical device companies often lack the resources, infrastructure, or expertise to conduct comprehensive in-house testing. As a result, the increasing demand for specialized testing services is expected to drive the demand for outsourced testing services, boosting the market.

Additionally, a significant proportion of R&D expenditure by medical device companies is allotted to preclinical trials. Adherence to safety protocols is ensured during the preclinical trials phase before undertaking further stages of drug development. In addition, the failure rate of preclinical trials is significantly lower than failures in further stages. Such factors ensure robust growth for the preclinical medical device testing services market.

Furthermore, medical devices have improved due to technological advances over time. IoT and AI are already included in medical devices. Additionally, market players are innovating a range of cutting-edge medical devices to maintain their competitiveness in the market. Real-time patient monitoring, remote patient monitoring, and continuous patient monitoring are the focal areas of interest in chronic disease management, such as diabetes & cardiovascular diseases. The emergence of personalized medicine, drug-device combinations, artificial intelligence, wearables, and increased focus on real-time patient monitoring resulted in a complex medical device ecosystem expected to drive the market.

Moreover, the increasing pipeline of drugs for oncology and rare diseases is further expected to propel the development of breakthrough therapies over the forecast period. The majority of medical device testing services granted are for oncology and rare diseases. The drugs approved by the FDA in oncology and rare disease segments are expected to achieve peak sales over the forecast period, contributing to market growth.

Service Insights

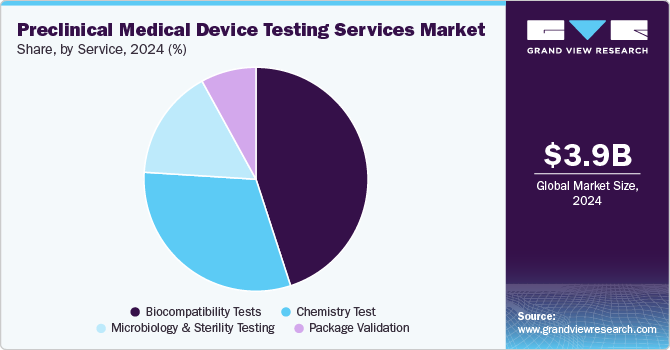

Based on services, the market is segmented into Biocompatibility Tests, Chemistry Test, Microbiology & Sterility Testing, and Package Validation. In 2024, the biocompatibility tests segment dominated the market, accounting for a revenue share of 45.06%. The test is a critical step for medical device development where an assessment of biocompatibility helps medical device manufacturers ensure the device’s safety for patients & provides data that can be used to support regulatory compliance. In addition, it helps determine the potential toxicity of a material resulting from contact of devices or products with the body. Such tests are performed to ensure the safety of devices. In addition, the tests comply with the guidelines issued by various organizations such as FDA & ISO.

The chemistry test segment is expected to rise with the fastest CAGR of 9.63% during the forecast period. Chemistry tests support the medical device industry across the value chain. These tests ensure that medical devices do not cause adverse reactions when in contact with the human body. In addition, the test is used for regulatory submissions while being flexible to deliver against rapid problem-solving, manufacturing quality control & internal medical device component R&D requirements. These tests support the review of the safety parameters of medical devices. Therefore, the FDA is facilitating data analysis of polymer & colorant examinations to provide a holistic view of the safety of these tests. This is expected to positively impact the segment growth over the forecast period.

Regional Insights

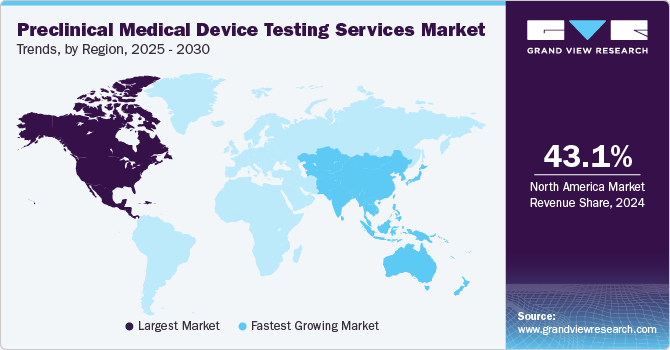

North America preclinical medical device testing services market dominated the global industry in 2024 with the largest share of 43.13%. This can be attributed to the growth of the medical device industries in the U.S. and Canada. In addition, the market players are increasingly focusing on expanding their product portfolio, enabling them to advance technologically advanced medical devices. Additionally, outsourcing medical device preclinical testing services enables medical device companies to focus on their core capabilities, share associated risks, and improve device delivery, which helps companies gain competitive advantages.

U.S. Preclinical Medical Device Testing Services Market Trends

The preclinical medical device testing services market in the U.S. dominated the North American region. The country is home to numerous medical device companies, which outsource part of their R&D functions to service providers, thereby contributing toward the growth of the preclinical medical device testing services market. The high cost of R&D is a significant challenge, which has encouraged medical device companies in the region to outsource functions to third parties with a high level of expertise in the domain. Additionally, medical device companies are committed to expanding their services with the innovations of new device development for patients, which has led to a rise in the requirement for preclinical medical device testing services in the country.

Canada preclinical medical device testing services market is driven by high demand for efficient healthcare, increased commitment to provide high-quality medical device services, and increasing need for outsourcing services that cater to medical device manufacturers' manufacturing and regulatory compliance needs. In addition, the innovation of medical devices with new technologies to meet patients' requirements due to the growing aging population, increased life expectancy & chronic diseases are expected to drive the market.

Europe Preclinical Medical Device Testing Services Market Trends

The Europe preclinical medical device testing market is driven by the increasing demand for a range of medical devices and a growing number of clinical trials for different infectious diseases. Besides, medical device companies mostly prefer outsourcing their preclinical trials in EU member states as they can access a larger market and decrease costs by complying with the regulatory structure prevalent across the EU. Additionally, the rising expansion of new facilities and emerging R&D activities are changing market scenarios rapidly. Such factors are expected to drive the region's growth.

Germany preclinical medical device testing services market accounts for the highest share of the European industry owing to the country's growing number of clinical trials and rising R&D investment for new technology-based medical device products. Additionally, increasing requirements for outsourcing service providers and emerging research and development activities are changing market scenarios in Germany, further fueling the market.

The preclinical medical device testing services market in the UK is driven by the increasing trend of outsourcing among medical device companies; technological advancements and expanding innovation among medical device companies and outsourcing companies have benefited the market growth. Also, the presence of major early-stage development outsourcing companies, R&D spending and increasing number of preclinical trials in the UK fuels the market.

Asia Pacific Preclinical Medical Device Testing Services Market Trends

The preclinical medical device testing services market in Asia Pacific is expected to grow at a CAGR of 9.47% during the forecast period, owing to the cost-effectiveness of medical device testing outsourcing services and rising costs of R&D activities. In addition, the presence of multinational medical device companies in the region and an increasing number of collaborative partnerships & strategic alliances are creating growth opportunities in the market. Moreover, the rise in disease burden, the growing demand for advanced medical devices, and government initiatives such as tax exemption and revamping regulatory policies fuel market growth in Asia Pacific.

Japan preclinical medical device testing services market is driven by an increasing adoption of outsourcing models and growing strategic alliances among medical device companies and outsourcing companies. The country is one of the major markets for clinical trials due to well-established clinical development knowledge, clinical investigational sites with well-trained site staff, & regulatory processes. In addition, increasing demand for preclinical medical device testing services to evaluate the safety of new medical devices is anticipated to drive the market.

The preclinical medical device testing services market in China is driven by an increasing burden of diseases, a growing number of clinical trials, low costs with a large pool of technical expertise, and an increasing focus on assessing medical device safety in the discovery process. Besides, the availability of technology for innovating medical devices is further boosting the growth of the Asia-Pacific market. Additionally, the country offers services at low costs with a large pool of technical expertise and high manufacturing capabilities of generic drugs. In addition, the outsourcing trend is expected to support medical device product innovation with compliance and relevant regulations & standards.

India preclinical medical device testing services market is driven by the increasing presence of medical device companies in the country. The country has become one of the preferred sites for clinical trials due to its cost competitiveness, increasing patient pool, developing healthcare sector, and highly educated physicians. Besides, growing investment in research and development is expected to support market growth over the projected period.

Key Preclinical Medical Device Testing Services Company Insights

The market players are seeking to enhance their customer base, production capacities, and market presence with the adoption of in-organic strategic initiatives such as partnerships & agreements, service launches, expansions, mergers & acquisitions, and others to increase market presence & revenue and gain a competitive edge drives the market growth. Additionally, growing strategic initiatives are anticipated to boost the market share of prominent players operating across the market. For instance, in November 2023, Crown Bioscience & JSR Life Sciences company mentioned the launch of a service offering, OrganoidXplore. This platform provides robust, reproducible, & clinically relevant output, accelerating preclinical oncology drug discovery by reshaping the landscape of cancer treatment development.

Key Preclinical Medical Device Testing Services Companies:

The following are the leading companies in the preclinical medical device testing services market. These companies collectively hold the largest market share and dictate industry trends.

- SGS SA

- Eurofins Scientific

- Pace Analytical Services LLC

- Intertek Group Plc

- WUXI APPTEC

- TÜV SÜD AG

- Sterigenics International LLC

- Nelson Labs

- North American Science Associates, Inc.

- Charles River Laboratories International, Inc.

Recent Developments

-

In December 2023, Veranex announced the acquisition of T3 Labs, a preclinical laboratory. The acquisition of T3 Labs will allow Veranex to complete the entire MedTech development process, from concept to commercialization.

-

In October 2023, Glucotrack, Inc. announced the development of an implantable continuous glucose monitor (CGM) by commencing preclinical animal testing.

-

In May 2023, STEMart introduced medical device testing services for researchers across the globe. In accordance with ISO 10992 & ISO 18562 standards, American Society of Testing Materials standards, FDA guidance, & other guidelines, the company can assist clients, ensuring that medical device is inspected precisely.

Preclinical Medical Device Testing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.22 billion

Revenue forecast in 2030

USD 6.55 billion

Growth rate

CAGR of 9.20% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, region

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Sweden, Denmark, Norway, Japan, China, India, Thailand, South Korea, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

SGS SA, Eurofins Scientific, Pace Analytical Services LLC, Intertek Group Plc, WUXI APPTEC, TÜV SÜD AG, Sterigenics International LLC, Nelson Labs, North American Science Associates, Inc., Charles River Laboratories International, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Preclinical Medical Device Testing Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global preclinical medical device testing services market report on the basis of service, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Biocompatibility Tests

-

Chemistry Test

-

Microbiology & Sterility Testing

-

Bioburden Determination

-

Pyrogen & Endotoxin Testing

-

Sterility Test and Validation

-

Ethylene Oxide (EO) gas sterilization

-

Gamma-irradiation

-

E-beam sterilization

-

X-ray sterilization

-

-

Antimicrobial Activity Testing

-

Others

-

-

Package Validation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global preclinical medical device testing services market was estimated at USD 3.87 billion in 2024 and is expected to reach USD 4.22 billion by 2025.

b. The global preclinical medical device testing services market is expected to grow at a compound annual growth rate of 9.20% from 2025 to 2030 to reach USD 6.55 billion by 2030.

b. North America dominated the global market in 2024 with the largest share of 43.13%. This can be attributed to the growth of the medical device industries in the U.S. and Canada. In addition, the market players are increasingly focusing on expanding their product portfolio, enabling them to advance technological advanced medical devices.

b. Some of the players operating in the preclinical medical device testing services market are SGS SA, Eurofins Scientific, Pace Analytical Services LLC, Intertek Group Plc, WUXI APPTEC, TÜV SÜD AG, Sterigenics International LLC, Nelson Labs, North American Science Associates, Inc., Charles River Laboratories International, Inc.

b. Some of the major factors driving the market include complexity in the product design, strict approval norms, intense competition in the medical device industry, and increase in number of small medical device lacking in-house testing capabilities.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.