- Home

- »

- Food Safety & Processing

- »

-

Preservatives Market Size, Industry Report, 2020-2028GVR Report cover

![Preservatives Market Size, Share & Trends Report]()

Preservatives Market (2020 - 2028) Size, Share & Trends Analysis Report By Type (Natural, Synthetic), By Function (Antimicrobial, Antioxidant), By Application (Food, Feed), By Region (APAC, North America), And Segment Forecasts

- Report ID: GVR-4-68039-907-3

- Number of Report Pages: 238

- Format: PDF

- Historical Range: 2017 - 2019

- Forecast Period: 2021 - 2028

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

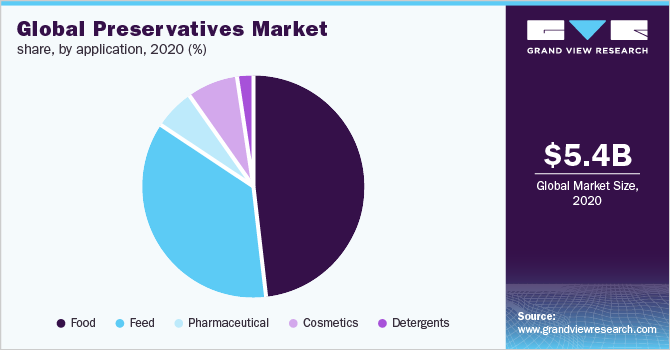

The global preservatives market size was estimated at USD 5.43 billion in 2020 and is projected to reach USD 8.12 billion by 2028, growing at a CAGR of 5.1% from 2020 to 2028. Increasing demand for long-lasting food products coupled with concerns about quality and safety in pharmaceutical and cosmetic products have contributed to the demand for preservatives. Rapid urbanization and an increasing number of working individuals across the globe are driving the demand for convenience foods. This demand has triggered the food processing companies to add preservatives to their products to extend the shelf life without compromising on the quality, thereby augmenting the market growth.

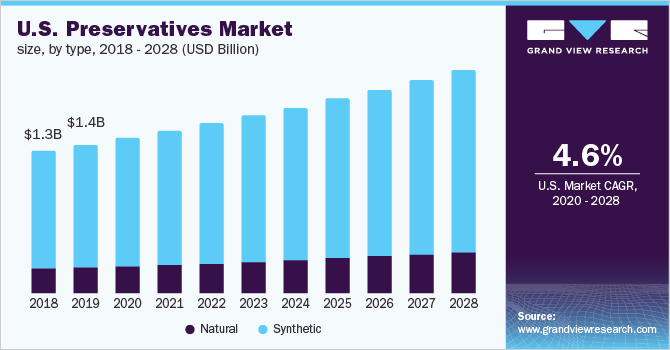

Rising demand for cosmetics coupled with the growing aging population is primary factors contributing to the product demand. With cosmetic manufacturers increasingly using preservatives to maintain the authenticity of cosmetic products, its demand is expected to increase. The U.S. dominated the market in North America in 2020 owing to the strong foothold of key manufacturers in the country coupled with well-established application industries. The busy lifestyle of people has increased the dependency on packaged food products, which is a major factor contributing to the high market share.

The prevalence of various livestock diseases has raised apprehension among consumers regarding meat quality. Thus, animal feed manufacturers are making efforts to develop feed with natural ingredients to offer high-quality meat to consumers. This is expected to surge the incorporation of natural preservatives, thereby driving the market growth. The panic purchasing and hoarding of packaged food products during the initial phase of the COVID-19 pandemic turned out to be beneficial for the food preservative manufacturers.

The pandemic placed increased importance on packaged food that is deemed uncontaminated, benefitting the food preservatives market. In anticipation of potential shortages, farmers panic-bought animal feed as part of the stay-at-home order implemented by the government. This move spiked the demand for animal feed additives, such as preservatives, during the initial phase of the pandemic.

Type Insights

The synthetic type segment dominated the market in 2020 with a revenue share of 84.0%. The effectiveness of synthetic preservatives in inhibiting the growth of mold and yeast coupled with its cost-effectiveness is the primary factor contributing to the segment growth. The use of propionates is expected to increase globally as they are increasingly replacing several toxic synthetic preservatives. Manufacturers, such as Niacet Corp. and BASF SE, are focusing on increasing the production of calcium and sodium propionate to cater to its rising demand for use in food, feed, and pharmaceutical applications. There is an increase in demand for traditional natural food preservatives globally due to the growing use of natural products in a variety of applications.

The Asia Pacific region is a major producer of spices, honey, vinegar, and other natural products. Thus, many companies are expanding and commissioning their production facilities in the region, which is driving the segment growth. Food manufacturers are increasingly using natural bioactive to obtain functional foods, which is becoming a rapidly growing market worldwide. Vegetable oil is the fastest-growing segment in the commercial segment of functional foods as the natural alternatives are seen as potential health-promoting compounds, thereby benefitting market growth.

Function Insights

Antimicrobial function emerged as the dominant segment with a revenue share of more than 78% in 2020. As disease outbreak and adulteration cases are rising globally, foodborne diseases have become a major concern, which has increased concern about food safety, leading to the high market share of antimicrobial preservatives. Antimicrobial properties against pathogens and microbes can be found in herbal plants and edible oils. With the rising concerns among consumers regarding chemical preservatives, natural antimicrobial agents are becoming popular for increasing the shelf life of products, thereby driving the market. The demand for antioxidant preservatives will increase over the forecast period.

This is due to oxidation being a problem that causes rancidity in foods and cosmetics when the oxygen reacts with the fat and pigment content. Green tea extracts, acerola, rosemary extract, and ascorbic acid possess antioxidant properties and are being widely used for oxidation prevention purposes, thereby contributing to segment growth. The consumption of processed foods, such as meats and snacks, along with various types of beverages has increased to larger volumes, which is expected to bolster the demand for antioxidants. In addition, manufacturers are utilizing antioxidants for the neutralization of free radicals in the body, which is further expected to contribute to the segment growth during the forecast period.

Application Insights

The food application segment accounted for the maximum revenue share of more than 48% in 2020. The growth of the processed meat industries in Asia Pacific and North America is largely responsible for the demand for food preservatives. In addition, the high demand for processed foods, such as bakery, dairy, and beverages, contributed to the segment growth in 2020. The use of feed preservatives has been prominent owing to their effectiveness to preserve feed quality during their transportation and storage. With fluctuating raw material prices and emerging regulatory requirements, feed manufacturers are prioritizing the usage of preservatives in their products, thereby driving the segment growth.

Preservatives amplify the shelf life of drugs and medicines by lowering or decreasing the oxidation level of active ingredients in them by reducing microbial production. Thus, increasing demand for pharmaceutical products globally is expected to bolster the demand for preservatives that do not affect the therapeutic action of active ingredients. The global cosmetics industry has experienced significant growth in the past few years owing to increasing consumer consciousness about their appearance. With the rising investments in research and development for organic and paraben-free cosmetic products, the demand for natural preservatives is expected to increase in the coming years.

Regional Insights

North America accounted for the largest revenue share of more than 31.8% in 2020 owing to the high consumption of packaged food coupled with the demand for premium cosmetic products with natural additives. Inaddition, the healthcare sector in North America is highly evolved, which is another major factor driving the product demand. The exports of the food & beverage industry in Europe are increasing substantially with the top destinations being the U.S., China, Canada, Australia, Saudi Arabia, and Japan. Products that are predominantly exported arebeverages, such as spirits & soft drinks, and meat, seafood, & dairy products. With the view to ensure food safety on account of increasing processed food imports and exports, the EU has established a directive 2003/99/EC for assessing the microbial risk associated with ready-to-eat (RTE) foods.

Thus, the government intervention in ensuring the quality of food products is expected to drive the demand for preservatives in the region. The market in Asia Pacific is highly fragmented and dynamic owing to the presence of many players in emerging economies. The rapidly developing economies, including China and India, are major revenue contributors to the regional market owing to the increasing purchasing power of the middle-class population. In addition, changing lifestyles, rapid urbanization, and shifting eating preferences of consumers have led to increasing demand for convenience food in Asia Pacific. A favorable outlook towards the pharmaceutical and cosmetic industries’ growth on account of increasing industrialization is further expected to drive the regional market.

Key Companies & Market Share Insights

The market has been characterized by the presence of a large number of manufacturers of synthetic food preservatives. The increasing demand for natural preservatives has fueledthecompetition with new players entering the market. Public companies in the industry are proactive in initiating strategies to push the adoption of their products in the global market. Manufacturers compete on the basis of innovations and new launches with different formulations to improve the shelf life of various products without compromising their texture and flavor. The demand for natural preservatives is gradually increasing worldwide owing to rising health consciousness among consumers and willingness to pay more for premium products.

Thus, manufacturers, such as DSM N.V. and BASF SE, are capitalizing on their widespread distribution networks to expand their product range of natural preservatives. New entrants, such as Kemin Industries, Inc. and Galactic S.A., compete in the market by introducing new products that are formulated from various natural sources, such as vinegar. In addition, these players are expanding their geographical footprint by opening new sales offices and strengthening their distribution networks. Some prominent players in the global preservatives market include:

-

Zhejiang Bossen Technology Co., Ltd.

-

APAC Chemical Corp.

-

Nantong Acetic Acid Chemical Co., Ltd.

-

Jinneng Science and Technology Company Ltd.

-

Guangzhou ZIO Chemical Co., Ltd.

-

Nanjing Jiayi Sunway Chemical Co., Ltd.

-

CFS Wanglong Flavors Co., Ltd.

-

Tianjin Haitong Chemical Industrial Co., Ltd.

-

Wanglong Tech Co., Ltd.

-

Celanese Corp.

-

FBC Industries

-

Veckridge Chemical

-

Shandong Hongda Group

-

REIPU (QINGDAO) International Trade Co., Ltd.

-

Jiangsu Mupro IFT Corp.

-

Daicel Corp.

Preservatives Market Report Scope

Report Attribute

Details

Market size value in 2021

USD 5.69 billion

Revenue forecast in 2028

USD 8.12 billion

Growth rate

CAGR of 5.1% from 2020 to 2028

Base year for estimation

2020

Historical data

2017 - 2019

Forecast period

2020 - 2028

Quantitative units

Volume in tons, revenue in USD million/billion, and CAGR from 2020 to 2028

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, function, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; U.K.; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; Brazil; Argentina; South Africa

Key companies profiled

Zhejiang Bossen Technology Co., Ltd.; APAC Chemical Corp; Nantong Acetic Acid Chemical Co., Ltd.; Jinneng Science and Technology Company Ltd.; Guangzhou ZIO Chemical Co., Ltd.; Nanjing Jiayi Sunway Chemical Co., Ltd.; CFS Wanglong Flavors Co., Ltd.; Tianjin Haitong Chemical Industrial Co., Ltd.; Wanglong Tech Co., Ltd.; Celanese Corp.; FBC Industries; Veckridge Chemical; Shandong Hongda Group; REIPU (QINGDAO) International Trade Co., Ltd.; Jiangsu Mupro IFT Corp.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2028. For the purpose of this study, Grand View Research has segmented the global preservatives market report on the basis of type, function, application, and region:

-

Type Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Natural

-

Edible Oil

-

Rosemary Extracts

-

Natamycin

-

Vinegar

-

Others

-

-

Synthetic

-

Propionates

-

Sorbates

-

Sorbic Acid

-

Potassium Sorbate

-

Sodium Sorbate

-

Calcium Sorbate

-

-

Benzoates

-

Others

-

-

-

Function Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Antimicrobial

-

Antioxidant

-

Others

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

Food

-

Meat & Poultry Products

-

Bakery Products

-

Dairy Products

-

Beverages

-

Snacks

-

Others

-

-

Feed

-

Pharmaceutical

-

Cosmetics

-

Detergents

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2017 - 2028)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global preservatives market is expected to witness growth owing to increased demand by customers for products with enhanced shelf life. Change in customer lifestyle dynamics with an inclination towards convenient and processed food and beverage products is further contributing towards the market growth during the forecast period

b. The global preservatives market size was estimated at USD 5.43 billion in 2020 and is expected to reach USD 5.69 billion in 2021.

b. The preservatives market is expected to grow at a compound annual growth rate of 5.1% from 2020 to 2028 to reach USD 8.12 billion by 2028.

b. Food dominated the application segment with a value share of 48.2% in 2020. An increase in demand for processed, convenient, on-the-go food products globally is majorly contributing towards the high market share of the segment.

b. Some of the key players operating in the preservatives market include ZHEJIANG BOSSEN TECHNOLOGY CO., LTD., APAC Chemical Corporation, Nantong Acetic Acid Chemical Co., Ltd., Jinneng Science and Technology Company Limited, Guangzhou ZIO Chemical Co., Ltd., Nanjing Jiayi Sunway Chemical Co., Ltd

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.